Is cryptocurrency set to go mainstream? Adoption rises every year and exchanges are offering more investment products than ever before. But in order for growth to continue, financial institutions need to buy in and fully integrate into the cryptocurrency ecosystem. That’s why earlier this month, we polled 350 finance professionals on how they view cryptocurrency heading into 2020.

The results were telling. We found that while respondents believe in cryptocurrency’s growth potential, many organizations have concerns around safety and compliance. Though the hesitation is understandable, we believe that financial institutions are underestimating their ability to solve these challenges. As a result, they risk needlessly holding off from engaging with cryptocurrency and denying themselves a huge opportunity.

Let’s dig into the survey results.

Survey Results: What Finance Professionals Think About Cryptocurrency

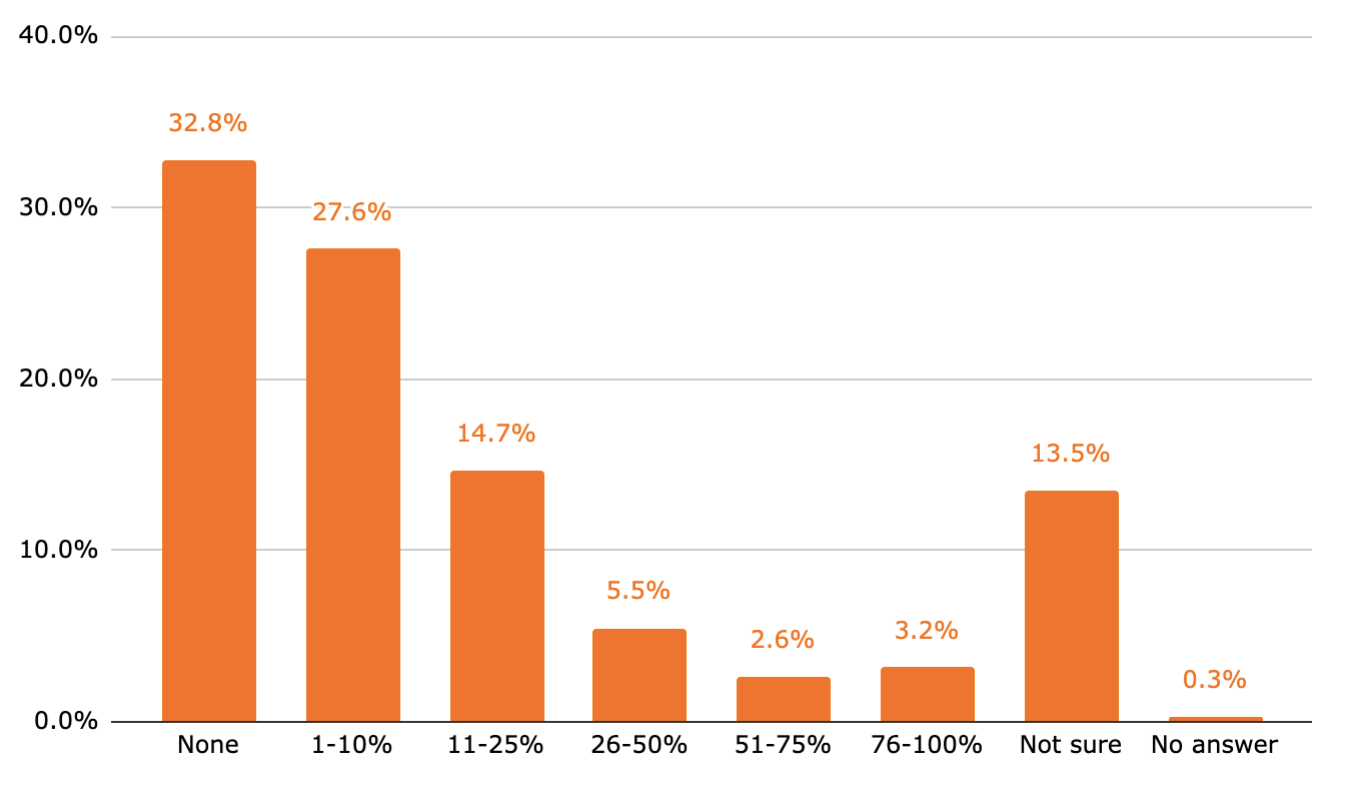

Question 1: What percent of your retail customers transact with cryptocurrency businesses?

