3% of a Bitcoin trade goes to transaction fees, on average.[1]

As Bitcoin has become a popular financial asset, the millions of people now looking to purchase Bitcoin must choose an exchange on which to trade. Picking the right exchange can be confusing because each exchange varies by Bitcoin price, trading volume, fiat currency, accessibility and so on. Transaction fees can also vary significantly across exchanges. So which exchange should you use to buy your crypto? How much will the transaction fees affect your initial investment?

To help you understand which exchange offers you the lowest transaction fees given the size of your investment and currency of choice, Chainalysis has developed the Exchange Efficiency Index (EEI). The EEI adds up the fees incurred to enter and exit a Bitcoin trade to give the total cost of investing in crypto and cashing out into fiat.

Transaction fees on smaller trades can leave you with almost nothing of the initial traded value due to fixed transaction fees. Yes, you read correctly – fixed transaction fees. This means that small trades are penalized more than larger trades. For example if the transaction was for $10 of Bitcoin traded in British Pounds on Kraken, you would get only $0.01 back. On the other hand, larger trades can be very efficient, costing as little as 0.3% of the initial traded value. For example if $10,000 of Polish Zloty was traded on Bitbay, you would get $9,975 back. These are extreme examples – the median rate across the top 10 exchanges by fiat volume is 3%, meaning that if you bought $1,000 of Bitcoin and immediately cashed out to fiat you would get $970 back.

It Adds Up! The Six Different Exchange Fees!

The EEI [2] adds up the fees incurred to enter and exit a Bitcoin trade so that the total transaction fees of investing in crypto and cashing out into fiat can be summarised by a single number. Its purpose is to inform how much of your initial investment is eroded by transaction fees.

The EEI captures six different transaction fees from investing in Bitcoin and cashing out into fiat:

- Deposit fee to transfer fiat to exchange from your bank account

- Transaction fee to trade Bitcoin for fiat

- Withdrawal fee to transfer Bitcoin from the exchange to your personal wallet

- Deposit fee to transfer Bitcoin to an exchange from your personal wallet

- Transaction fee to trade fiat for Bitcoin

- Withdrawal fee to transfer fiat to your bank account from exchange

EEI shows you which exchange gives you the best value for money in Bitcoin – higher is better!

