FTX’s collapse has shaken the cryptocurrency market. But this isn’t the first time crypto has faced significant turmoil related to the collapse of an exchange. Mt. Gox’s collapse in February 2014 did likewise, but since then crypto has grown and thrived. Below, we’ll compare the collapse of the two exchanges and how markets responded in order to place FTX’s demise in the proper historical context.

Comparing FTX and Mt. Gox’s roles in the crypto ecosystem

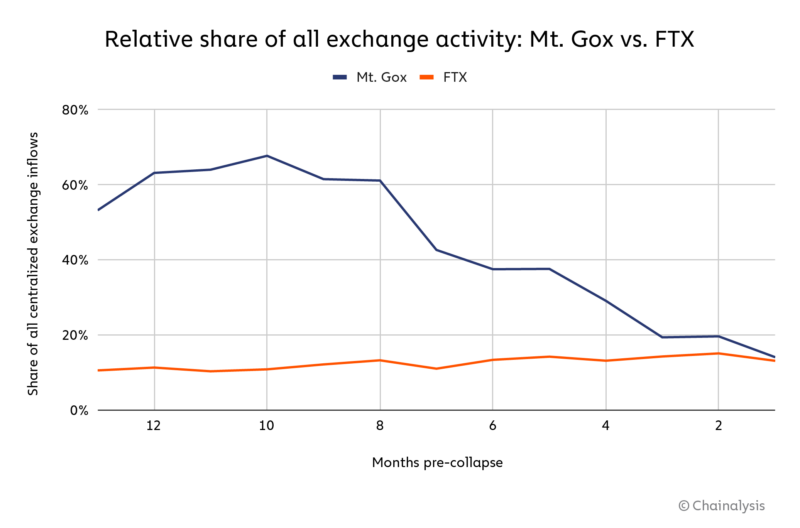

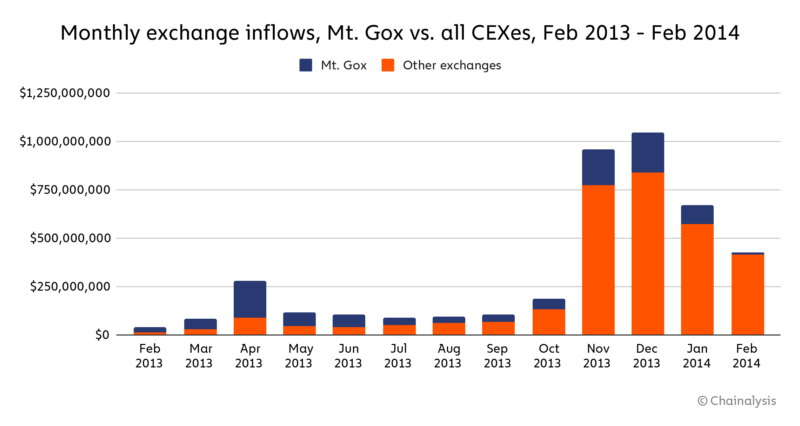

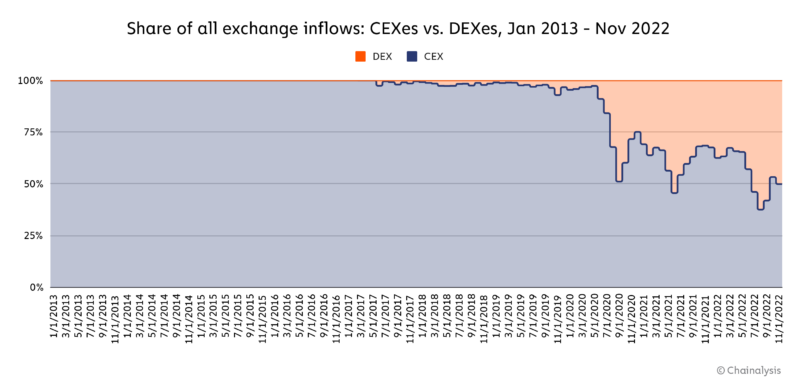

The first question we need to ask: How prominent were Mt. Gox and FTX within the overall crypto exchange ecosystem at the time of their respective collapses? In the year prior to its closure, Mt. Gox averaged a 46% share of all exchange inflows, while FTX averaged around 13%. Objectively, Mt. Gox was a much bigger industry player than FTX at the time of its collapse. That’s good news since Mt. Gox’s collapse didn’t destroy crypto. However, the trajectories of the businesses matter too, especially when considering the psychological impact of a collapse.

