Cryptocurrency businesses are working hard to meet new regulatory requirements regarding counterparty risk. Perhaps the most notable of these requirements is the Travel Rule, which is relevant to nearly all cryptocurrency businesses operating in FATF jurisdictions. The Travel Rule dictates that Virtual Asset Service Providers (VASPs), such as exchanges, must identify the originators and beneficiaries of cryptocurrency transactions initiated by their users above a certain size. In cases where the counterparty of those transactions is also a VASP, the original VASP must then transmit that user information to the second VASP.

In order to comply, VASPs need simple tools that allow them to identify transactions that meet the rule’s requirements, pull users’ KYC information, and send it to VASP counterparties as the transactions are completed. All of this needs to happen instantly to avoid compromising user experience, which is no easy task for cryptocurrency businesses processing thousands of transactions per day.

Today, we’re excited to announce that we’ve partnered with Notabene to provide a frictionless, scalable tool that does exactly that. With our integrated solution, cryptocurrency businesses can automate transactions with trusted counterparties, while providing them with the data they need to detect suspicious activity and meet their regulatory requirements. By adopting now, cryptocurrency businesses can start complying with the Travel Rule immediately, put themselves in a better position with regulators, and gain a market advantage.

The Travel Rule’s requirements and challenges

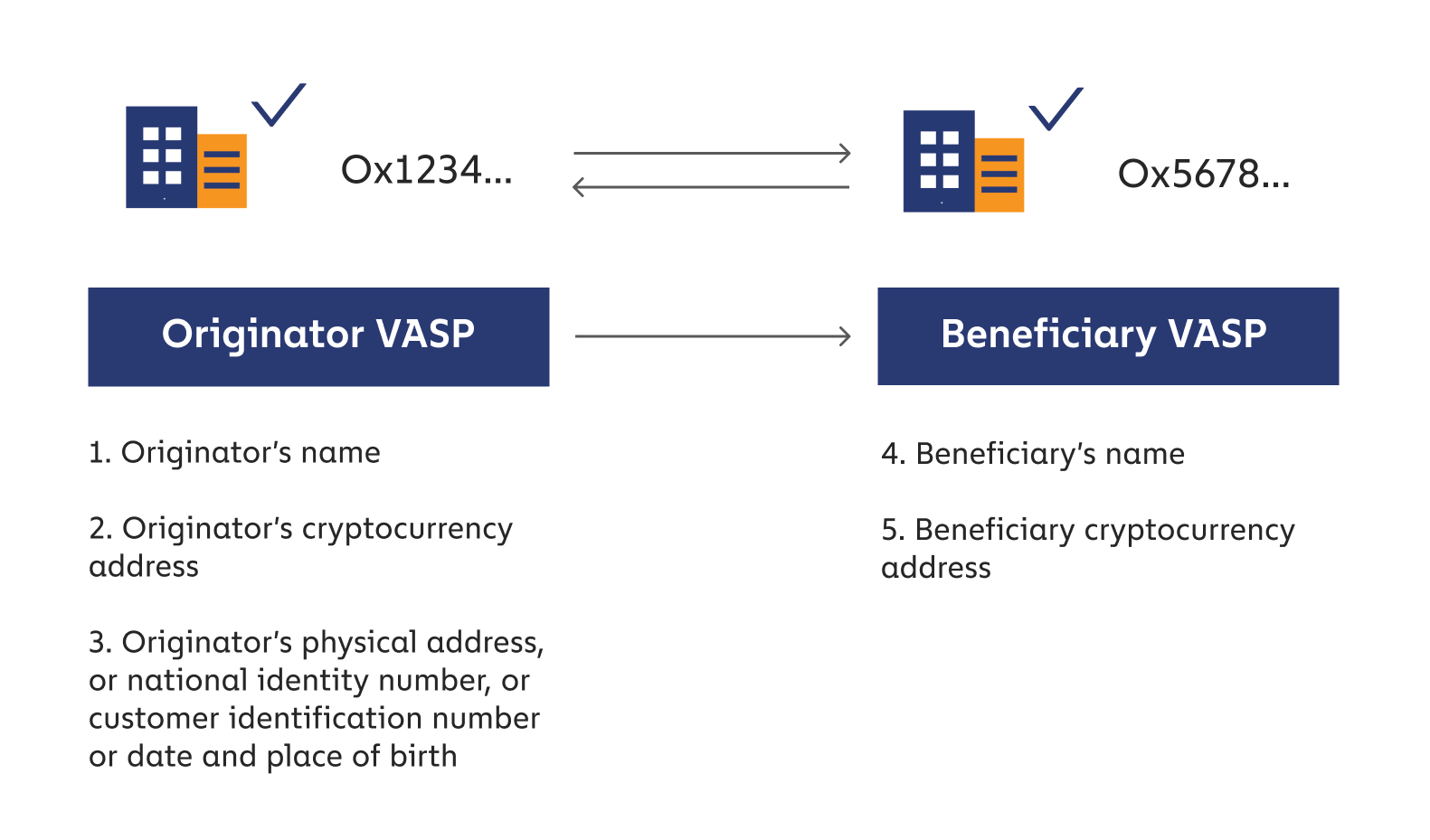

The Travel Rule is meant to help cryptocurrency businesses mitigate counterparty risk and establish a source of funds for cryptocurrency received by their users. While some jurisdictions have implemented the rule differently, the version recommended by FATF says that VASPs must exchange counterparty information with one another on cryptocurrency transactions valued above $1,000 or €1,000. Specifically, the originator and beneficiary VASPs must provide each other the following:

