One of our core beliefs at Chainalysis is that for cryptocurrency to keep growing, it needs to become safe enough for traditional financial institutions to support and invest in. This process is well underway but still in its early stages. Cryptocurrency has become much safer as adoption has grown, but while most cryptocurrency businesses have implemented successful Know Your Customer (KYC) measures, some still struggle with risky activity happening on their platforms. Given this, financial institutions who see opportunities in the cryptocurrency industry generally need help evaluating and comparing risk among cryptocurrency businesses.

That’s why we’re excited to announce that we’ve built the cryptocurrency industry’s first ever risk benchmarking tool. Financial institutions and regulators can now compare a cryptocurrency business’ exposure to risky activity to that of a composite of the most popular businesses. With these benchmarks, financial institutions can identify cryptocurrency partners who fit into their risk appetite, based on how they compare to their industry peers.

Why cryptocurrency needs risk benchmarking

When financial institutions evaluate businesses to invest in or provide services to, they need to evaluate whether there’s a substantial risk those businesses (or their customers) could be engaged in money laundering, sanctions evasion, and other kinds of illegal activity. While traditional industries have established methods, standards, and data points for evaluating those risks, nascent industries like cryptocurrency don’t — at least, not ones that financial institutions are familiar with. What does normal versus outlier cryptocurrency activity look like? And how does one distinguish between activity that’s specific to one cryptocurrency business versus activity systemic to the whole industry?

Risk benchmarking cuts through the noise and provides clear data on how specific cryptocurrency businesses compare to the rest of the industry on exposure to risky activity. Instead of relying on perception or self-reporting, financial institutions can see for themselves exactly how well a cryptocurrency business is enforcing compliance policies.

We calculate risky exposure based on each business’ transaction volume with addresses we’ve tagged as associated with a specific category of criminal activity, including scams, sanctions, ransomware, and more. Users can benchmark cryptocurrency businesses based on exposure to all risky activity, or limit their analysis to specific types of activity.

Let’s look at a few quick examples of how this could be useful.

