A transformative aspect of public blockchains is their openness, allowing anyone to participate in and influence the activities of an ecosystem. Arguably, no blockchain or cryptocurrency embodies this more than Ethereum. Over the years, Ethereum’s smart contracts have encouraged rapid token creation and collaboration — fueling its transformation into the second largest blockchain network by market capitalization. But Ethereum wasn’t always this robust. Initially, without standardized token creation and exchange methods, not all tokens were compatible with all of Ethereum’s decentralized applications. Users would therefore have to find complicated means of converting their tokens between apps.

Developer Fabian Vogelsteller proposed a solution to these challenges. In 2015, he submitted an idea called “Ethereum Request for Comments 20” (ERC) on the Ethereum Github page, marking the 20th comment on the forum. In it, he described what is now known as the ERC-20 standard, or a technical guideline for smart contracts that power tokens created on Ethereum. ERC-20 was approved and implemented in 2017. Today, many tokens built on Ethereum operate within the ERC-20 standard, including Uniswap’s UNI, Circle’s USD Coin (USDC), and Aave’s AAVE.

Keep reading to learn more about:

- What is the ERC-20 token standard?

- Advantages and benefits of ERC-20 tokens

- Risks and challenges of ERC-20 tokens

- Creating an ERC-20 token

- ERC-20 token use cases and growth

- ERC-20 standards and variations

What is the ERC-20 token standard?

The ERC-20 standard (also known as EIP-20) details technical guidelines that all Ethereum-based fungible tokens should follow. Tokens built from the ERC-20 standard can be traded with all other tokens on Ethereum and used with diverse products and services, including virtually all dApps built on the Ethereum blockchain, without the need for specialized conversion.

Advantages and benefits of ERC-20 tokens

The ERC-20 standard is one of the major drivers of Ethereum’s decentralized applications because it provides the basic framework on top of which participants can innovate and interact with one another. First, it helps simplify the tasks of developers by streamlining token creation. Developers do not have to start their code from scratch or worry that their tokens might be incompatible with other tokens or dApps on the Ethereum blockchain. For this reason, the ERC-20 standard was a significant catalyst for the initial coin offering (ICO) boom between 2017 and 2018, enabling Ethereum participants to build virtually anything they wanted.

ERC-20 tokens also help boost liquidity. Before 2017, when Ethereum users could not necessarily use tokens across all dApps, trading was not as accessible. The ERC-20 standard incentivizes active participation within any application by removing conversion barriers, and fueling Ethereum ecosystem productivity and growth.

