This blog is a preview of our webinar on cryptocurrency and human trafficking. Click here to watch the recording!

Human trafficking is a massive, worldwide criminal industry that generates over $150 billion per year according to the International Labour Organization. More than 40 million individuals today live in a state of modern slavery, and every nation in the world is implicated as either a country of origin, destination, or transit for victims.

Financial services providers are at the forefront of the fight against human trafficking, as their transaction monitoring abilities allow them to proactively spot the financial warning signs and notify the authorities. In fact, after the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) added a human trafficking reporting option to its Suspicious Activity Reports (SARs) in 2018, financial institutions filed nearly 11,000 human trafficking-related SARs within a year.

However, we can’t rely on fiat currency-based institutions alone to reduce human trafficking and its related crimes. Cryptocurrency is the preferred payment option for web-based human trafficking-adjacent services, most of which revolve around sexual exploitation and exist on both the clearnet and darknet. Below, we’ll share some of our research and data on how cryptocurrency intersects with human trafficking, as well as strategies for cryptocurrency businesses and the financial institutions they work with to counteract this activity.

Background information on web-based human trafficking and sexual exploitation

A huge percentage of human trafficking victims are forced into sexual exploitation, which we see manifested on the internet generally in one of two ways:

- Adult services advertisements

- Child sexual abuse material (CSAM)

Sex workers often meet customers on classified advertising clearnet websites that aggregate their listings, such as Craigslist, AdultSearch, and most infamously until it was shut down, Backpage. While sex workers ostensibly post advertisements on these sites and meet clients consensually, we know from law enforcement that this isn’t always the case. All too often, sex workers on these sites are working against their will, or being coerced to do so while underage. That’s one reason why in 2015, major credit card companies began refusing to process payments to sites like Backpage for sex work advertisements, leaving Bitcoin and checks as the only accepted forms of payment. While Backpage and others quickly adopted Bitcoin, it became much more difficult for them to operate following the 2018 passage of the SESTA/FOSTA Acts, which make it illegal for any site to knowingly facilitate sex trafficking. Previously, these sites could claim not to be responsible for their users’ advertisements, even if they were illegal. Around this time, law enforcement shut down Backpage and arrested its administrators due to its outsized role in facilitating internet-based sex trafficking.

While sites with adult services-focused classified advertisements have historically been able to operate on the clearnet due to their place in a legal grey area, CSAM has always been unambiguously illegal. Because of this, it’s rarer on the clearnet, and virtually any sites explicitly hosting or advertising it are on the darknet only. These sites are rare and difficult to find for outsiders, and nearly all mainstream darknet markets explicitly ban the sale of CSAM.

The CSAM-focused darknet sites that do exist, such as the infamous Welcome to Video that was shut down last year, almost ubiquitously accept Bitcoin and other cryptocurrencies as payment, with some also allowing users to upload their own content in exchange for credits to view more content. Because of their reliance on cryptocurrency, we can analyze darknet CSAM sites’ transactions to provide unique insight into an otherwise opaque criminal industry.

