This blog is a preview of our 2021 Geography of Cryptocurrency report. Sign up here to download the whole thing!

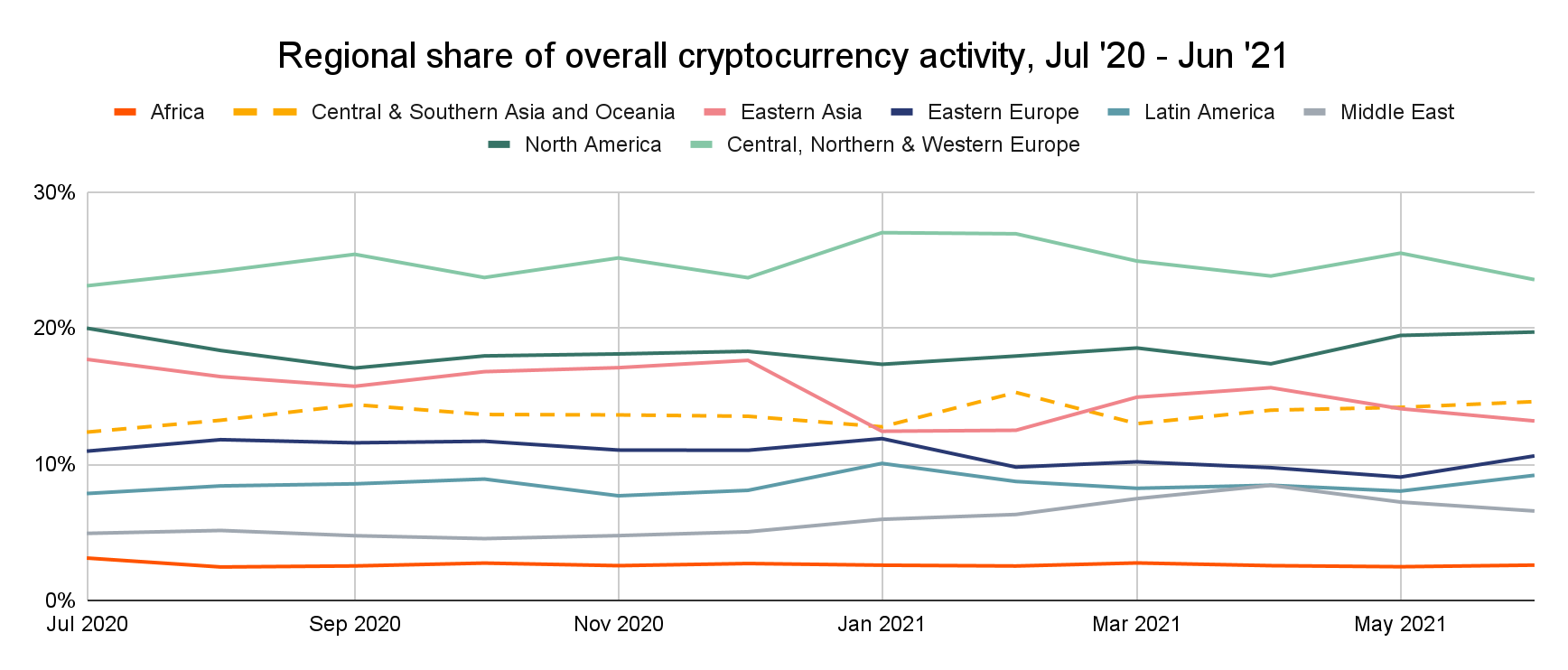

Central & Southern Asia and Oceania (CSAO) is the fourth largest cryptocurrency market we study with $572.5 billion in value received between July 2020 and June 2021, which represents 14% of global transaction value during the time period. CSAO’s transaction activity grew by 706% compared to last year in terms of raw value, and its share of global cryptocurrency activity grew by 2%, making CSAO one of the fastest-growing of all the regions we study.

But even more impressive is the region’s grassroots adoption. CSAO contains the top three countries in our Global Crypto Adoption Index, with Vietnam at number one, India at two, and Pakistan at three. Thailand also placed 12th and the Philippines 15th. Below, we’ll analyze key trends in the region and examine the factors that have powered cryptocurrency adoption in the region.

What drives cryptocurrency adoption in Central & Southern Asia and Oceania?

