On August 1st 2017, Bitcoin Cash forked from the main Bitcoin blockchain. Since then, a debate has emerged over whether Bitcoin Cash can survive long term. Chainalysis analyzed the supply activity on the Bitcoin and Bitcoin Cash blockchain and found that profit motivated miners, such as ViaBTC, shifted up to 80% of their mining power from Bitcoin to Bitcoin Cash when BCH was 250% more profitable than BTC. Translation: due to the incentive structures that cause miners to behave strategically, it is unlikely that cryptocurrencies can ever truly die out.

A Bit of Bitcoin Cash History

Bitcoin (BTC) is regulated by a protocol, which specifies the rules of the blockchain and underlying mining processes. After a long debate over how to scale the currency, on August 1st the developers of Bitcoin Cash (BCH) altered this protocol to speed up transaction verification by allowing for greater flexibility in block size. Thus Bitcoin Cash was born: an entirely separate currency sharing its transaction history with the Bitcoin main blockchain. This is called a fork.

Despite different block size specifications, both Bitcoin and Bitcoin Cash use the same mining algorithm, meaning that miners can relatively freely shift between mining both currencies. Given that a large portion of miners are profit motivated, they likely base their decision of which chain to mine based on which chain is more profitable at any given moment. Immediately after the fork, there was discussion that this currency competition was going to be a fight to the death. Neither can live while the other survives. After early sell offs and plummeting prices, some predicted that Bitcoin Cash was on the way out and that no miner would devote computing power towards the Bitcoin Cash chain – which is a necessary process for generating currency supply. After an abrupt and pronounced increase in trading volume in mid-August, Chainalysis chose to investigate this trend with one specific question in mind: is it even possible for a cryptocurrency to die?

It turns out that the Bitcoin Cash mining reward system adjusts to macroeconomic trends, creating special incentives when mining activity is low to lure new miners to the chain. Miners respond to these special incentives by channeling large amounts of computing power to the newly profitable chain, allowing them to make more money for less resources even when price, interest, and demand is low. This system essentially acts as a defibrillator to a stopped or stalled cryptocurrency, making currency death a remote, if not impossible event.

What the F**k?