We were surprised to see that nearly one third of respondents said none of their customers have transacted with cryptocurrency. That’s highly unlikely.

Polling from September shows about eight in 10 Americans are familiar with at least one type of cryptocurrency. Among all US adults who are familiar, 18% say they’ve purchased cryptocurrency in the last year.

13.5% of respondents also said that they didn’t know whether any of their customers had purchased cryptocurrency. Both underestimating and not knowing is a problem. Without understanding their customers’ cryptocurrency activity, these organizations risk exposure to money laundering, terrorism financing, human trafficking, sanctions violations, and more. But financial institutions can use blockchain analysis to learn more about their customers’ current cryptocurrency activity.

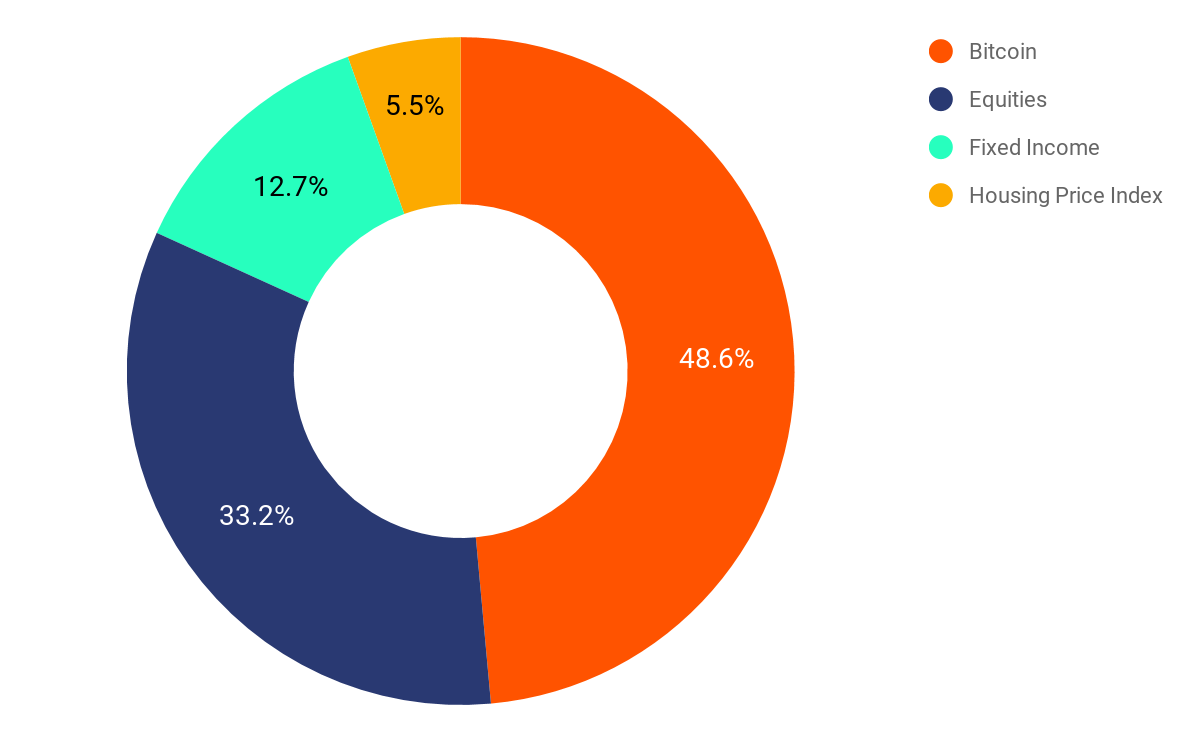

Question 2: Which of the following will have the biggest growth rate over the next 12 months: Bitcoin, the S&P 500, the Bloomberg Barclays Bond Index, or the House Pricing Index?

