Allow us to state the obvious: There’s been a lot of doom and gloom in conversations around cryptocurrency over the last month. This is warranted to an extent: FTX, one of the industry’s biggest and seemingly most stable crypto exchanges, collapsed virtually overnight thanks to a lack of transparency and closely-held, centralized, irresponsible power. And of course, the demise of FTX caused cryptocurrency prices to fall.

But let’s get down to brass tacks: How bad was FTX’s collapse for crypto investors? And was it as bad as other market-shaking events this year? We’ll answer those questions below using on-chain methodology to calculate the FTX investor impact by looking at investors’ realized losses across the ecosystem.

Calculating realized gains and losses: Our methodology

We can measure realized gains and losses for a set of personal wallets in a given period of time by measuring the value of each wallet’s assets at the time they were acquired, minus the value of any portion of those assets sent to another wallet during the time period studied, while also accounting for pricing differences at different times the assets were acquired (e.g. a wallet holding some Bitcoin acquired at $30,000 and some acquired at $20,000). We can’t assume that any cryptocurrency sent from a given wallet is necessarily going to be liquidated, so think of these numbers as an upper bound for realized gains of a given wallet. This methodology can therefore give us a directional sense of when investors lock in gains and losses.

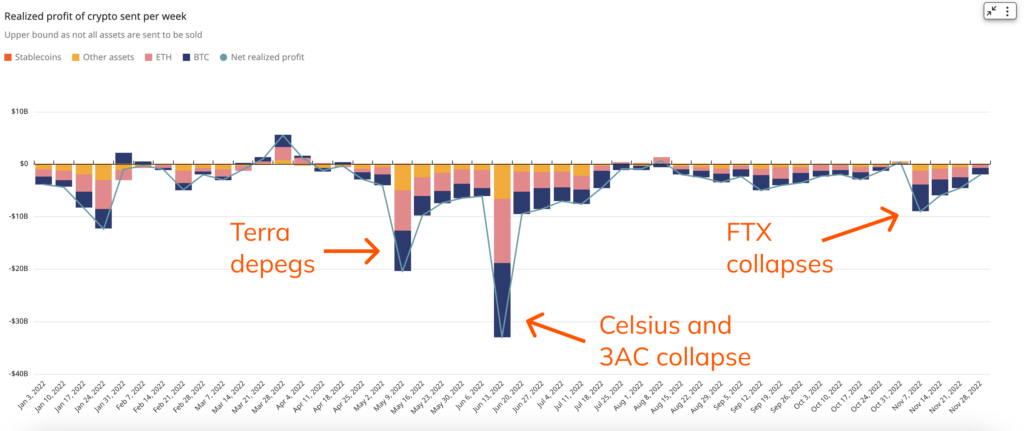

Weekly realized cryptocurrency gains and losses for 2022: How different market crises affected investors

Using the methodology described above, we can calculate the weekly realized gains and losses of all personal wallets over the course of 2022. We’ve annotated the graph to highlight weeks when important, market-moving events occurred, and also highlighted the types of assets that drove gains or losses in each week.

The data suggests that FTX’s demise hasn’t been investors’ biggest issue this year. Both the depegging of Terra’s UST token and the collapse a few weeks later of Celsius and Three Arrows Capital (3AC) drove much bigger realized losses for investors: $20.5 billion in the case of UST and a whopping $33.0 billion in the case of Celsius and 3AC, versus just $9.0 billion for FTX.

These charts don’t take everything into account: For instance, people who used FTX likely lost any funds they kept on the exchange, and the likelihood of recovering them is unknown. But from a market-wide point of view, the data above suggests that as of now, the heaviest hitting crypto events of 2022 were already behind investors by the time the FTX debacle took place.

Not Investment or Other Advice: This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.