This blog is an excerpt from the Chainalysis 2020 Geography of Cryptocurrency Report. Sign up here and we’ll email you the full report as soon as it comes out in September!

North America is the third-most active region by cryptocurrency volume moved on-chain, just behind Western Europe and well behind East Asia. Overall, North America-based addresses accounted for 14.8% of all cryptocurrency activity over the last 12 months. Like East Asia, North America has an extremely active professional market, though that market’s strategies for cryptocurrency investment appear to be much different from its East Asian counterpart, as we’ll explore later.

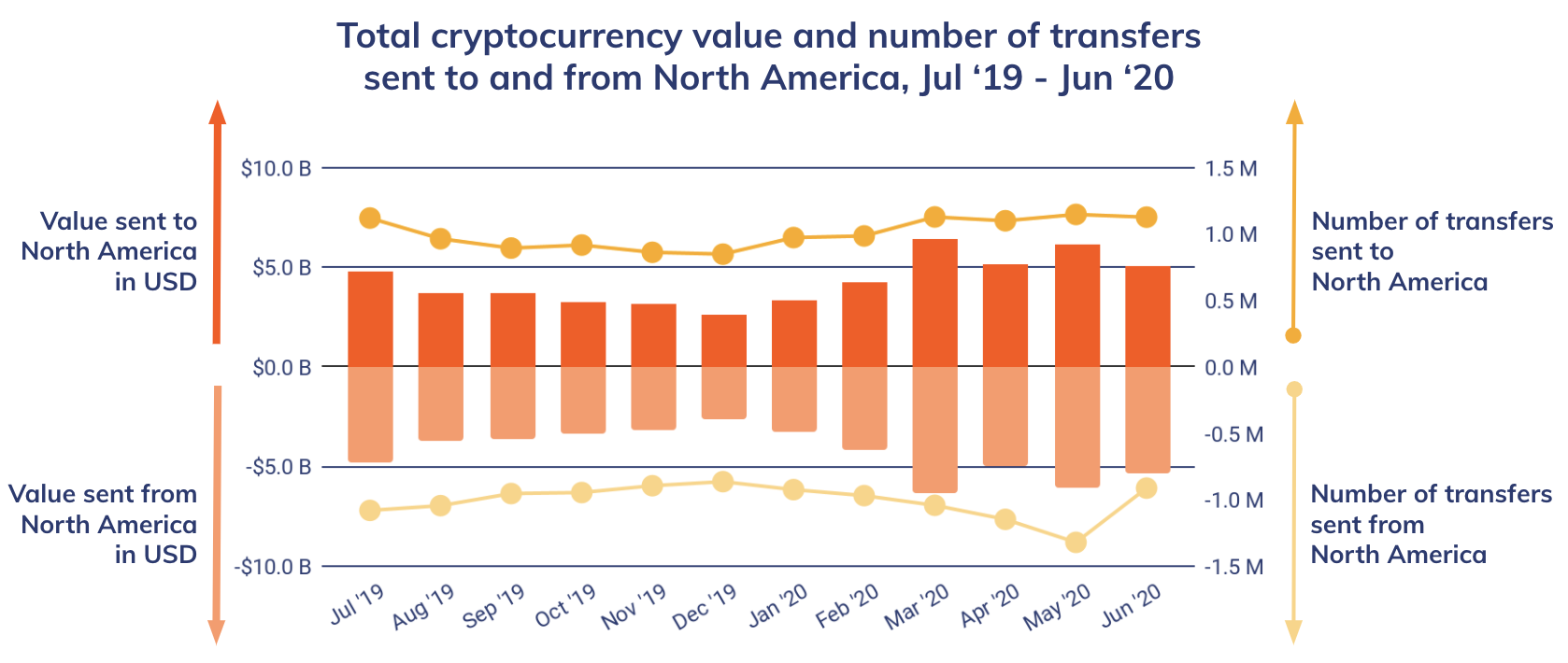

North America also hosts a growing class of institutional investors moving even larger transfers of cryptocurrency than those we typically see from professional traders. The institutional share of the market has grown over the past few years, which can be seen by many to legitimize cryptocurrency as an asset class. In addition, we’ll also explore North America’s relationship with other regions, in particular East Asia and Western Europe, which represent the region’s two largest trading partners.