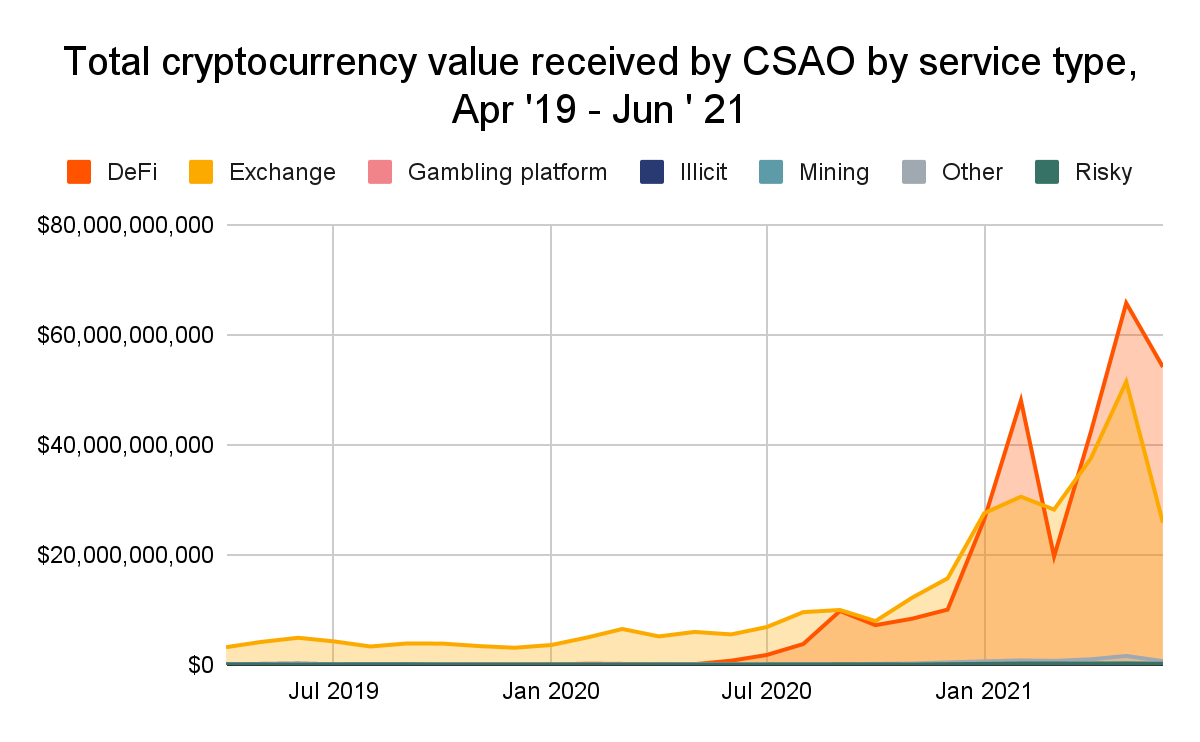

As is the case in other regions, CSAO has seen huge growth in DeFi activity over the last year.