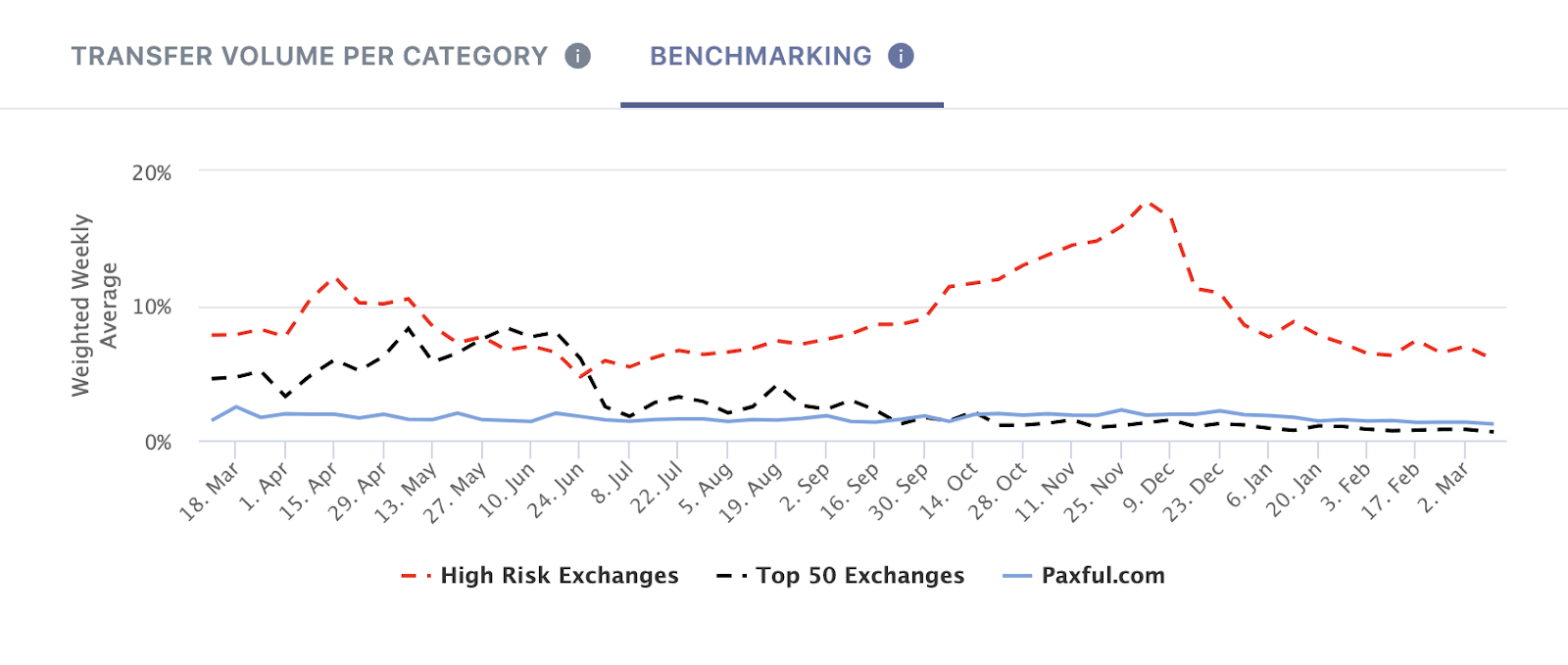

Paxful: Fighting negative perceptions of P2P services

Peer-to-peer (P2P) exchanges and marketplaces facilitate direct trades of cryptocurrency, fiat, and other assets between users, without centralized management or set prices — users can negotiate amongst themselves. P2P exchanges are often more attractive to criminals due to a perceived lack of oversight, but many have implemented robust compliance measures to keep their platforms safe. Our client Paxul is one of them, and our benchmarking data proves it. Paxful’s exposure to risky counterparties is consistently lower or in line with that of the 50 largest exchanges by volume (the top 50 includes both retail and P2P), and well below that of Chainalysis’ High Risk Exchanges index. This data can help banks and regulators understand why Paxful is a trustworthy partner in a historically risky part of the cryptocurrency ecosystem.

