In 2013, developer Nicholas van Saberhagen – most likely a pseudonym – published the CryptoNote white paper in which he stated that “privacy and anonymity are the most important aspects of electronic cash.” This publication attracted the attention of Bitcoin developers Gregory Maxwell and Andrew Poelstra, inspiring a subsequent paper that explored the impacts of privacy- and anonymity-enhancing features on existing cryptocurrencies. Other developers used ideas from CryptoNote to create Bytecoin, the first private cryptocurrency. It was then that the first iteration of the Monero blockchain emerged.

“Thankful_for_today,” an anonymous user of the Bitcointalk forum, coded on Bytecoin to create a fork named BitMonero. Some users disagreed with this direction and eventually created another fork in the blockchain known as Monero, or “coin” in Esperanto. Almost a decade later, Monero (XMR) is the top privacy coin by market capitalization and has sparked important discussions about the role of privacy and traceability in the blockchain ecosystem.

In this blog, we’ll explore:

- Monero’s privacy-enhancing features

- Monero in action

- Monero market growth

- Monero mining rewards

- Darknet market activity

- Monero bans and regulations

- Monero’s future

What is Monero (XMR)?

Monero, also known as XMR, is a cryptocurrency with privacy-enhancing features encoded into its protocol. Most popular cryptocurrencies, such as Bitcoin and Ethereum, operate on a transparent, immutable ledger, enabling anyone to view and trace transactions. Monero is also an open-source blockchain, but its features are designed to reduce traceability and protect user anonymity.

Monero’s privacy-enhancing features

Monero’s primary purpose is to provide a decentralized network with enhanced transaction privacy and anonymity. As Justin Ehrenhofer, organizer of the Monero Space workgroup explained, “We want to provide privacy and just clog some of the basic holes that are present in most cryptocurrency protocols. . . So to that end, Monero really is the only coin that hides the sender, receiver and amount.”

The Monero blockchain employs diverse privacy-focused methods to obscure user transaction history:

- Ring signatures join together multiple users in a “ring” to hide their individual identities, making it more difficult to determine which user generated a given signature.

- Ring Confidential Transactions, or RingCT, were added to Monero in 2017 and hide transaction amounts.

- Through the use of stealth addresses, all Monero senders automatically generate new addresses every time they initiate new transactions, thus obscuring origins and destinations of funds. A stealth address is cryptographically tied to a public address which actually receives payments, but only the sender and recipient know the association between the two. Involved parties have a private view key, which displays incoming transactions, and a private spend key, which is used to send payments.

- Transactions can be initiated over Tor/I2P, which protects the privacy of transaction sources by utilizing an anonymous network. This feature began more recently and is still considered experimental.

- Dandelion++ hides IP addresses associated with nodes to reduce the risk of sensitive information being used to expose the address’ identities.

Monero in action

Monero’s anonymity-enhancing features have contributed to the stereotype that it is often used for illegal purposes such as money laundering. These activities do occur, but Monero is used for many legitimate purposes, too. Analysis of Monero’s market growth, mining rewards, and darknet market activity help provide a bigger picture of how it is used – for both good and bad.

Monero market growth

In recent years, Monero has experienced substantial growth, reaching a market capitalization of nearly $2.8 billion as of May 2023. This is significantly higher than the market caps of other popular privacy coins and privacy-preserving cryptocurrencies Zcash and Dash, which are around $600 million and $550 million, respectively.