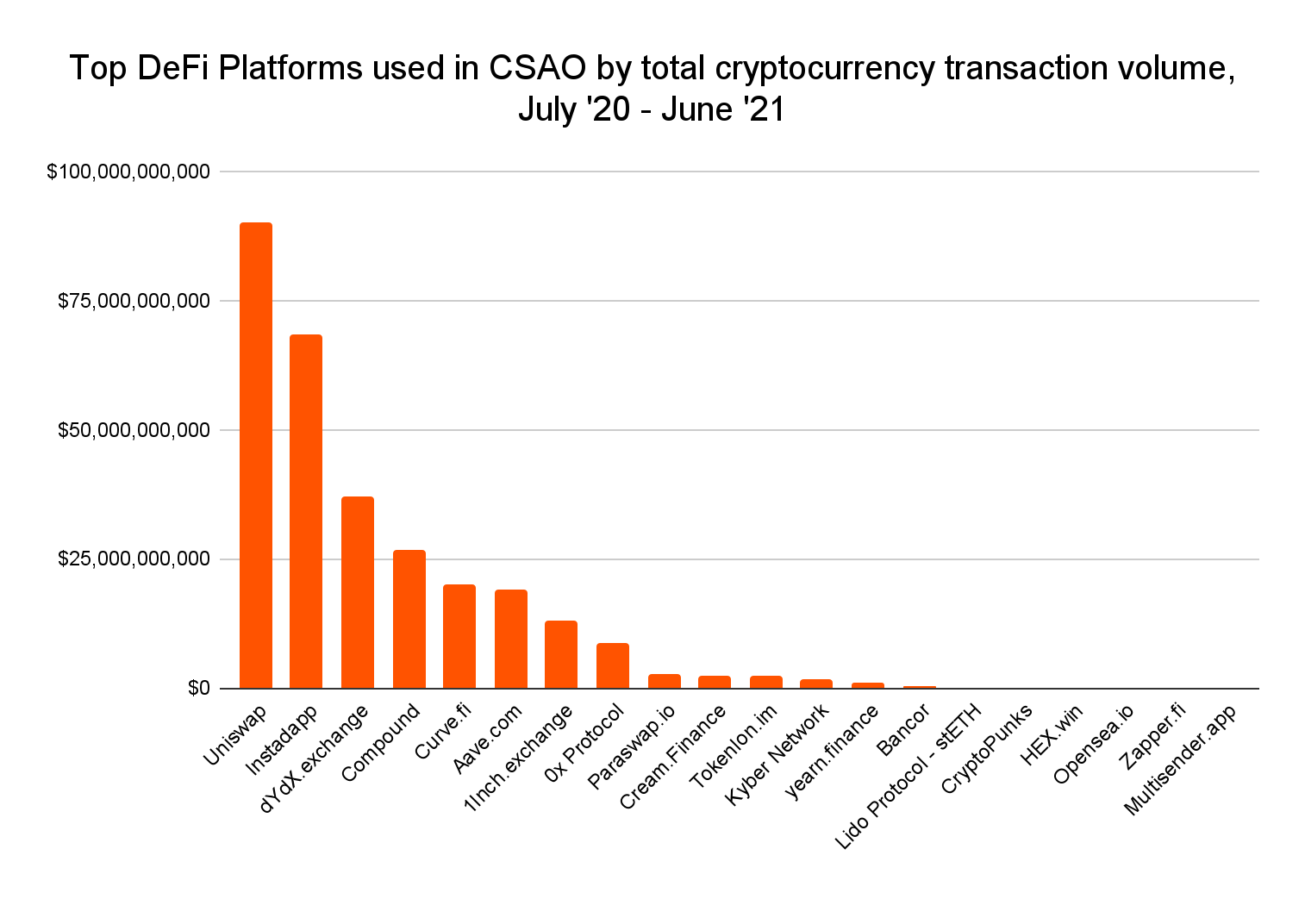

Starting around May 2020, DeFi activity as a share of all transaction volume skyrockets, reaching above 50% by February. This activity is primarily driven by Uniswap, Instadapp, and dydx, with significant activity on Compound, Curve, AAVE, and 1inch as well.

