This blog is a preview of our State of Web3 Report. Sign up here to download your copy!

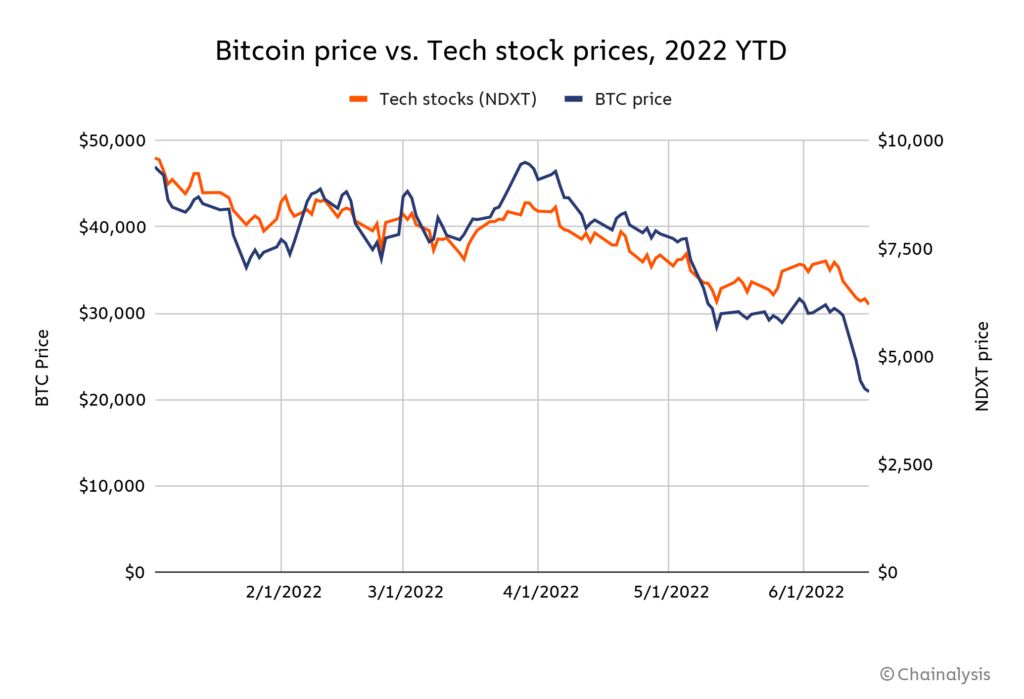

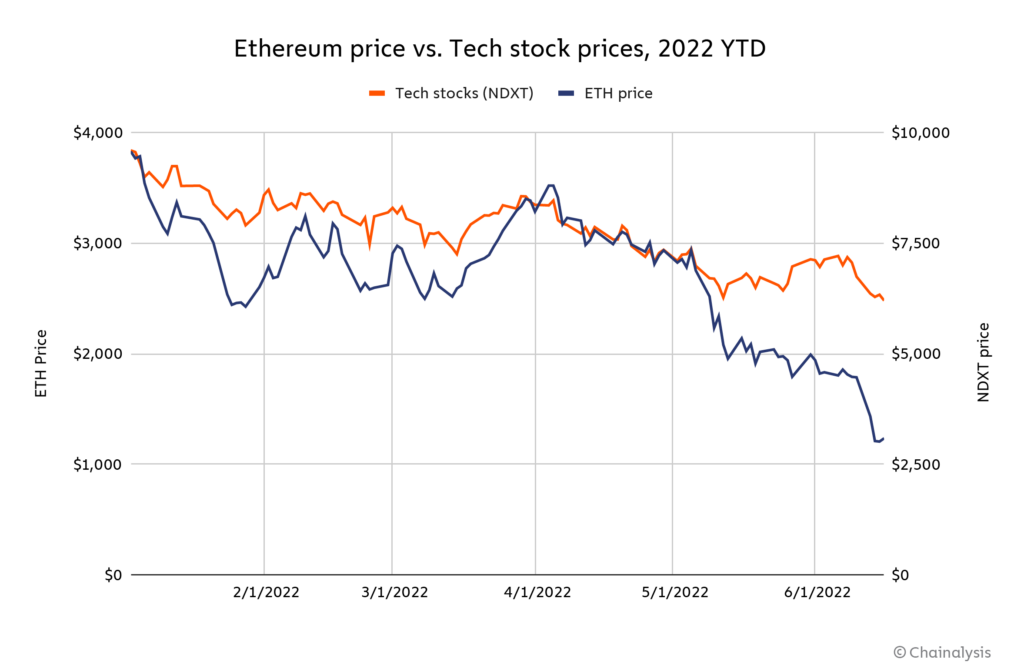

We’re in a bear market across financial assets, and cryptocurrencies – especially Bitcoin, the most established cryptocurrency – are now more correlated to tech stocks than they were in the past. When the broader financial markets slump, crypto does too.

This correlation reflects crypto’s maturity as an asset class: there are a growing number of institutional players involved, new types of financial products are being offered, regulatory oversight is developing, and the market is more efficiently pricing in new information.

But there’s one important difference between crypto and traditional finance: transparency. The market downturn has catalyzed mass liquidations of leveraged positions across both the traditional and crypto markets resulting in exacerbated price declines. In crypto, we are seeing this play out in real-time.

