This blog is a preview of our 2021 Geography of Cryptocurrency report. Sign up here to download the whole thing!

Africa has the smallest cryptocurrency economy of any region we study, having received $105.6 billion worth of cryptocurrency between July 2020 and June 2021, but despite that it’s also one of the most dynamic and exciting.

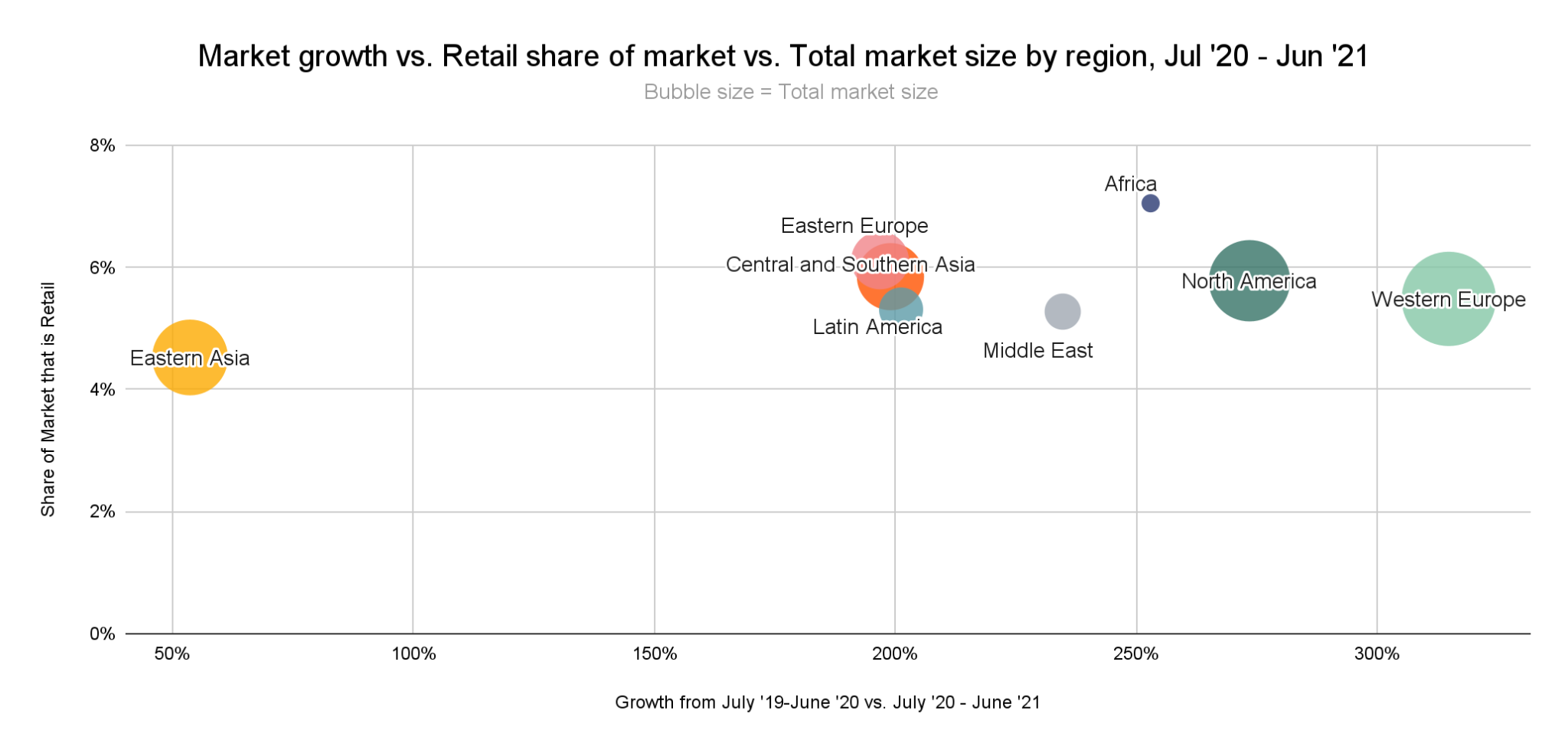

Not only has Africa’s cryptocurrency market grown over 1200% by value received in the last year, but the region also has some of the highest grassroots adoption in the world, with Kenya, Nigeria, South Africa, and Tanzania all ranking in the top 20 of our Global Crypto