From professional to institutional

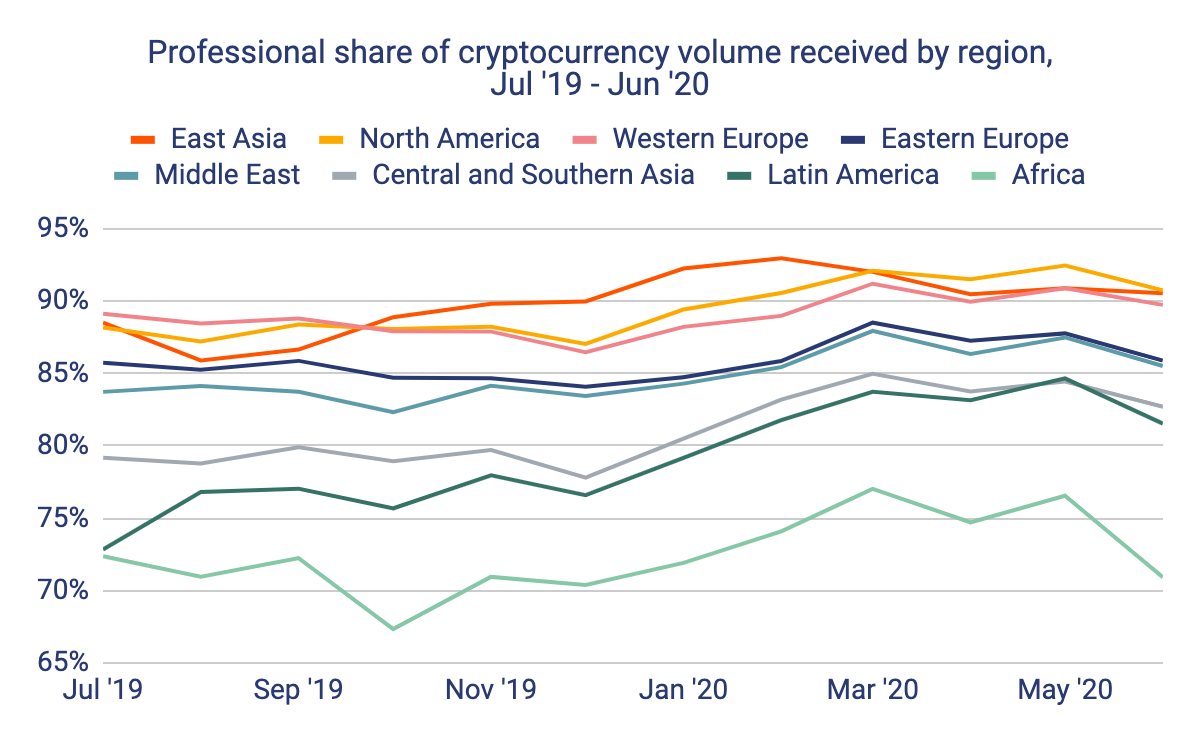

In March 2020, North America surpassed East Asia for the second time in the past year as the region where professional investors dominate most.

As of June, approximately 90% of North America’s cryptocurrency transfer volume came from professional-sized transfers, which we categorize as those above $10,000 worth of cryptocurrency.

