This blog is a preview of our 2021 Geography of Cryptocurrency report. Sign up here to download the whole thing!

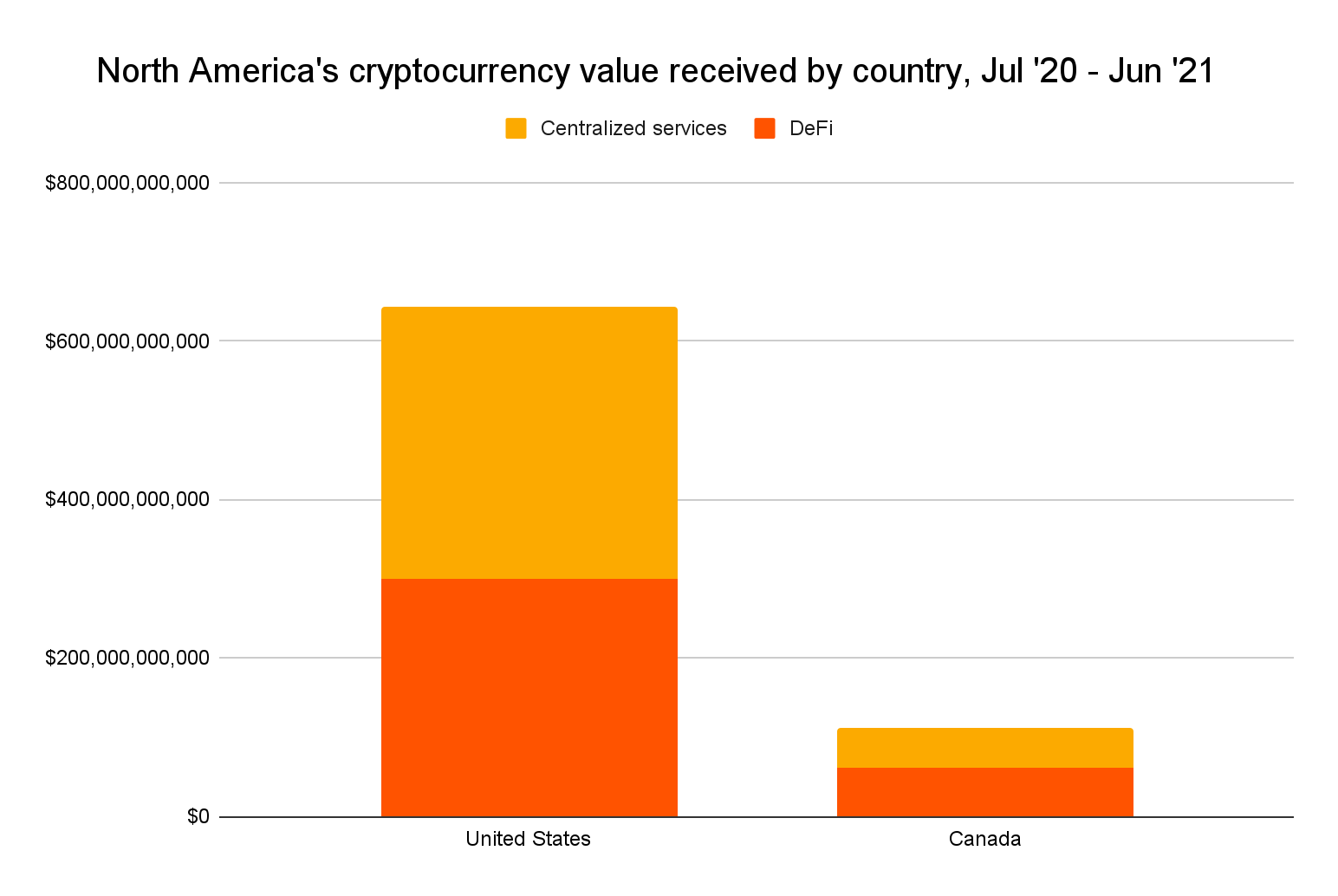

North America is the second-largest cryptocurrency economy we study, having received over $750 billion in cryptocurrency between July 2021 and June 2020, which accounts for 18.4% of global activity in that time period. The United States accounts for the majority of this activity, and also shows relatively high grassroots adoption, ranking eighth on our Global Crypto Adoption Index. The U.S.’s ranking is largely due to its high ranks in total cryptocurrency value received and value received in retail-sized transactions in proportion to internet-using population and purchasing power, ranking fourth and third in each category respectively. Simply put, more Americans are devoting a higher share of their purchasing power to cryptocurrency than in nearly every other country.