Adoption Index. In addition to being the third-fastest growing cryptocurrency economy, Africa also has a bigger share of its overall transaction volume made up of retail-sized transfers than any other region at just over 7%, versus the global average of 5.5%

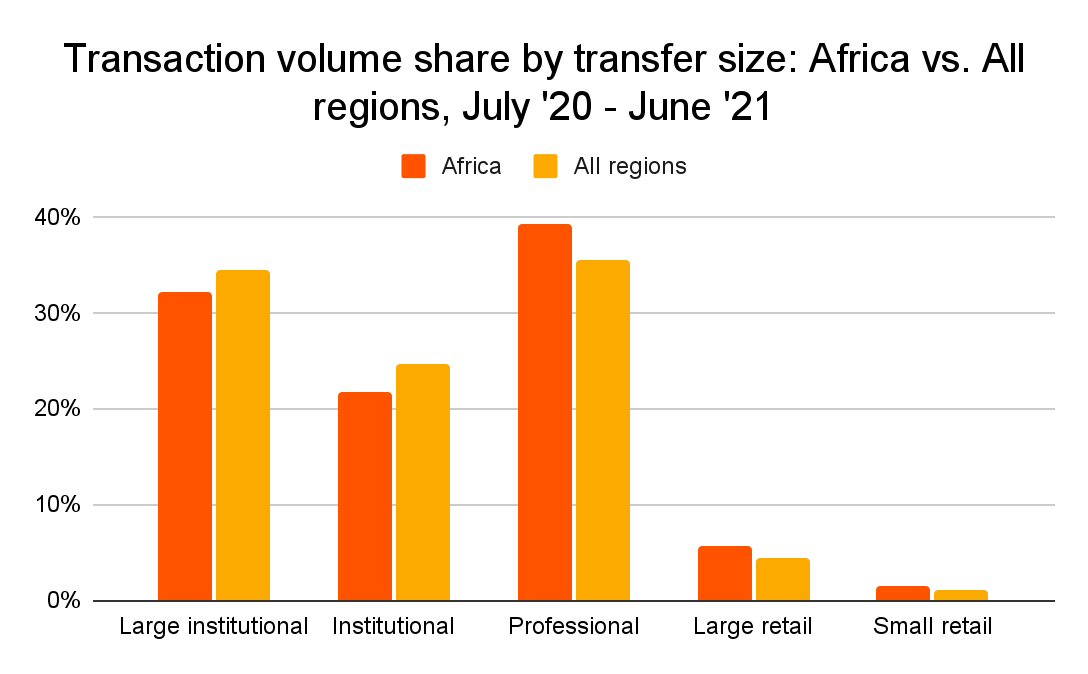

Drilling down further, Africa also sees a bigger share of its transaction volume made up of large retail and small retail-sized payments than the global average.

These numbers are a big part of why so many African countries rank high on our adoption index, as smaller transfer sizes suggest higher grassroots adoption amongst everyday users.