Cryptocurrency payments and CSAM

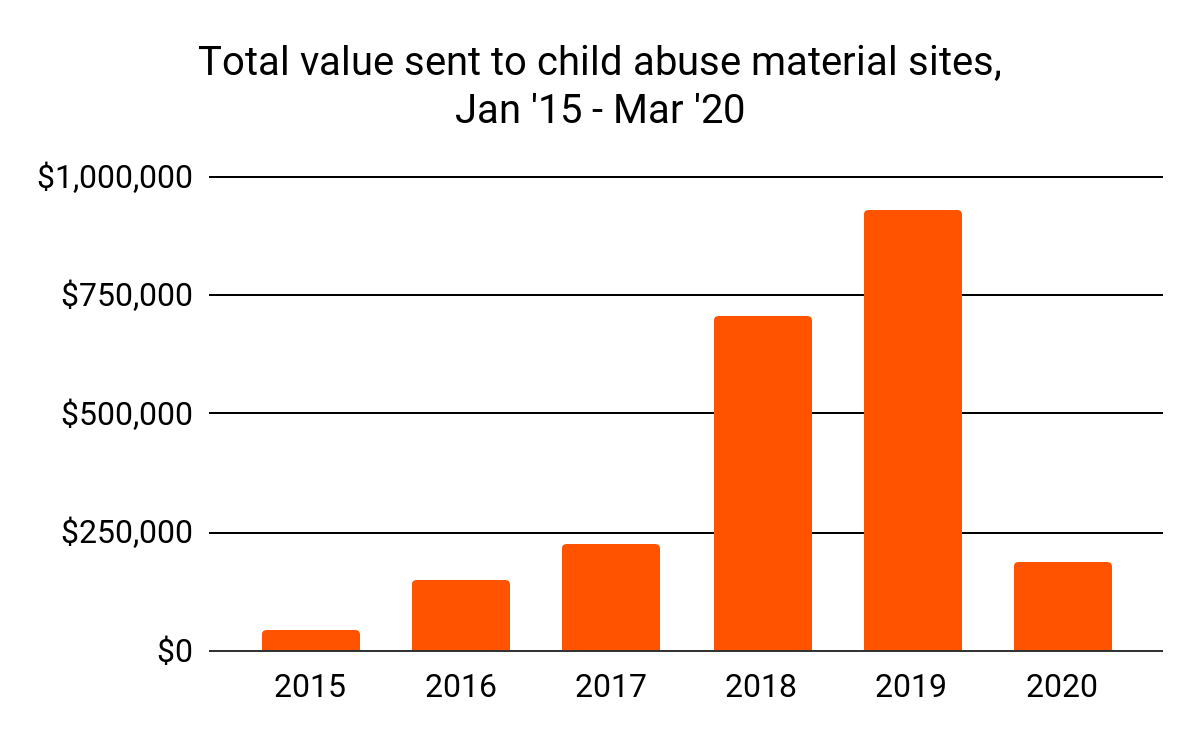

In 2019, we tracked just under $930,000 worth of Bitcoin and Ethereum payments to addresses associated with CSAM providers. That represents a 32% increase over 2018, which in turn saw a 212% increase over 2017. We attribute most of these yearly increases to rising adoption of cryptocurrency rather than increased demand for CSAM, and it’s important to keep in mind these transactions represent a miniscule fraction of all cryptocurrency activity. Even so, this should be a concerning trend for the cryptocurrency industry, from both a moral and reputational standpoint.

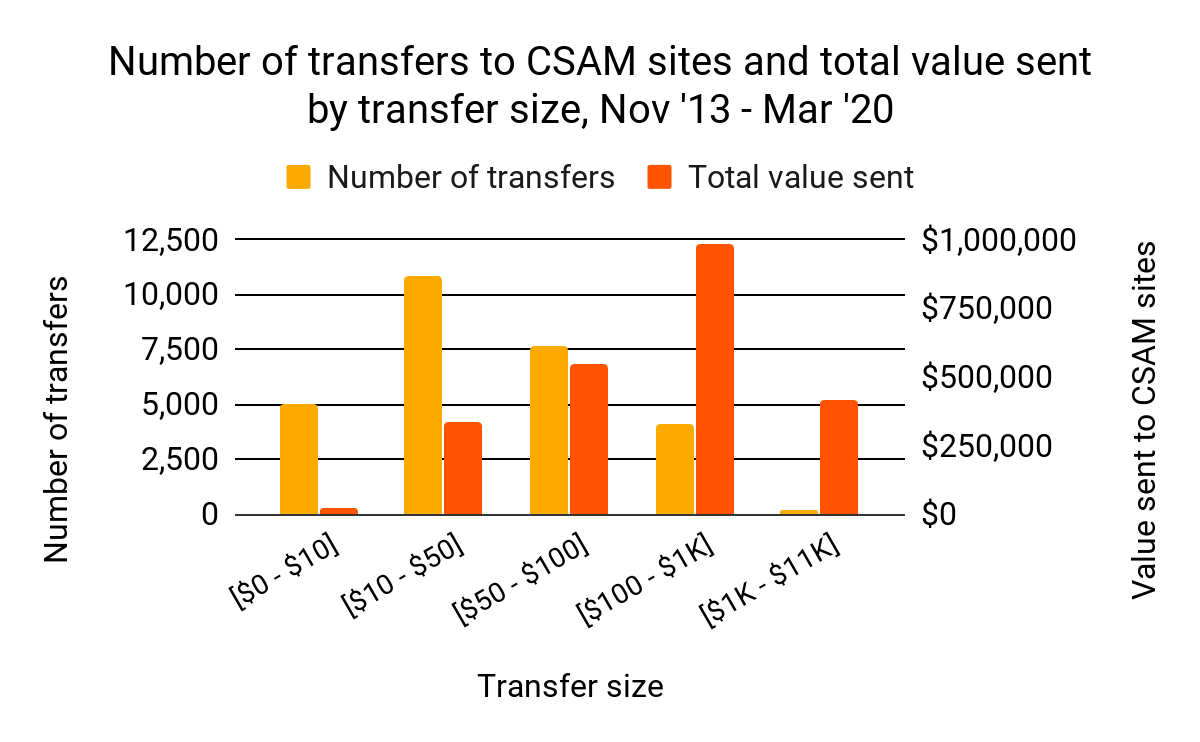

Most individual cryptocurrency payments to CSAM providers fall between $10 and $50, though a significant percentage of these sites’ total revenue comes from much larger payments. We know from law enforcement that payments between $10 and $50 would likely indicate either a one-time purchase of CSAM or, if seen on a recurring basis, possibly a subscription to a consistent CSAM provider.