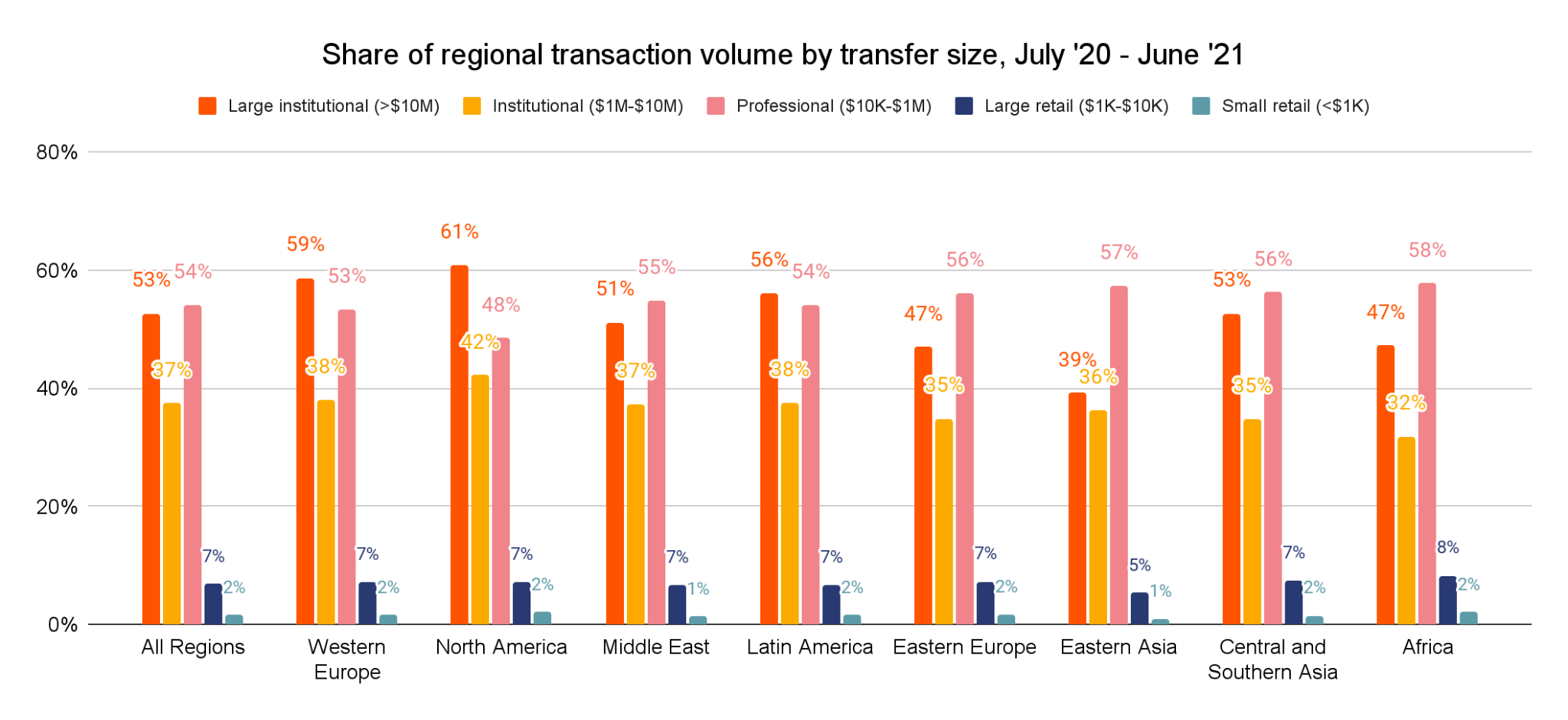

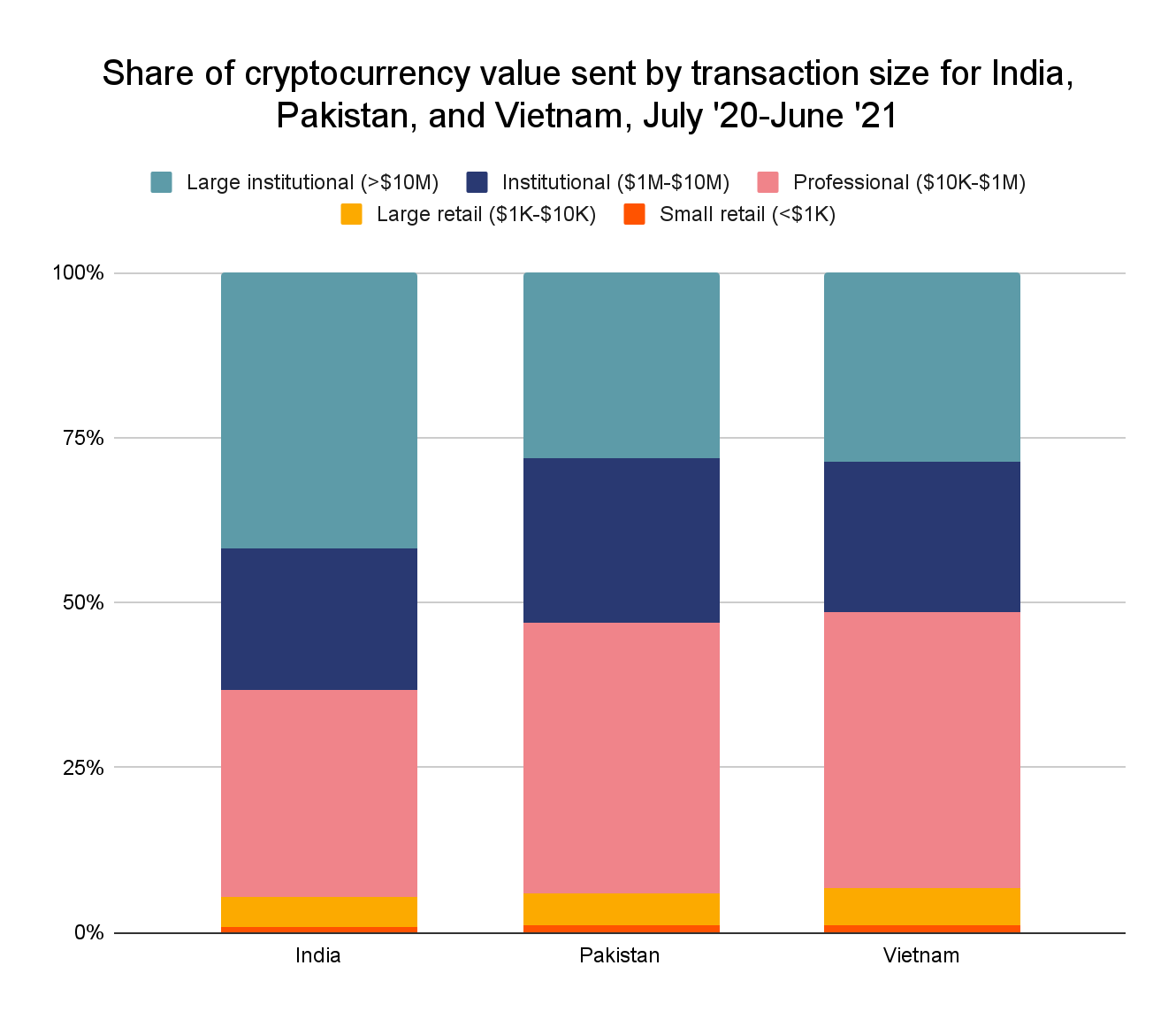

Professional-sized transfers between $10,000 and $1 million worth of cryptocurrency make up the largest share of transaction volume in CSAO.

However, institutional and large institutional payments combined dominate activity, though not quite to the same degree as in the larger markets of North America and Central, Northern, & Western Europe.

Comparing CSAO countries with the highest grassroots adoption: India vs. Vietnam vs. Pakistan