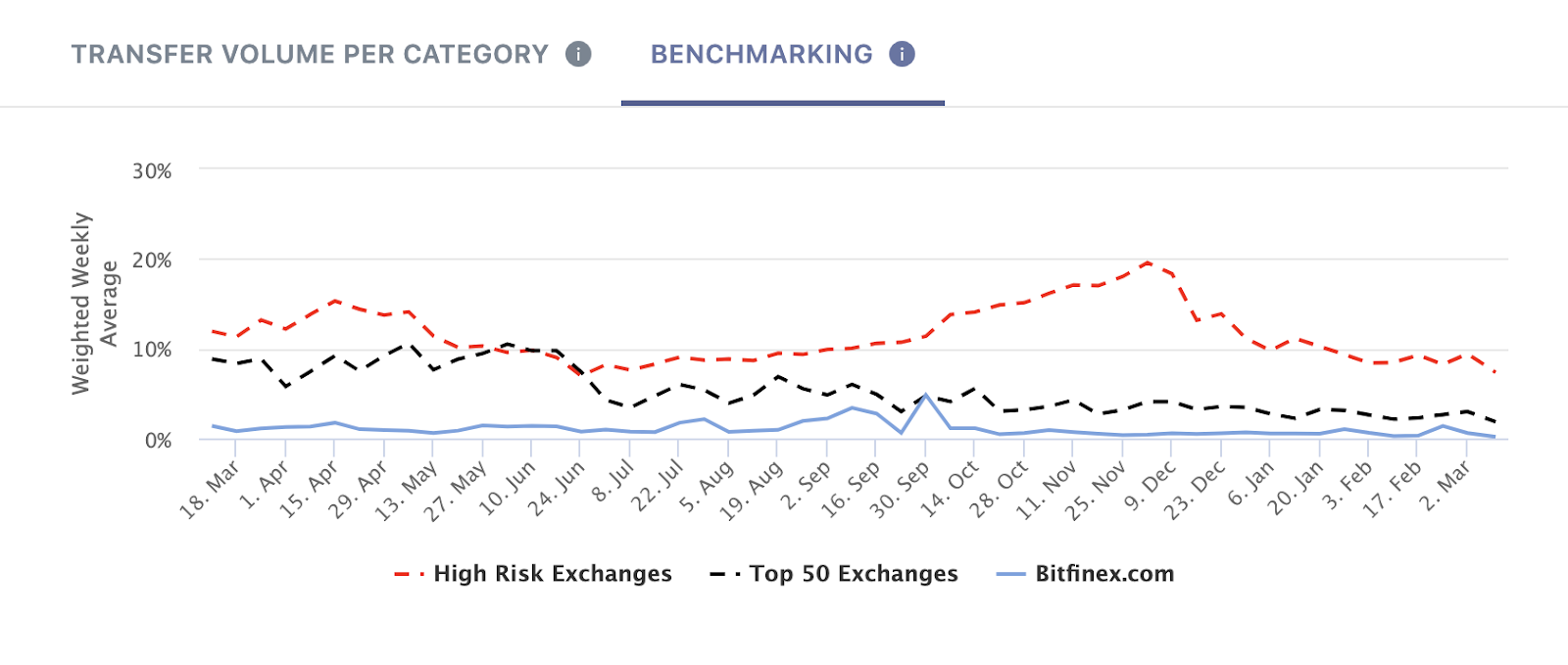

Bitfinex: Benchmarking vs. media coverage

Bitfinex is one of the most popular cryptocurrency exchanges operating, but negative news coverage has given some the perception that the exchange is unsafe. However, our benchmarks show that Bitfinex has consistently lower exposure to risky categories than even the most popular exchanges. Instead of relying on perception, banks and other potential partners could use this on-chain data to conclude that Bitfinex is likely a low risk business.

