Cryptocurrency is shifting paradigms in finance. Already, the technology has helped early adopters around the world invent innovative new business models, preserve their savings in the face of wider instability, and send funds across borders more easily. Lately, cryptocurrencies have drastically increased in value as financial institutions recognize its potential as a safe haven asset in the face of worrisome macroeconomic trends.

However, we have to balance cryptocurrency’s utility against other problems the world faces, such as climate change. Recently, many have questioned cryptocurrency’s impact on the environment given the large amounts of energy required for the mining activity that powers the entire ecosystem. These questions are especially important to the mainstream financial institutions that have helped fuel the latest cryptocurrency rally. Like most big businesses today, these financial institutions have recognized the dangers of climate change and made pledges to invest in more sustainable business models. Many are rightfully questioning if those pledges are compatible with a technology that requires so much energy consumption.

However, cryptocurrency proponents have pushed back on this, and argue that miners can take advantage of energy that would otherwise go unused, and in the long run their activity could even incentivize further investment in green energy. Below, we break down the concerns and counterarguments around cryptocurrency’s environmental impact.

Cryptocurrency’s environmental impact: Mining uses lots of energy

There’s no denying one simple fact: Cryptocurrency networks require huge amounts of energy consumption. This is due to the essential process of mining. Cryptocurrency miners verify previous transactions recorded on blockchains, thereby ensuring those blockchains remain permanent, immutable ledgers of a currency’s previous activity, and enable new transactions to occur. In return for this service, miners receive cryptocurrency as a reward every time they successfully verify a new block.

Given the rewards, verification is a competitive process, in which miners race to solve complex mathematical problems requiring immense computing power — the more miners competing, the more computing power and therefore electricity needed. Robust mining competition is crucial for cryptocurrency networks. Any one miner gaining control of over half of the hashrate — meaning the total, collective computing power being used to mine on any one blockchain — would allow them to damage the network’s integrity by, for example, refusing to verify new transactions. Mining is an ingenious way of incentivizing participants to keep blockchains running, but unfortunately it also incentivizes high energy usage. There’s no way around that.

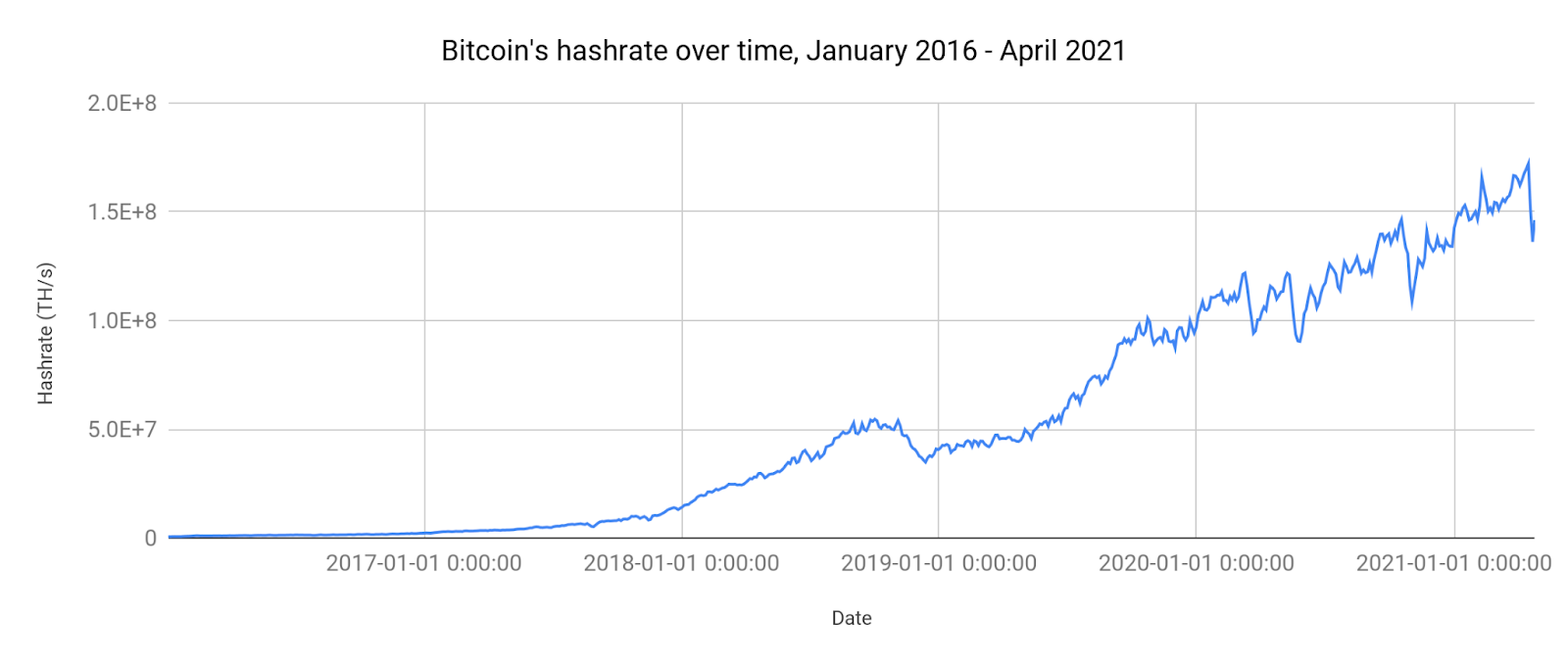

As expected, mining competition has trended upwards over time as cryptocurrencies have become more expensive. We’ll focus on Bitcoin since it’s the most popular cryptocurrency.