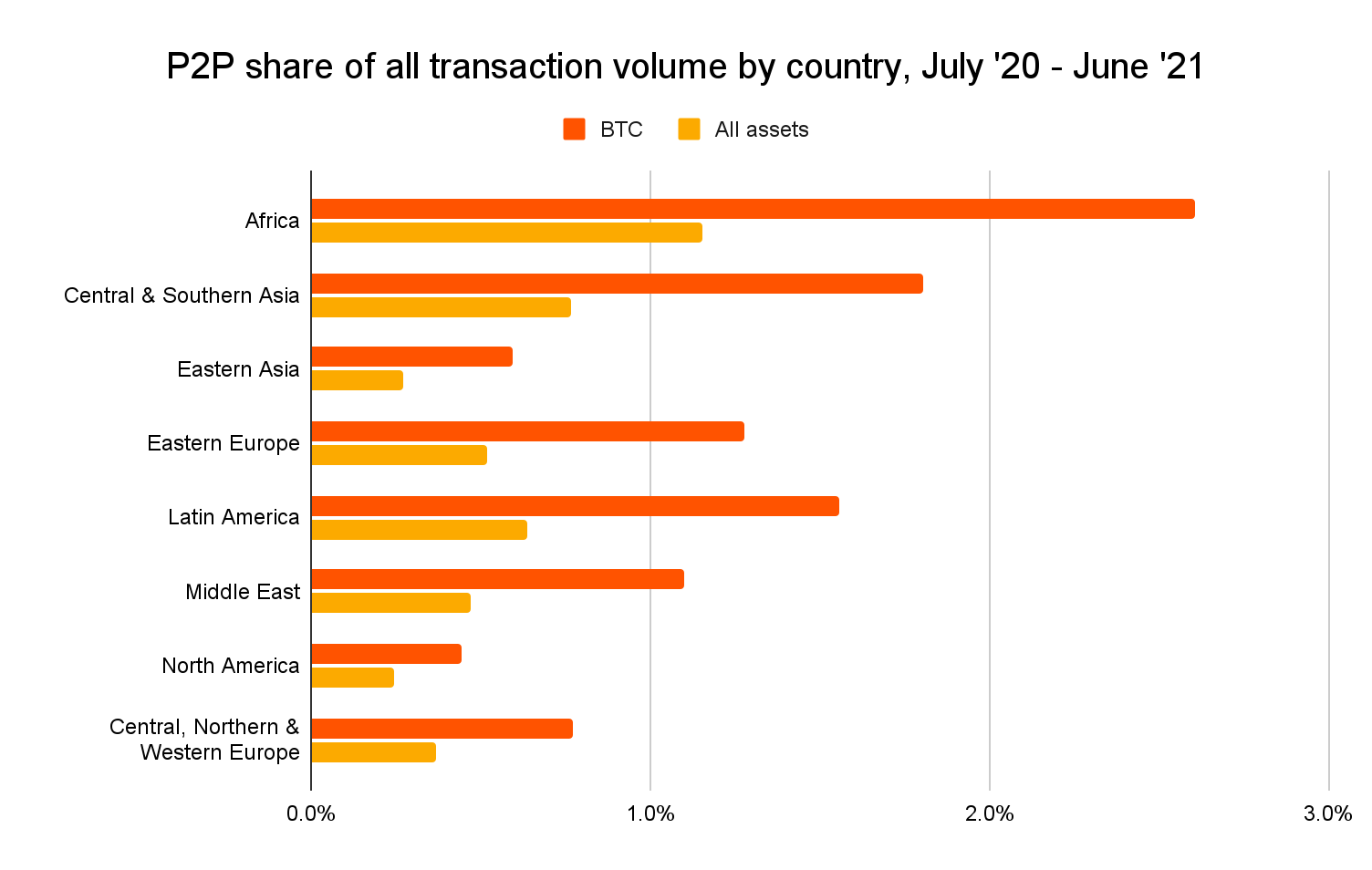

As we’ll explore, P2P platforms are especially popular in Africa compared to other regions, and many African cryptocurrency users rely on P2P platforms not just as an on-ramp into cryptocurrency, but also for remittances and even commercial transactions. Cross-region transfers also make up a bigger share of Africa’s cryptocurrency market than any other region at 96% of all transaction volume, versus 78% for all regions combined. Below, we’ll explore the unique use cases and needs driving these trends in Africa.

What drives cryptocurrency usage in Africa?