Choosing the Right Exchange

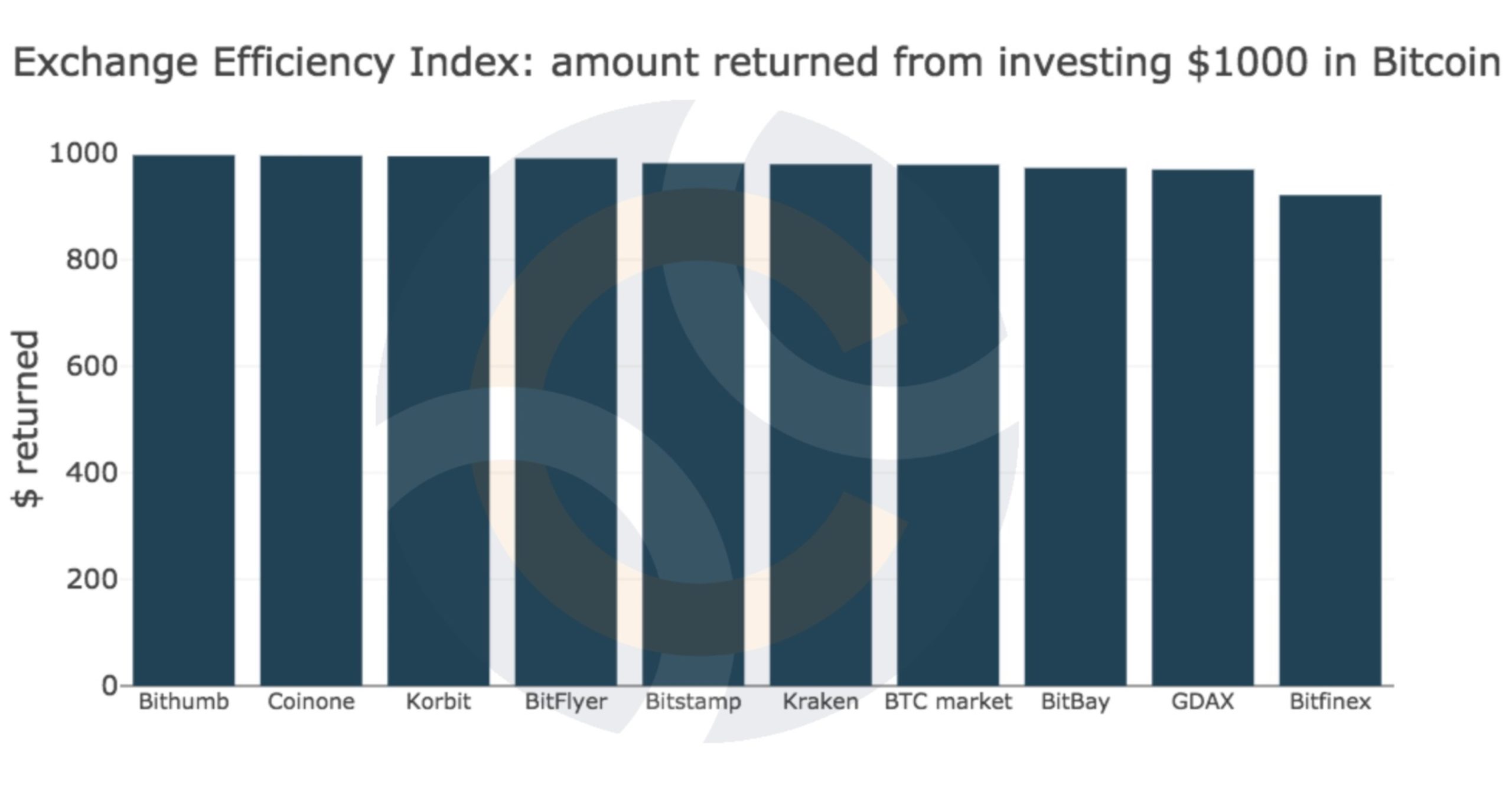

The amount of fees paid depends on the exchange and the size of your investment. As shown in the chart below for a $1,000 trade, there is a range in the efficiency across exchanges. Typically, for a $1,000 trade, the EEI ranges between 0.92-0.99. This means that you would retain between $920-$990 of that $1,000 trade in Bitcoin after buying Bitcoin and cashing out to fiat (so $10-$80 is paid as transaction fees). Similarly, for $100 trade, the EEI ranges between 0.57 and 0.99. Overall, the average EEI for a $100 trade is 0.89, whereas the average EEI for a $1,000 trade is 0.97, indicating that larger trades are more efficient than trades for smaller amounts.

Our research suggests exchange efficiency varies depending on the main currencies they serve. In particular, we identified three interesting questions, explored in the sections below:

- US Dollar and Euro trades: does GDAX aim for consistency while Kraken targets for efficiency?

- Cut throat competition in Korea?

- Did alternative business models allow for very low fees in China?

US Dollar and Euro trades: does GDAX aim for consistency while Kraken targets for efficiency?