This is an opportunity for the industry to leverage blockchains’ transparency to analyze systemic risk, build better systems, and design better rules for the next bull market. In this blog, we’ll break down what happened from a macro perspective as well as opportunities for regulators, lawmakers, and the industry overall to ensure the ecosystem can continue to grow safely and responsibly.

What happened: The bird’s eye view

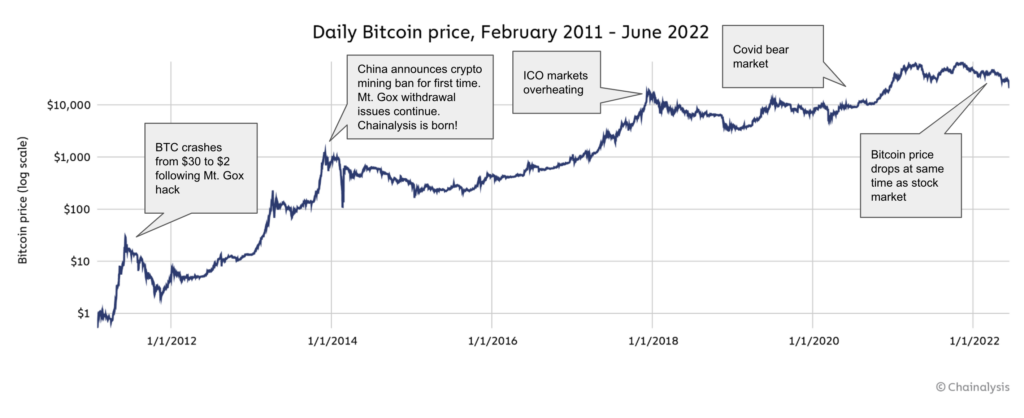

This isn’t the first market crash in crypto. Here are a few of the greatest hits:

Only more recently have these downturns correlated with the broader markets. So why is the crypto market price crash more extreme than in the equity markets right now?

One major factor is that DeFi has gotten more competitive, driving some entities to execute on riskier investment strategies that can have ripple effects across the ecosystem.

How did we get here?