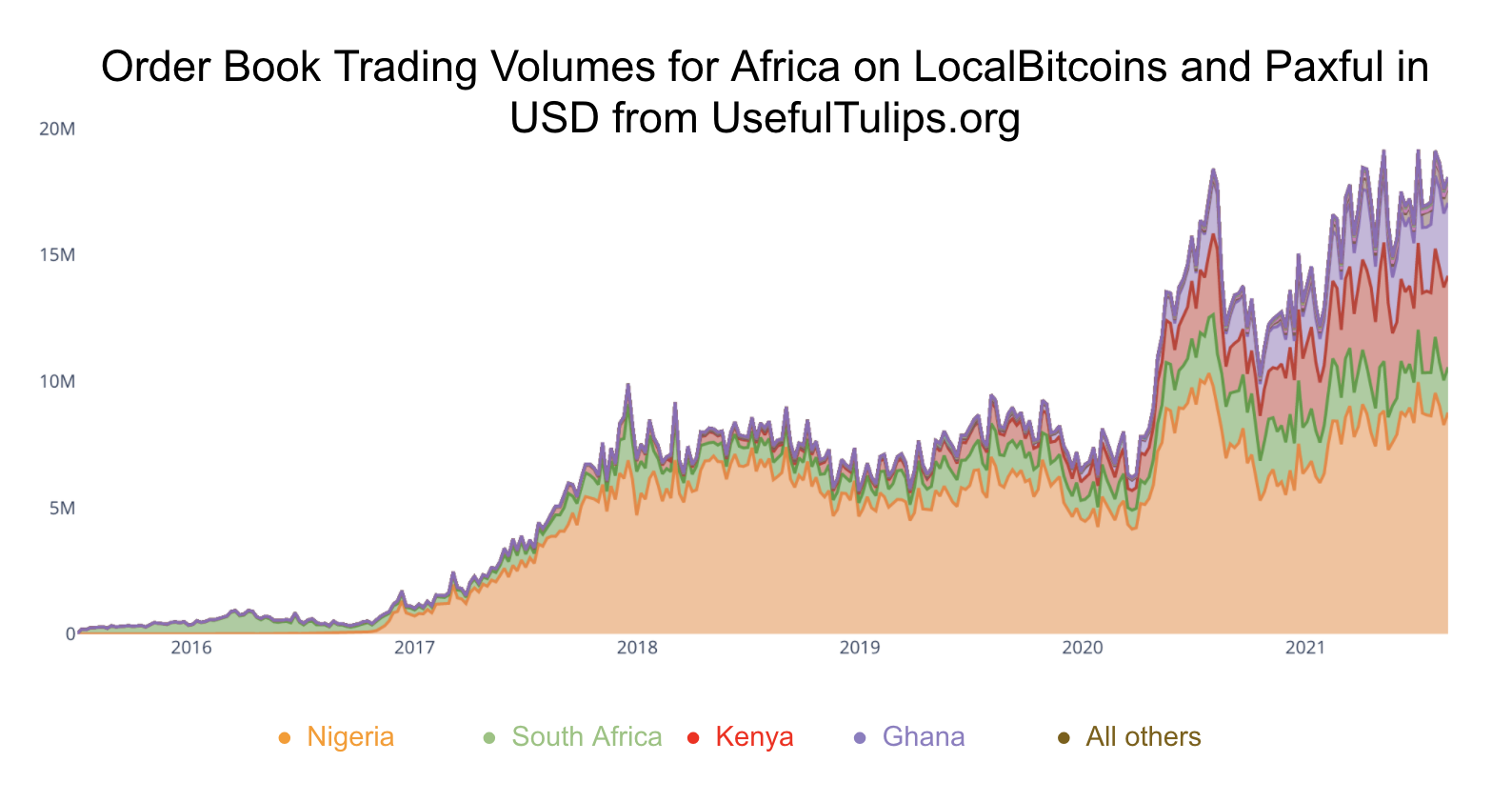

One important trend in Africa has been the continued growth of P2P cryptocurrency exchanges over the last year. The chart below shows how trading volumes for several African currencies have grown on LocalBitcoins and Paxful — the world’s two biggest P2P platforms by transaction volume — since 2016.