Good news for the cryptocurrency industry: Our polling shows that finance professionals believe Bitcoin’s value will grow at a higher rate than that traditional investment categories like stocks, fixed income bonds, and housing. Given the optimism, you’d expect that financial institutions are lining up to provide opportunities for their customers to invest in cryptocurrency, right?

Not necessarily. As we’ll explore in the next two questions, the finance world still has significant concerns about the industry.

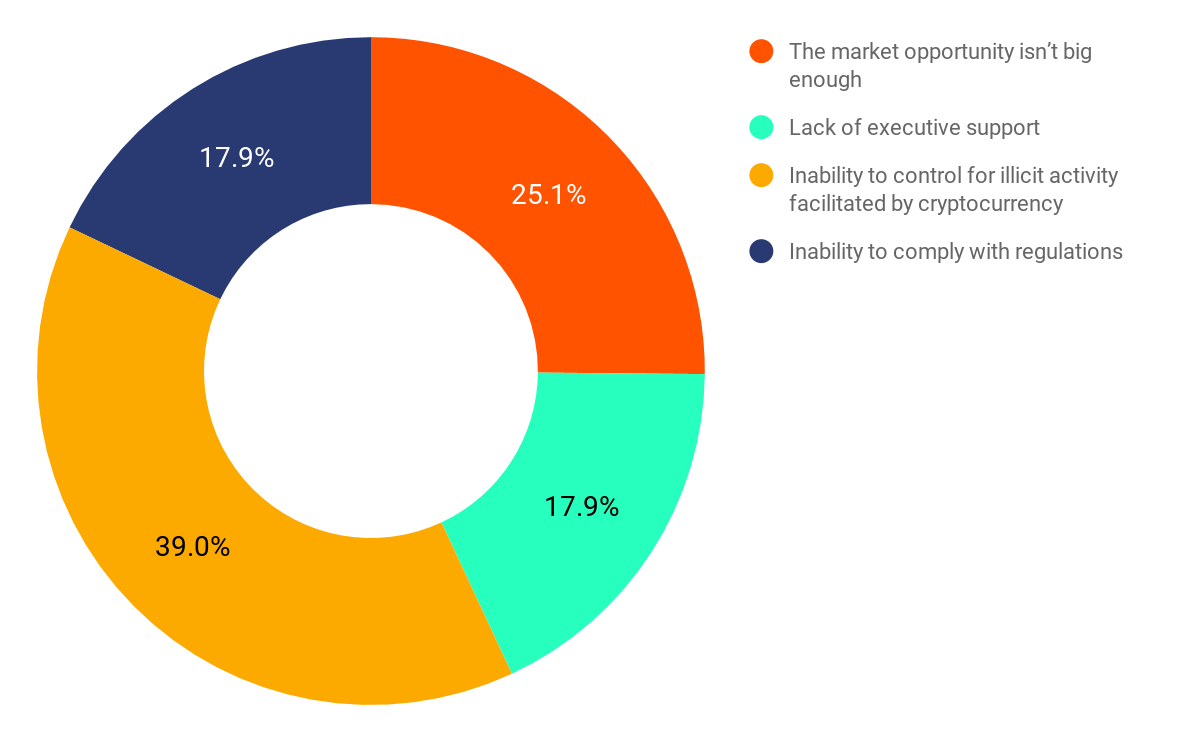

Question 3: Of the following, what is the #1 thing holding you back from doing more work with cryptocurrency?

More than half of our respondents cited compliance in one form or another as the issue preventing them from investing more in cryptocurrency. 39% said they worry about the inability to control for illicit activity, while nearly 18% said they are unsure of their ability to comply with government regulations in the space.

