This blog post is a preview of our report on competition in Bitcoin mining. Click here to download the whole thing!

Mining is integral to cryptocurrency markets. The complex mathematical problems miners compete to solve enable new transactions to occur, and also verify old transactions, ensuring that the blockchain remains as a permanent, immutable ledger. In return, miners receive new cryptocurrency as a reward any time their computers win the competition to verify the newest block. The new cryptocurrency that flows through those miners ultimately goes back into the market, meaning miners are a crucial source of liquidity as well.

Mining pools, which coordinate the resources of individual miners, have been important since 2013. Mining pools now dominate bitcoin mining but there is significant competition between mining pools. Competition is important, not just because it determines who wins new coins, but because robust competition is necessary for the health of the cryptocurrency ecosystem. If one miner or mining pool controlled more than half of the hashrate for Bitcoin (or any other cryptocurrency), they could in theory hold the entire ecosystem hostage by refusing to verify new blocks. But the data shows this isn’t much of a threat at the moment.

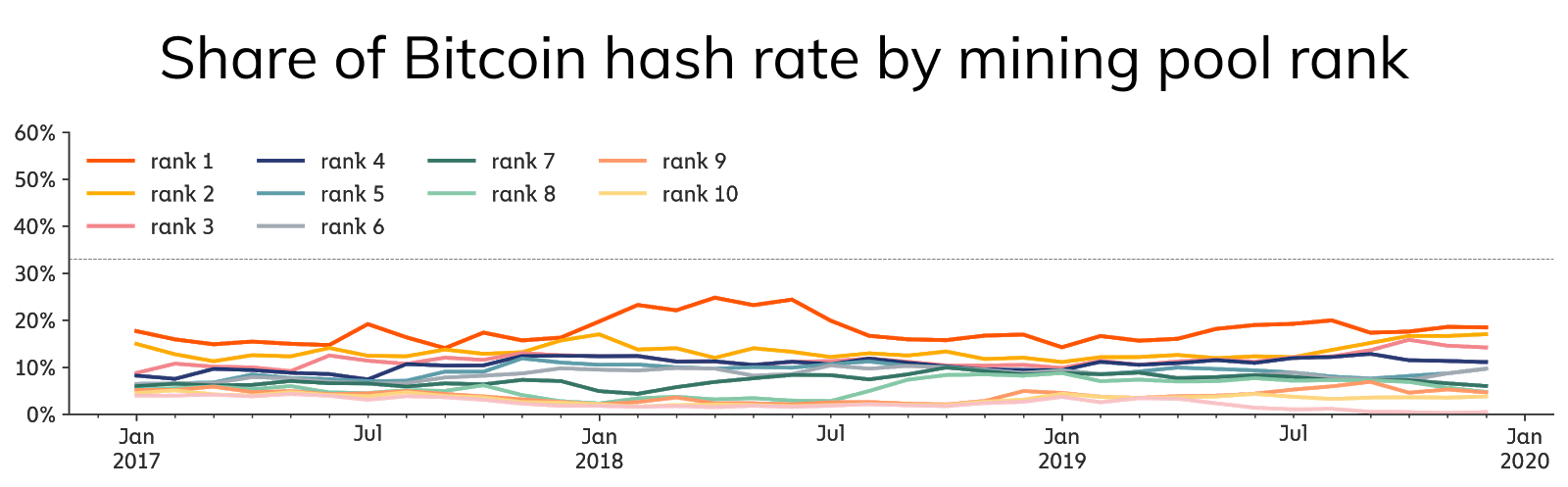

Above, we see how much of hashrate is under the control of top-ranked miners over time. Since 2016, the largest mining pool at any point in time has never had more than 33% of the total hashrate. In 2019, the top ranked mining pool had 16.8% of the hashrate, closely followed by the second and third ranked mining pools, with 12.9% and 12.8% respectively. This suggests that miners have distributed their hashrate between pools, such that no one pool is dominant, although the top four mining pools do control a majority of the hashrate.

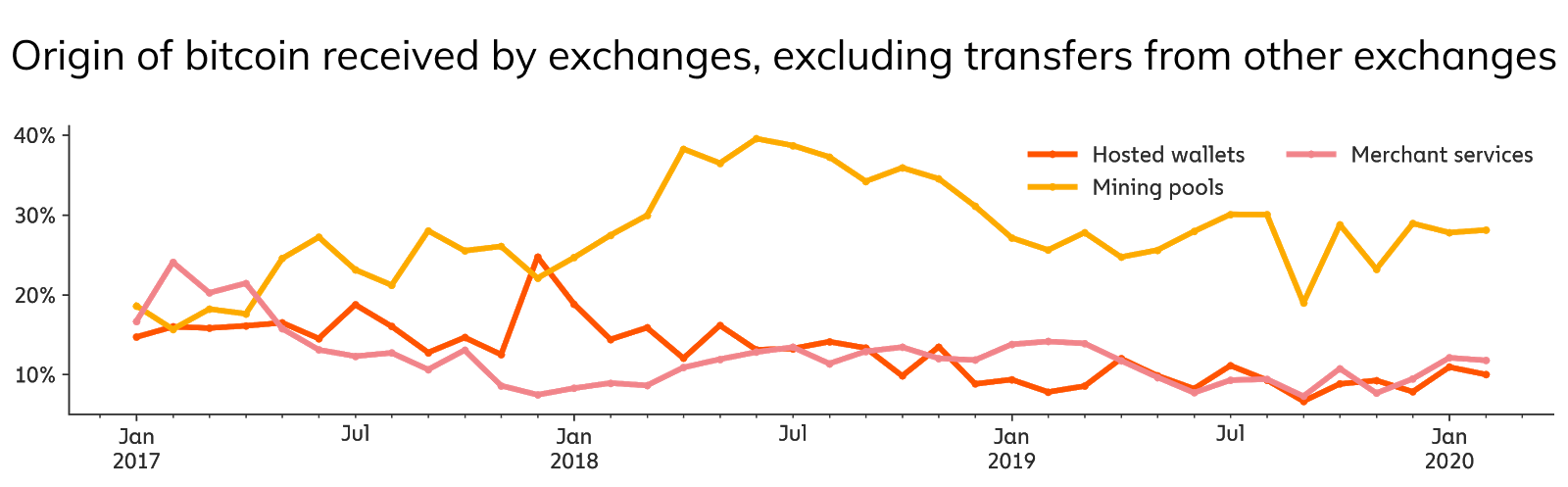

However, competition between mining pools is just part one of the equation. Once pools receive new bitcoin rewards, they need to send it to cryptocurrency exchanges in return for fiat currency to keep funding their operations.

Bitcoin from miners is crucial for exchanges’ liquidity. Exchanges receive 88% of their bitcoin from other exchanges, but miners are the largest other source of bitcoin, providing 28% of the remaining 12%. As a result, there is substantial competition between exchanges to be the recipient of mining pools’ bitcoin.

Download our full Mining Pool Market Power case study for original data and research on which exchanges receive newly mined Bitcoin. In addition, you’ll get more data on the competition between mining pools not covered above, including a look at the overall mining pool landscape, the average time top pools remain dominant, and more!