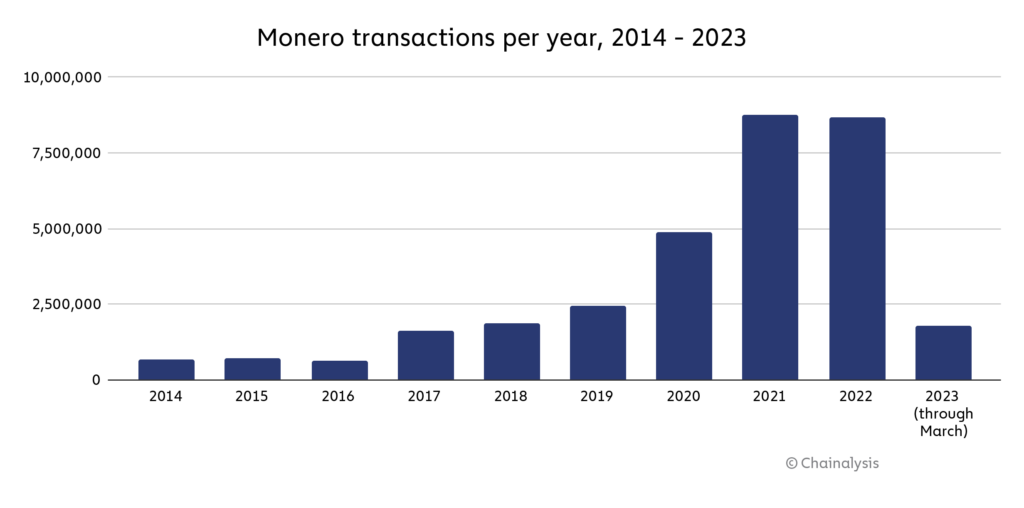

Since Monero’s inception in 2014, there have been approximately 32 million XMR transactions. In 2022, there were around 8.6 million XMR transactions, off slightly from its peak in 2021 of 8.8 million. For comparison, during that same time period, there have been nearly 800 million Bitcoin transactions.

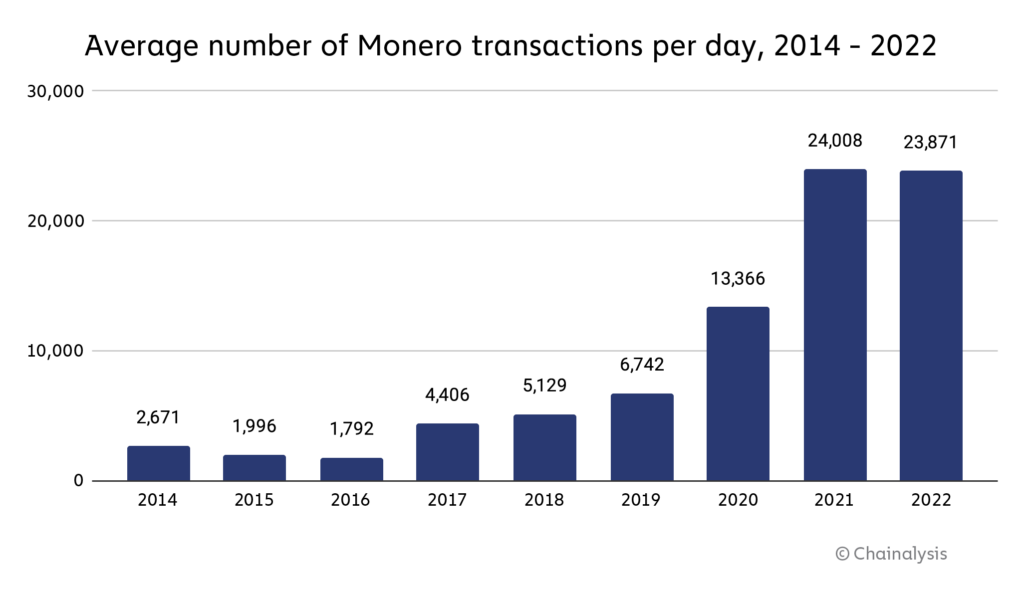

XMR activity doubled between 2019 and 2020, and experienced a similar increase between 2020 and 2021. As we see below, the past two years both had an average of around 24,000 transactions per day.

Monero mining rewards

Similar to the Bitcoin blockchain, Monero utilizes a Proof-of-Work consensus mechanism. Its PoW algorithm, RandomX, was designed to maintain decentralized mining and resist specialized hardware like ASICs. XMR emission is unlimited to ensure continued mining incentives, and Monero generates a new block approximately every two minutes. Miners can decide whether to mine solo or in a pool, though the Monero Project encourages solo mining because it helps boost network security.