The United States also places first on our new DeFi Adoption Index, which ranks countries by grassroots adoption of DeFi platforms specifically. As we’ll explore later, DeFi played a huge role in North America’s strong cryptocurrency growth over the last year, and several DeFi platforms are now among the most popular overall in the region. Below, we’ll discuss these growth trends and also take a look at North America’s — in particular, the United States’ — issues with ransomware.

DeFi drove North America’s cryptocurrency growth in the last year

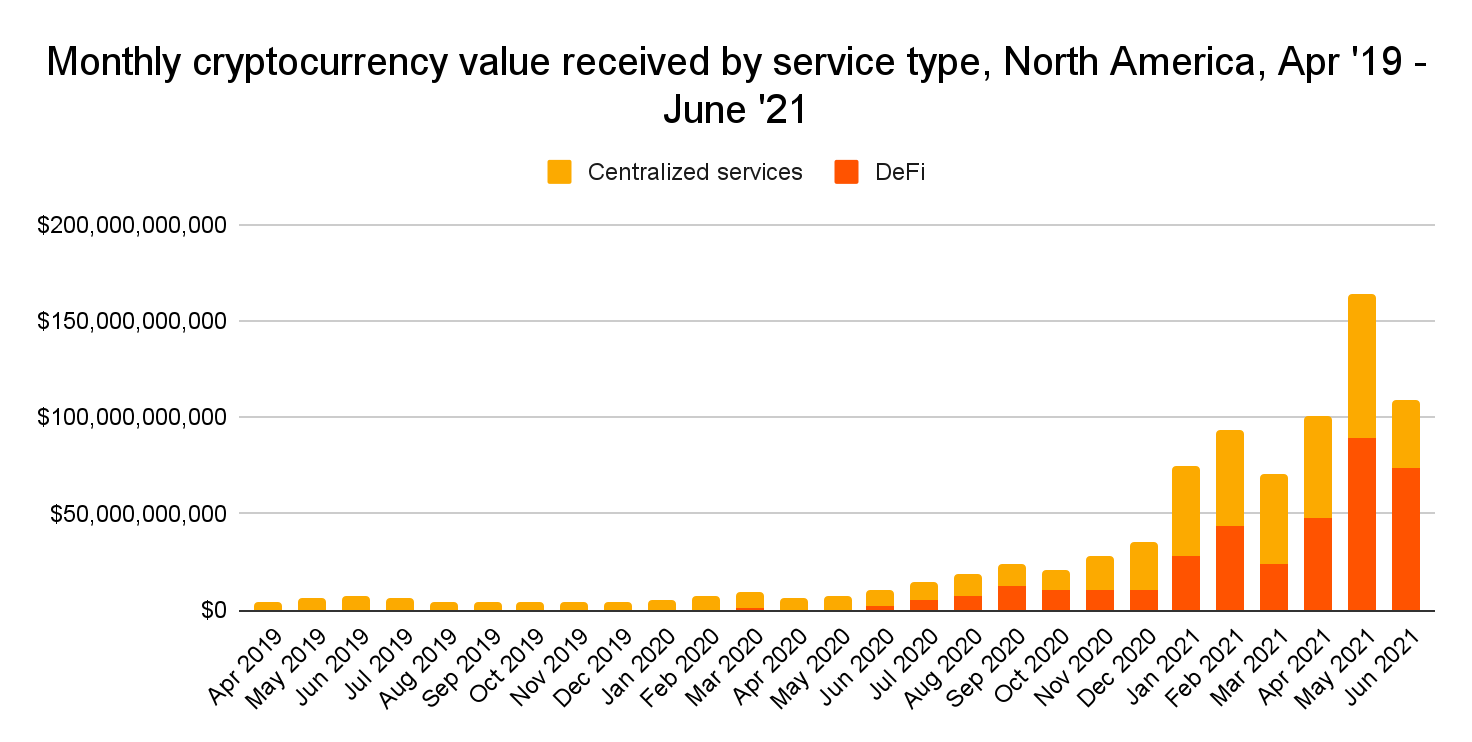

North America’s monthly cryptocurrency transaction volume grew significantly during the time period studied, rising from $14.4 billion in July 2020 to a high of $164 billion in May 2021 — an increase of over 1,000% — before a slight dip in June. Much of this growth was driven by the growing popularity of DeFi.

This growth has made North America one of the world’s strongest markets for DeFi.