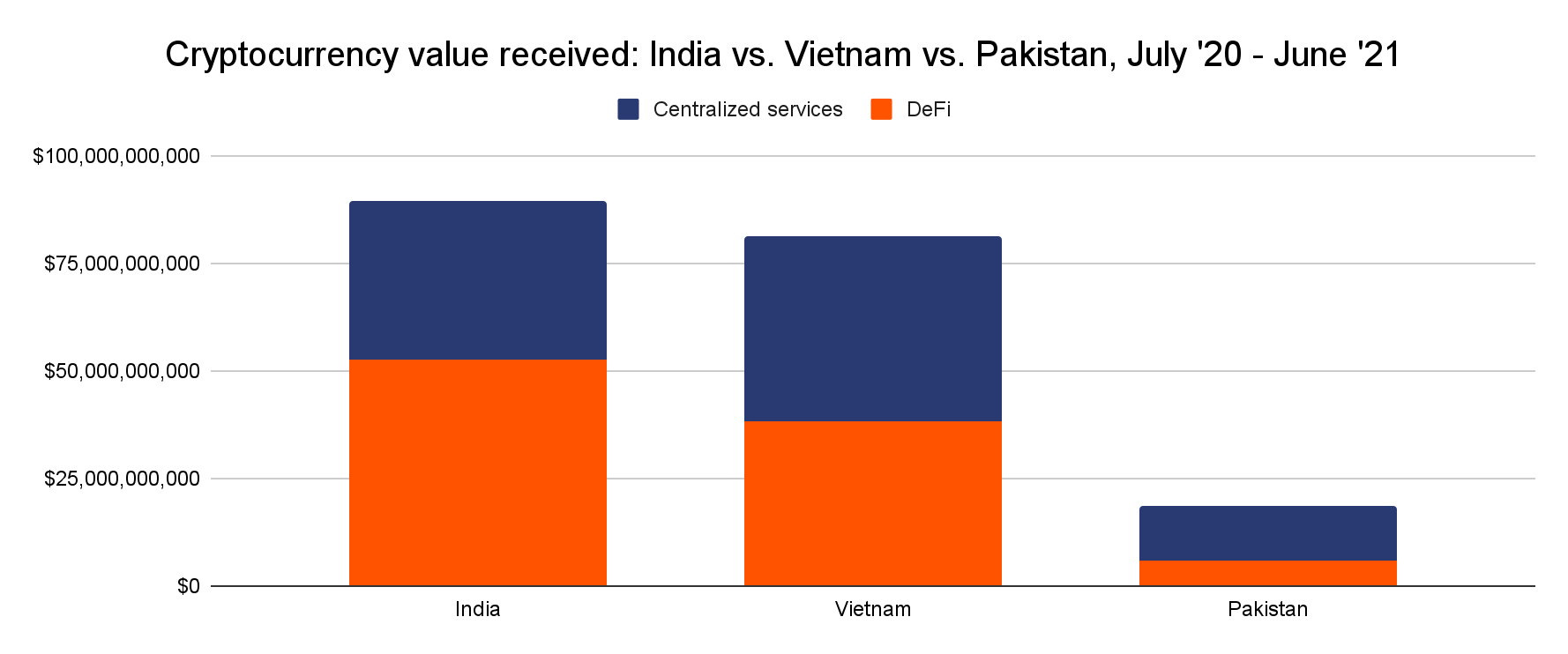

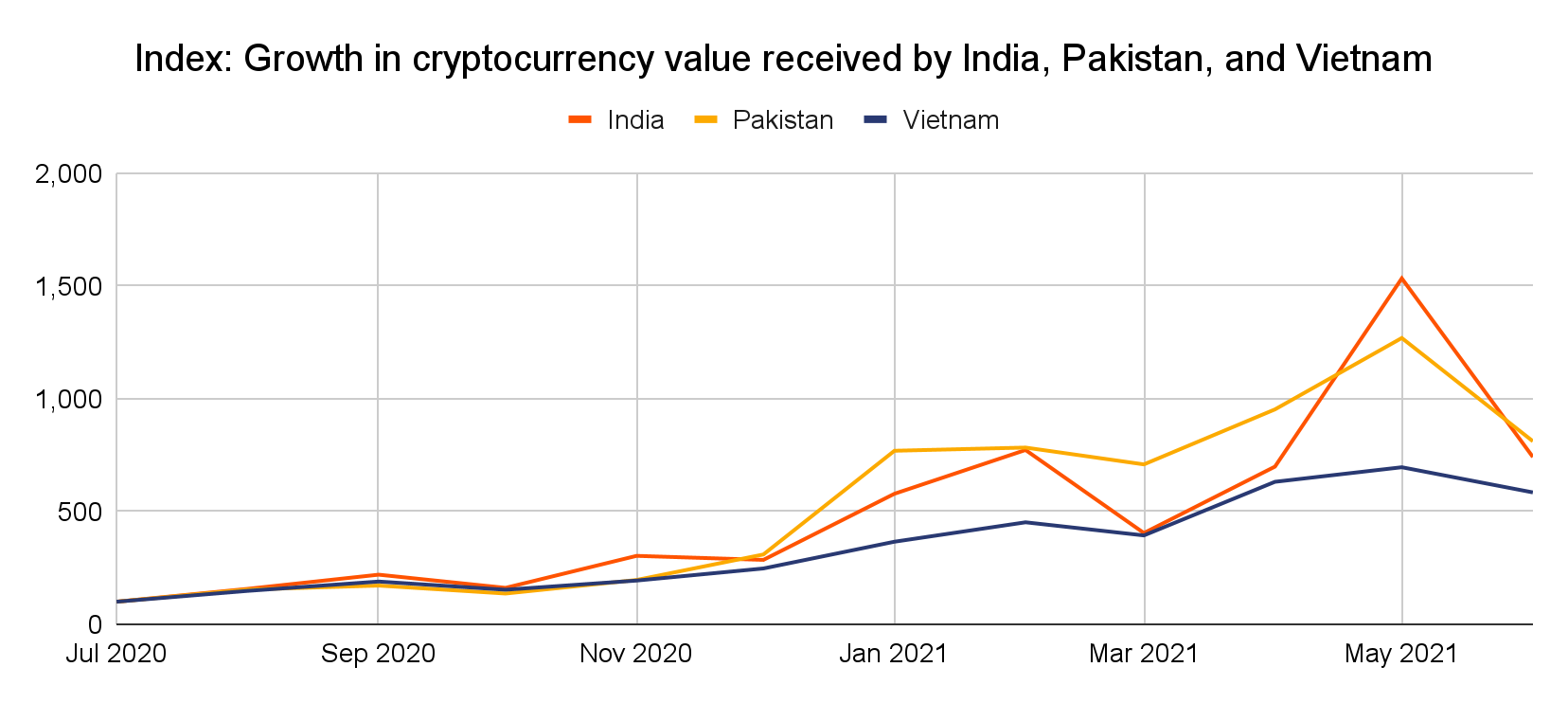

While India, Vietnam, and Pakistan all have high levels of grassroots cryptocurrency adoption, they’re quite different in terms of raw transaction value.

Two things stand out: One is that India and Vietnam’s markets are much larger than Pakistan’s. The other is that India has a much bigger share of activity taking place on DeFi platforms at 59%, versus 47% for Vietnam and 33% for Pakistan. All three regions grew substantially over the last year. Pakistan experienced the most growth at 711%, just ahead of India at 641%.

