Today, BTC-e sent nearly $165 million worth of Bitcoin — representing almost all of the Bitcoin left in the service’s wallet — to a group of personal wallets, exchanges, and other services. This marks the largest withdrawal by BTC-e’s controllers since April 2018. For background, BTC-e was a Russia-focused cryptocurrency exchange that U.S. authorities shut down in 2017 due to its role in laundering funds associated with several forms of cybercrime, including cryptocurrency stolen in the 2014 Mt. Gox exchange hack.

Breaking down BTC-e cryptocurrency movements post-shutdown

At the time of its shutdown in 2017, BTC-e still held a substantial amount of Bitcoin. In April 2018, BTC-e moved over 30,000 Bitcoin out of its service wallet, a substantial portion of which worth over $50 million went to the now-sanctioned OTC desk Suex. Since then, the actor (or actors) controlling the BTC-e wallet were still occasionally able to move small amounts of funds to other destinations, presumably to convert them to cash or otherwise salvage them for future use. For example, in October 2021, BTC-e transferred over 100 Bitcoin (valued over $6 million at the time of the transfer) to personal wallets and eventually to several exchanges that service Russia and other Eastern European countries.

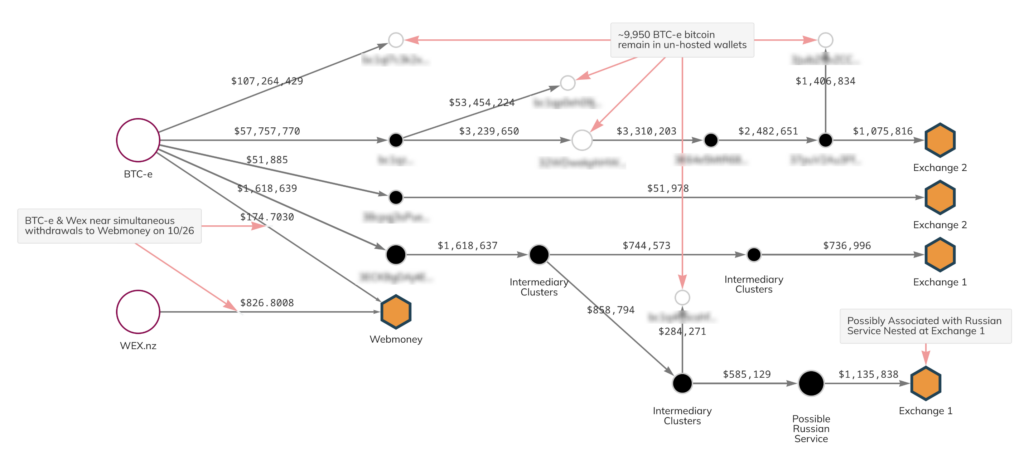

While today’s $165 million withdrawal marks the largest withdrawal since April of 2018, BTC-e actually began withdrawing funds from its wallet nearly a month ago. On October 26, both BTC-e and WEX, an exchange generally understood to be the successor entity to BTC-e, sent small amounts of Bitcoin to Webmoney, a Russian electronic payments service that supports cryptocurrency. Then on November 11, BTC-e made a test payment out of its wallet before transferring approximately 100 Bitcoin indirectly to an exchange on November 21, two days prior to today’s large withdrawals.

Of the total sent in the last several days, approximately 9,950 Bitcoin remain in personal wallets, while the rest was moved through a series of intermediaries to four deposit addresses at two large exchanges. In the case of Exchange 1, depicted above, our analysis suggests a Russian exchange may have served as an intermediary to launder this BTC-e money.

We will continue to monitor BTC-e, WEX, and all addresses associated with today’s fund movements and share updates when possible.