This blog is an excerpt of today’s Market Intel Report, written by Chainalysis Chief Economist Philip Gradwell. Click here to subscribe and get these data-driven cryptocurrency market insights delivered to you every week!

Cryptocurrency prices have plunged this week, falling by 30% or more. The bitcoin price was as high as $58,000 last week on Wednesday 12 May. Today, Wednesday 19 May, it has reached as low as $36,000, although it is now recovering towards $40,000. The Ethereum price reached an all time high seven days ago, of $4,308, but approached as low as $2,200 today before recovering above $2,800.

The end-of-day bitcoin price has only fallen by more than 25% over seven days on four other occasions since the start of 2017. These were:

- 24 December 2017, when the price fell from the $20,000 peak of the 2017 bull run

- 5 February 2018, when the price fell below $10,000 as the bull run ended

- 25 November 2018 when the price went to $4,000 as crypto winter set in

- Mid-March 2020, when the price fell as low as $4,000 as financial markets reacted to Covid.

While the current price fall is very significant, the price level, for both bitcoin and Ethereum, is still historically high.

Crypto Winter Part Two?

When Coinbase went public, I wrote that it was ‘the end of the beginning for crypto but new growth needs uses beyond trading’. Since then, people have been asking hard questions, as crypto has matured into an asset that people have made serious investments in. Crypto faced questions before, but they were largely a mix of curiosity and cynicism. Now, the industry needs to answer questions about environmental impact, use cases, illicit activity and regulation. I provide answers in the links, but the depth of this week’s price falls show that more needs to be done to keep the investment coming in.

So, is this the end of the bull market? Is crypto winter coming? I don’t know, but my inclination is to say no. There are many differences between now and the major price declines in March 2020 and December 2017 as I’ll show in the charts below. While buyers’ concerns have risen, there are many recent entrants who have bought large amounts of cryptocurrency. The stakes are much higher now than they ever were. The on-chain data suggests that retail is selling on exchanges while institutional investors are simply not buying as much as before rather than selling, although some have started to buy the dip today.