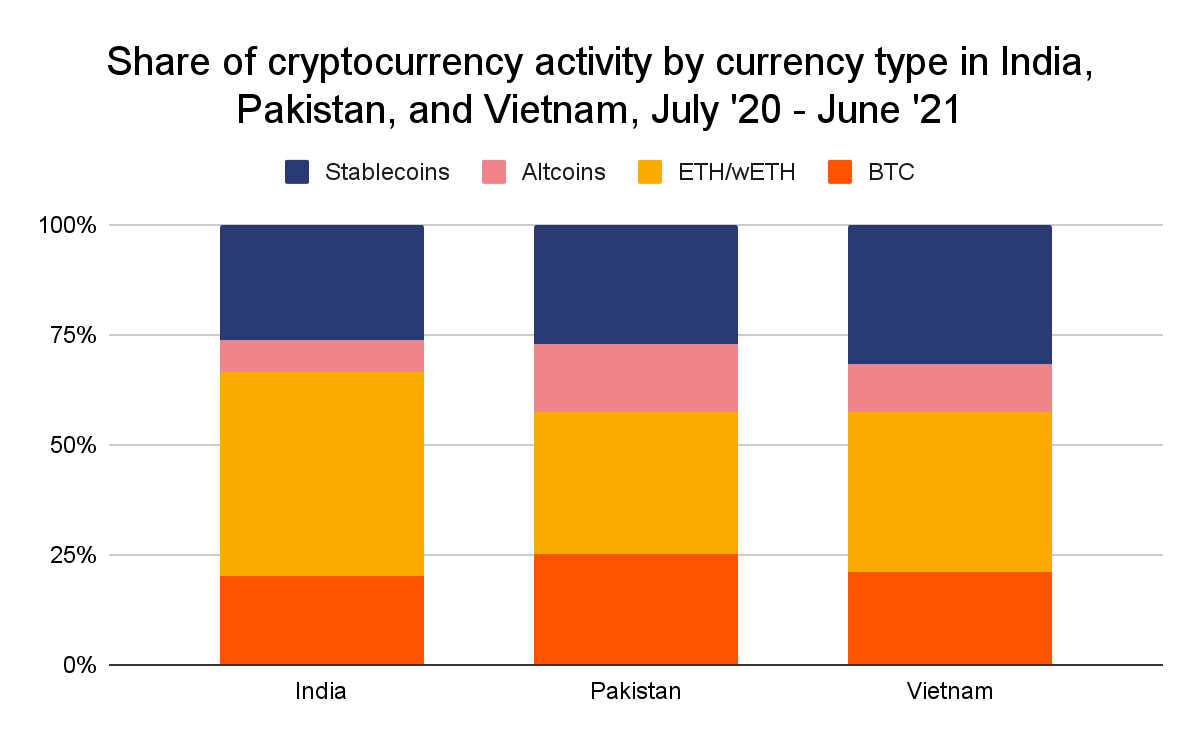

Interesting differences also emerge when we look at the breakdown of transaction value by currency. For instance, we see that Ethereum and wETH make up a bigger share of Indian activity than of Vietnamese or Pakistani activity.

This isn’t surprising, as Ethereum and wETH more commonly used for DeFi transactions.

These breakdowns may also reflect differing levels of sophistication between the markets. We spoke to Binh Nguyen, the Coordinator of the RMIT Fintech-Crypto Hub and Senior Program Manager of Finance at the Royal Melbourne Institute of Technology- Vietnam (RMIT) who has studied the local cryptocurrency market extensively. He characterized a lot of the cryptocurrency activity he sees as akin to gambling. “Most forms of gambling are illegal but quite popular in Vietnam, and I think that’s one reason people here are willing to invest in high volatility assets like cryptocurrency,” he said. According to Binh, while there’s a technologically savvy contingent of the Vietnamese cryptocurrency community interested in changing the future of money and building innovative projects, including in DeFi, many of those investing in cryptocurrency don’t have high financial literacy or experience managing risk. “Low financial literacy is a driver of excessive risk-taking and may create lucky financial rewards for crypto-investors during a bull market. Lots of sophisticated investors may be waiting five to ten years and missing out.”

While he characterized Vietnam’s cryptocurrency market as retail-driven, Binh didn’t think that, at the moment, many in the country were using cryptocurrency to preserve their savings for the long term or protect against inflation, noting that there’s relatively low cryptocurrency adoption in poor and remote areas. “Young people here don’t have many options for investing. We don’t have a well-developed financial market for ETFs, options, or futures and the stock brokerage penetration rate is lower than 5% in Vietnam.” said Binh. “If you have $5,000 to invest, there aren’t many other places to put it.” Binh expressed hope that with clearer regulatory direction for the government, Vietnam’s cryptocurrency market could mature. To that end, he hopes that regulators will soon provide clearer guidance on whether cryptocurrencies are property or not, and advocates for a regulatory sandbox for cryptocurrency projects.