According to Blockchain.com, Bitcoin reached a peak hashrate of 172M THs in mid-April of 2021, which is 233x greater than it was in January 2016. As mining competition has increased, many have drawn attention to the corresponding rise in energy consumption. The BBC recently reported that the Bitcoin network consumes 121.4 TWh of power per year, which means that it would be the 29th highest energy-consuming country in the world, above Argentina and below Norway.

These figures have many questioning whether it’s possible to invest in cryptocurrency while remaining committed to sustainability.

But is that the whole story? Others claim cryptocurrency can be an environmental positive

Cryptocurrency advocates have pushed back on claims that the technology is uniquely destructive to the environment. Castle Island Ventures partner Nic Carter, for example, recently wrote an article in response to several claims on Bitcoin’s environmental impact, including one that rising Bitcoin prices necessitate greater energy expenditures. He points out that physical commodities function in much the same way, with gold as his example. When gold’s value rises, so too does gold mining activity, which itself has a negative environmental impact. Others have advanced similar arguments of comparison, essentially asking why cryptocurrency should be treated differently from other industries whose energy consumption is taken as more of a given. While it’s a fair philosophical question to ask, many would argue that those touting cryptocurrency as the future of finance should hold the technology to a higher environmental standard than mining for gold.

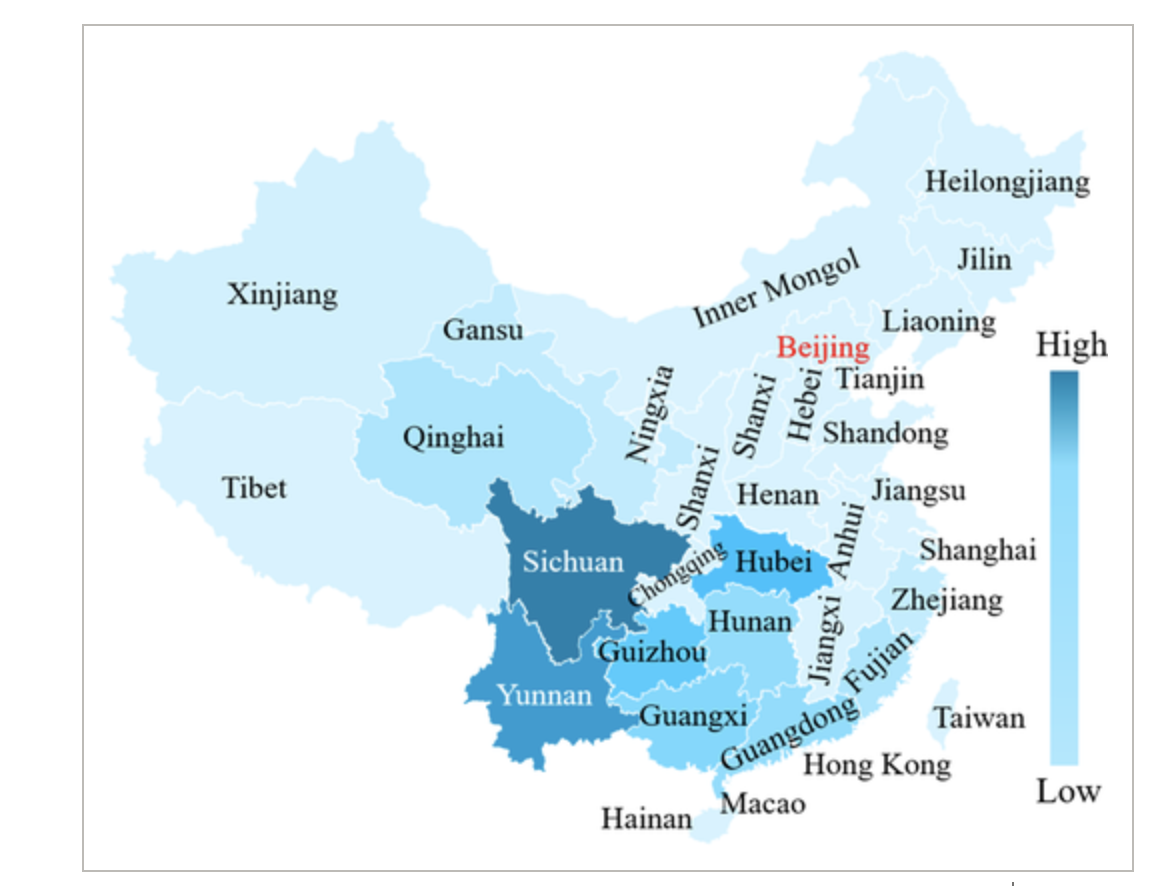

However, perhaps even more compelling are those questioning the energy consumption narrative itself, arguing that cryptocurrency can have a neutral or even positive environmental impact in the long run. For instance, many point out that cryptocurrency miners can take advantage of energy that would otherwise go unused. Nic Carter covers this in the same article we cited above, using China’s biggest cryptocurrency mining regions as an example. Miners in these areas rely on hydroelectric power. Hydroelectric power plants tend to be in rural, sparsely populated areas and often produce more power than can be transported to densely populated areas. Since they’re location-agnostic, cryptocurrency miners can operate near these hydroelectric power plants and use excess power that would otherwise still be produced but impossible to use.

Carter points out that the same can be done with natural gasses like methane. Methane is a natural byproduct of oil extraction, but can’t be transported for use in a cost-efficient manner, so it’s usually combusted on-site in a process known as flaring, or vented into the atmosphere. Both options cause pollution, though much less than simply releasing the methane. However, Bitcoin miners can set up operations at oil extraction sites and use that methane for power, thereby putting it to productive use in a way that results in even less pollution. The amount of natural gas flared each year is more than enough to power the entire Bitcoin network, and mining companies like EZ Blockchain and Crusoe Energy are already taking advantage.

These arguments form the basis of the idea of Bitcoin as a “battery.” The metaphor isn’t literal, as miners can’t actually store excess energy. However, miners can effectively convert this energy into a liquid asset — cryptocurrency — which can then be sent anywhere in the world, exchanged for dollars, and even reinvested into improvements to energy grids or green energy projects. Kjell Inge Rokke, head of Norwegian energy conglomerate Aker ASA, made this exact argument when he announced plans to launch a green Bitcoin mining project that will utilize energy produced in areas without enough local demand.