While compliance issues in cryptocurrency present a valid concern, we think that financial institutions may not realize how solvable they are. Blockchain analysis makes it possible for compliance pros to track suspicious transactions along the blockchain, comply with regulations like the Travel Rule, and share data with law enforcement when necessary. If finance professionals truly see Bitcoin (and potentially other cryptocurrencies) as the high-growth asset class, then they’re shooting themselves in the foot by not exploring ways to invest safely.

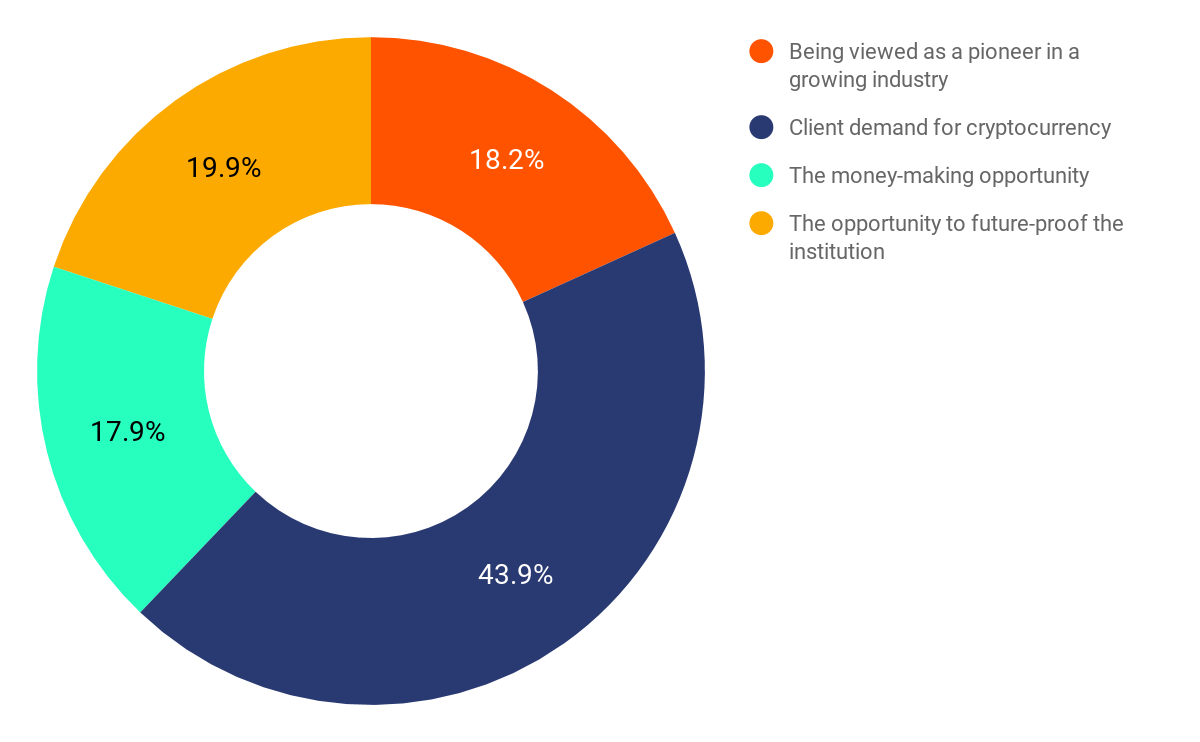

Question 4: What is/would be the most likely factor to motivate your employer to get more involved in cryptocurrency?

At nearly 44%, client demand is cited the top factor that would prompt financial institutions to get more involved in cryptocurrency. That makes perfect sense — like any other business, financial institutions want to serve their customers. However, it’s possible that for some institutions, the demand is there and they don’t realize it. As we mentioned before, 18% of Americans familiar with cryptocurrency — or roughly 15% of all Americans going by YouGov’s numbers — have bought at least one type of cryptocurrency. That’s a significant number on its own. But the poll we cited also found that the number nearly doubles to 35% for American millennials who are familiar with cryptocurrency. It seems likely that demand will increase as the millennial age cohort increases its buying power with age.

There’s also a clear message here for cryptocurrency enthusiasts who want more support from their financial institutions around crypto: Speak up! Our survey results suggest that if you’re vocal about your need for cryptocurrency support, these organizations may respond.