Thanks in part to this recent growth, no region uses P2P platforms at a higher rate than African cryptocurrency users, as they account for 1.2% of all African transaction volume and 2.6% of all volume for Bitcoin specifically.

Why are P2P platforms so popular in Africa? One reason is that some countries, such as Nigeria and Kenya, have made it difficult for customers to send money to cryptocurrency businesses from their bank accounts, either by passing laws or simply by advising banks not to allow these transfers. However, this isn’t an issue for P2P platforms, which are non-custodial and let customers trade cash for cryptocurrency amongst themselves. From there, users can send cryptocurrency to centralized exchanges for more trading options if they so choose. Adedeji Owonibi, CEO and founder of a Nigerian blockchain consultancy company Convexity and the associated 1st cryptocurrency community Hub CBHUB, told us about how Nigeria’s cryptocurrency economy has changed since the country’s central bank disallowed banks from facilitating cryptocurrency transactions.

“Binance used to be the most popular platform by far, but after the central bank’s sanction, many are moving to P2P platforms, like Paxful and Remitano” he said. However, according to Owonibi, lots of P2P activity is taking place over informal group chats on messaging apps rather than on conventional platforms. “Informal P2P trading is huge in Nigeria on Whatsapp and Telegram. I’ve seen young people and businessmen in these groups carry out transactions for several millions with popular OTC merchants.” Keep in mind it’s not possible to capture the activity of these informal P2P trades in our dataset, so we have to recognize that the rate of P2P activity in Africa is even greater than the chart above would indicate.

Artur Schaback, COO and cofounder of popular P2P exchange Paxful, confirmed that he’s seeing similar trends, and told us that his platform has seen 57% growth in Nigeria over the last year and 300% growth in Kenya. “In many of these frontier markets, people can’t send money from their bank accounts to a centralized exchange, so they rely on P2P.” He also highlighted the importance of UI improvements by P2P platforms to attracting new users in these markets over the past year. “Crypto products are getting more user friendly, so they can onboard more people into the crypto economy and help them see that crypto is faster, cheaper, and more convenient.”

What needs is cryptocurrency fulfilling for African users once they’ve acquired it using P2P platforms? Remittances is one. In 2019, Sub-Saharan Africa received at least $48 billion worth of estimated remittances, about half of which went to Nigeria, according to a Brookings Institute study. While most of that money is moving to Africa from Europe and North America, there’s also a large volume of remittance payments among African countries. However, some African countries have implemented strict controls on how much currency can be moved abroad. In Nigeria, for example, some banks limit customers to sending as little as $500 out of the country at a time. Schaback told us that this has created another use case for cryptocurrency. “If the government is strictly limiting the amount of money people can send abroad, they’ll get creative and turn to cryptocurrency,” he told us.