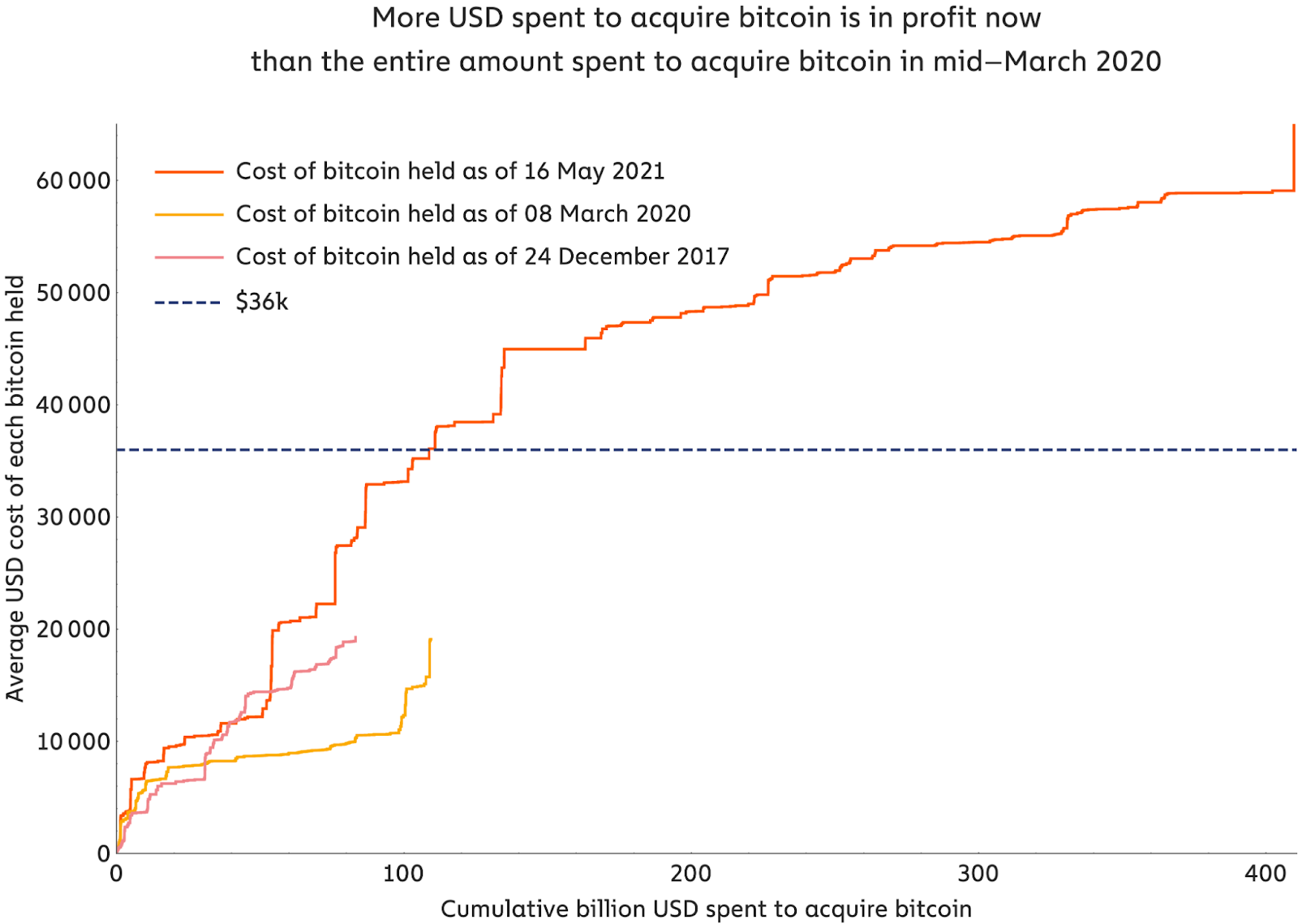

To understand just how much higher the stakes are now, consider the cost curves in the chart below. You may ask: how is cost curve analysis doing right now, as price falls below multiple support levels? For me, cost curves provide a floor where price should settle, not when the market panics. Today it looks like the price may settle around $38,000, which actually is a plateau on the current cost curve.

However, the main insight I draw from comparing the current cost curve with the cost curves in March 2020 and December 2017, is just how much more has been invested in bitcoin since those dates. Investors have spent $410 billion to acquire their current bitcoin holdings. $300 billion of this has made a loss at a price of $36,000. However, the remaining $110 billion in profit is greater than all that had been spent to acquire all bitcoin held in mid-March 2020, when the last major price fall occurred. That means there are serious incentives for investors to resolve the problems that people may have with cryptocurrency and to invest in improvements, rather than sell and call it quits.

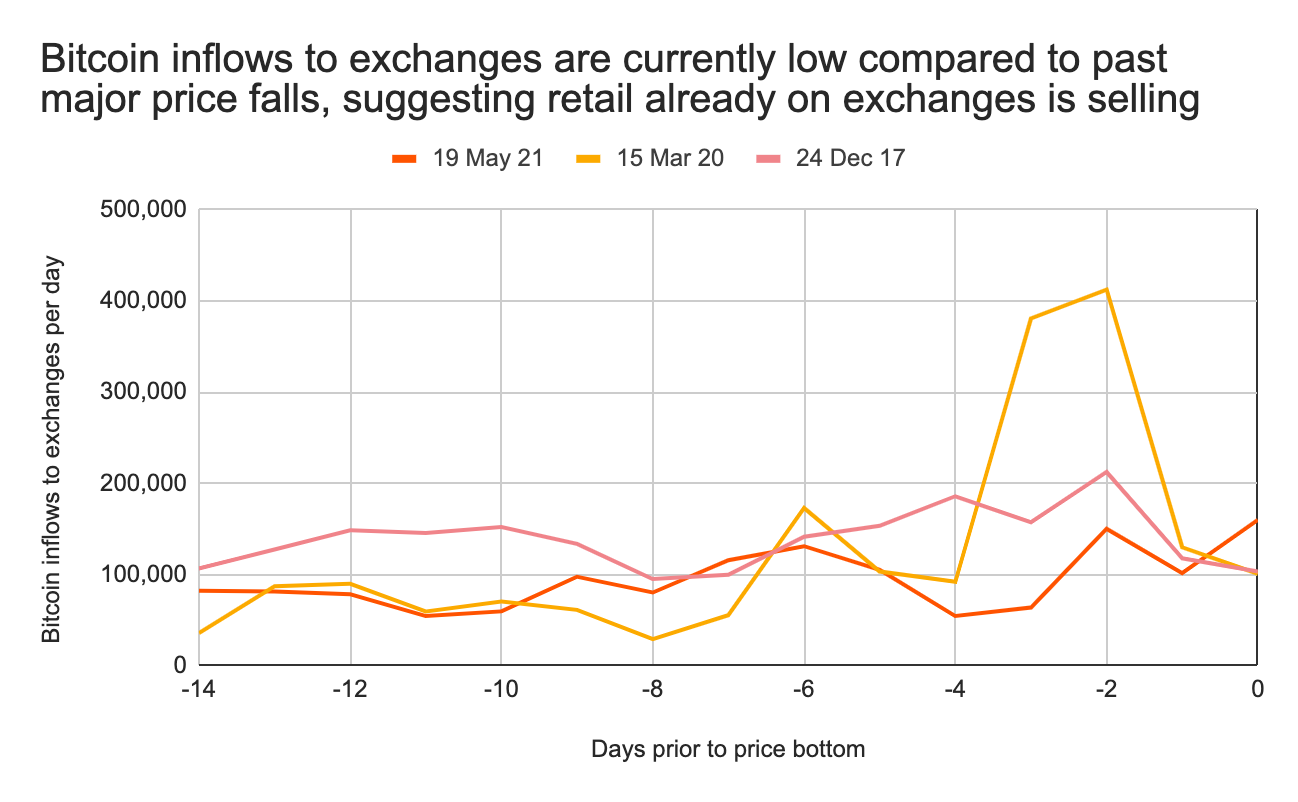

It also does not appear that institutions are significant sellers, although they may be more cautious as buyers right now. The chart below shows that bitcoin inflows into exchanges are relatively low compared to past sell-offs, at 412,000 BTC in the last three days, compared to 412,000 on the 13 March 2020 alone. This suggests that much of the selling is from people with assets already on exchanges, who tend to be retail investors.