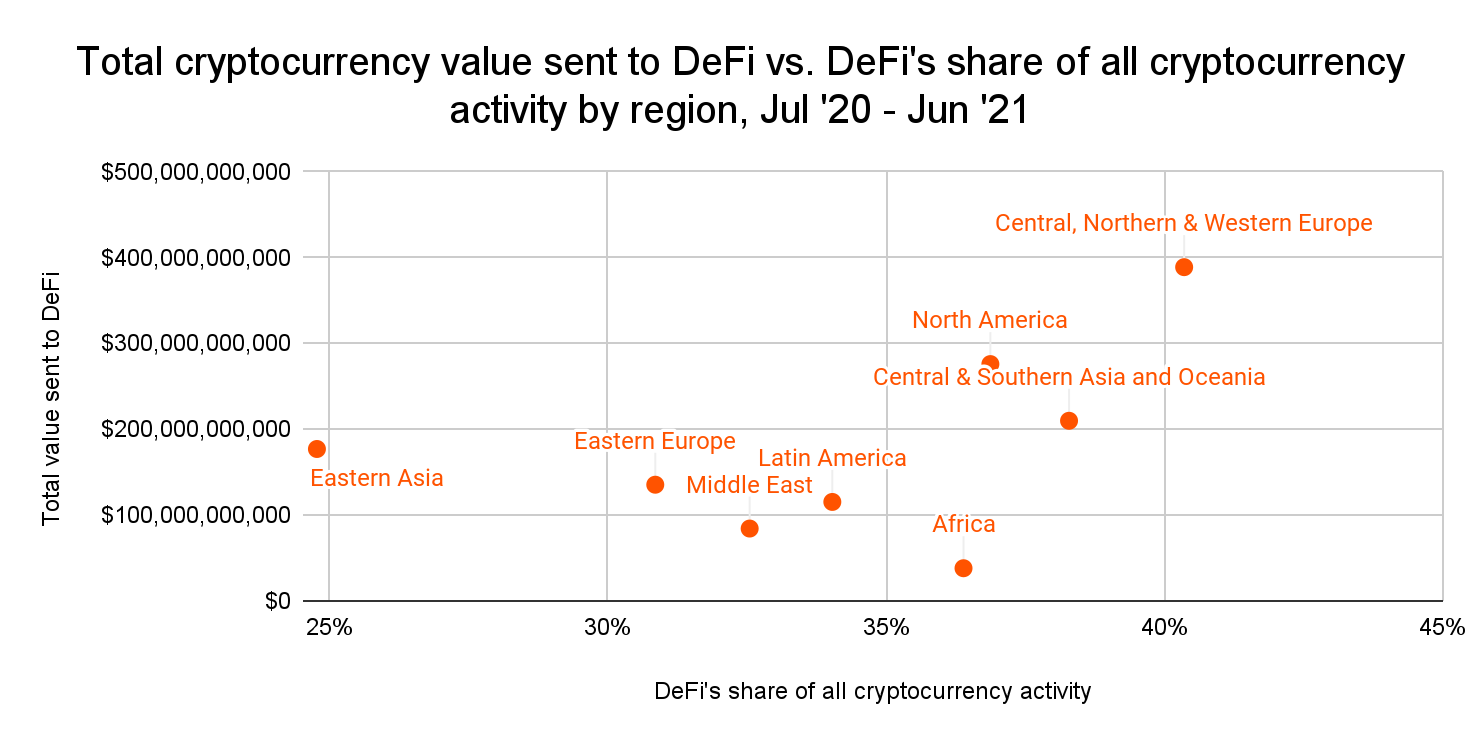

North Americans sent roughly $276 billion worth of cryptocurrency to DeFi platforms between July 2020 and June 2021, second only to Central, Northern & Western Europe (CNWE) at $389 million. DeFi transactions represented 37% of North America’s overall transaction volume during the time period — only CNWE and Central & Southern Asia and Oceania (CSAO) devoted a higher share of activity to DeFi, and in recent months, DeFi activity has eclipsed activity on centralized services.

