The 2022 Geography of Cryptocurrency Report

Everything you need to know about crypto trends around the world!

Latin America is the seventh largest cryptocurrency market in our index this year, with citizens of Latin America countries receiving $562.0 billion in crypto from July 2021 to June 2022. This represents a 40% growth over last year’s total. Latin America is also home to five of the top thirty countries in this year’s crypto index: Brazil (7), Argentina (13), Colombia (15), Ecuador (18), and Mexico (28).

In our analysis of Latin America’s on-chain activity, we identified three key use-cases driving crypto adoption:

- Storing value

- Sending remittances

- Seeking alpha

Let’s take a closer look at these three drivers – and the Latin American countries where each use case is most prevalent.

Storing value

In April, the International Monetary Fund found that the combined inflation rate of the five largest Latin America’s economies (or the “LA5”) – Brazil, Chile, Colombia, Mexico, and Peru – had surpassed 8% – a 15-year high. Four months later they updated this estimate to 12.1% – a 25-year high. Meanwhile, in countries like Venezuela and Argentina, the state of affairs is even worse. These two countries face year-on-year inflation rates of 114% and 79%, respectively, meaning that their fiat currencies have lost around half of their value within the last twelve months.

The last time inflation reached such a height across Latin America, Bitcoin had not yet been invented. While Bitcoin hasn’t yet proven to be the inflation hedge many believed it would be, stablecoins – cryptocurrencies that are designed to stay pegged to the price of fiat currencies like USD – are a favorite in the most inflation-ravaged countries in the region. In fact, recent data from Mastercard suggests that more than a third of Latin American consumers already use stablecoins to make everyday purchases.

Below, we discuss how citizens of the two of the most inflation-impacted Latin American countries use stablecoins to modernize the way they save.

Spotlight: Venezuela

Venezuela is unranked in this year’s index, as reliable and recent estimates of its PPP per capita were unavailable. However, if we use the World Bank’s 2014 estimate as a proxy, Venezuela ranks 11th overall.

Given Venezuela’s sharp downturn in the eight years since and growing crypto adoption, they could rank higher. Its national currency, the Bolivar, has depreciated by more than 100,000% from December 2014 to September 2022. Venezuela is also, despite its incredible fiat currency devaluation, still a growing crypto market in U.S. dollar terms. Last year, Venezuelans received $28.3 billion worth of cryptocurrency. This year, they received $37.4 billion, up 32%.