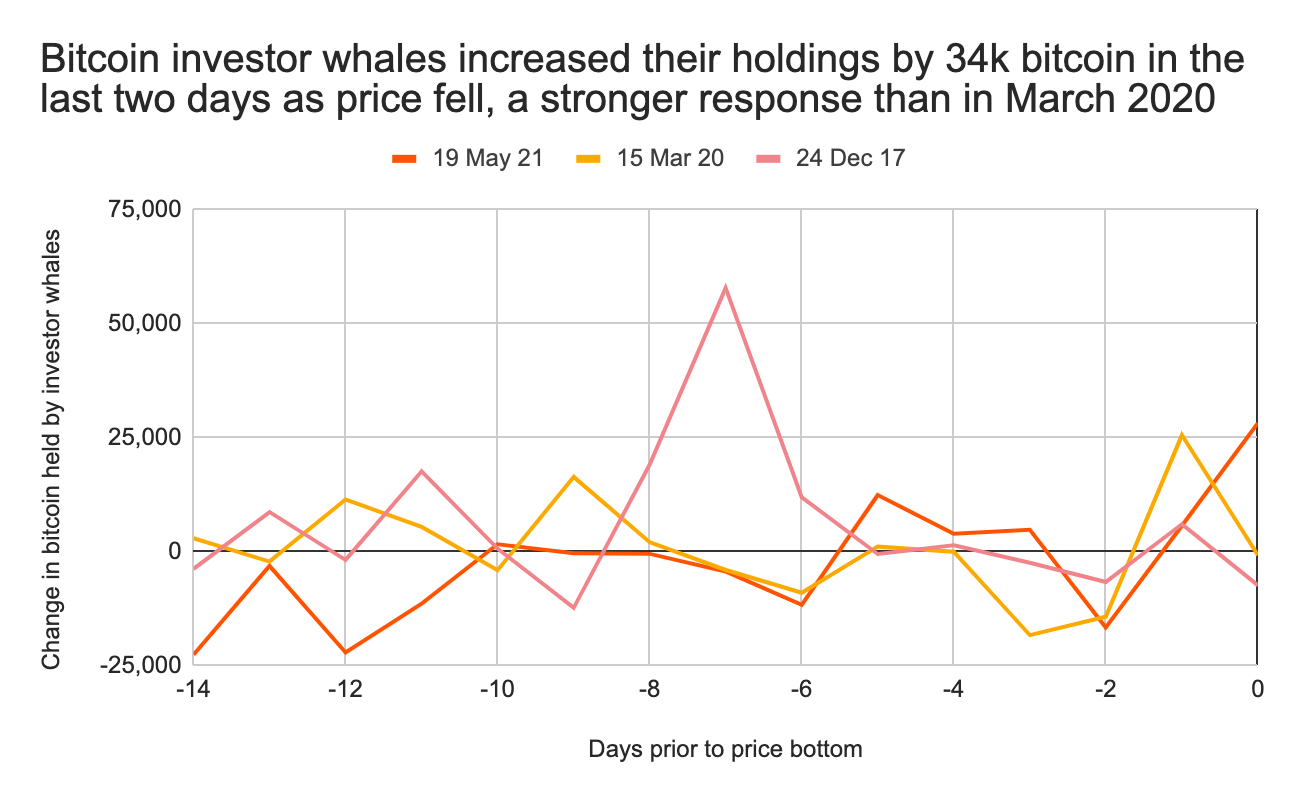

The next chart further strengthens this view. It shows the change in bitcoin held by post-2017 investor whales for the 14 days before the price bottom of the current and past declines. Post-2017 investor whales are self-hosted wallets that have held at least 1,000 BTC in their lifetime, acquired this since the start of 2017, and who retain at least 75% of the bitcoin they receive.

The chart shows that post-2017 investor whales bought 34,000 BTC on Tuesday and Wednesday, 18 and 19 May, after reducing their holdings by as much as 51,000 BTC cumulatively in the last two weeks. This is a stronger response than in March 2020. So investor whales currently appear cautious, but overall the low prices appear to be tempting them to buy the dip, rather than sell into it.

Speaking of buying the dip, Philip be presenting at Consensus on the question of “Should I Buy the Dip?” on Tuesday, 25 May at 9:05pm EST. You can also follow him on Twitter for further analysis, and as always, subscribe to the Market Intel Report to receive this analysis every week in your inbox.

We’re also excited to announce that you can now listen to the Market Intel Report in podcast form every week on Spotify! In addition, you can click here to read the archive of previous Market Intel Reports.