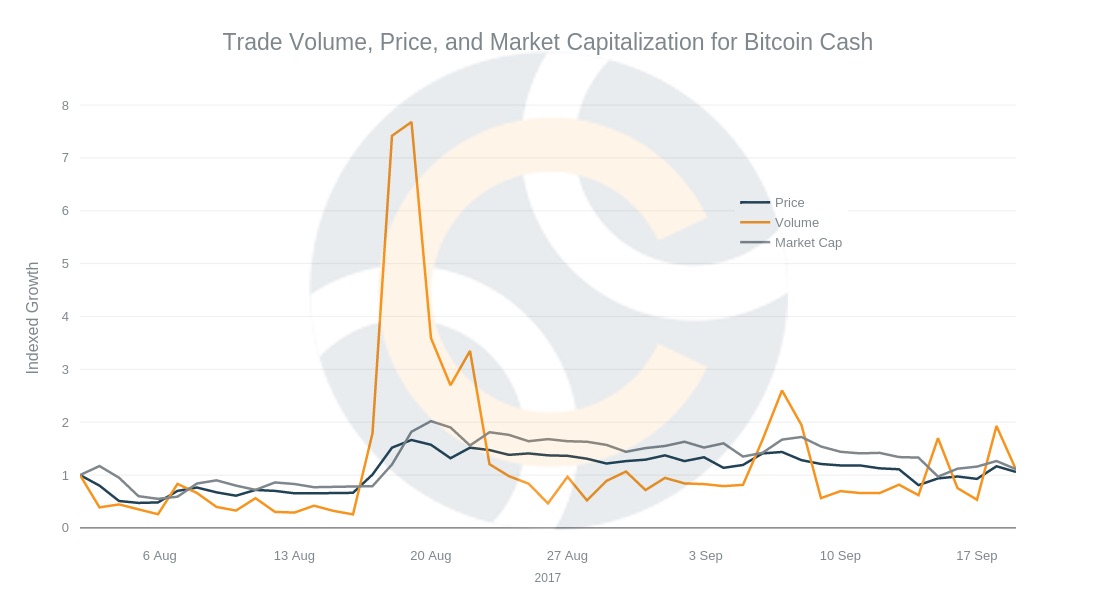

Immediately after the fork, there was a dip in Bitcoin Cash price, trading volume, and market capitalization across the board. Then suddenly, on August 19, 2017, trading volume for Bitcoin Cash rose from $744 millionto more than $3 billion, eclipsing the price gains of 150% over a 3 day period. Then things calmed for a few weeks, only to return to marked volatility around September 7th and again two weeks later (see below).

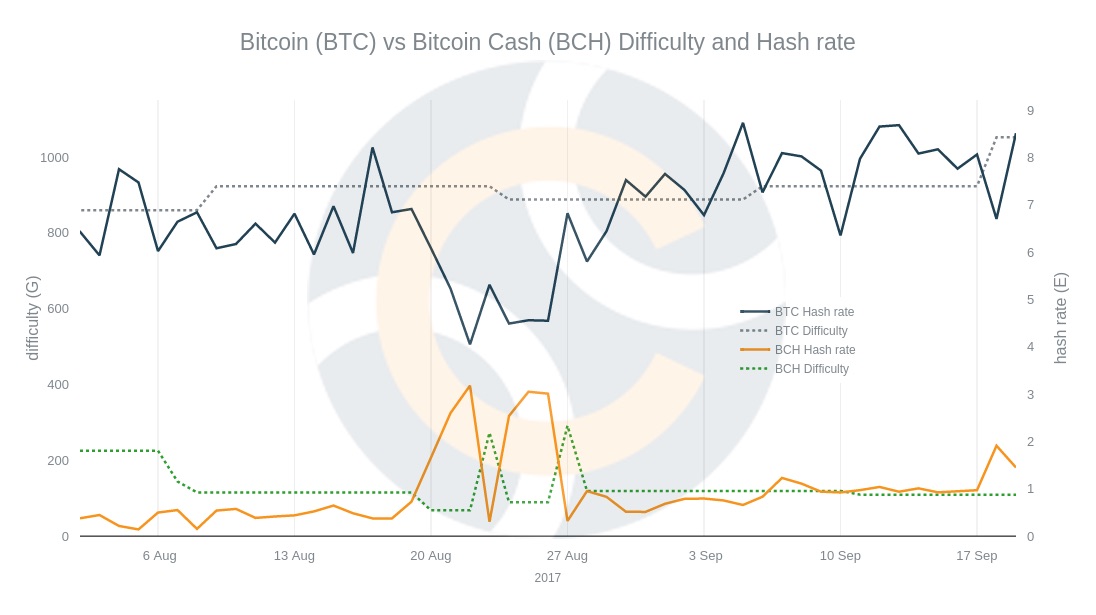

These trends in trading volume and prices can be explained in part by the mechanisms dictating how profits are generated by miners. The profitability of mining a chain is determined mainly by the reward and block difficulty. Now, most blockchains create a target for the number of blocks mined within a designated time frame. To ensure that this designated number of blocks is maintained, there is a difficulty setting which will increase if too many blocks are being mined and decrease if too few are being mined.Periods of volatility change the profitability equation through automatically adjusting the difficulty settings. As shown in the below graphs, when Bitcoin Cash becomes more profitable, the hashrate dedicated to mining Bitcoin Cash increases in tandem, and the difficulty settings adjust in response to the increased hashrate.