At first glance, the Travel Rule appears to be a simple matter of transmitting counterparty information between two VASPs. But in reality, the Travel Rule requires end-to-end changes to existing compliance processes, as VASPs must identify and take action on all transactions that meet the rule’s threshold in real time. This presents significant technical challenges, especially to implement at scale, as blockchain analysis shows that roughly 12% of all VASP transactions in February 2021 — roughly 2 million transfers overall — would qualify under the current FATF recommended threshold of $1000. We lay out the technical challenges introduced by the Travel Rule below.

Challenge 1: Identifying a Travel Rule transaction

When a customer initiates a transaction, the originating VASP needs to automatically determine whether or not the transaction meets Travel Rule requirements. That means they must:

- Determine if the transaction amount meets the Travel Rule threshold in the relevant jurisdiction(s)

- Identify whether the counterparty wallet is hosted by another VASP

- Collect any missing counterparty information

All of this needs to happen instantaneously.

Challenge 2: Performing due diligence on the counterparty VASP

Once the originating VASP has determined that a transaction meets Travel Rule requirements, it must then:

- Identify the counterparty VASP

- Assess the counterparty VASP’s risk level to determine whether it’s safe to share users’ personally identifiable information (PII)

In assessing counterparty risk, the originating VASP must take into account the counterparty VASP’s reputation, compliance program quality, security practices, and exposure to risky entities.

Challenge 3: Initiating and completing the travel rule transfer

Finally, the originating VASP must have an appropriate communication channel to conduct a secure data transfer with the counterparty VASP. Both VASPs must have a secure means of storing the data they each receive in order to protect customers’ privacy and prevent internal misuse of that data.

That leaves us with two questions: Can all of these challenges be met at scale with minimal impact on transaction flow? And how can VASPs comply without introducing unnecessary friction for users?

With Chainalysis data and Notabene’s compliance platform, cryptocurrency businesses can follow the Travel Rule frictionlessly and at scale