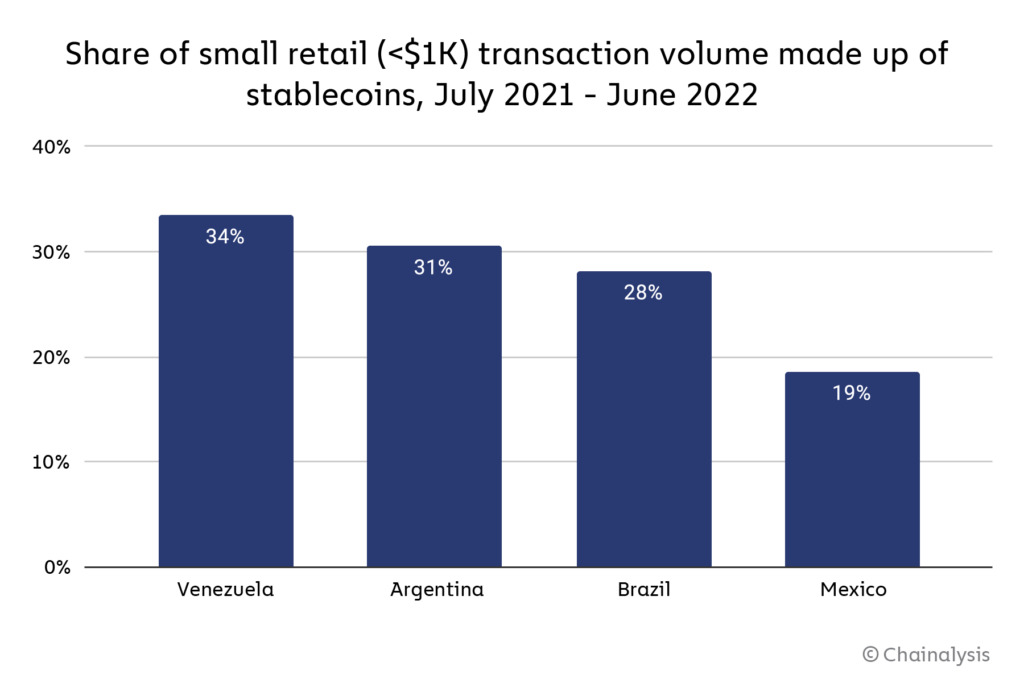

Much of this transaction activity is stablecoin-related. 34% of all small retail transaction volume in Venezuela consisted of stablecoin trades – more than any other country in Latin America. This aligns well with the store-of-value thesis behind Venezuela’s grassroots adoption of crypto.

This economic precarity also helps explain Venezuelans’ affinity for play-to-earn blockchain games, a few of which have (briefly) yielded economic returns that outpace Venezuela’s monthly minimum wage. As a result, Venezuela has the second most Axie Infinity players of any country this year, right after the Philippines, which placed 2nd in this year’s adoption index. Brazil, the next most active Latin American play-to-earn community, has the fifth largest Axie Infinity playerbase.

Spotlight: Argentina

Argentina has had an inflation problem for much of the twentieth and twenty-first centuries. During the Latin American debt crisis of the 1980s, when the conflict was especially acute, Argentina’s inflation rate briefly eclipsed 3,000%. For that reason, explained Rodolfo Andragnes, Founder of ONG Bitcoin Argentina, “Argentinians have gotten used to buying U.S. dollars and literally storing them under the mattress.” It’s also why almost every high-level purchase is paid for in USD. “To buy a house, you go with 400,000 physical dollars, and you pay for the house. There are no 30 year loans or anything like that.”

But Argentina’s government enforces strict capital controls that make it hard to accumulate savings. Citizens with bank accounts can only swap enough Pesos at the official rate — 140 pesos per dollar — to save $200 per month. And on the black market, where much of the country’s exchange trading is actually done, the unofficial rate or ‘Dólar Blue’ is around 270 pesos per dollar. This has forced many Argentinians to get creative about how they save.

One popular solution: stablecoins. Why? Because “psychologically, Argentinians are using crypto for safety,” said Sebastian Serrano, CEO of Argentina-based crypto payments company Ripio. “That’s why you see so much use of stablecoins — because it’s a good digital alternative to storing physical dollars.”

On-chain data suggests that this use-case is popular, especially in Venezuela and Argentina.

More than 31% of Argentina’s small retail-sized crypto transaction volume comes from the sale of stablecoins, compared to just 26% of Brazil’s and 18% of Mexico’s. These stablecoins – USDT, USDC, and USDD especially – have become popular in Argentina for three simple reasons:

- They are pegged to the U.S. Dollar, which is many Argentinians’ preferred currency;

- They are digital, and therefore easy to access on multiple devices; and

- There are no purchase limits, meaning that Argentinians can convert any amount of pesos into stablecoins.

While Argentinians may not get a better fiat-to-stablecoin exchange rate than the dólar blue, it at least engenders some sense of stability once converted.

An alternative economy – and community

One welcome byproduct of Argentina’s long-standing economic instability is that it has become one of the most active communities in blockchain in all of Latin America. “We have a big amount of people working in cryptocurrency and being paid in cryptocurrency, too,” said Andragnes. This is especially true in Buenos Aires, where many of the crypto industry’s biggest players live and largest events are held. MakerDAO and Chainlink, for example, each have a number of key developers based in city, and LABITCONF, the largest bitcoin conference in Latin America, draws thousands of attendees and speakers like Vitalik Buterin, the founder of Ethereum, and Elizabeth Stark, the CEO and co-founder of the Bitcoin Lightning Network, to Buenos Aires every year.

Sending remittances

Remittance payments are also common throughout Latin America. Latin America’s formal remittance market is estimated to reach $150 billion this year, and the adoption of crypto-based remittance services has been uneven, but swift, throughout the region. El Salvador’s government-backed payment app Chivo processed $52 million in Bitcoin remittances from January to May this year; and, as we’ll explore below, crypto services have processed billions in remittances to Mexico as well.

