On or around September 15, 2022, the Ethereum blockchain (Eth) is expected to switch its consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS). Under PoS, validators “stake” the blockchain’s native cryptocurrency by sending it to a smart contract where it stays locked, with one validator chosen at random to confirm each new block and receive the associated reward. In Ethereum’s case, validators must stake 32 Ether, but users can receive staking rewards with less by joining a staking pool. PoS is more environmentally friendly than the PoW consensus mechanism, under which miners compete to validate new blocks by expending large amounts of energy-intensive computing power. In addition to requiring less energy consumption, many believe the switch to PoS can reduce the risk of over-centralization by opening up the validator role to anyone with Ether to stake, as opposed to just those with expensive mining equipment.

Ethereum’s switch is known as “The Merge” because Ethereum’s PoS blockchain, known as Eth2 or Ethereum 2.0, has been operating in a testing state known as the Beacon Chain since late 2020. With The Merge, Eth2 and Eth1 will come together to form one blockchain, with Eth1 acting as the execution layer handling transactions and Eth2 as the consensus layer handling PoS consensus. Below, we’ll look at a few possible knock-on effects of The Ethereum Merge, as well as the on-chain indicators observers can use to track those effects within the crypto and Ethereum ecosystem.

Increased Ethereum staking following The Merge

One of the first questions is whether The Merge will spur more staking activity on the Ethereum blockchain.

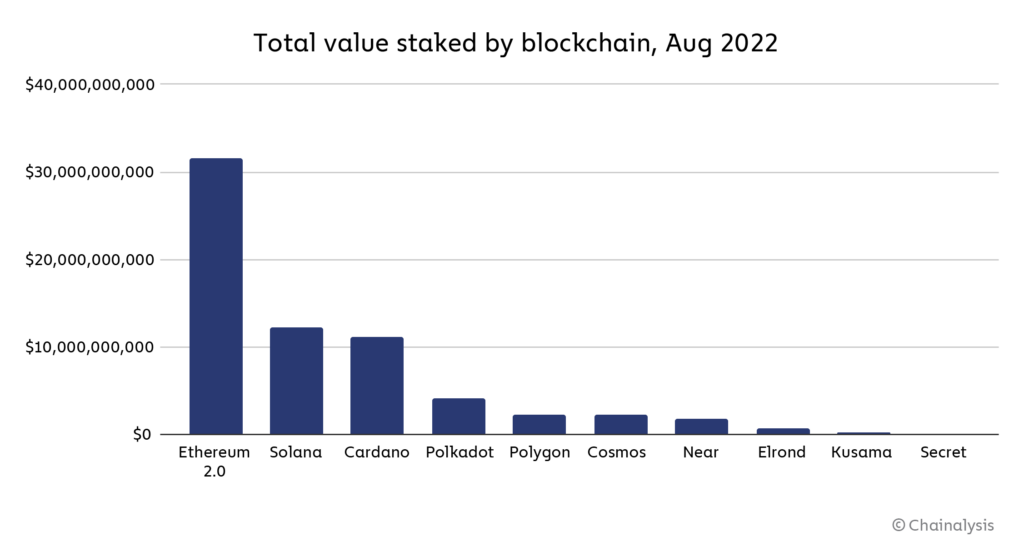

Users have already staked more than $30 billion worth of Ether on the Eth2 blockchain, making it the biggest PoS blockchain by value staked before even replacing Eth1. Some have staked Eth directly by setting up their own validator nodes, which requires specialized software and hardware in addition to 32 Ether. Others have staked by sending Ethereum to a staking pool — similar to a mining pool, staking pools allow several users to pool their resources, increase their chances of being selected to propose a new block, and share the rewards amongst themselves.

Staking could become an even more attractive proposition following The Merge for a few reasons. For one, Ethereum users will likely become more comfortable staking once PoS is officially in place and PoW is left in the past. The switch to PoS will also make Ethereum more eco-friendly, which could make investors with sustainability commitments more comfortable with the asset. This especially applies to institutional investors, who we’ll cover more later.