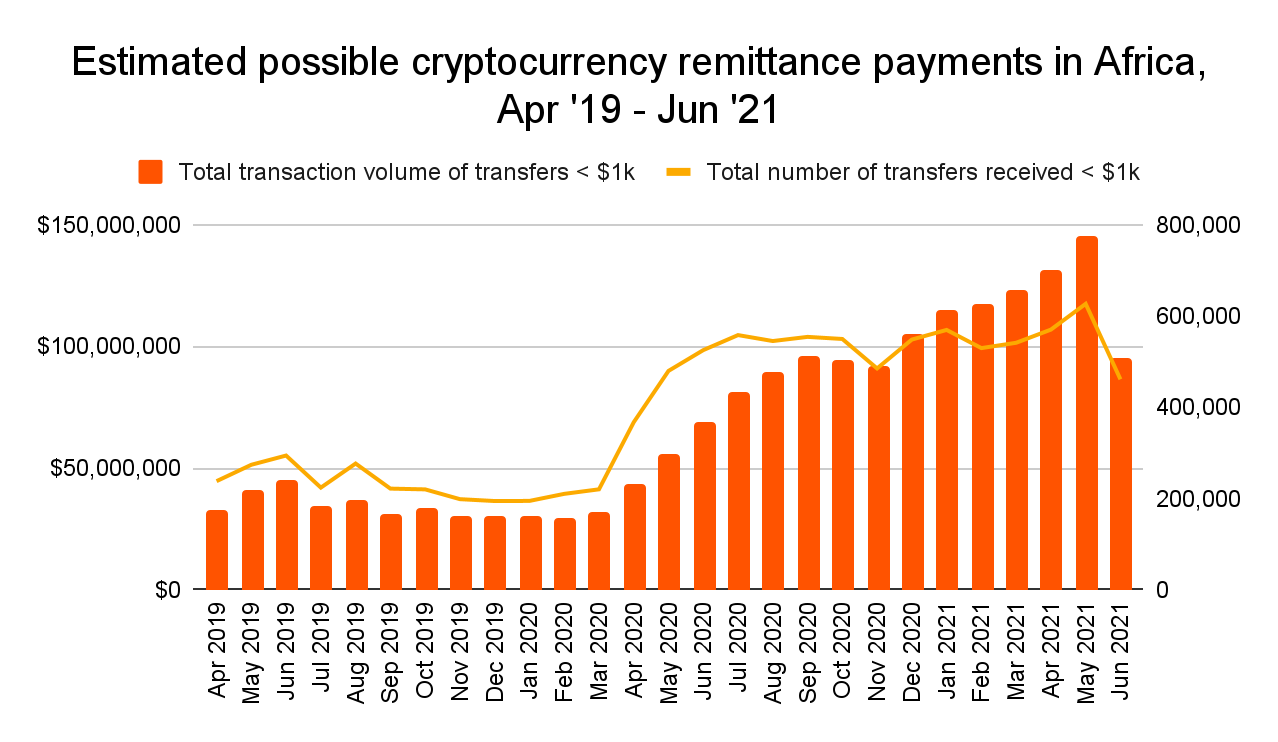

Blockchain analysis confirms that cryptocurrency-based remittance payments are likely increasing in Africa. The graph below shows the monthly growth of cryptocurrency payments below $1,000 in both volume and number of transfers, which we consider the upper boundary of estimated remittance payments sent to African countries.

Possible cryptocurrency remittance payments have grown consistently since April 2020, save for a recent drop in June.

Many African users also rely on cryptocurrency transactions for international commercial transactions. Both Owonibi and Schaback told us about several examples of African business owners using cryptocurrency to pay for goods to import and sell at home. “If you’re working with a partner in China to import goods to sell in Nigeria or Kenya, it can be hard to send enough fiat currency to China to complete your purchases,” said Schaback. “It’s often easier to just buy Bitcoin locally on a P2P exchange and then send it to your partner.”