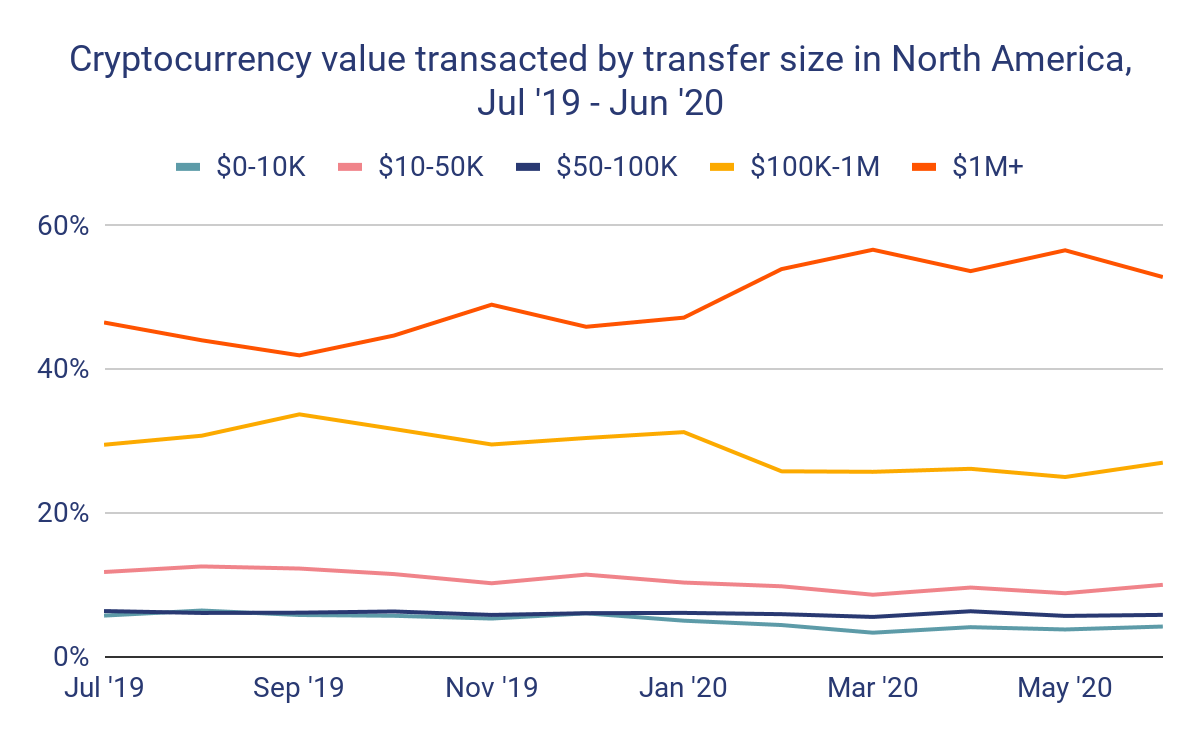

However, over the last two years in North America, we’re seeing the impact of a growing class of institutional investors whose transfers account for the growing dominance of professionals in the North American market since December 2019. Below, we show North America’s cryptocurrency value transacted by transfer size, with professional-sized transfers broken out into larger, more granularly sized buckets beyond just the initial $10,000 USD threshold.

Starting around December 2019, the share of North America’s total value transferred made up of transfers above $1 million rises from 46% to a high of 57% in May 2020. That corresponds with the jump in the overall professional market share of North America activity rising from 87% in December 2019 to a high of 92% in May 2020. In other words, the increasing dominance of North America’s professional market since December 2019 appears to be almost entirely driven by transfers of $1 million or more worth of cryptocurrency, many of which we believe are coming from institutional investors.

Institutional investors’ interest in cryptocurrency appears to be growing based on recent reports. In Fidelity Investments’ June 2020 survey of nearly 800 institutional investors across the U.S. and Europe, 36% said they’re currently invested in digital assets, while 60% said they believe digital assets have a place in their portfolio. Fidelity itself is helping to meet that demand with its Fidelity Digital Assets platform, which offers crypto custody for institutional investors. In the crypto world, Coinbase has launched a similar initiative with Coinbase Custody, also geared towards institutional investors. As institutional involvement in cryptocurrency continues to grow, it’ll be interesting to see whether the preferred custody options for those investors come from a mainstream financial services company or a crypto-native company.