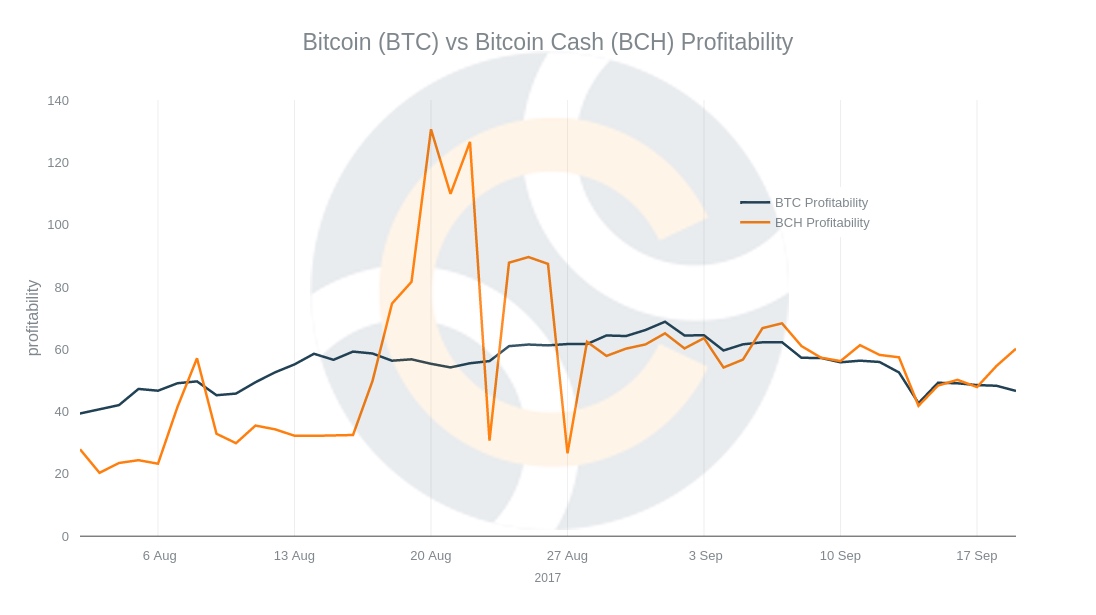

As a result, miners have been chasing profitability, creating a cycle in which miners switch computing power across chains fairly regularly. Bitcoin Cash became more profitable to mine than Bitcoin at least 6 times, and on August 20, Bitcoin Cash was almost 250% more profitable to mine than Bitcoin. Meaning with the same computing power a miner could get 250% more reward by mining Bitcoin Cash instead of Bitcoin.If no one mines Bitcoin Cash, the difficulty settings will go so low that it will become more profitable to mine than Bitcoin and the profit motivated miners will switch chains. The supply will grow and the cryptocurrency will stay alive!