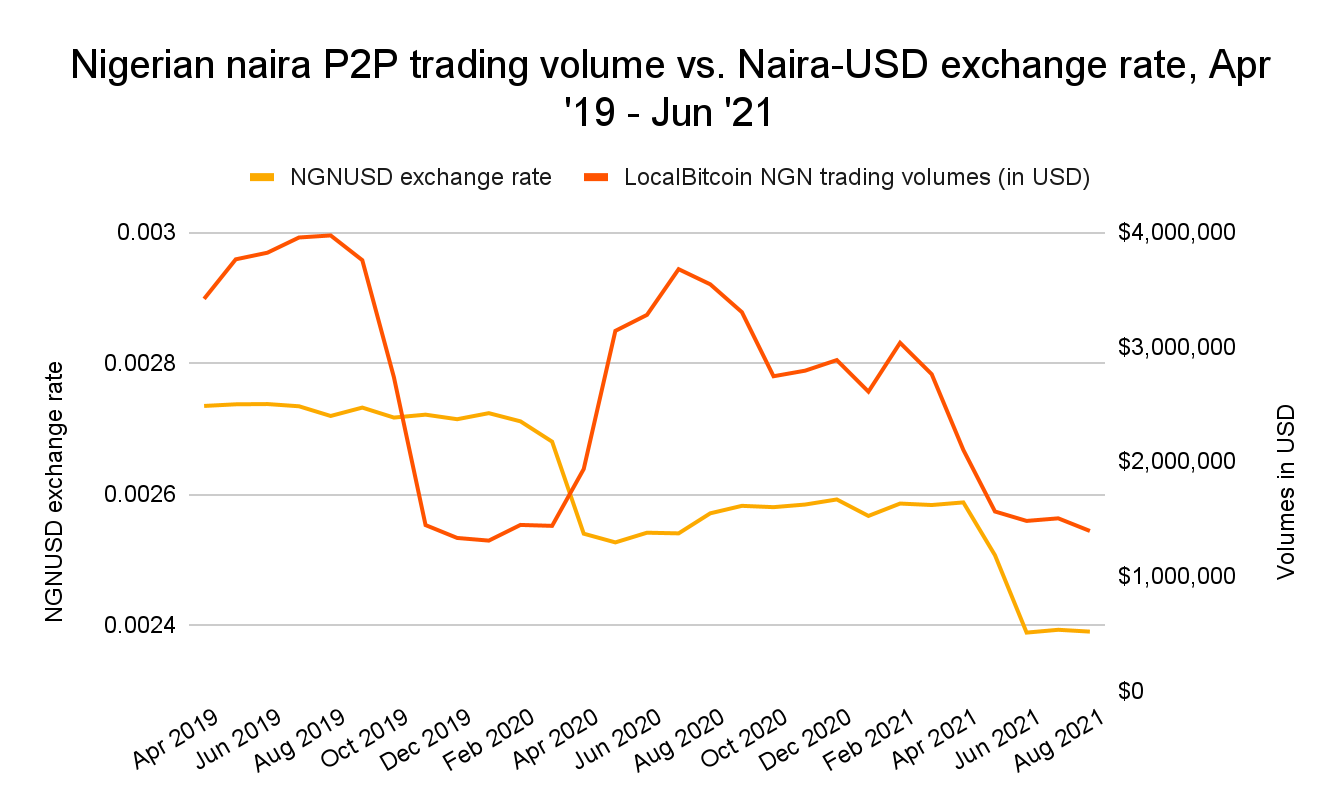

Finally, many African users are turning to cryptocurrency to preserve their savings amidst harsh economic conditions. Schaback told us that Paxful’s growth accelerated in Nigeria this past year during times of currency devaluation. Our data confirms this as well. Check out the graph below, which shows the value of the Nigerian naira in U.S. dollars on the left-hand axis compared to naira trading volumes on P2P platforms on the right-hand axis.