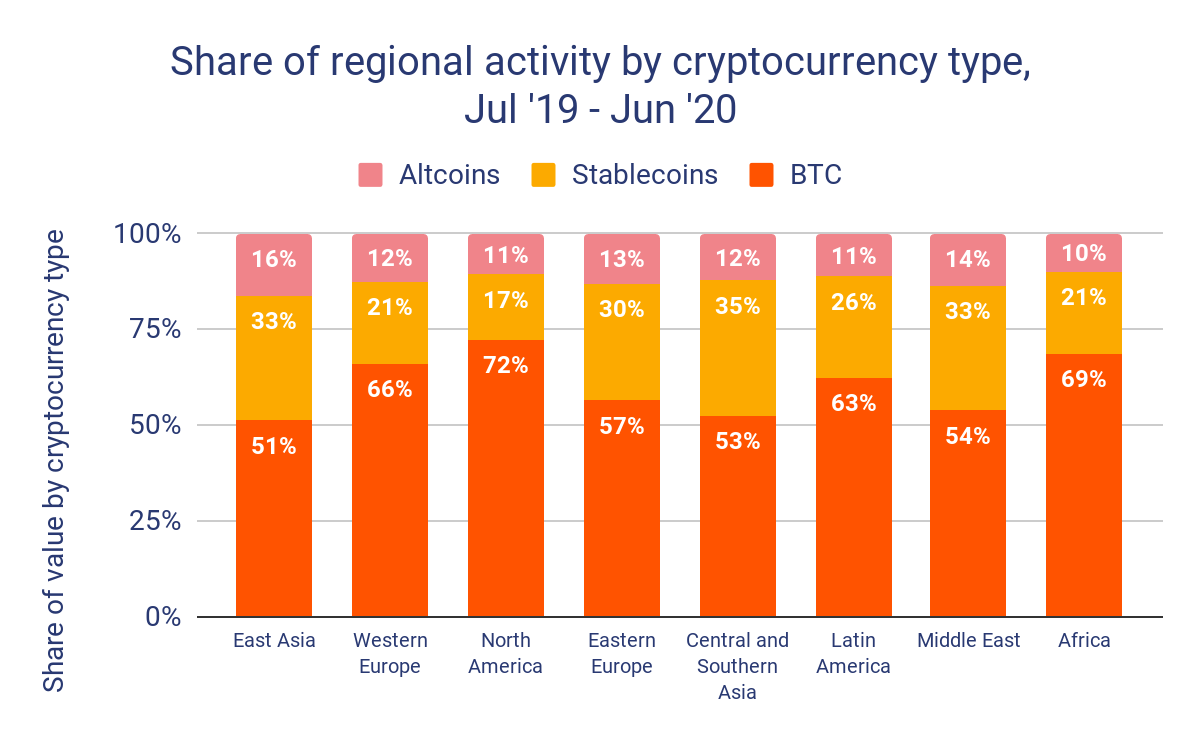

What’s the strategy for professional and institutional investors in North America when it comes to cryptocurrency? The first thing we see from the data is that North American investors disproportionately favor Bitcoin.

While Bitcoin is the most popular cryptocurrency in every region by transaction volume, it makes up the biggest overall share of North American cryptocurrency activity, accounting for 72% of all transaction volume. Altcoins (not including stablecoins) make up just 17% of activity in North America, compared to 33% in East Asia. In other words, altcoins are nearly twice as prominent in East Asia compared to North America.