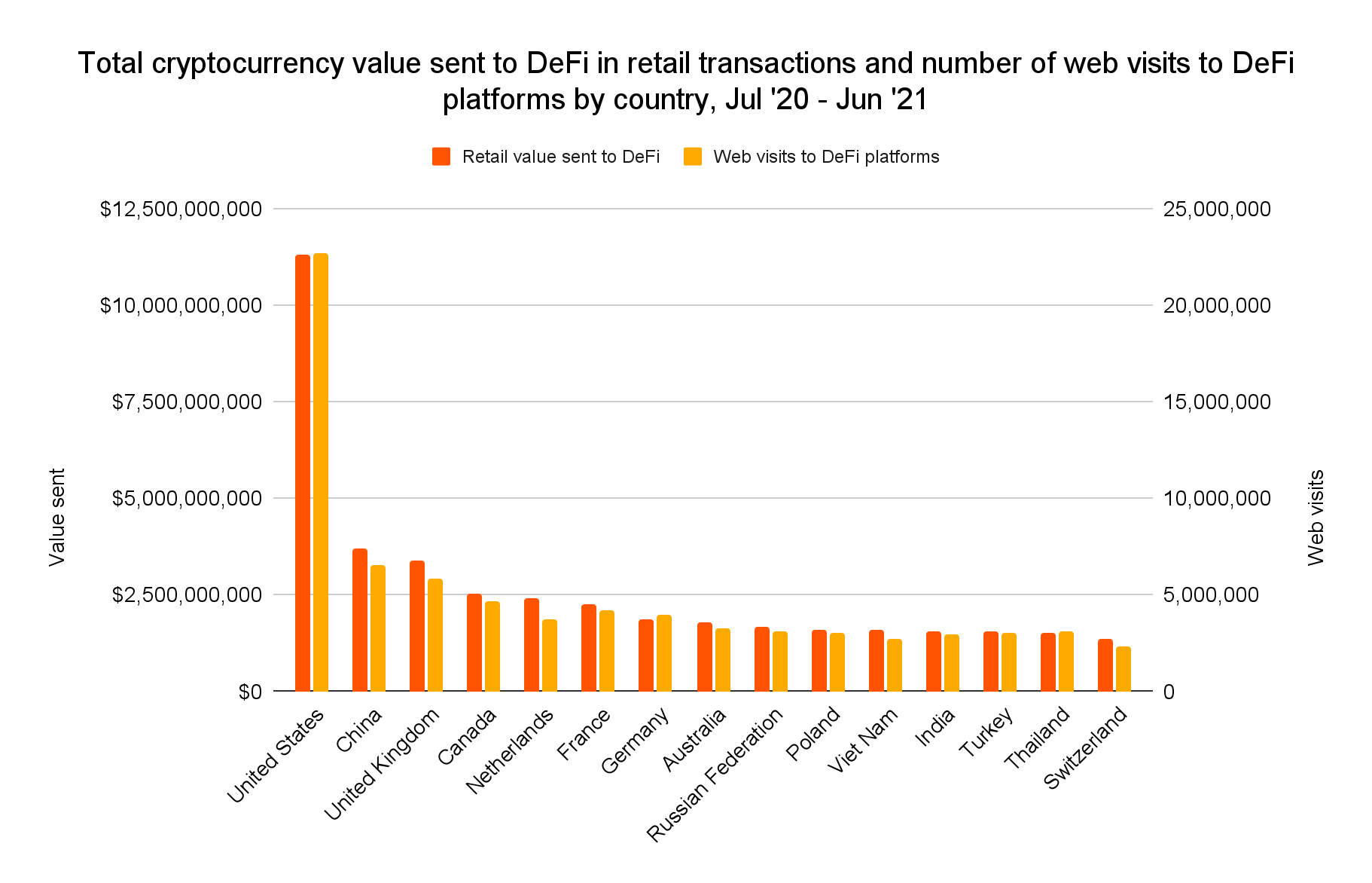

Interestingly, while DeFi activity tends to be driven by larger investors based on transaction size, the United States leads the way in retail-sized DeFi transactions, meaning those below $10,000 in value. Canada places fourth, showing the high degree to which DeFi has penetrated the North American retail market.