Pakistani cryptocurrency traders we spoke to said similar things about cryptocurrency adoption in their country, whose usage patterns are similar to Vietnam’s in terms of frequently used service types and cryptocurrencies. Muhammad, a Paxful Expert Trader, told us that in his experience, most traders are focused on trading altcoins rather than saving. “Everybody wants easy money obviously. But nobody wants to risk or have any loss,” he said. Junaid, another Paxful Expert Trader, described the cryptocurrency scene similarly. “I’m trading a lot of altcoins like ADA, TRX, WAVES, SOL, DOT, CAKE, DLT, COMP, SC, SHIB, XRV, and CRV with a USDT pair,” he said. “As you know, ADA,WAVES,SOL and many other coins pumped huge amounts and I gained profit by holding them.”

India’s cryptocurrency market, by comparison, appears more mature. We can see this in the breakdown of transaction sizes in the region.

Large institutional-sized transfers above $10 million worth of cryptocurrency represent 42% of transactions sent from India-based addresses, versus 28% for Pakistan and 29% for Vietnam. Those numbers suggest that India’s cryptocurrency investors are part of larger, more sophisticated organizations.

As we noted above, India’s DeFi market is also much bigger (though not when adjusted for population size), and there’s been a big increase in cryptocurrency-related entrepreneurship and venture capital investment in the region. Joel John, a principal at cryptocurrency investment firm LedgerPrime, told us about witnessing the legitimization of cryptocurrency businesses in India in real time. “There used to be a certain amount of stigma. In 2014, if you were at a VC event and said you were in crypto, you might have someone coming up to you later in the evening asking if you could get them drugs online,” said John. “Now, crypto has become the cool place to be.” While John noted that while some older investors still treat cryptocurrency with suspicion, the sentiment is overall much more positive now.

John also told us more about what drives the majority of India’s cryptocurrency investors. “Investing in equities in India is a long, painful process that requires you to sign lots of documents. It takes about three to four days. Investing in crypto takes less than an hour.” John estimates that there are 4x as many cryptocurrency investors in India as there are equity investors. According to him, many of these investors were previously focused on assets, like real estate, whose returns have decreased recently. Cryptocurrency has given them easy access to a new source of alpha. But that’s just the high end of the market. On the lower end, John mentioned that many in India’s large freelance economy — mostly those doing technology-related work for employers abroad — have started to request being paid in cryptocurrency, due to both convenience and interest in the asset.

Krishna Sriram, Managing Director at Quantstamp, told us more about this. “Tons of Indian developers, fund analysts, and independent freelancers working for overseas employers have started requesting to be paid in cryptocurrency. It’s a very bottom up way of adopting,” said Sriram. He also noted that most of the people he knows who do this opt to be paid in Ethereum or USDC, receiving payments through centralized exchanges or DEXes. “I think the reason for this is that lots of these people are working fulltime in the Ethereum and DeFi ecosystem. We’re seeing huge growth there, with many developers moving into the space after having worked at traditional tech unicorns.”

As for the large DeFi market, Krishna attributes much of the popularity to centralized exchanges becoming more difficult to use for users in areas with uncertain regulations like India. “Centralized exchanges are becoming more stringent and harder to use for people in certain jurisdictions. DeFi doesn’t discern where you’re from or care if it has a relationship with your bank,” he said. “It’s an open, permissionless system.” The past year has seen conflicting reports of India’s regulatory perspective on cryptocurrency, with some reporting that the country may ban digital assets altogether. More recently though, it appears India’s regulators will instead seek to tax cryptocurrency transactions rather than ban them.

Indeed, the past year has been tumultuous in terms of understanding India’s regulatory perspective on cryptocurrencies. Headlines speculated that the country would ban digital currencies altogether. More recently, it seems, the country favors an approach that taxes cryptocurrency transactions as opposed to banning them

Sriram also stressed the importance of the development of India’s cryptocurrency media and influencer ecosystem. He pointed to Kunal Kapoor, a popular Bollywood actor who’s promoted NFTs, and Akshay BD and Tanmay Bhat, social media influencers who have gone on to found the educational cryptocurrency YouTube channel Superpumped. “These people aren’t just shouting ‘Buy bitcoin!’ Influencers are discussing the merits of different projects in a nuanced way.”

The differences between Central and Southern Asia’s biggest markets may reflect the fact that these countries are at different stages of cryptocurrency market development. Many first look to cryptocurrency in search of quick returns on speculative trading of a variety of investments, which can be done on centralized services and conventional P2P platforms, which appears to be the predominant use case in Vietnam and Pakistan. However, in markets like India where the cryptocurrency community has grown and attracted outside investment, we see more development and usage of innovative projects like DeFi protocols.

This blog is a preview of our 2021 Geography of Cryptocurrency report. Sign up here to download the whole thing!