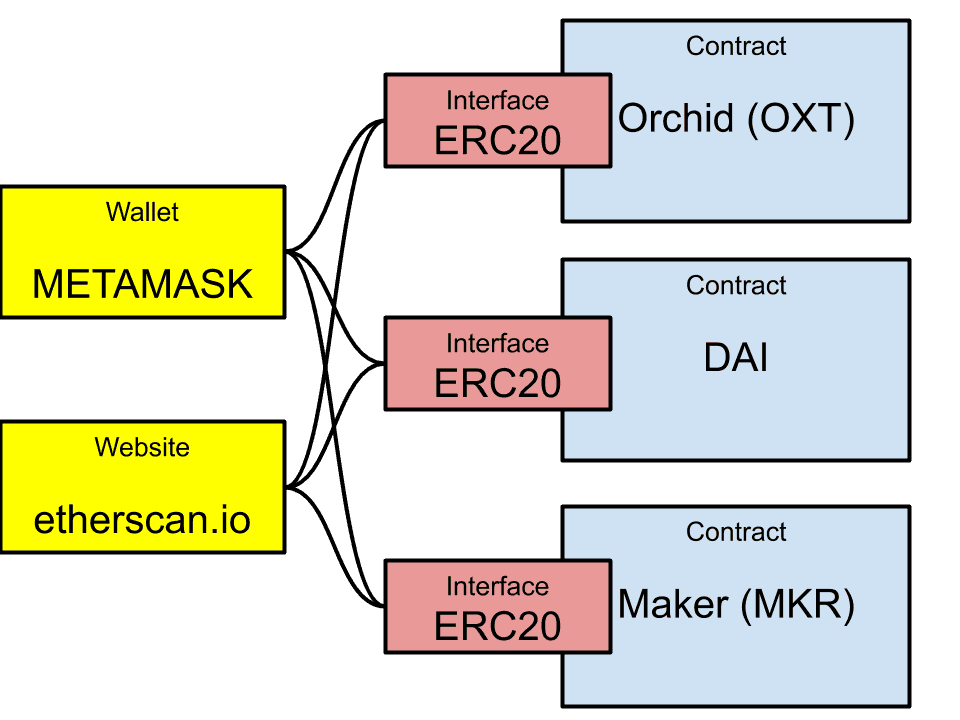

In the below image, we see how ERC-20 tokens work with various third-party crypto wallets and other contracts, such as a liquidity pool or decentralized finance (DeFi) protocol. Metamask and etherscan.io are very different products, yet both are compatible with ERC-20s due to the underlying, standardized framework.

Source: Ethereum.org

The ERC-20 standard offers predictive benefits, too. In an ecosystem where token creation is standardized, participants are better able to anticipate how any token will function once publicly accessible. This may help Ethereum users make informed transaction decisions and positively influence aspiring token creators.

Risks and challenges of ERC-20 tokens

Unfortunately, the ease with which Ethereum participants can create ERC-20 tokens has the potential to enable bad actors. This low barrier to entry means that scammers, for instance, can easily create their own tokens, and may be one reason we’ve seen so many pump and dump token launches in recent years.

Creating an ERC-20 token

Due to the standard code provided by ERC-20, creating Ethereum tokens is generally intuitive. The Ethereum developer community details six functions and two events that developers must include in their smart contract code during the early stages of token creation. There are also three optional criteria for additional token customization.

Functions:

- totalSupply: The total number of tokens circulating

- balanceOf: The balance of the token creator’s account

- allowance: Allows a third-party account to retrieve tokens from the owner’s account if granted permission. Remaining tokens are returned to the owner’s account.

- transfer: Refers to the automatic transfer of tokens between addresses

- approve: Determines the amount of tokens a third-party can withdraw from an account

- transferFrom: Allows the token owner to send tokens to a recipient

Events:

- transfer: Triggers when a transfer is complete

- approval: Logs a completed transaction

Optional criteria:

- Token name (i.e. Uniswap)

- Token symbol: The ticker that represents the token (i.e. UNI)

- Decimal points: The number of decimals displayed for users who hold the token in their wallets

After incorporating this code, many developers deploy tokens using the Ethereum testnet to confirm smart contract accuracy. If successful, this process can be repeated with real tokens.

The Ethereum network provides detailed, step-by-step documentation on how to create tokens with the ERC-20 standard and why it boosts network compatibility. Other developer communities such as Alchemy and Moralis offer similar walkthroughs with existing code for public use.

ERC-20 token use cases and growth

Tokens powered by the ERC-20 standard can represent many different digital assets — both digital currencies and those based on real-world assets. Common types of ERC-20s include governance tokens, rewards tokens, stablecoins, and memecoins. For instance, Axie Infinity uses ERC-20 tokens called Axie Infinity Shards for governance. Additionally, Uniswap allowed investors to use ERC-20-based tokens in a 2023 NFT offering.

