Today, Chainalysis announced product support for the Lightning Network, a layer 2 protocol built on the blockchain that uses smart contract functionality to enable faster, cheaper Bitcoin transactions. With Lightning, small, recurring transactions that wouldn’t be economical to carry out on the blockchain due to transaction fees become feasible, enabling new commercial use cases for Bitcoin. Below, we’ll tell you more about the Lightning Network, its growing popularity, and how Chainalysis will enable our customers to process Lightning transactions at the same level of security and compliance as blockchain transactions.

What is the Lightning Network?

The Lightning Network is a payment network built on top of the Bitcoin blockchain that allows users to conduct bitcoin transactions off-chain. Users can do this by establishing their own channel on the Lightning network, which functions as a payment gateway between them and another user. One user starts by “funding” the channel with an initial amount of Bitcoin — that transaction happens on-chain. After that, they can route a virtually unlimited number of micropayments to the other user in the channel, funded by the initial amount deposited on-chain. Those small transactions are settled instantaneously on the Bitcoin Lightning Network. Later, when the channel is closed out — either when the initial funds run out or when one or both users decide to close it — all those small transactions are integrated into the blockchain as a single Bitcoin transaction, saving the users money on fees. While channels are limited to two participants, the Lightning Network also allows users to send funds to users in other channels if they share channel partners. That means that with just a few “hub” (or “routing node”) channels comprising users with many connections, a Lightning Network user can make a payment to virtually any other.

The easiest use case to imagine for Lightning Network transactions is that of a retail store — CoinTelegraph cites the hypothetical example of a coffee shop in its helpful explainer. Using Bitcoin for small, recurring transactions like buying coffee a few times a week wouldn’t be feasible if all transactions were settled on-chain, as the fees and settlement times would be too high. Lightning Network solves that problem and introduces greater scalability to the Bitcoin ecosystem, enabling more commerce-based use cases.

How popular is the Lightning Network?

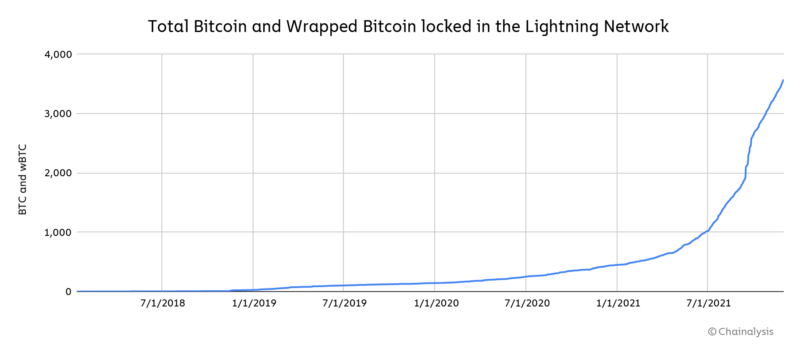

The amount of Bitcoin locked in the Lightning Network — meaning the amount being used to fund Lightning channels — has grown significantly throughout 2021.

The amount of Bitcoin locked in the Lightning Network — meaning the amount being used to fund Lightning channels — has grown significantly throughout 2021.

As of December 1, 2021, just under 3,600 BTC worth over $205 million is locked in public Lightning Network channels, up from 468 BTC worth roughly $4.8 million on January 1, 2021. The number of open lightning channels has also increased substantially over time.

