The Chainalysis 2020 Crypto Crime Report is here! Click here to download.

If the last few years have proven anything, it’s that cryptocurrency isn’t just for criminals. Polling shows that adoption is increasing, as 18% of all Americans and 35% of American millennials have purchased cryptocurrency in the last year. Mainstream financial institutions like JP Morgan are getting involved. Popular retailers like Amazon and Starbucks now allow customers to pay in Bitcoin.

Nonetheless, cryptocurrency’s decentralized, semi-anonymous nature makes it a uniquely appealing option for criminals, and their embrace of the technology has helped shape its overall reputation. But the upside is that unlike cash and other traditional forms of value transfer, cryptocurrency is inherently transparent. Every transaction is recorded in a publicly visible ledger. With the right tools, we can see how much of all cryptocurrency activity is associated with crime, hone in on the types of crime that dominate the ecosystem, share insights with law enforcement and the industry to stop bad actors from abusing the system and, in many cases, taking advantage of vulnerable people.

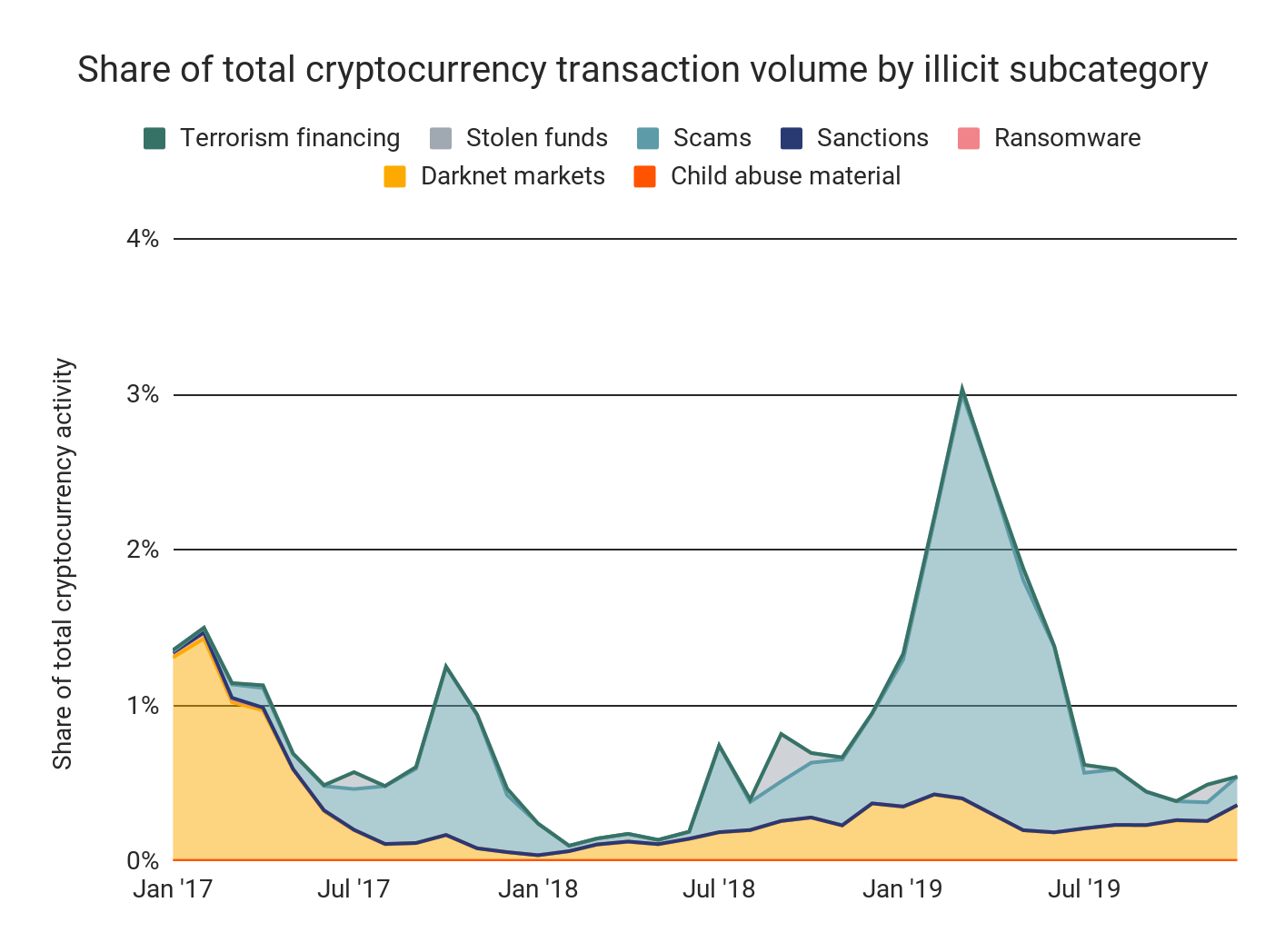

So, what did crypto crime look like in 2019? Our analysis shows a total of $11.5 billion USD worth of cryptocurrency transactions last year were associated with criminal activity, representing just 1.1% of total activity. The graph below shows which types of crimes have taken up the biggest share of all cryptocurrency activity over time since 2017.

The data is clear: Scams were by far the biggest type of crime in cryptocurrency in 2019 based on economic value. After a brief lull in 2018, scam activity shot up to account for a whopping $8.6 billion worth of transactions. Scammers bilked roughly $4.3 billion worth of cryptocurrency from millions of victims, and sent a roughly equal amount to other entities, presumably to convert their stolen funds into cash. The vast majority of that $4.3 billion went to just two large-scale Ponzi schemes, without which crime overall would account for just 0.46% of all cryptocurrency activity.

Download the full report to learn more about the Ponzi schemes and other scams that drove crypto crime in 2019. You’ll also get data, research, and case studies on other forms of crypto crime, including darknet markets, ransomware, exchange attacks, and more.

Why we research crime in cryptocurrency

Our mission at Chainalysis is to build trust in blockchains. We want the world to know that cryptocurrency is a safe way to store and transfer value — only then can the technology continue to grow and make the global economy bigger and fairer.

It may seem counterintuitive to publish so much research on criminal usage of cryptocurrency. Why not just focus on the 98.9% of transactions that are legitimate?

For one thing, you can’t solve problems by ignoring them. Law enforcement, regulators, and traditional financial institutions have to be on board for cryptocurrency to keep growing. The only way that can happen is if they have the tools and information they need to fight financial crimes as effectively– or more effectively– as they do in the fiat world.

Second, the very fact that we can quantify and investigate crypto crime so effectively demonstrates cryptocurrency’s inherent transparency. This kind of analysis would never be possible in fiat currency, but it is in cryptocurrency (with the right tools, of course) since every transaction goes into a public ledger. We hope our research helps raise awareness of cryptocurrency’s built-in transparency, prompting reputational gains for the industry and, ultimately, more mainstream adoption.