Ah, ha, ha, ha, Stayin’ Alive, Stayin’ Alive

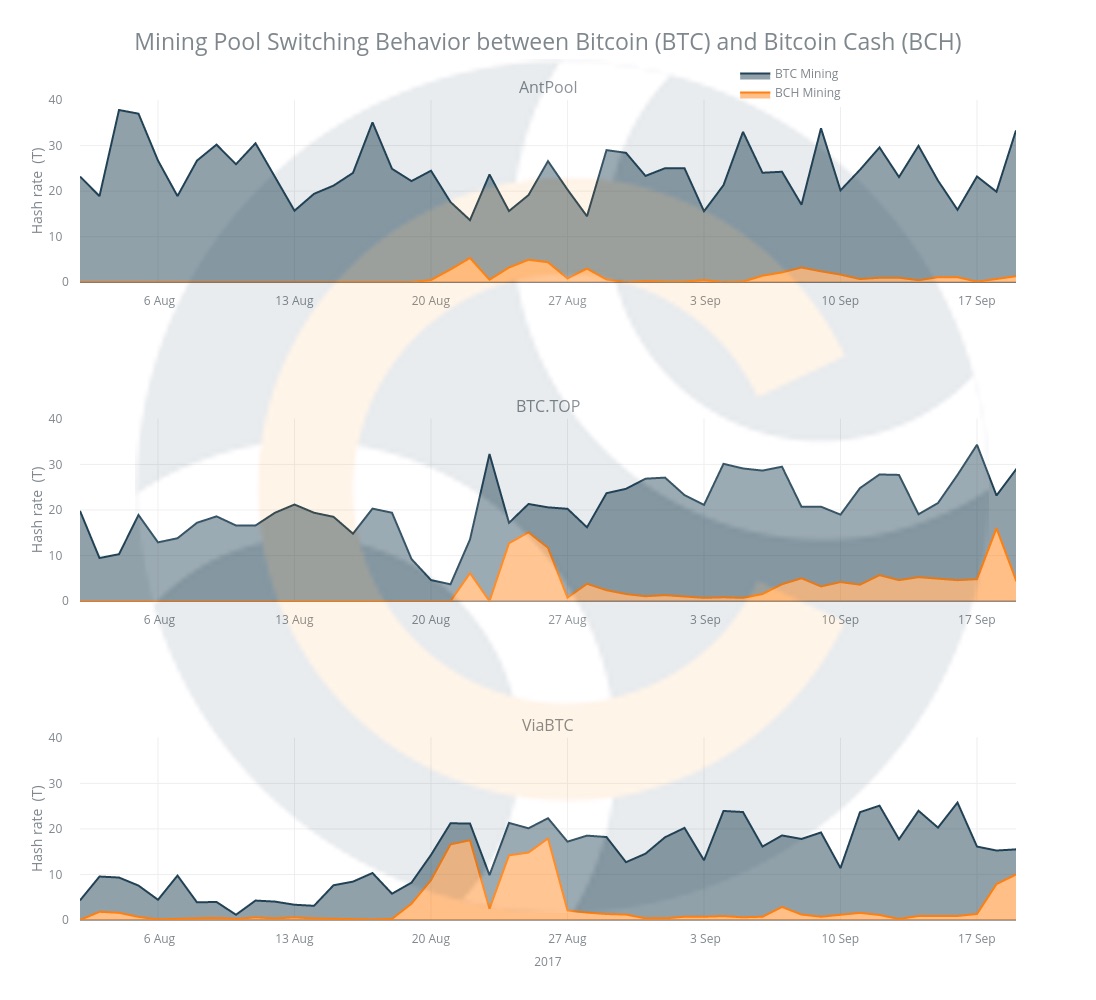

Investigating real time mining behavior revealed that mining pools are acting strategically across chains and diverting hashrate based on profitability. Chainalysis can analyze how miners distribute hashrate on the Bitcoin Cash and Bitcoin blockchain and confirmed that many of the mining pools previously working on Bitcoin moved to Bitcoin Cash when it became more profitable. The mining pools’ change in strategy was enough to give a significant spike in the hash rate and therefore increase the number of blocks mined until difficulty settings adjusted. Specifically, between August 18 and August 22, the number of blocks mined per hour increased fourfold as a direct result of this new hashpower, only to return to zero the following day.While miners typically pursue profitability, different prominent mining pools still choose to direct different amounts of computing power to Bitcoin Cash when it becomes more profitable. Going back to August 20 – when the BCH profitability was 250% higher than BTC – ViaBTC’s shifted 80% of its computing power from Bitcoin to Bitcoin Cash. In the following days, BTC.TOP devoted ~60%, and AntPool ~15% of their hashrate from BTC to BCH, as shown below.

The mining protocol governing Bitcoin and Bitcoin Cash ensures that miners are incentivized to shift computing power based upon profitability adjustments. The key impacts of the profit motivated miners like ViaBTC, BTC.TOP, AntPool and others are that it is likely that cryptocurrencies cannot die due to the incentive structures that cause miners to redirect their hash power. So long as crypto developers build within their protocols a means of self preservation such as that in the Bitcoin and Bitcoin Cash protocol, failure is a more remote possibility.

More about Bitcoin Cash soon when Chainalysis will look into the demand side. Meanwhile, Sign up here and stay tuned with our weekly coverage on the latest news in crypto world.