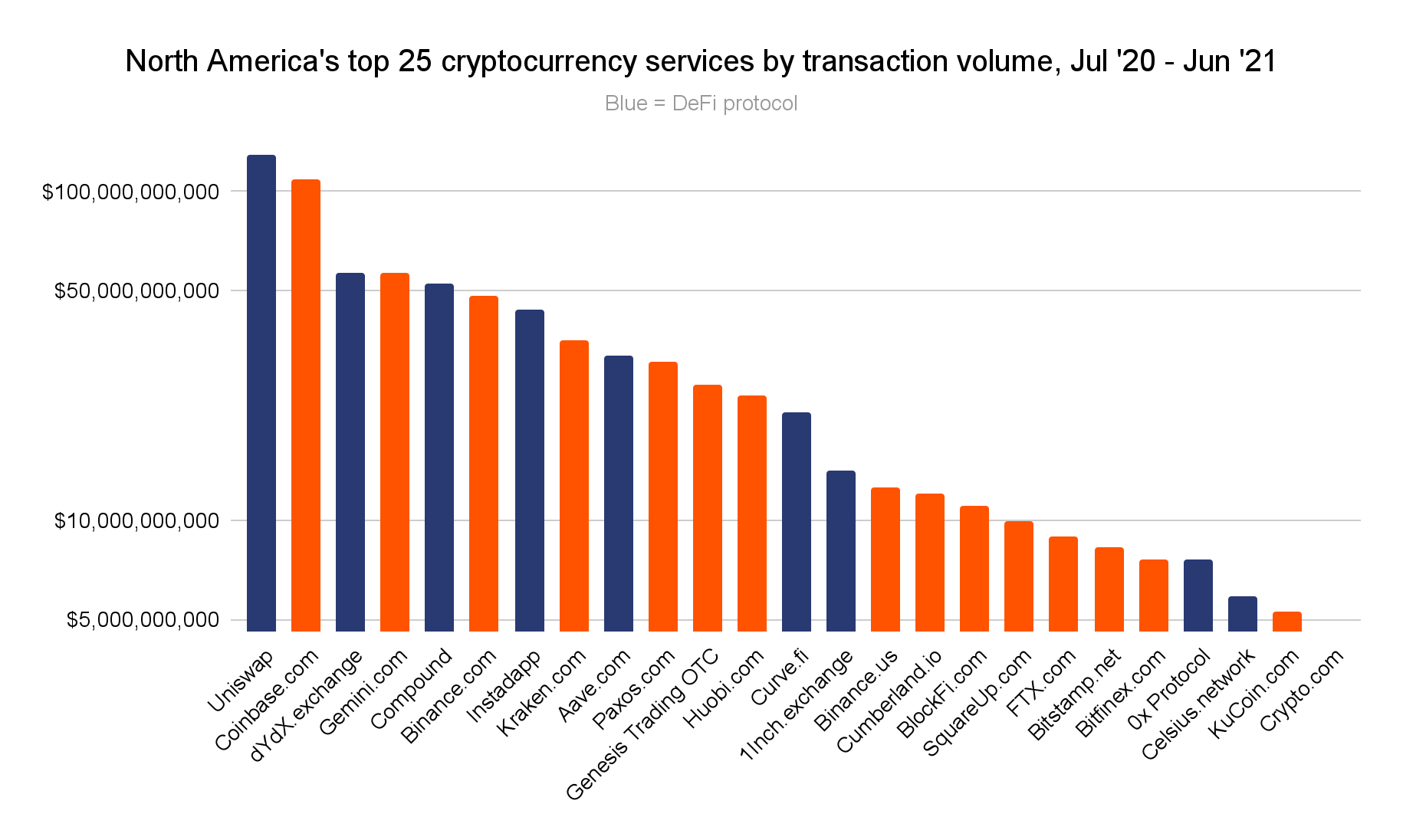

Several DeFi platforms now count among the most popular services overall by North American cryptocurrency users, with Uniswap taking the number one position in terms of transaction volume.

Overall, nine of the 25 biggest cryptocurrency services by transaction volume in North America are now DeFi protocols, with Uniswap, dydx, and Compound being the most popular. Interestingly, all three of those platforms fulfill distinct DeFi use cases. Uniswap is a decentralized exchange (DEX), meaning it serves a similar function to a traditional, centralized exchange, but is non-custodial and offers a wide variety of ERC-20 tokens not available on centralized exchanges. dydx, on the other hand, is more focused on cryptocurrency derivatives, and Compound on interest-based lending. The relatively high popularity of all three suggests broad interest in the DeFi category for multiple reasons, rather than interest in just one particular DeFi use case.

dydx Growth Lead David Gogel told us more about the current state of DeFi adoption, which provides helpful context for DeFi’s explosive growth in North America over the last year. “Right now, DeFi is targeted towards crypto insiders,” he said. “It’s people who have been in the industry for a while and have enough funds to experiment with new assets,” said Gogel. He pointed to the United States specifically, along with China, Russia, and several others in Western Europe as those leading the way in the category, which shouldn’t be a surprise. A large number of professional institutional investors in North America have now taken the first step of investing significantly in cryptocurrency, so projects in the DeFi space focused on new types of coins and use cases like lending would be the next logical step in the search for cryptocurrency investment gains.

