This post is the second in our “Crypto Crime” series, detailing the recent trends in crypto crime and our predictions for the coming year. Sign up here for access to the complete Chainalysis Crypto Crime Report: Decoding Increasingly Sophisticated Hacks, Darknet Markets, and Scams.

Fewer scams, bigger revenues: a radically changing landscape for Ethereum crime

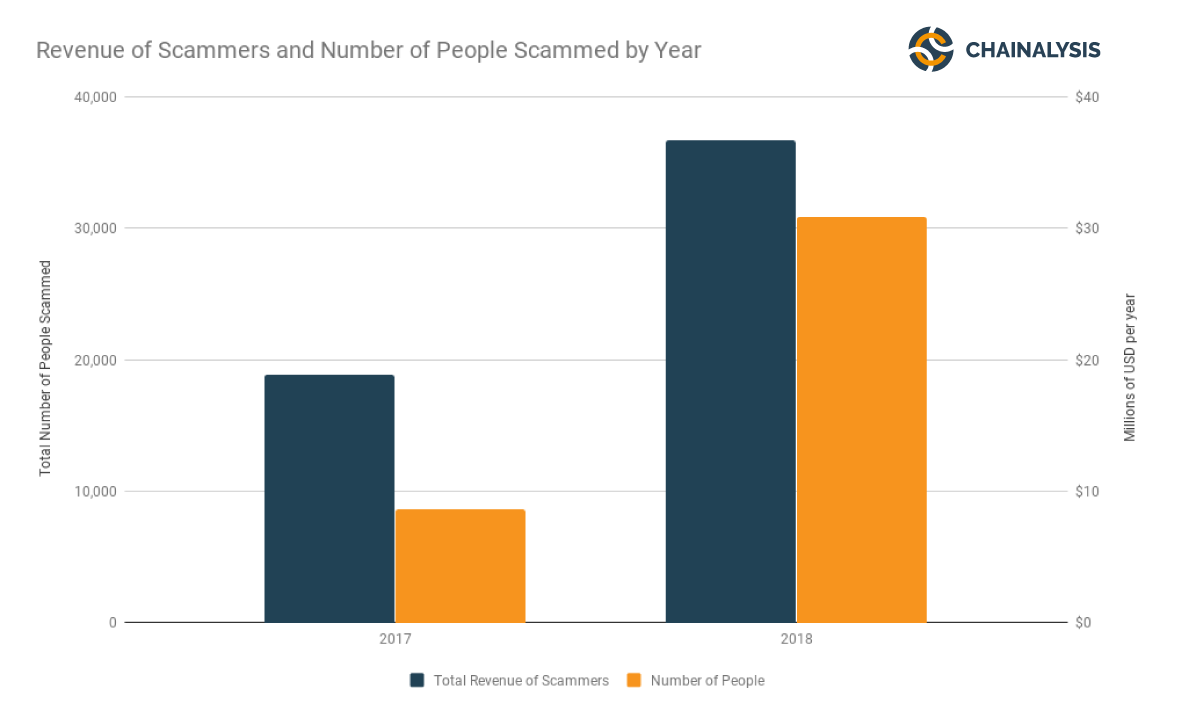

In 2018, only about 0.01% of ether was stolen in scams, worth $36 million, double the $17 million take for 2017. Furthermore, the number of scams declined through 2018, although those that remained were bigger, more sophisticated and vastly more lucrative.

The rise and fall of scamming activity

Ether has long been known as the cryptocurrency of choice for scams, for a variety of reasons, (which we dive into in our full report). From late 2016 through the end of 2018, Chainalysis has identified over 2,000 scam addresses on Ethereum that have received funds from nearly 40,000 unique users. Scam activity increased dramatically in 2018 with nearly 75% of scamming activity taking place that year.