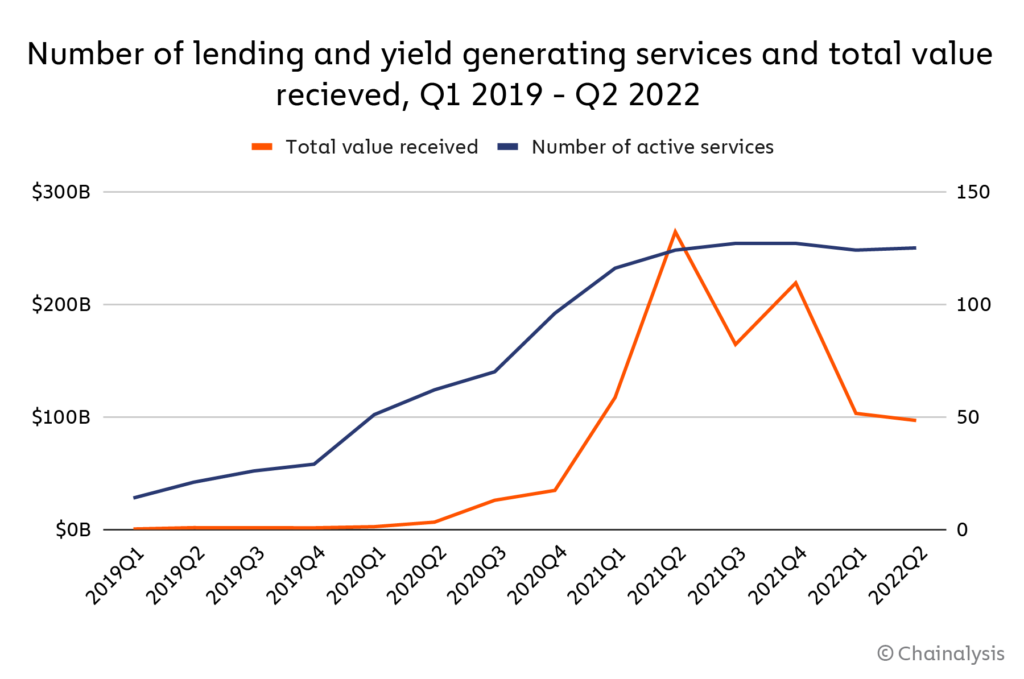

After the crypto crash of 2018, DeFi experienced explosive growth. But as that growth slowed, the number of active DeFi services, including those specializing in lending and yield generating, continued to increase, even as the value invested in DeFi started to drop.

Note: “Lending and yield generating services” includes both centralized and decentralized services.

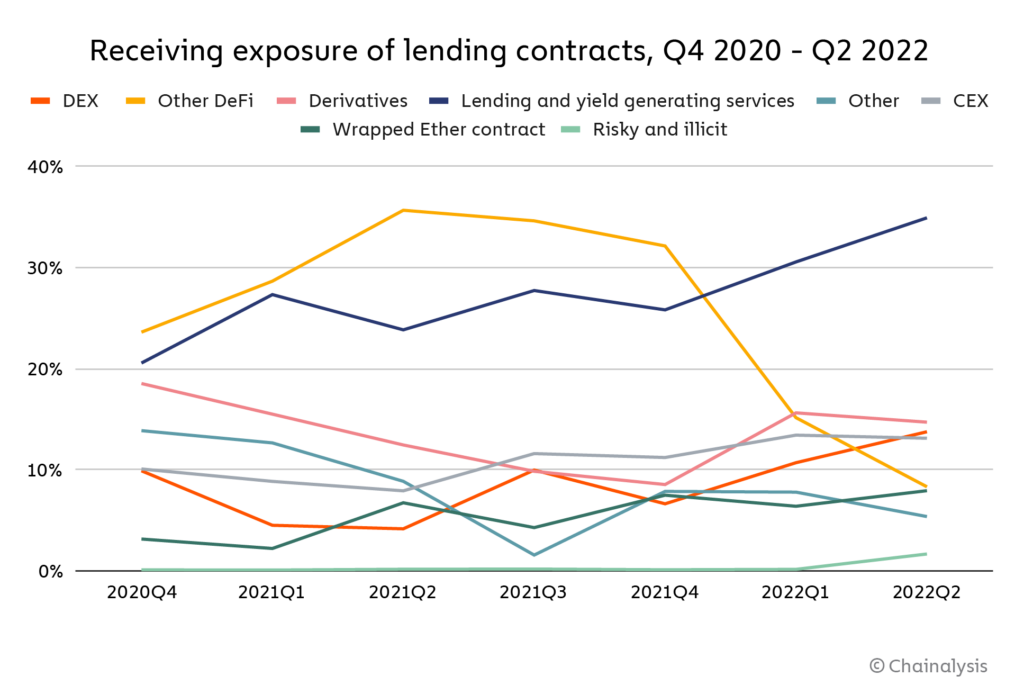

It appears that with more competitors chasing fewer investor dollars, lending platforms – acting as de facto centralized entities, including some that are technically decentralized – had to promise higher and higher yields to continue their growth. This led them to actively put user funds into riskier investments. For instance, as we see below, lending protocols’ biggest source of funds became other lending and yield-generating services in Q1 2022. So, when asset prices began to drop, the effects cascaded throughout the DeFi ecosystem.