North America is the biggest target for ransomware attackers

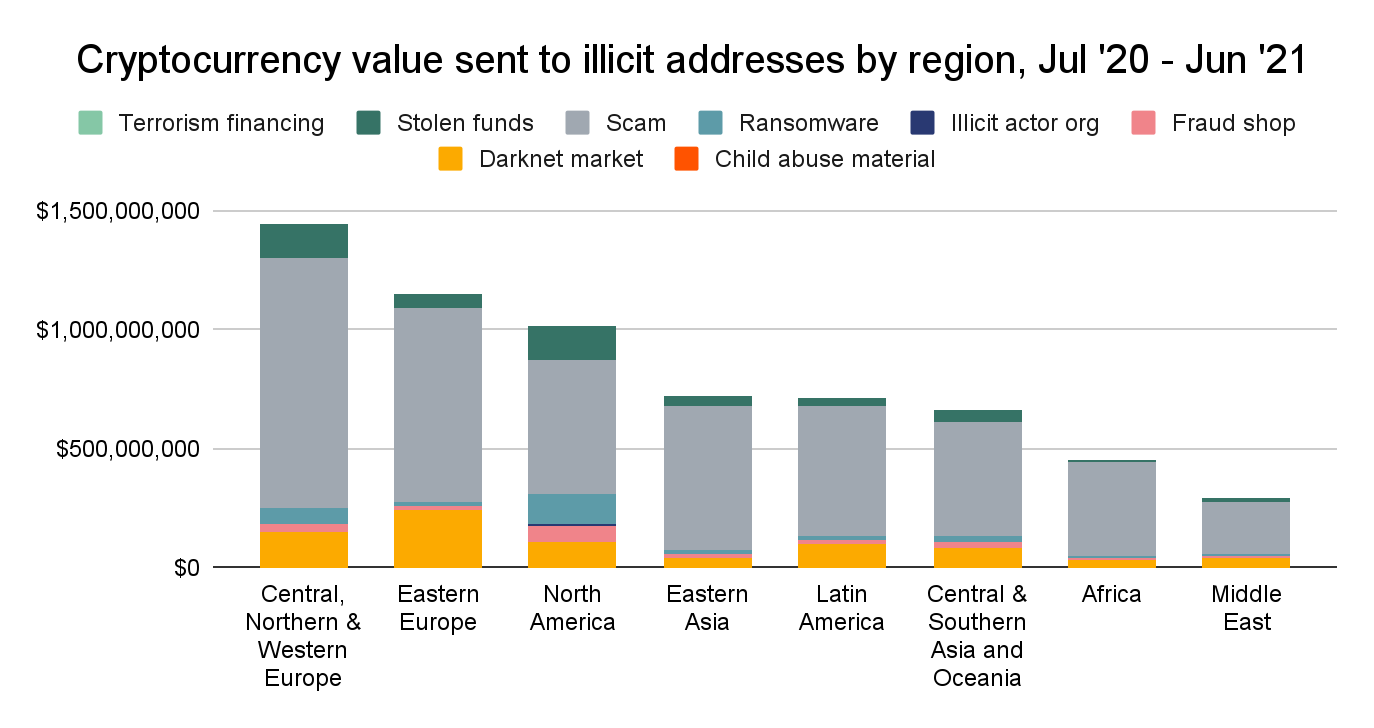

When it comes to cryptocurrency-based crime and illicit activity, what stands out most about North America is that it’s been the biggest victim of ransomware attacks during the yearlong time period we study.

North American users sent $131 million worth of cryptocurrency to ransomware attackers between July 2020 and June 2021, more than double that of Western Europe, which sent the second most.