Understanding types of scams

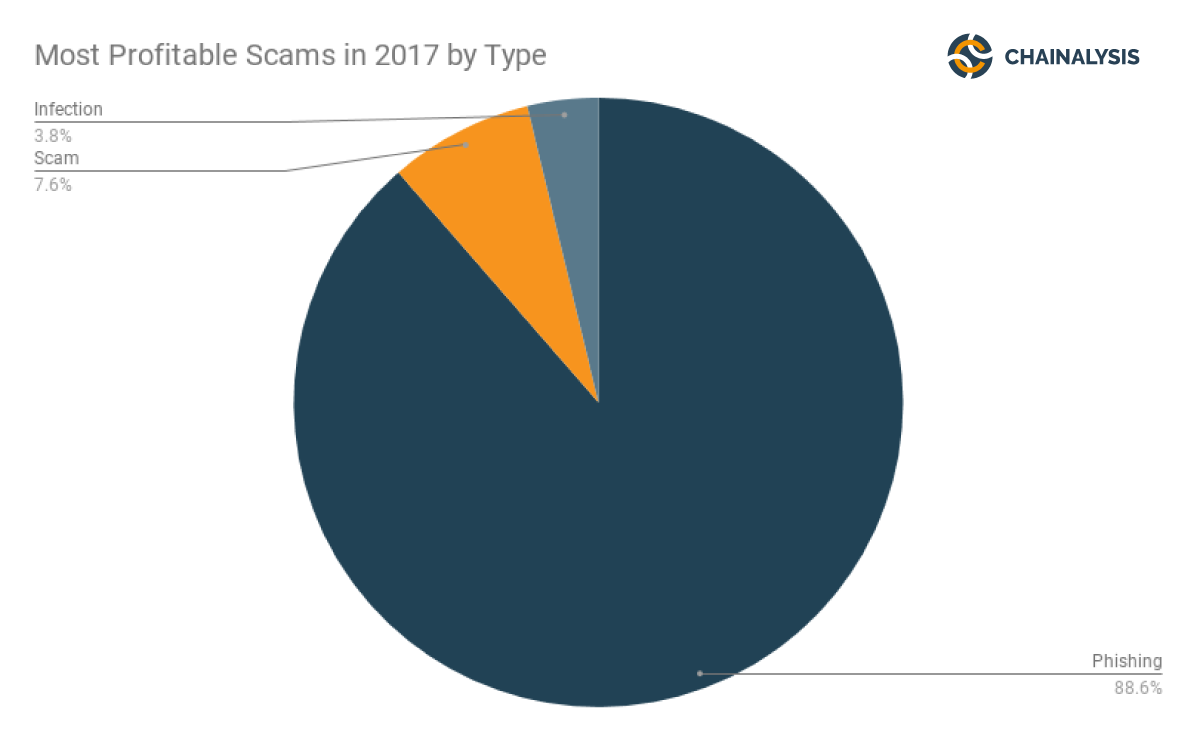

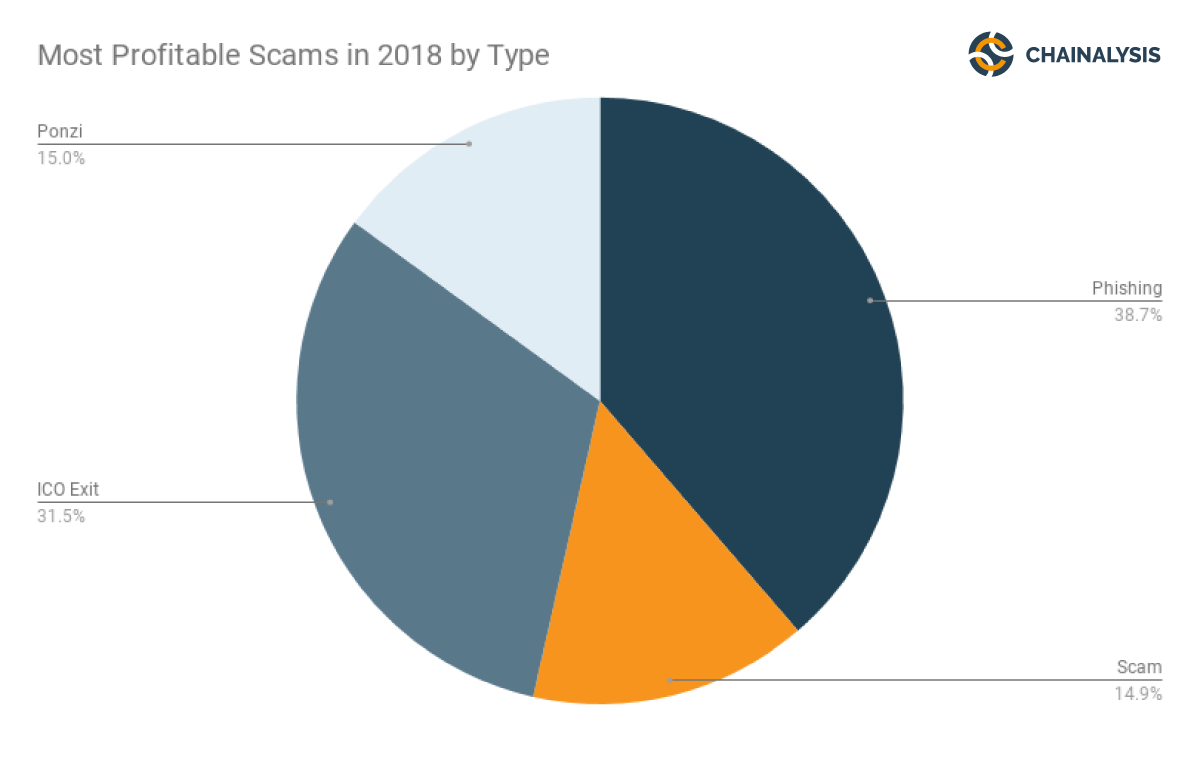

Though phishing, ponzi schemes and ICO exits are the most common scam types, there are additional types of Ethereum scams, such as infection scams. The frequency and success rates of these types of scams has changed over time.

In 2018, scamming activity shifted in two ways. First, after the success of phishing scams in 2017, many more criminals jumped on the bandwagon. They saturated the market with phishing attacks, but fewer users took the hook. As a result, phishing scams were much less effective than in previous years. In 2018, the median amount sent to a scam was around 50% less than in the prior year. A smaller group of innovative criminals executed more complex ponzi and ICO exit scams that generated millions of dollars in income. These more sophisticated schemes dominated the second half of the year.