Finally, The Merge also sets the stage for future improvements to Ethereum. Right now, Ether staked directly on Eth2 is locked in the contract and cannot be withdrawn. Some staking services provide liquid, synthetic assets representing users’ staked Ether, but those synthetics don’t always maintain a 1:1 peg with Ether. While The Merge won’t change this immediately, an update known as the Shanghai upgrade, planned for six to 12 months following The Merge, will allow users to withdraw staked Ether at will, providing more liquidity for stakers and making staking a more attractive proposition overall. Sharding and other scalability improvements intended to lower gas fees and increase transaction speed are also on the horizon following The Merge.

Taken together, these changes, starting with The Merge, should make Ether a more attractive asset to hold, and therefore to stake as well.

Institutional investors embracing Ethereum

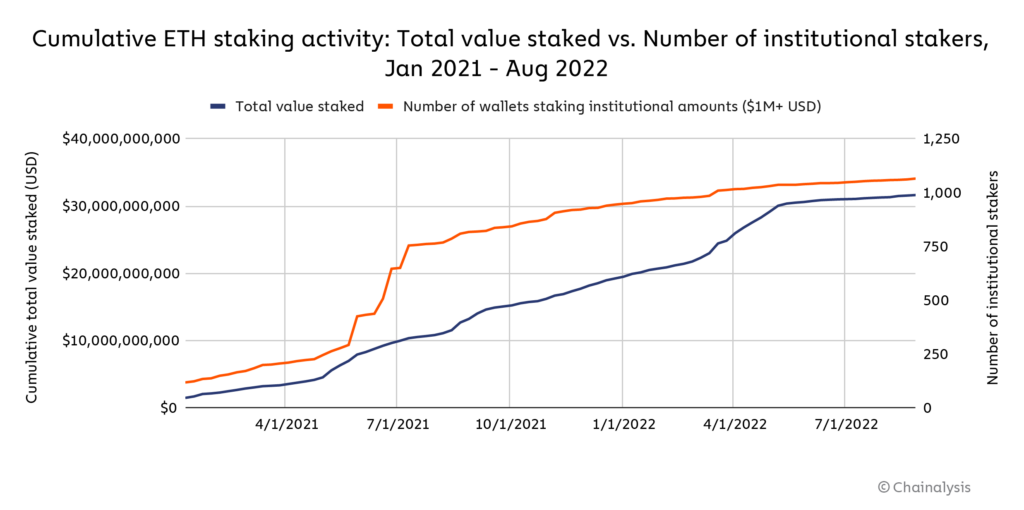

In addition to increased staking overall, we’ll also be on the lookout for institutional investors specifically to begin or ramp up their Ethereum staking activity.

We’ve written before about how the prices of digital assets like Bitcoin (BTC) have become more correlated with those of tech stocks and other high-risk, high-upside assets. However, Ether’s price could decouple from other cryptocurrencies following The Merge, as its staking rewards will make it similar to an instrument like a bond or commodity with a carry premium. Some predict that between staking rewards and transaction fees distributed to validators, stakers can expect Ether yields of 10-15% annually, and that’s before factoring in the potential for the price of Ether itself to rise, which would also increase returns in terms of fiat value (of course, Ether’s price could also fall, which would hurt fiat returns). Those returns could make Ethereum staking an enticing bond alternative for institutional investors. For comparison, yields for one-year U.S. Treasury bonds sit at 3.5% as of September 2022, though that number has been rising over the past year.

The data shows that the number of wallets staking $1 million or more worth of Ether — which we’ll refer to as institutional stakers — has been steadily increasing already.

It’ll be interesting to see if the number of institutional-sized stakers increases at a faster rate following The Merge, as this could suggest that institutional investors do indeed see Ethereum staking as a good yield-generating strategy.