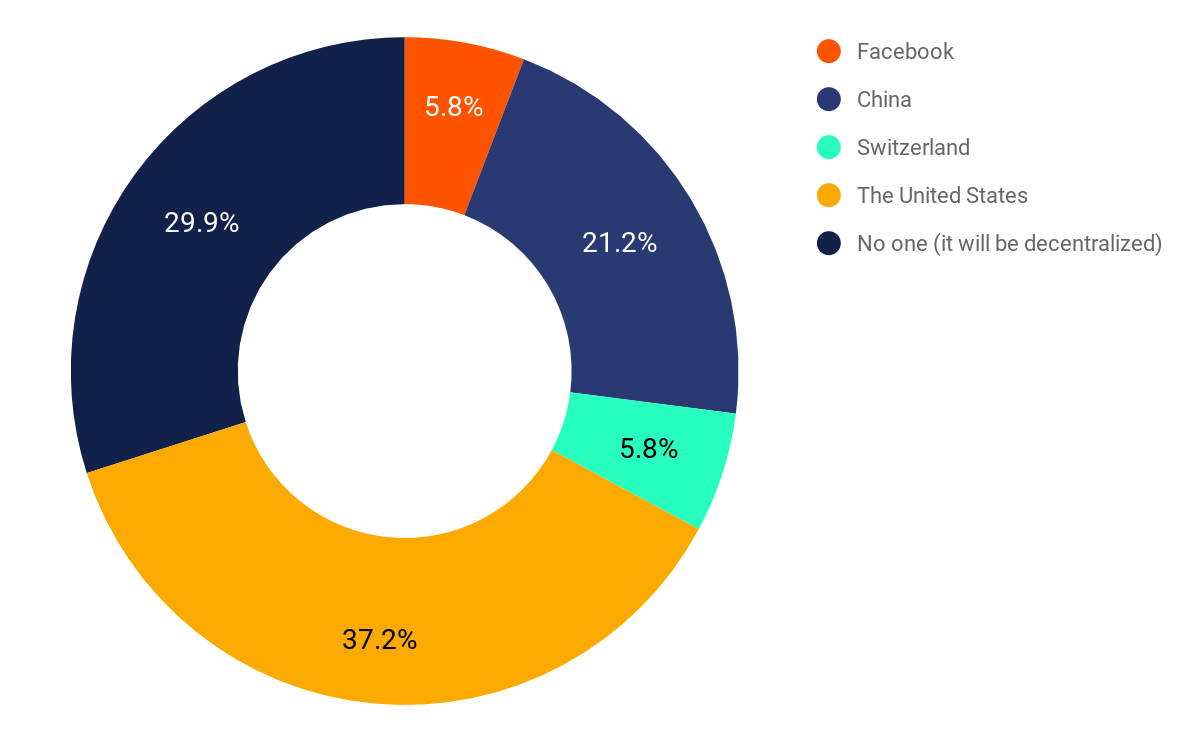

Question 5: If we were to have a global digital currency in the next 5-10 years, who do you think is most likely to control it?

This question presents an interesting thought experiment. The top response was the United States, which makes sense considering that the U.S. dollar is the world reserve currency. If the U.S. controls the fiat dollar of choice for the world financial system, why not the crypto dollar too? China was the other popular nation-state answer, and it’s looking like a decent one as its government made announcements voicing support for blockchain technology in recent days. However, a significant portion of respondents believe that today’s status quo would hold true, and that any dominant future cryptocurrency will remain decentralized.

Financial institutions embracing the future

Financial institutions will ultimately invest where they believe they can safely uncover significant value. For that reason, we’re even more optimistic they’ll embrace cryptocurrency following this survey. As suspected, the key obstacle will be overcoming concerns around compliance, but as blockchain analysis software continues to gain traction, we believe this is more a problem of education than capability. If our vision of an entire economy built on blockchains comes true, the organizations that move quickly to embrace new compliance tools will have a head start on meeting customer demand.