Square made similar arguments in a recent white paper on Bitcoin’s environmental impact, focusing more on how miners can tap into solar and wind power. Square points out that solar and wind power, having fallen in price by 90% and 71% respectively over the last decade, are now cheaper than fossil fuel energy. The issue, however, is that both are impractical for many customers, since they can only generate energy when the sun is shining or the wind is blowing, which often doesn’t match up with the times people need power. However, that demand mismatch doesn’t affect mining operations as much, since they can run at any time day or night.

Square argues that by incorporating cryptocurrency mining, solar and wind facilities can become more profitable, making them more attractive to investors so that more such facilities are built. That in turn would make wind and solar even cheaper, thereby encouraging more profitable, green cryptocurrency mining activity, creating a flywheel effect that results in a greater share of all energy coming from solar and wind. A recent CoinDesk research report shows that 39% of Bitcoin mining energy came from renewable sources in 2019, up from 28% in 2018, suggesting this process may be underway.

Cryptocurrency market entrants must address the question of environmental impact

Anyone who invests in cryptocurrency, from individual consumers to large financial institutions, has to grapple with the question of environmental impact. It’s important for them to keep in mind not just the current energy consumption levels, but also how future events may impact their trajectory, and whether that energy can come from renewable sources in the future.

At some point, cryptocurrency investors and miners may not have any choice but to go green. Cryptocurrency reporter Daniel Kuhn covered this in a recent article for CoinDesk, exploring the possibility that future regulations may force investors to only purchase cryptocurrency mined using renewable energy. It may already be happening: a new bill on the floor of the New York State Senate aims to prohibit crypto mining centers from operating until the state can assess their environmental impact.

Kuhn argues this is easier said than done. For instance, while blockchain analysis could theoretically be used to trace the path of any given coin and ensure that it came from an environmentally friendly miner, cryptocurrencies usually pass through services like exchanges that commingle and store coins from many different services, so that the original source of any given coin can’t be determined. Plus, the mining pools responsible for mining the majority of new coins generally rely on several individual miners around the world with their own computing power resources, making it difficult to verify that all of them are drawing on renewables.

Perhaps, though, the market will begin to favor bitcoin mined from more environmentally friendly sources. Given demand for “green” bitcoin from institutions in particular, exchanges may augment the due diligence processes they already conduct with mining partners for compliance to also ensure their operations depend on renewable energy sources. It could become a competitive advantage for both the exchanges that service these buyers and the miners that provide liquidity to exchanges to roll out green operations and controls.

Chainalysis takes the criticism of cryptocurrency’s energy use seriously, and believes there are compelling solutions to address these issues. Investors must ultimately conduct their own research, and talk to subject matter experts in green energy and the cryptocurrency industry as they decide how to proceed.