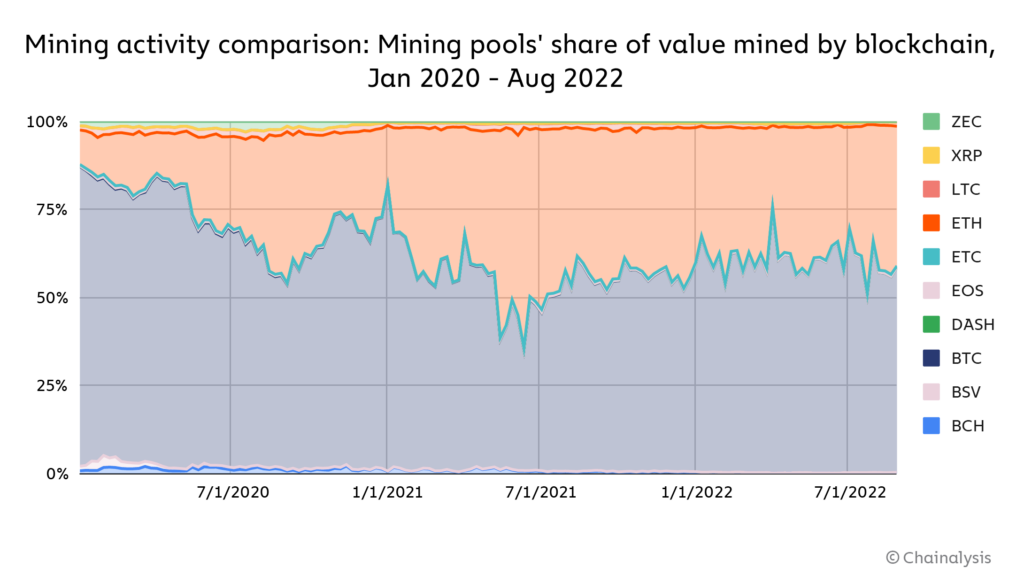

Ethereum miners will have to go somewhere, but Bitcoin probably isn’t an option

Ethereum’s switch to PoS will also necessitate changes in mining activity. Right now, many miners and mining pools mine assets across several different blockchains, dynamically distributing their hashrate between blockchains based on market trends. Generally though, most mining focuses on Bitcoin and Ethereum.

After The Merge, hashrate dedicated to Ethereum mining will either disappear or disperse to other blockchains. However, don’t expect that hashrate to move to Bitcoin. Why? The equipment used to mine Ethereum won’t cut it for Bitcoin. Most Ethereum miners use computer processors known as GPUs (graphical processing units), while Bitcoin miners use more powerful processors called ASICs (application-specific integrated circuits). While GPUs are too weak to profitably mine Bitcoin, the Ethereum blockchain was designed to be ASIC-resistant, meaning it requires a type of hashing that cannot be performed by ASICs. That means Ethereum’s switch to PoS is a huge blow to GPU miners. Ethereum currently makes up 97% of all GPU mining activity, and all remaining GPU-mineable coins have a collective market cap of just $4.1 billion, a mere 2% of Ethereum’s. That’s not enough to support GPU miners.