Let’s take a closer look at what might currently be the world’s largest crypto remittance corridor: the US-to-Mexico border.

Spotlight: Mexico

According to Felipe Vallejo, Chief Regulatory Officer at Bitso, the largest crypto exchange in Mexico, a high percentage of families in Mexico’s lowest socioeconomic classes receive remittance payments from family members abroad — and the crypto industry’s slice of that $51.6 billion market is rapidly growing. Bitso alone has already processed more than $1 billion in US-to-Mexico remittances in 2022 as of June, representing a year-over-year growth rate of 400% and a grip on 4% of Mexico’s remittance market.

Coinbase is also giving traditional cross-border retail payment providers like Western Union a run for their money. This February, Coinbase announced the launch of crypto cash-out services across 37,000 establishments in the country, including department stores, supermarkets, and all 20,000 branches of Oxxo, Mexico’s largest chain of convenience stores.

Seeking alpha

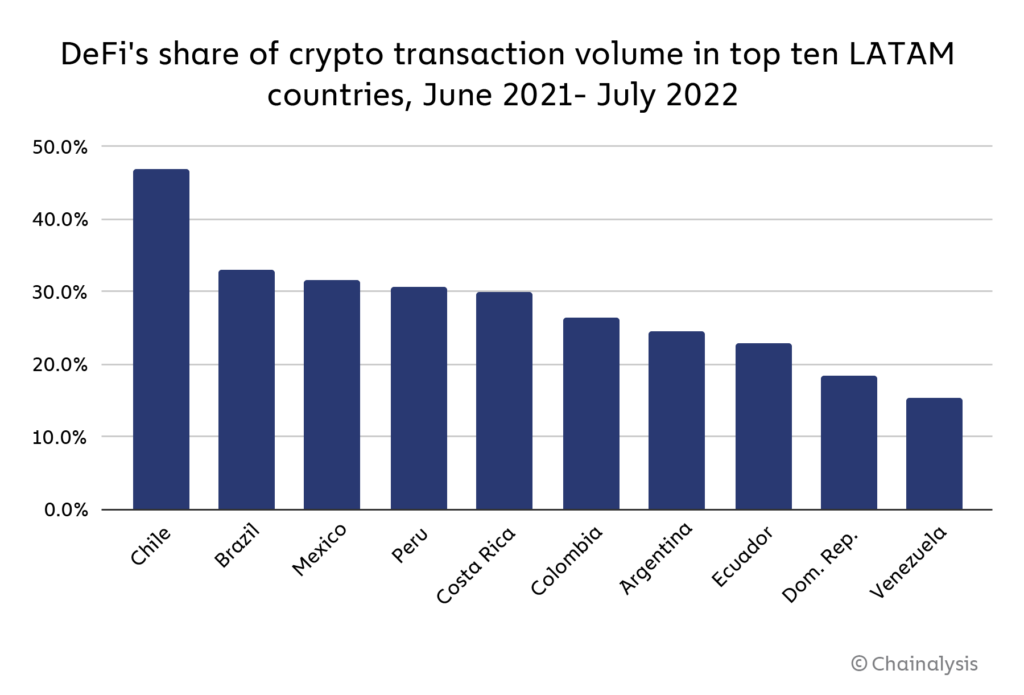

Finally, we find that citizens of the largest and most advanced Latin American economies are more likely to adopt cryptocurrency not just for savings, but for profit. As the below graph shows, the LA5 hold the top six places in terms of DeFi’s share of total crypto activity. This means that in these countries, large numbers of crypto users are engaging with permissionless protocols that enable them to lend, trade, stake, and borrow tokens of all kinds – a speculative activity with significant risk and upside potential.

Latin America’s more DeFi-centric crypto markets are not unlike Western Europe’s or North America’s, where market participants are embracing cutting edge, returns-focused crypto platforms moreso than savings-centric centralized services. Brazil is among the leaders in DeFi adoption in the region.