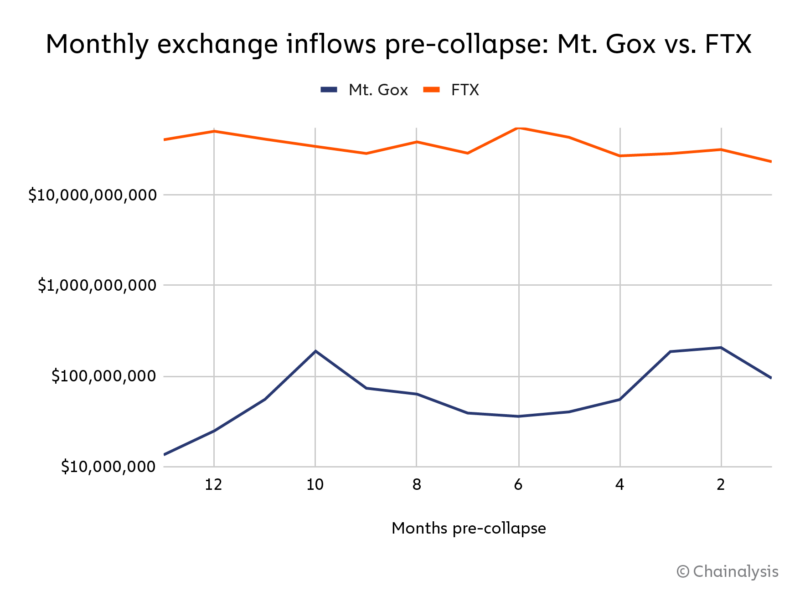

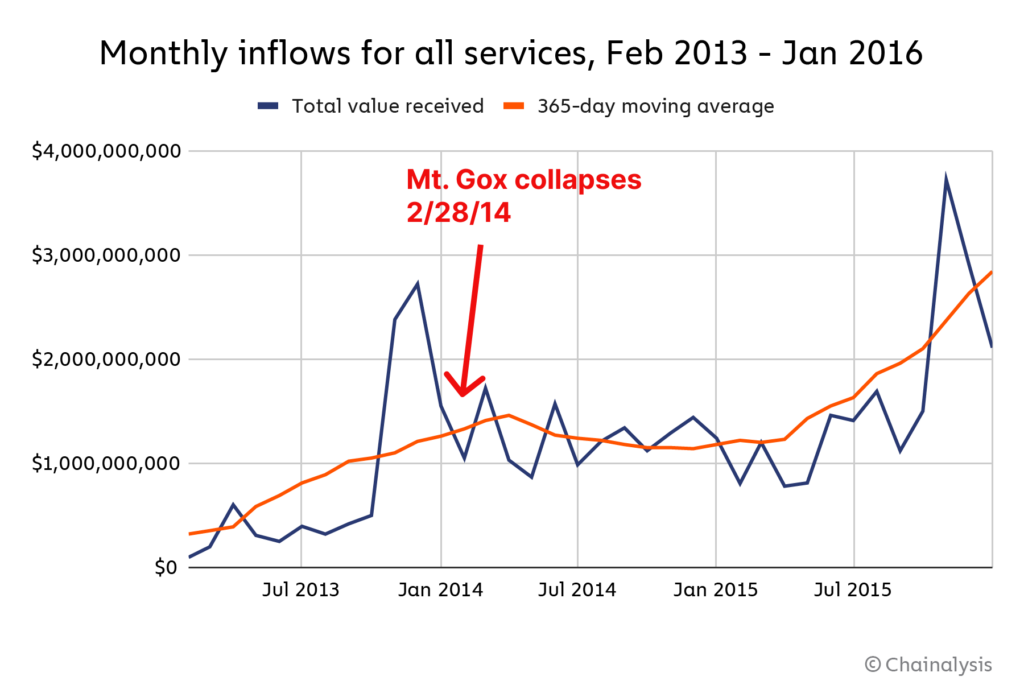

We can see that Mt. Gox was steadily declining in its share of overall exchange activity in the leadup to its collapse, while FTX was slowly gaining in share leading up to Nov 2022. That would suggest FTX’s collapse may be a bigger blow to the industry’s confidence – it was a successful business gaining in market share! But the story changes if we look at raw dollar inflows over time. On this measure, Mt. Gox’s volumes were increasing, while FTX’s were decreasing.

Put simply, Mt. Gox was becoming one exchange among many during a period of growth for the category, taking a smaller share of a bigger pie. FTX on the other hand was taking a bigger share of a shrinking pie, beating out other exchanges even as its raw transaction volume declined.

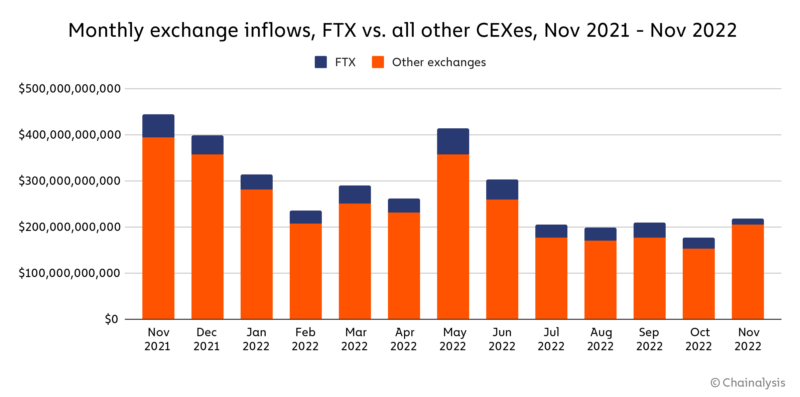

Of course, one big difference between 2014 and now is that there are more crypto services facilitating economic activity than just centralized exchanges. As of late 2022, DEXes are capturing nearly 50% of exchange inflows, while CEXes were the only game in town in 2014.

That’s why Mt. Gox was ultimately a bigger part of the crypto ecosystem overall when it collapsed than FTX was. Mt. Gox accounted for 10.9% of total service inflows in the 12 months before its collapse, vs 4.7% for FTX. In other words, Mt. Gox was a linchpin of the CEX category at a time when CEXes dominated. But as we all know, crypto survived Mt. Gox’s collapse and continued to grow and thrive.

So, what were the immediate effects of that historical collapse?

How the crypto market reacted to Mt. Gox’s collapse

On-chain transaction volume stagnated for roughly a year following Mt. Gox’s collapse, but after that, picked up again and was soon more than double its pre-crisis levels.

This comparison should give the industry optimism. Mt. Gox was a bigger part of the crypto ecosystem when it collapsed in 2014 compared to FTX now, and while the market impact was bad, it rebounded relatively quickly. There are other differences, of course. FTX CEO Sam Bankman-Fried was the face of the industry to many, and the revelations about him will damage perceptions of cryptocurrency. Leveraged risk is also probably higher now than before. But, when we boil it down to market fundamentals, we can see that cryptocurrency has survived worse than the fall of FTX. There’s no reason to think the industry can’t bounce back from this, stronger than ever.

Not Investment or Other Advice: This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.