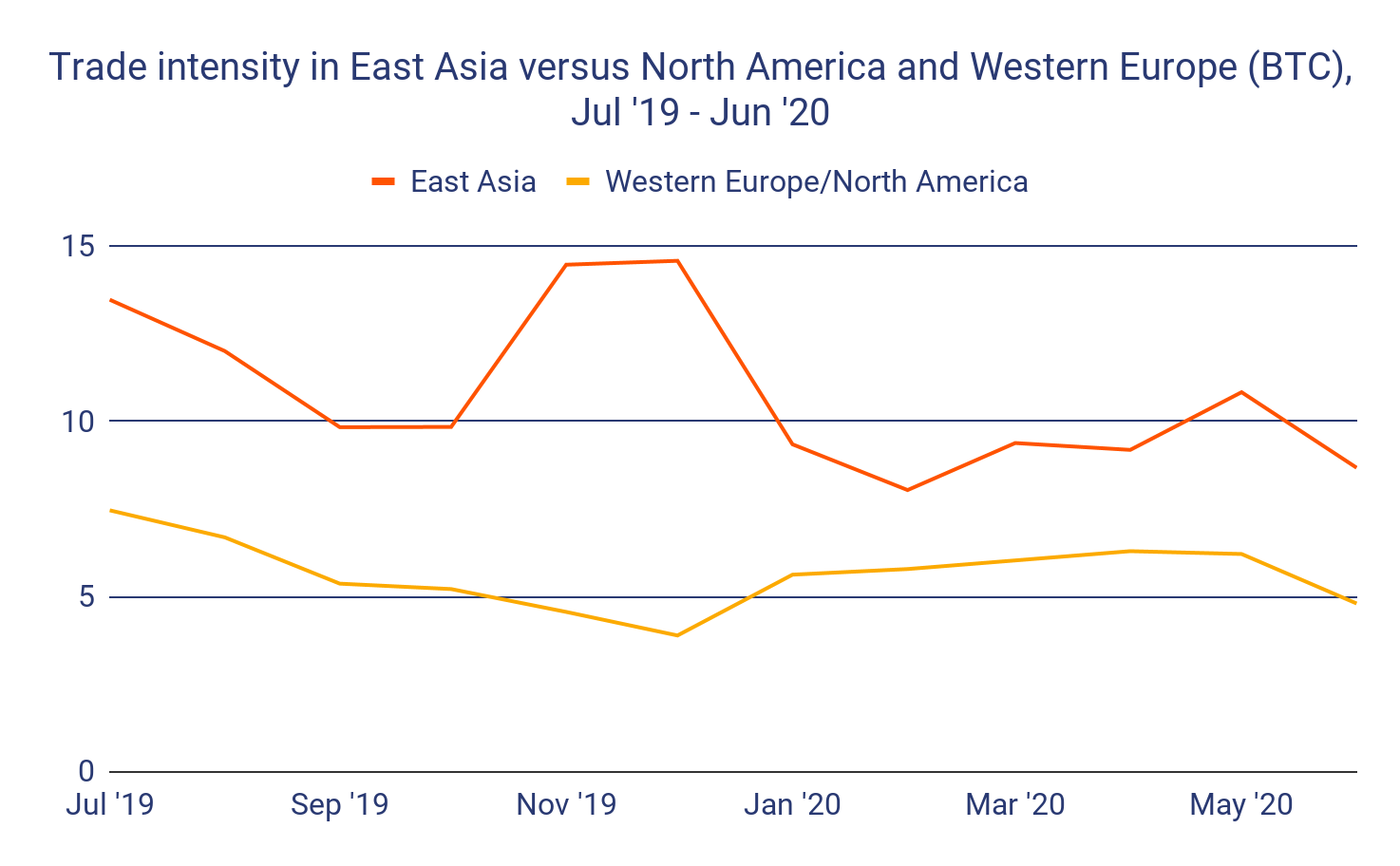

The data also suggests that North America-based professional and institutional investors tend to buy and hold cryptocurrency moreso than those based in East Asia, who tend to trade at a higher frequency. We see this in the below chart that compares the trade intensity over time of six exchanges with predominantly Europe and North America-based users to that of six with predominantly East Asia-based users. Trade intensity measures the number of times a Bitcoin is traded on a spot exchange for every Bitcoin deposited to that exchange.

In most months, the East Asia-based exchanges have a trade intensity close to double that of the North American ones, save for the period of November and December 2019 when the East Asia exchanges’ trade intensity shoots up to more than 3x that of the North America-based exchanges (it’s unclear why the figure jumps so much during this time). These figures suggest that users of the exchanges catering more to North American and European users trade the cryptocurrency they deposit there less frequently than those catering to users in East Asia, instead opting to hold.