Spotlight: Brazil

According to Thomaz Fortes, the crypto lead at Nubank, one of the world’s largest digital banking platforms that recently launched a crypto trading platform, the main use case for crypto in Brazil right now is as a speculative investment. “Customers want a way to expand their earnings,” he explained. “Interest rates at all-time lows in the country and strong price appreciation in cryptocurrency prices may have contributed, but the adoption continued strong even in the so-called crypto winter.”

“The retail growth in the number of users in crypto has been much faster than in the equities market. It took several years to get to several millions of equity investors,” Fortes observed. Nubank reached 1 million customers just one month after launching its crypto platform. “It’s not only institutional or high-net-worth individuals. Democratizing access means a lot of retail adoption. Here at Nubank, we developed the experience for trading cryptocurrencies so that we could break the barriers of complexity common in niche crypto brokers.”

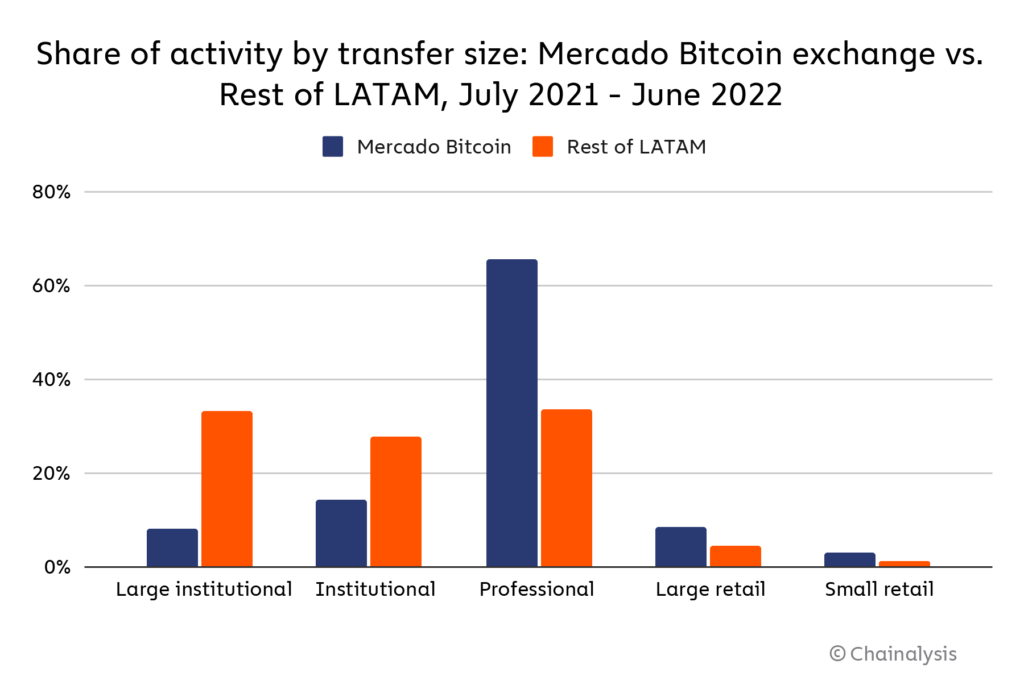

We can see some evidence of this retail adoption on-chain. Compared to other Latin America countries, a higher share of Brazil’s transaction volume takes place in retail-sized increments. Trading activity on Mercado Bitcoin, one of the largest Brazilian crypto exchanges, illuminates this trend.

As the above chart shows, small retail (<$1K), large retail ($1K-$10K), and professional ($10K-$1M) sized transfers represent a much larger proportion of total trading volume on Mercado Bitcoin than they do across the rest of Latin America.

A diversity of use cases

Overall, on-chain data and interviews with operators in the region show that Latin America has embraced cryptocurrency for a diverse array of reasons depending on the unique needs of each country. Users in countries with weaker economies tend to rely on cryptocurrency for remittances and, if inflation is high, for savings preservation, while users in more developed markets like Brazil treat cryptocurrency more as a speculative investment. As cryptocurrency evolves and the needs of Latin American users shift, it’ll be interesting to see what use cases emerge to serve their needs.

This blog is an excerpt from our 2022 Geography of Cryptocurrency Report. Download your copy today!

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.