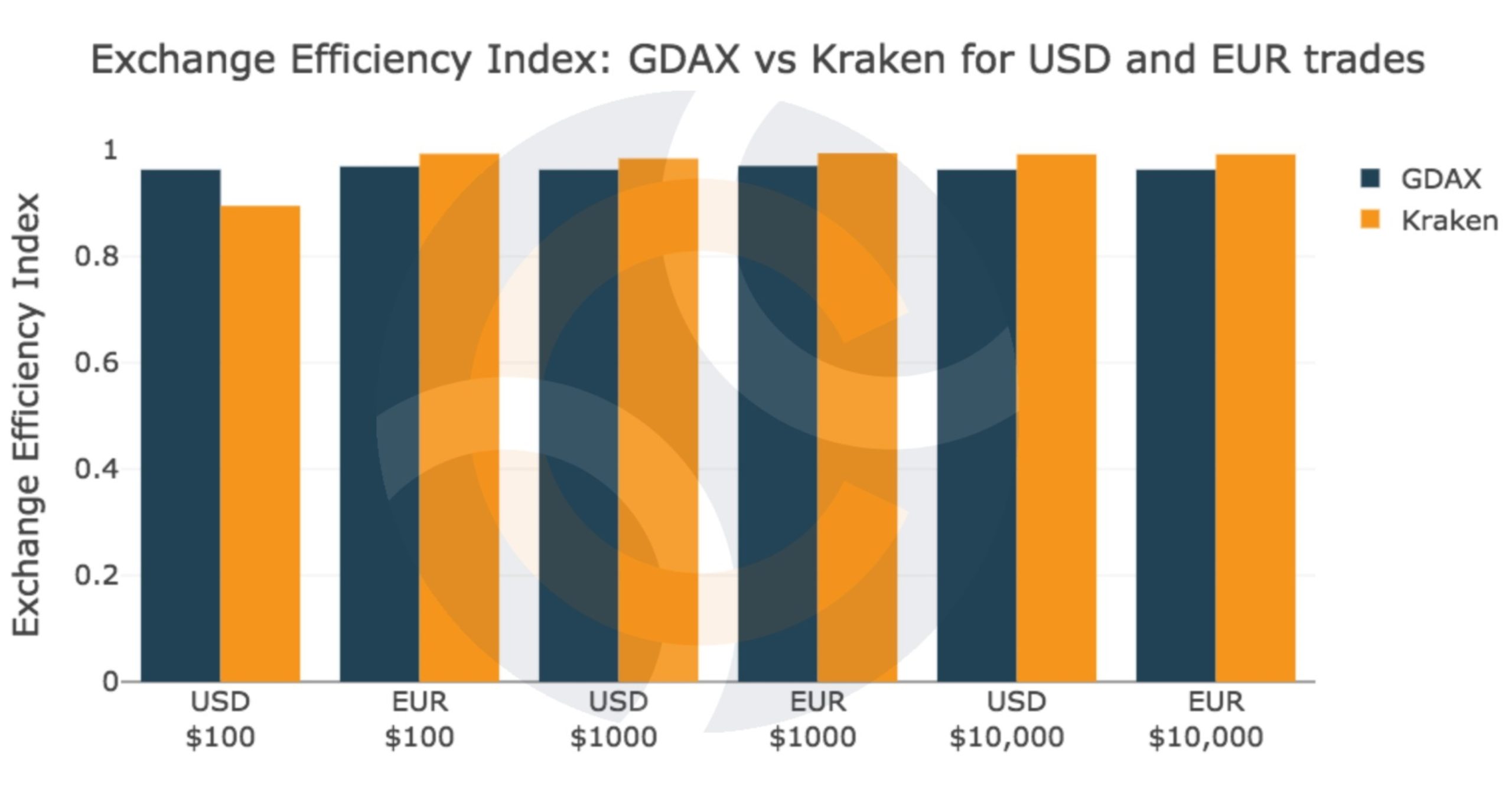

The US Dollar ($) and the Euro are the most widely accepted fiat currencies, accepted on 5 of the top 10 exchanges. For the $, the size of a trade affects the EEI more than any other currency. For large trades in $, Kraken is the most efficient with an EEI of 0.99 for $1,000 trades. For smaller deals of $100 however, Kraken’s EEI of 0.89 is beaten by Coinbase’s exchange, GDAX, with an EEI of 0.97. Kraken’s fees, however, favour Euro trading, with an EEI of above 0.99 across all trade sizes. This reflects its role as one of the market leaders in Euro to Bitcoin trading.

GDAX, has the third highest traded volume in the world, and appears focused on serving a wide range of customers. Many new users who started out on Coinbase use GDAX, which has a middle of the road EEI of ~0.96-0.97 across all trade sizes and all currencies. In other words, no matter what amount you wish to transact, and what base currency you choose to trade from, you will be spending between 3% and 4% on transaction fees on GDAX. The consistent fee across all currencies and trade sizes is useful for reaching a broad audience.

Cut throat competition in Korea?

Bithumb, Korbit, and Coinoine all appear to be competing for market share in Korea. These three exchanges only accept the Korean Won and all have an average EEI of ~0.99 across all trade sizes. Bithumb accounts for 75% of the Bitcoin trade market in Korea, and while all three exchanges have very comparable transaction fees, Korbit and Coinone are only a fraction of the size of Bithumb. These three exchanges are extremely efficient across the board, but the price of Bitcoin is higher in Korea due to regulations and strictly enforced banking requirements. Therefore, while traders using these exchanges benefit from extremely efficient systems, they are paying a higher price for Bitcoin than that available on the global market.

Did alternative business models allow for very low fees in China?

The most efficient exchange overall was Huobi during the time the data was sampled. However, it has since shut down due to the Chinese government crackdown on crypto. Huobi’s EEI of 0.99 was consistent across all trade sizes – meaning whether you traded $100 or $10,000 worth of Chinese Yuan, you would complete a full deal with 99% of that value. Before its closure, Huobi only accepted the Chinese Yuan and charged users extremely low fees. According to an investigation by the People’s Bank of China, Huobi invested idle client funds in high-yielding “wealth management products” which contribute to most revenue – this may have enabled it to provide such efficient transaction fees.[3]

The Bottom Line

- 3% of a Bitcoin trade goes to transaction fees, on average.

- It can be less efficient to trade in small amounts on certain exchanges using the USD.

- When trading with EUR or USD, the optimal choice of exchange depends on the amount of BTC purchased, with the highest fees for small trades in USD

- South Korean exchanges have particularly low fees, but higher Bitcoin prices.

- Alternative business models in China may have been the reason why Huobi maintained such low fees.

If you don’t know where to transact, check out the table below and keep a look out for the launch of our new interactive transaction fee tool early next year!

Appendix

- For this analysis, a trade involves the six stages of flow through an exchange pictured in the first chart. Data is from September 19 – December 12 2017

- Chainalysis measures the Exchange Efficiency Index (EEI) of entering and exiting Bitcoin across 13 different exchanges, representing 57% of the traded volume. The actual fees and bid-offer spread is queried every 10 minutes. The EEI is measured using actual order book and transaction information, not the fee schedule for each exchange. Technically the EEI is calculated by assuming a deposit of a particular amount of fiat to an exchange, then any Foreign Exchange (FX) fees and deposit fees are subtracted and Bitcoins are bought at the market price using the actual order book. Then they are sold again at the market price, using the same order book, and withdrawn, subtracting any FX fees and withdrawal fees first. The amount finally deposited is then divided with the initial deposit and the resulting percentage is the EEI.

- https://qz.com/1059179/huobi-and-okcoin-chinas-two-biggest-bitcoin-btc-exchanges-were-themselves-to-150-million-in-idle-client-funds/