This blog is an excerpt from our new report: The Crypto Maturity Model. Inside, we lay out a framework for how traditional financial institutions can build cryptocurrency product offerings in iterative stages. Read the whole thing here!

Over the last year, cryptocurrency has become a more mainstream asset class, with an inflow of institutional dollars driving Bitcoin and other cryptocurrencies to record prices. With that, plus the OCC’s announcement last year that banks can provide cryptocurrency custodial services, we expect to see more mainstream financial institutions incorporate cryptocurrency into their service offerings for both retail and institutional clients. Some banks have already begun this process, and have either launched cryptocurrency programs or announced their intent to do so. But many more are evaluating the market and considering how to productize offerings around this emergent asset class.

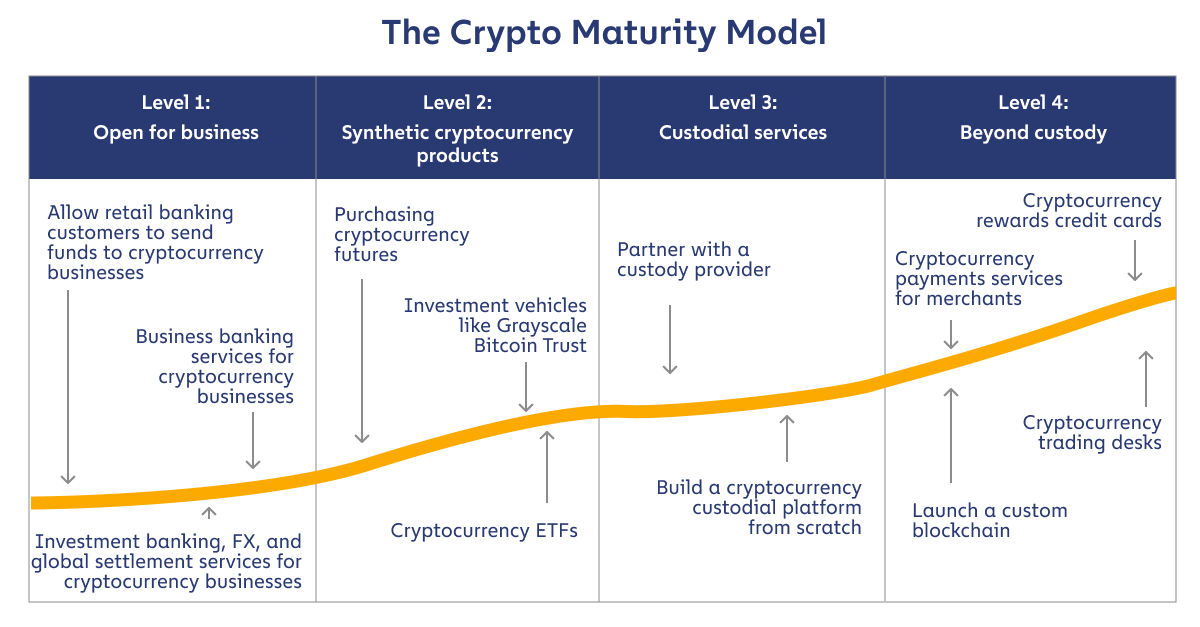

That’s why we’ve created the Crypto Maturity Model: a roadmap for financial institutions to offer cryptocurrency products. The Maturity Model defines an iterative path for cryptocurrency product rollout, enabling financial institutions to evaluate market opportunities while in parallel addressing regulatory and compliance requirements.

The model defines four levels of cryptocurrency adoption for financial institutions:

- Level 1: Open for business

- Level 2: Synthetic cryptocurrency products

- Level 3: Custodial services

- Level 4: Beyond custody

Download the full report to learn more about the Crypto Maturity Model, with examples of how different financial institutions have launched cryptocurrency products at each stage!