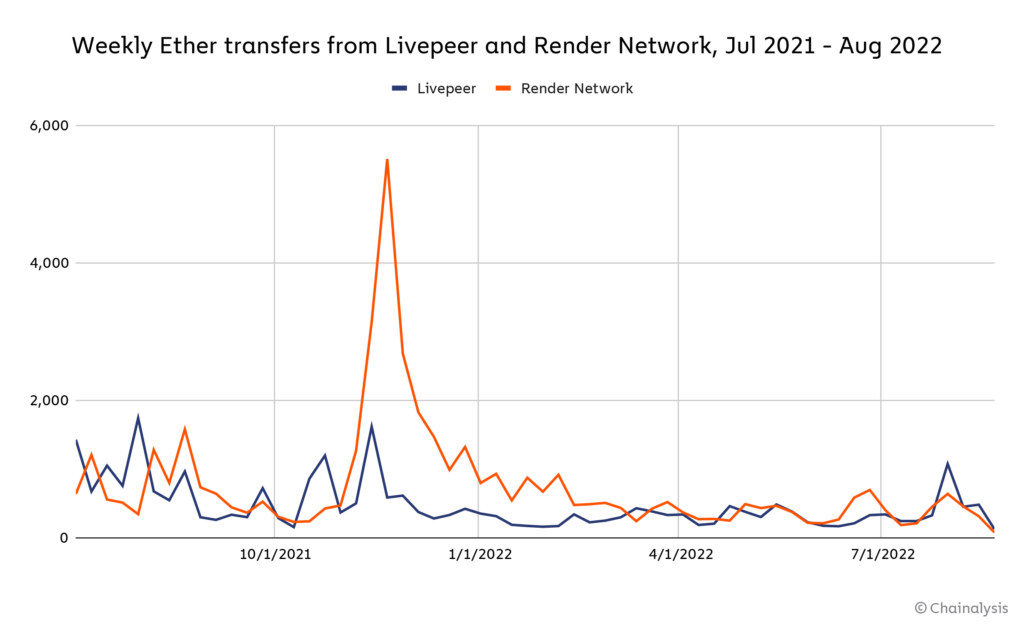

So, does this mean that millions of once-productive GPUs will now sit idle, their owners bereft of opportunities to make money in cryptocurrency? Not necessarily. There are several services built on the Ethereum blockchain that tap into the power of distributed GPUs to accomplish specific computing tasks in a decentralized manner, with GPU owners receiving Ether or ERC-20 token rewards in return. Consider the two following examples:

- Livepeer is a decentralized video streaming service that allows GPU owners to transcode video in exchange for cryptocurrency rewards

- Render Network offers a similar service for the rendering of 3D images, and also allows GPU owners to collect cryptocurrency rewards in exchange for donating computing power

The graph below shows the number of weekly Ethereum transactions sent from the LivePeer and Render smart contracts, some of which reflect rewards to GPU owners contributing to the services’ respective networks (note: the graph doesn’t include rewards paid out in each network’s native token).

While on-chain activity has declined of late, it’ll be worth monitoring whether these networks and similar ones pick up due to an influx of GPU owners seeking yield opportunities following the Ethereum merge. Of course, there are non-crypto uses for GPUs as well, such as providing processing for data centers, gaming computers, and other heavy-duty machines. Some miners may opt to sell their GPUs to businesses operating in those industries.

The merge’s impact on crypto markets starts with on-chain data

Overall, The Merge could have big implications for Ether’s price and overall attractiveness as an asset, which in turn impacts staking, mining, and institutional adoption of cryptocurrency. While it’s impossible to predict the exact market reactions or how pronounced they’ll be, the on-chain metrics we outline above can help you track them following The Merge.

How Chainalysis will support customers post-Merge

In addition to impacts on legitimate cryptocurrency usage, we’ll also be on the lookout for cybercriminals seeking to take advantage of confusion around The Merge. The Ethereum Foundation has posted warnings about Ethereum Merge scams that, for instance, ask users to send Ether to an address in order to “upgrade to Eth2.” If any such scams gain traction, we’ll be ready to provide the tools and services to support our law enforcement and private sector partners in tracking the activity of those responsible.

There’s also the possibility that if enough miners don’t want to comply with Eth2’s PoS requirements, they could create a rival fork of the Ethereum blockchain that continues with PoW. While we don’t expect this to happen, Chainalysis will keep an eye on any emergent forks that gain traction and be ready to evaluate our customer needs around support of the new fork. If The Merge proceeds as expected, Chainalysis customers don’t need to do anything to receive our continued support on the canonical Ethereum blockchain once it switches to PoS.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.