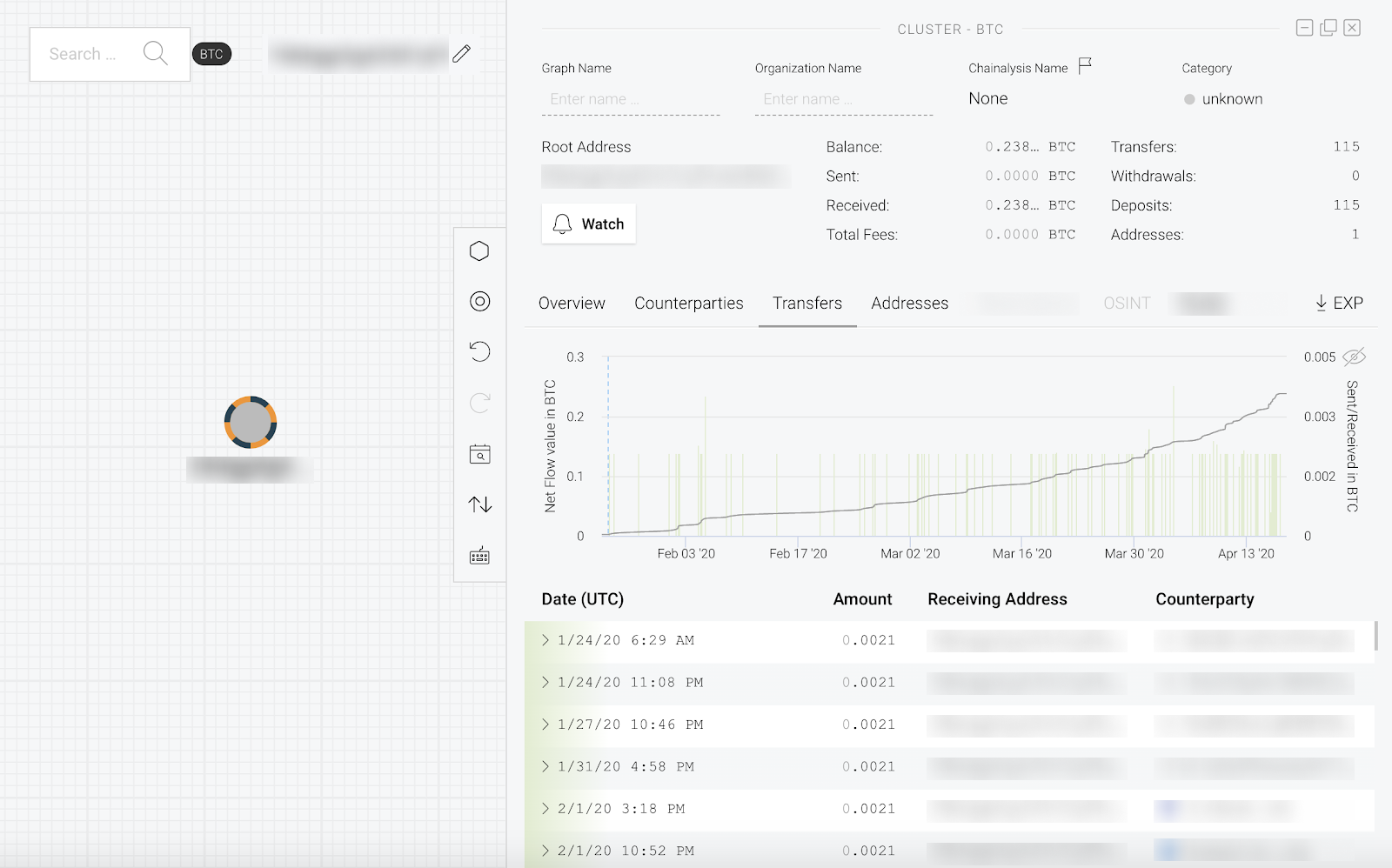

For example, the Chainalysis Reactor screenshot above shows some recent transactions to an address the Internet Watch Foundation (IWF) has identified as belonging to a CSAM provider. A clear pattern emerges: Nearly all transfers the service receives are for 0.0021 Bitcoin, worth roughly $15 as of April 2020.