Below are the top 15 ERC-20 tokens by market capitalization, showcasing diverse products and services that use the ERC-20 standard.

| Name | Token | Market capitalization (approx. as of 6/27/2023) |

| Polygon | MATIC | $5.34 billion |

| Wrapped Bitcoin | WBTC | $4.77 billion |

| DAI | DAI | $4.66 billion |

| Shiba Inu | SHIB | $4.51 billion |

| Binance USD | BUSD | $4.31 billion |

| UNUS SED LEO | LEO | $3.58 billion |

| Chainlink | LINK | $3.37 billion |

| TrueUSD | TUSD | $3.12 billion |

| Uniswap | UNI | $3.08 billion |

| Cronos | CRO | $1.42 billion |

| Quant | QNT | $1.28 billion |

| Stacks | STX | $1.00 billion |

| The Graph | GRT | $998.22 million |

| Aave | AAVE | $931.69 million |

| ApeCoin | APE | $867.38 million |

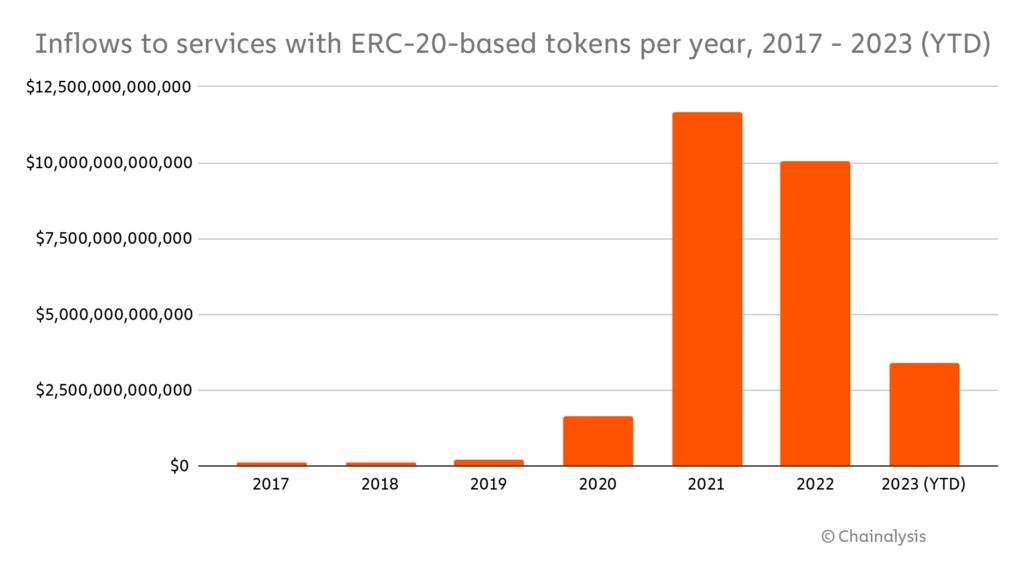

The growth of tokens like those shown above is a big reason why we’ve seen a large increase in ERC-20 token transaction volume over the last few years, particularly between 2020 and 2021. Check out the graph below, which shows total ERC-20 token inflows to services since 2017.

As of May 2023, all-time inflows are more than $27 trillion.

ERC-20 standards and variations

ERC-20 has inspired other technical standards on Ethereum for additional functionality:

- ERC-721 helps developers create non-fungible tokens (NFTs).

- ERC-1400 provides a unified framework for developing securities tokens.

- ERC-223 allows for transaction fees to be paid in the same token as the one being used, rather than paying fees in ETH.

- ERC-777 provides enhancements to ERC-20 through hooks, which enable the sending of tokens and the notification of contracts in one transaction. However, it is more susceptible to cyber-attacks and difficult to implement, which is why most Ethereum developers still prefer the ERC-20 standard.

Ethereum’s driving force

By employing the ERC-20 standard, Ethereum users are able to participate in transformative business opportunities, methods of value transfer, and innovative projects without substantial obstacles. These technical guidelines for Ethereum token creation dramatically boosted both the success of the developer community and participation in the blockchain industry as a whole.

Chainalysis supports ERC-20 tokens across its compliance and investigation product suite, including Chainalysis KYT and Chainalysis Reactor. To learn more about this support, reach out to us directly at [email protected].

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.