The Blockchain Insights Company

Celebrating 10 years of innovation

Explore our new solution framework that reflects how we’re continuing to innovate with the industry and enhance customer experiences.

Read the blogWe are paving the way for a global economy built on blockchains. Businesses, banks, and governments use Chainalysis to make critical decisions, encourage innovation, and protect consumers.

Watch the overview

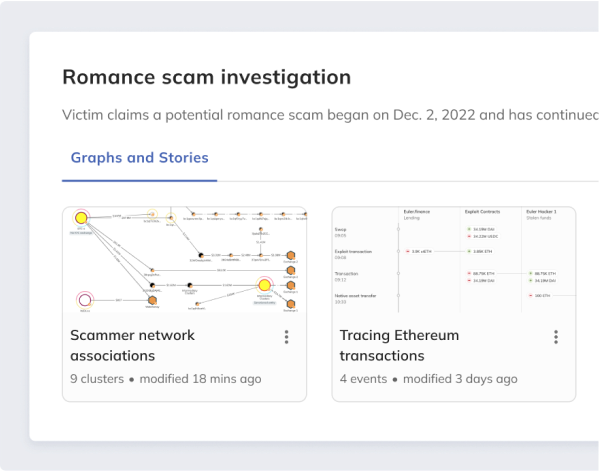

Law enforcement

Detect, disrupt, and deter crypto crime with blockchain insights.

Regulators

Protect consumers, establish safe markets, and maintain financial stability.

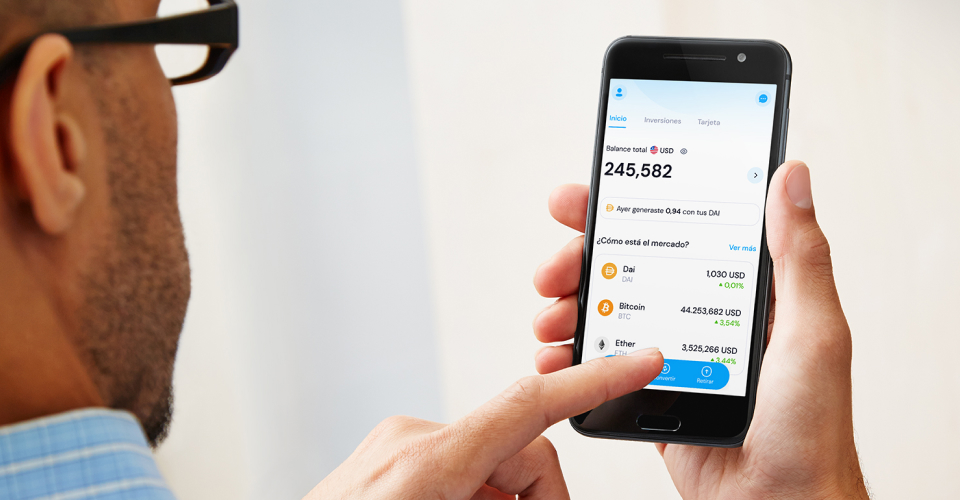

Financial institutions

Generate new revenue opportunities with digital assets for financial institutions.

Centralized exchanges

Harness the power of blockchain data to enhance security, mitigate risk, and ensure customer trust.

Unique insights

Research

The Chainalysis 2024 Crypto Crime Report

Download report- Apr 19, 2024 London’s Metropolitan Police Lead Disruption of Phishing-as-a-Service Provider LabHost

- Apr 11, 2024 Day 2 of Chainalysis Links NYC 2024: Stablecoins, Tokenization Paving the Way for an On-chain Future

- Apr 10, 2024 Day 1 of Chainalysis Links NYC 2024: Collaboration Powers the Future of Innovation

- Apr 08, 2024 Former IRS-CI Chief Jim Lee: Why I’m Joining Chainalysis

- Apr 04, 2024 Ten Years of Innovating with our Customers

Simplifying the complex

Solutions

Crypto Investigations Solution

Employ industry leading blockchain intelligence to tackle crypto challenges

Learn moreGlobal organizations trust Chainalysis

Customers

Why Choose Chainalysis

-

Breadth and depth of data

More than 1 billion addresses mapped to real world entities

-

Best in class customer satisfaction

Gartner® Peer Insights™ score of 4.7

-

Industry standard transaction monitoring

9/10 top crypto exchanges use Chainalysis