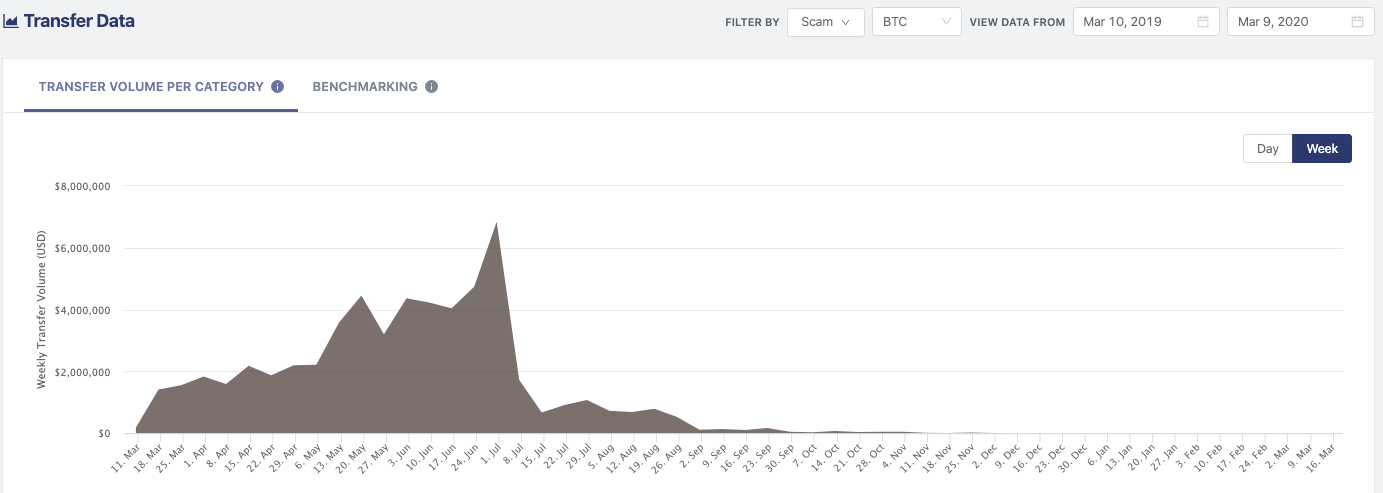

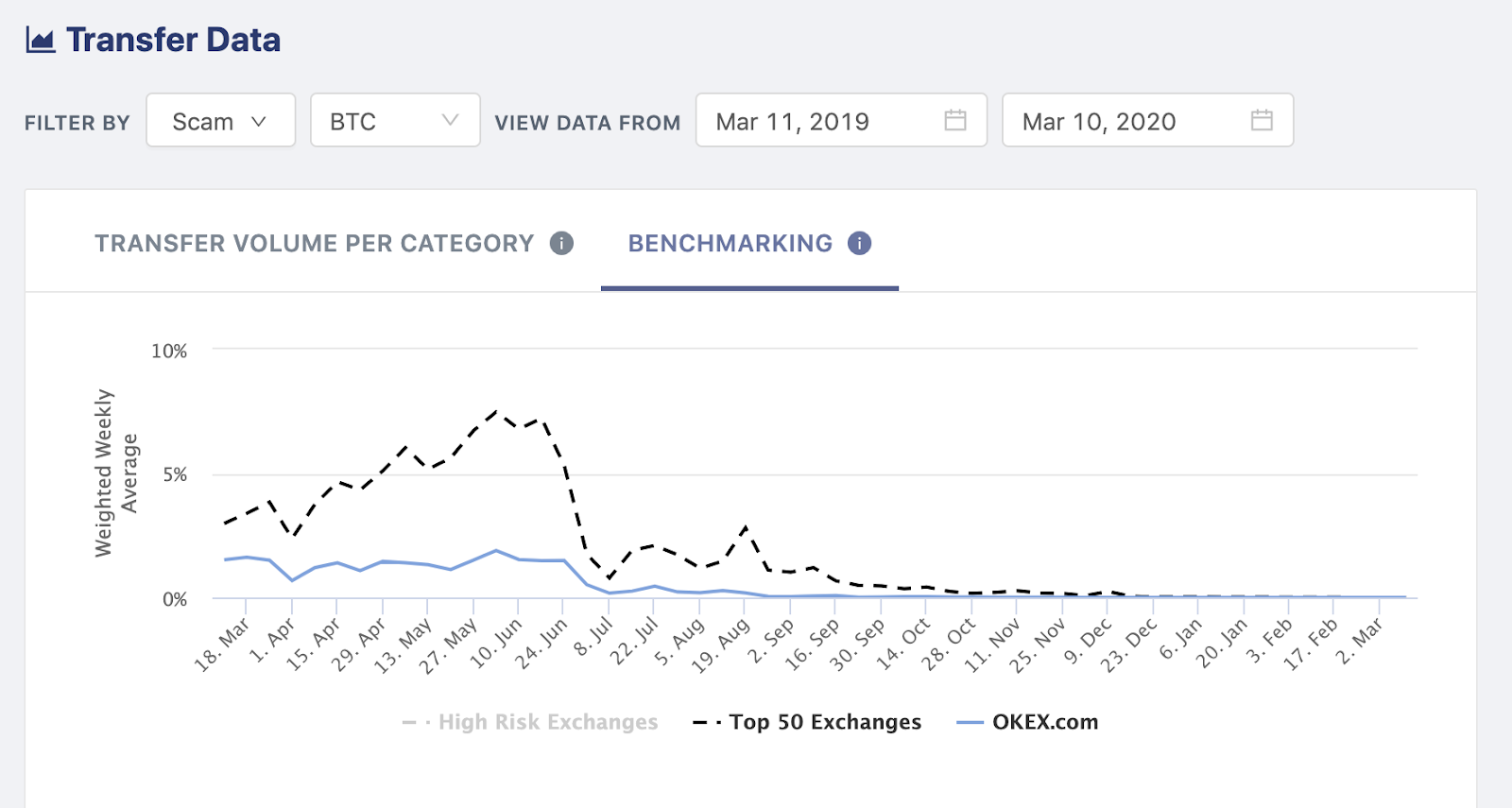

OKEx: Providing industry context on risky exposure spikes

Banks with cryptocurrency clients often use tools like Chainalysis to monitor risky activity on those clients’ platforms in real time. While this data is of course useful, it can lead them to bad conclusions if they’re not supplementing it with industry context. Consider the case of OKEx, a popular exchange headquartered in Hong Kong. Above, without benchmarking, we see that OKEx had a spike in exposure to scam-affiliated addresses in the summer of 2019. A bank may be concerned to see this data on its own. But what do the benchmarks say?

With the proper context, a bank would be able to see that several large exchanges saw a similar increase in scam activity during this time, largely driven by the infamous PlusToken scam. The bank would see that the spike likely isn’t the result of negligence on OKEx’s part, but rather an issue affecting the entire industry. From there, they’d be equipped to have a meaningful conversation with OKEx about what steps it took during this time.

Enabling empirical risk assessment

As financial institutions evaluate opportunities in cryptocurrency, they can’t afford to rely on news, chatter, and statements from cryptocurrency businesses when assessing risk. On-chain data is the only way to know how much risky activity is actually happening on a given platform, and benchmarking places that risky activity in the proper context so they can make the best possible decision. If you’d like to learn more about using Kryptos to benchmark a cryptocurrency business’ activity, request a demo here!