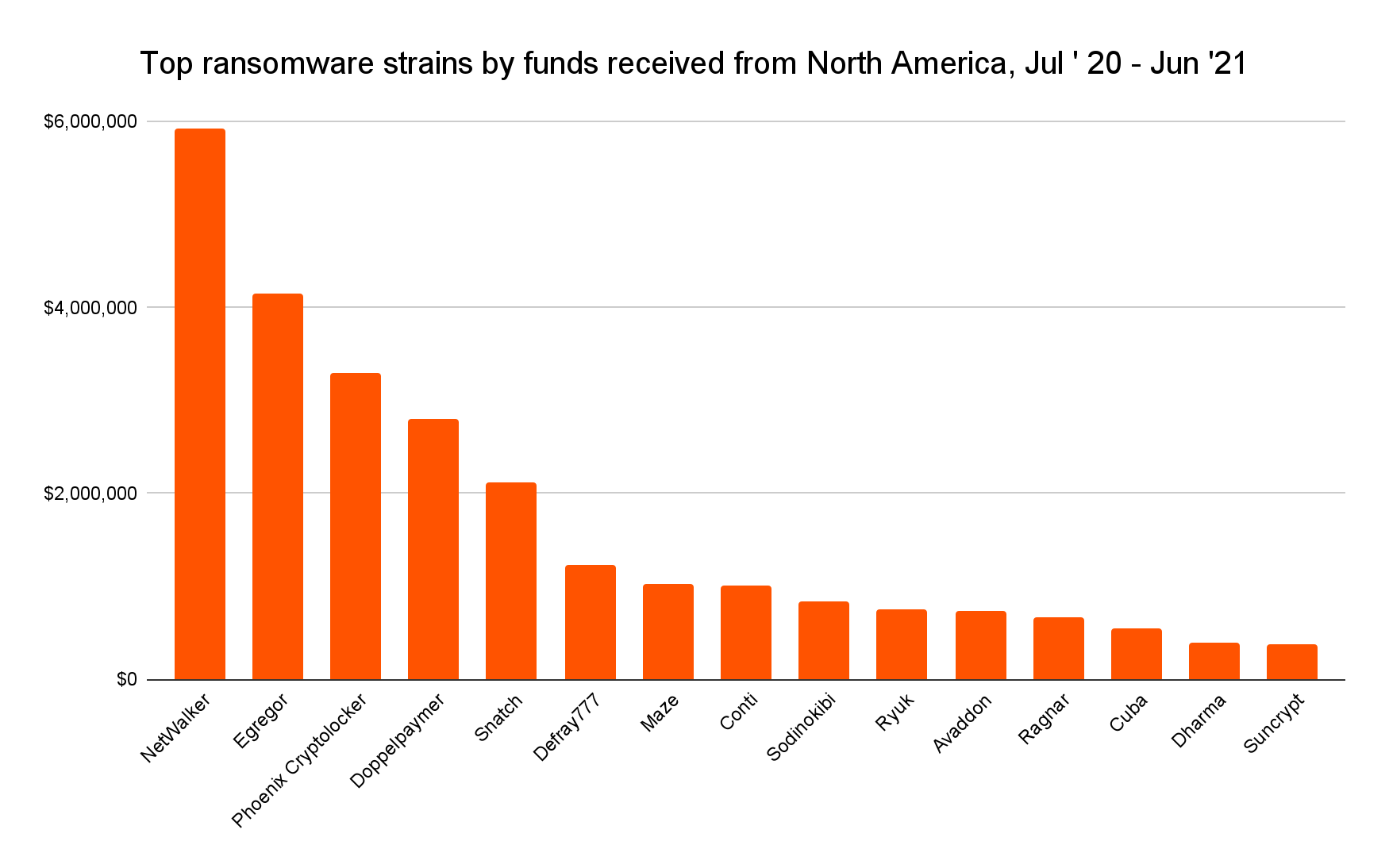

Ransomware strains that took the most from North American victims during the time period studied include NetWalker, Egregor, Phoenix Cryptolocker, and Doppelpaymer, all of which are associated with Russia-based cybercriminal groups including Evil Corp, which has been previously linked to the Russian government.

That dynamic prompted U.S. President Joe Biden to demand that Russian President Vladimir Putin act to rein in ransomware groups, warning that continued attacks would be treated as national security incidents rather than simply as crimes. Because many ransomware attacks hit organizations that are part of our critical infrastructure, including hospitals, energy providers, and banks, in June the U.S. Department of Justice elevated investigations of ransomware attacks to a similar priority as terrorism As Chainalysis Global Public Sector CTO Gurvais Grigg has argued, the comparison between ransomware and terrorism also extends to solutions, and counterterroism strategies can be applied to ransomware.

Ransomware is one of the fastest-growing forms of cryptocurrency-based crime and perhaps the most dangerous in its real-world implications given the types of organizations that are frequently attacked. But as we’ve discussed previously, the number of bad actors responsible for these widespread attacks is surprisingly small. While there are a seemingly endless number of individual ransomware strains, the ransomware affiliates who actually carry out the attacks frequently switch between multiple strains. Not only that, but the infrastructure providers that attackers rely on to carry out attacks, as well as the money launderers they work with to liquidate funds extorted from victims, also tend to work with several different strains. By taking action against the biggest players in each of those groups, law enforcement can have an outsized impact and disrupt the operations of multiple strains. We saw an example of this strategy in action earlier this year when U.S. authorities arrested a prominent affiliate for Netwalker, which to that point was one of the world’s most prolific ransomware strains. The arrest resulted in NetWalker’s shutdown, and blockchain analysis suggests the affiliate also carried out attacks for other strains like Ragnar Locker and Sodinokibi. In other words, arresting one affiliate allowed law enforcement to strike a blow against three prominent ransomware strains. Although ransomware developers may be primarily based in Russia, the supply chain of actors who enable ransomware operations is global, and each link provides North American law enforcement an opportunity to disrupt their operations.

This blog is a preview of our 2021 Geography of Cryptocurrency report. Sign up here to download the whole thing!