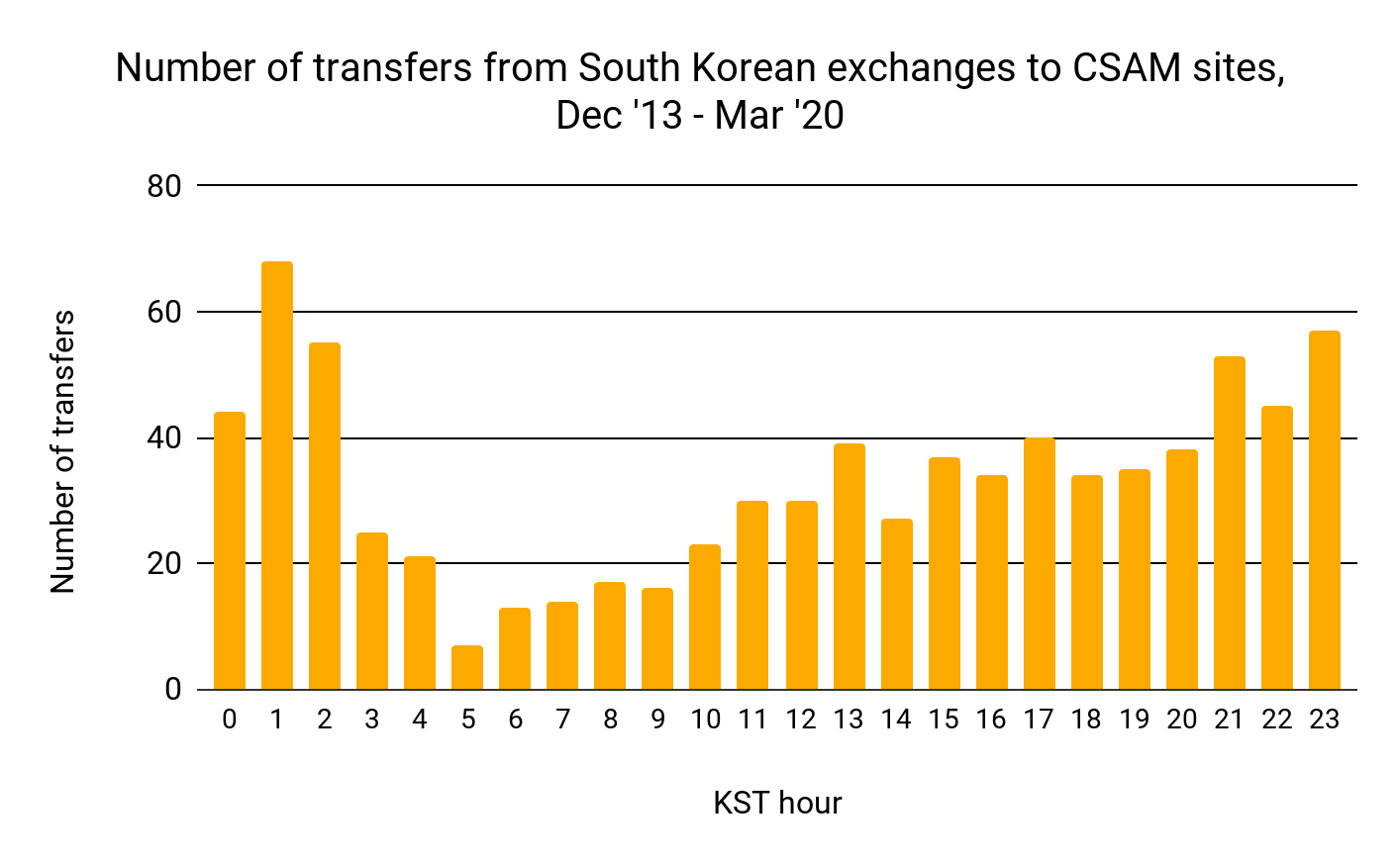

We can discern more patterns by isolating cryptocurrency payments to CSAM sites made from exchanges serving users in a single region. Above, for instance, we see that most payments for CSAM users in South Korea occur during nighttime hours, when most individuals are at home.

Using those data points, plus other heuristics borrowed from the fiat world, groups like the Association of Certified Financial Crime Specialists have provided warning signs that could indicate a cryptocurrency address is transacting with a CSAM provider:

- Frequent transactions in small amounts to one address or group of addresses belonging to the same entity

- Frequent transactions between 11PM and 5AM

- Cryptocurrency transactions tied to prepaid credit and debit cards

- Cryptocurrency payments to known escort services or other adult services providers

- Purchase of cryptocurrency tokens specific to the adult industry

While these warning signs by no means prove definitively that the owner of a cryptocurrency address is purchasing CSAM, they do give law enforcement and compliance professionals the context to evaluate other risky behaviors and build out better risk profiles.

Want to learn more?

If you’d like to learn more about cryptocurrency and human trafficking, click here to watch our webinar! It hasmore original research and data, plus case studies from the IRS-Criminal Investigation agents and Assistant U.S. Attorney who led recent shutdowns of Welcome to Video and Dark Scandals, two notorious CSAM providers operating on the darknet.