Note: “Lending and yield generating services” includes both centralized and decentralized services.

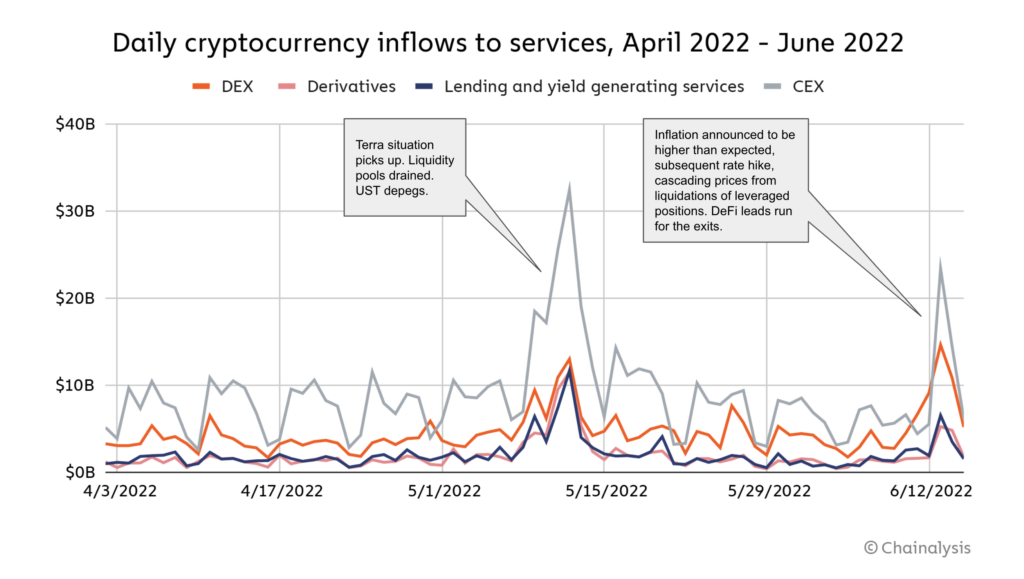

Given the broader bear market and other events including the UST collapse, net inflows to services have recently shifted. Most DeFi and exchange services suddenly saw huge inflows of cryptocurrency as people cashed out their funds or needed to pay back loans or avoid liquidations.

Our data shows that large institutions – identified as addresses that have received more than $1 million so far this month – are primarily behind these deposits, which is consistent with normal activity over time.

Opportunities for a safer ecosystem: Understanding systemic risks

Crypto’s inherent transparency – especially during the current down market – is bringing some of the inherent risks of DeFi into the spotlight. Some projects that were hastily built or services that didn’t properly manage risk will fail, and that’s a natural process for any new technology or industry.

This is crypto’s advantage. Due to the open nature of DeFi protocols, the market can often see where large, well-known players placed their bets and if those positions are facing liquidation. Furthermore, market participants can use this transparency to assess the stability of the core protocols that power the DeFi ecosystem.

However, this transparency has not stopped large, centralized companies from making bets on the price of various cryptocurrencies, both using open DeFi protocols and by lending funds to one another. This creates potential contagion risk, as various centralized market participants are financially exposed to one another. While DeFi protocols continue to function as designed at a technical level, some highly leveraged businesses have struggled to unwind complex financial positions in a hostile macroeconomic environment.

Recent events demonstrate that it is important for regulators and the industry more broadly to understand both the decentralized and centralized parts of the cryptocurrency market and how they may impact each other. For example, centralized players investing in decentralized finance may find themselves over-leveraged if they have not appropriately calculated the risks, in particular in a bear market. The decentralized projects in which centralized entities have invested may also fall victim to code exploits or hacks and lose their value precipitously; this nearly played out earlier this year with the Wormhole exploit. Being able to adequately oversee centralized players will require understanding the entire ecosystem.

This blog is a preview of our State of Web3 Report. Sign up here to download your copy!

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.