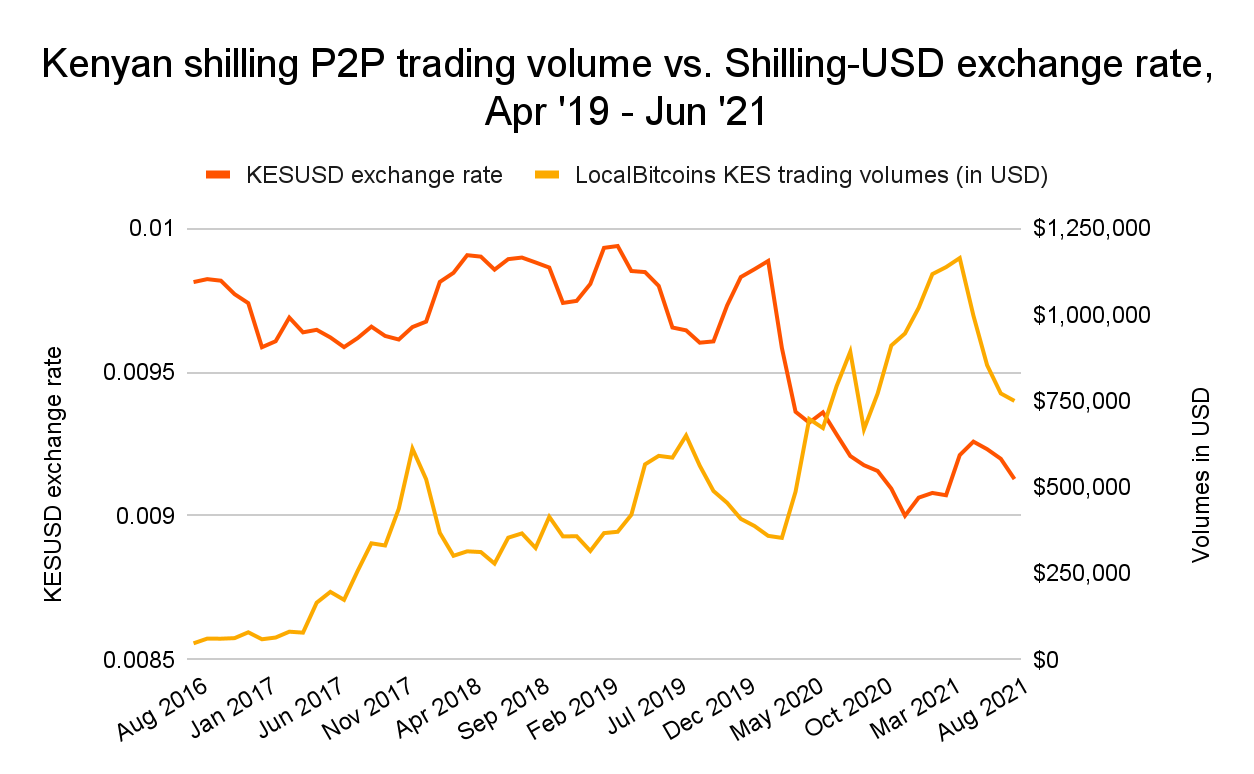

The data indicates that when the naira’s value falls, naira trade volumes increase.We see a similar trend in Kenya as well.

Owonibi shed more light on this, and pointed out the nuance in how different socioeconomic groups in Nigeria use cryptocurrency in different ways. “I hear many young people say, ‘Don’t rely on the naira, it’s too unstable, put your wealth in stablecoins instead,’” he says. “But that’s the middle class move. Richer people who want to make money are going for Bitcoin and other more speculative cryptocurrencies.” As Africa’s middle class continues to grow, it’ll be interesting to see how cryptocurrency use cases continue to diverge for groups at different levels of income.

We also may see African governments follow the lead of countries like China and introduce their own central bank digital currencies (CBDCs), meaning blockchain-based versions of their national currency that can be held in and sent from digital wallets. Nigeria has already announced plans to launch an e-naira, but it’s unclear whether this would solve the problems of citizens turning to cryptocurrency. “Last week in a Clubhouse room of Nigerian crypto users, I asked the group if they would use the e-naira when the central bank rolls it out,” Owonibi told us. “The overwhelming majority of attendees said no because they expect it to have the same instability and management issues the naira has today.”

While we can’t know for sure if users will embrace the e-naira, this anecdote shows that CBDCs may not be a magic bullet for better monetary policy, especially if citizens don’t trust them enough to use them. “The only reason to use the e-naira over cryptocurrency would be trust in the government, and that trust has been eroded for many,” said Owonibi.

This blog is a preview of our 2021 Geography of Cryptocurrency report. Sign up here to download the whole thing!