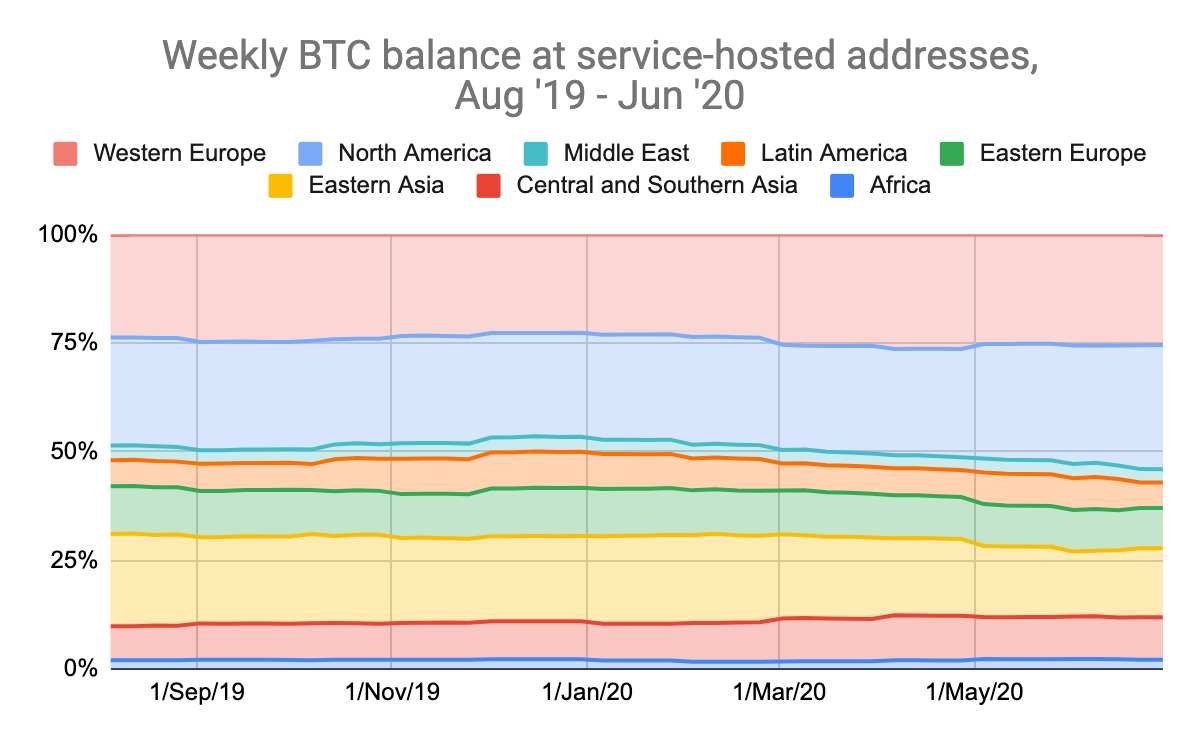

Our data on the balances of addresses broken down by region further suggests that North American users are more likely to buy and hold than those based in East Asia.

Despite North America-based addresses making up roughly 15% of all cryptocurrency activity globally as of June 2020, behind Western Europe at 17% and East Asia at 31%, North American addresses lead the way in cryptocurrency balances. North American addresses hold 29% of all cryptocurrency currently parked at service-hosted addresses, compared to 16% for East Asia-based addresses as of the end of June. Those figures would suggest that North America-based users tend to let the cryptocurrency they acquire sit in their wallets and accumulate, while East Asia-based users tend to trade it more frequently.

Want more insights into how cryptocurrency usage differs by region? Sign up here to get the full Geography of Cryptocurrency Report delivered to your inbox as soon as it comes out! You’ll get more original data and research on inter-regional trading patterns, the state of regulation by region, how cryptocurrency mitigates economic instability in the developing world, and more!