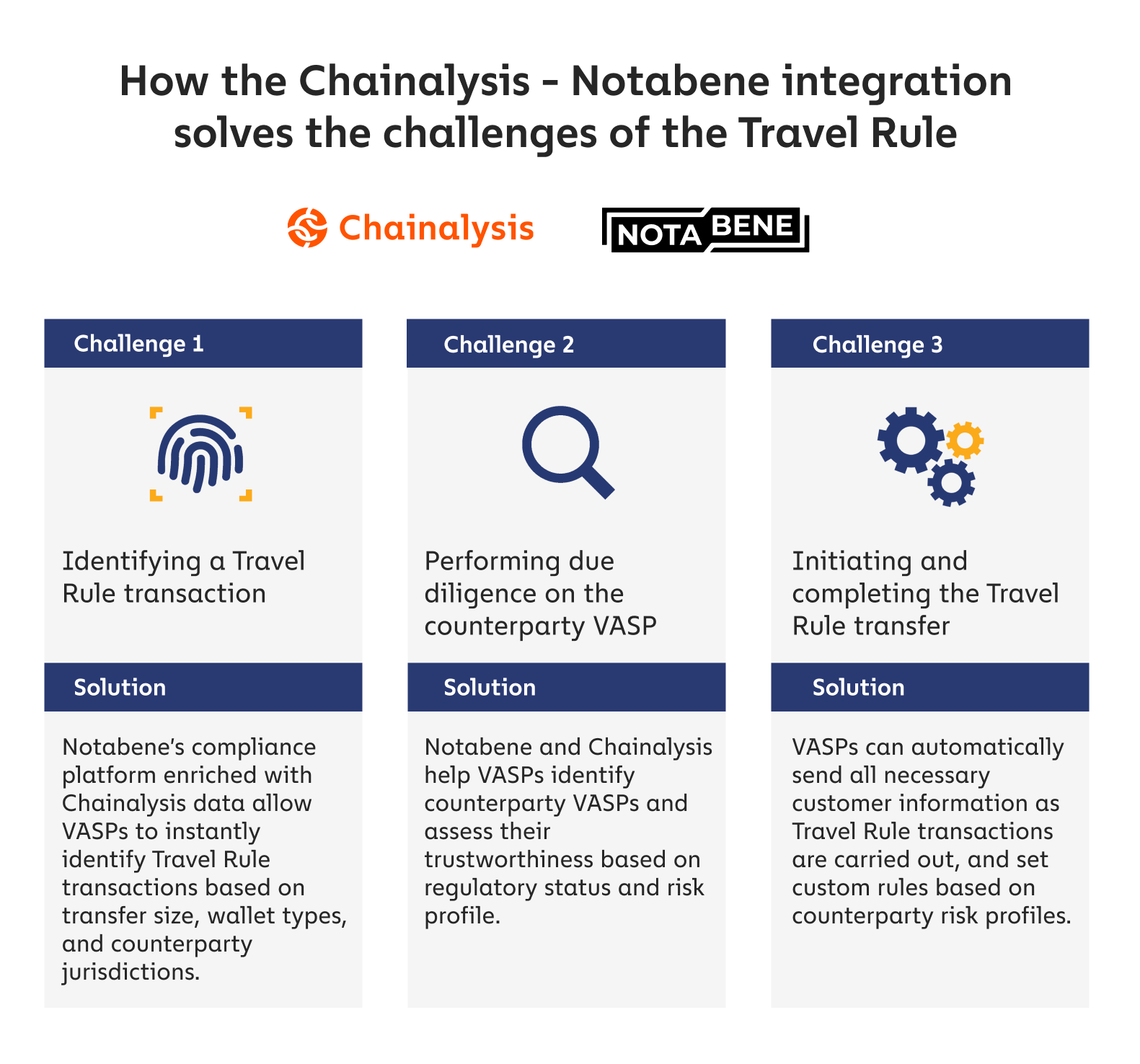

Notabene and Chainalysis have partnered to help VASPs meet the challenges outlined above and comply with the Travel Rule at scale.

Here’s what we each bring to the table.

Notabene provides an end-to-end travel rule platform that allows VASPs to manage regulatory and counterparty risks at scale. With its rule-setting tools, compliance officers can automate the exchange of Travel Rule data across the cryptocurrency business’s preferred communication protocols.

Chainalysis is the blockchain analysis platform trusted by investigators and compliance teams around the world. Our platform allows cryptocurrency businesses to identify Travel Rule transactions in real time, analyze counterparty wallets, and perform instant due diligence on counterparty VASPs so that they can get the information they need to stay compliant.

Through this partnership, Notabene customers can now use Chainalysis’s powerful blockchain analytics data to make smart decisions and set rules based on their own risk-based approach.

“Notabene’s platform provides a comprehensive, seamless, accessible offering that meets and exceeds the unique requirements of VASPs around the world,” said Chainalysis Chief Government Affairs Officer Jesse Spiro. “Through this integration, VASPs will have an additional tool for regulatory compliance, risk mitigation and data-driven decisioning.”

Users can view counterparty blockchain addresses identified by Chainalysis — including wallet type, hosting VASP, and risk score — directly on the Notabene dashboard. In addition, with Notabene’s API integration, they can automatically send or receive Travel Rule transfers based on data supplied by Chainalysis, allowing them to be Travel Rule-compliant at scale.

The Chainalysis-Notabene integration enables VASPs to meet all of the challenges necessary for Travel Rule compliance.

Why you should start meeting Travel Rule requirements today

Getting an early start on Travel Rule compliance signals to regulators that your cryptocurrency business is taking regulations seriously. That helps ensure your business receives its licenses on time without disrupting go-to-market strategy.

Further, as other VASPs become Travel Rule compliant, they may be forced to stop doing business with you if your compliance program isn’t up to par. By meeting Travel Rule requirements now, you can give your customers and partners the confidence to keep working with you, open up new opportunities, and gain an advantage in the market.

“In a fast-growing and increasingly competitive industry, we are seeing that crypto companies who view regulatory compliance as a market advantage are performing better. By taking action on requirements like the Travel Rule on time, they are able to unlock new opportunities: build the next suite of regulatory compliant financial products, receive licenses to operate in the biggest financial hubs, and expand their reach into new customer segments”, said Pelle Braendgaard, CEO of Notabene. “We are excited to play a pivotal role in helping companies achieve their growth plans. Through our partnership with Chainalysis, we provide crypto companies with a full solution to do compliance at scale.”

Want to learn more about the Notabene-Chainalysis Travel Rule integration? Join us Monday, March 29 at 11am ET for a webinar in which we’ll explain in-depth how the integration works and show a live demo.

Want to start using the integration right away? Contact the Notabene team at [email protected].