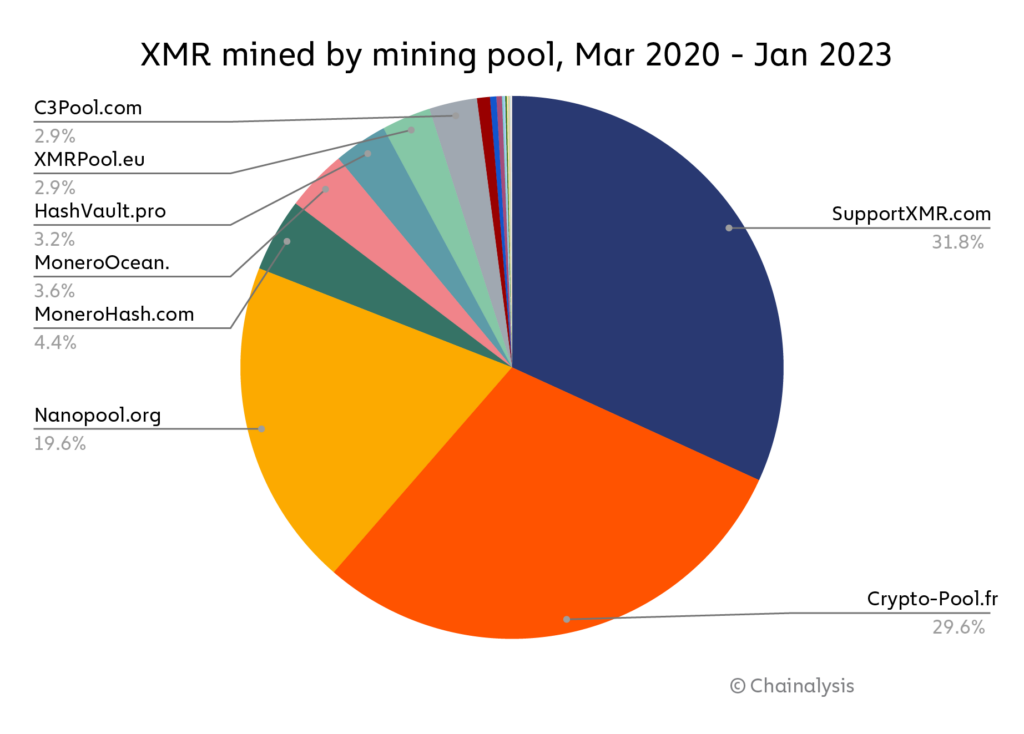

Between March 2020 and January 2023, Chainalysis identified a representative sample of recipients of Monero mining rewards. Three main pools have mined over 80% of XMR in our sample.

- SupportXMR.com

- Crypto-Pool.fr

- Nanopool.org

Darknet market activity

In the past several years, many darknet markets have adopted Monero to reduce traceability. For instance, White House Market, one of the most active darknet markets before its closure, encouraged its users to shift from Bitcoin to Monero for transactions and eventually transitioned to only accepting Monero. Other darknet markets, such as AlphaBay and Archetyp, followed similar models. However, Bitcoin is still the most commonly used digital currency on darknet markets.

Monero bans and regulation

Given Monero’s growth and popularity, it is often the primary focus in conversations about privacy coin bans and regulation. Major world economies such as Japan and South Korea have already banned Monero from exchanges in an effort to curb money laundering and reduce organized crime. In 2020, reports suggested that Australian regulators and banks encouraged cryptocurrency exchanges to delist XMR or risk being “de-banked.” Dubai is one of the latest countries to follow suit by prohibiting the use of Monero under its new digital asset regulatory framework.

Many cryptocurrency exchanges have also taken action to end Monero support for similar reasons. Bittrex, BitBay, and Huobi are three of these exchanges. Similarly, U.S.-based cryptocurrency exchange Kraken delisted Monero for its U.K. customers in 2021 to comply with the country’s developing regulations.

The future of Monero

Although many illicit actors use Monero to obscure transactions, they haven’t adopted Monero to the extent one might expect. The primary reason is due to Monero’s lower liquidity compared to that of other cryptocurrencies, making large transactions more difficult to execute. Regulatory uncertainty and XMR bans have also reduced its accessibility in certain countries.

As Monero’s developers continue to innovate and ecosystem participants explore its use cases, these will be important considerations. Regardless, all cryptocurrencies — including privacy coins — operate on immutable ledgers, which means evidence of transactions will exist forever, whether legitimate or illegitimate.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.