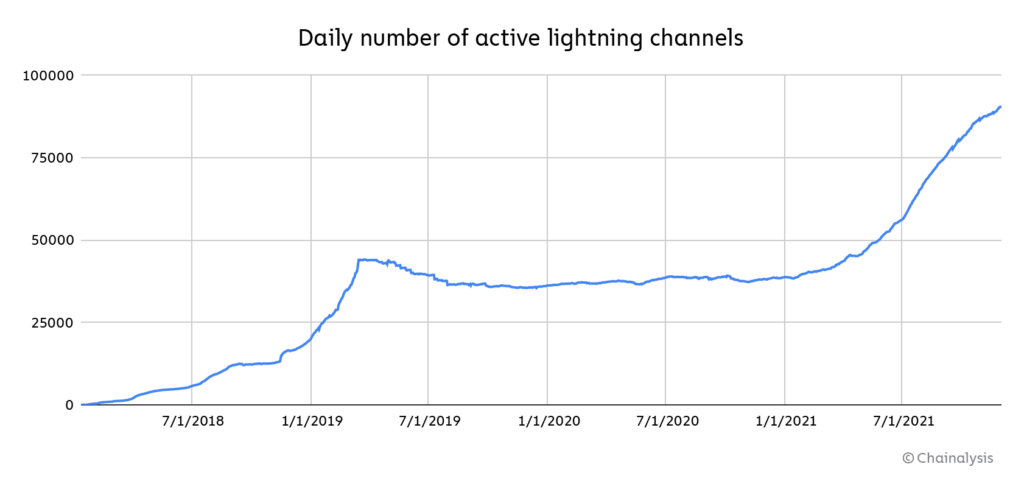

On Dec 1, 2021, there were over 90,000 open public Lightning channels, up from over 38,000 in January.

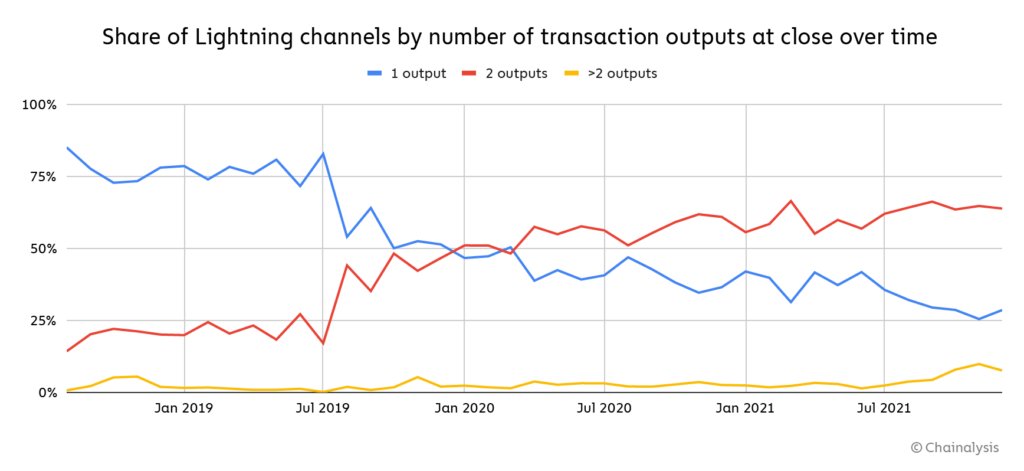

We can also get a sense of how people are using the Lightning Network based on the number of transaction outputs when a channel is closed. As we mentioned above, when a Lightning channel is closed, each user is sent their share of the Bitcoin funding the channel depending on the balance of the many transactions that have been conducted on the Lightning Network. If all the funds go to one user, there will be one transaction output when the channel is closed. This could mean that the user funding the channel sent all the original funds to the channel’s second user across a series of transactions, but more often than not it means the channel was simply never used. If funds exit through two transaction outputs, that means both users of the channel ended up with a positive balance following all of the Lightning transactions that occurred, suggesting that they actively used the channel to transact. So, to sum up, one transaction output means the channel likely wasn’t used, while two means it probably was. It’s also possible for a channel to have more than two outputs, which is usually the result of an error or sometimes a dispute between users.

Below, we look at how usage of the Lightning Network has changed by measuring the share of closed Lightning channels by number of outgoing transactions over time.

In 2019, when the Lightning Network was less popular, the majority of channels closed with one output, suggesting that most channels were never actively used. However, that changed beginning in 2020. Since then, the majority of channels have closed with two transaction outputs, suggesting the two users did indeed conduct transactions on the Lightning Network. The number of disputed channels — those with more than two outputs, has remained below 10% during the time period studied, though it has risen to its highest levels in October 2021 at 8%.

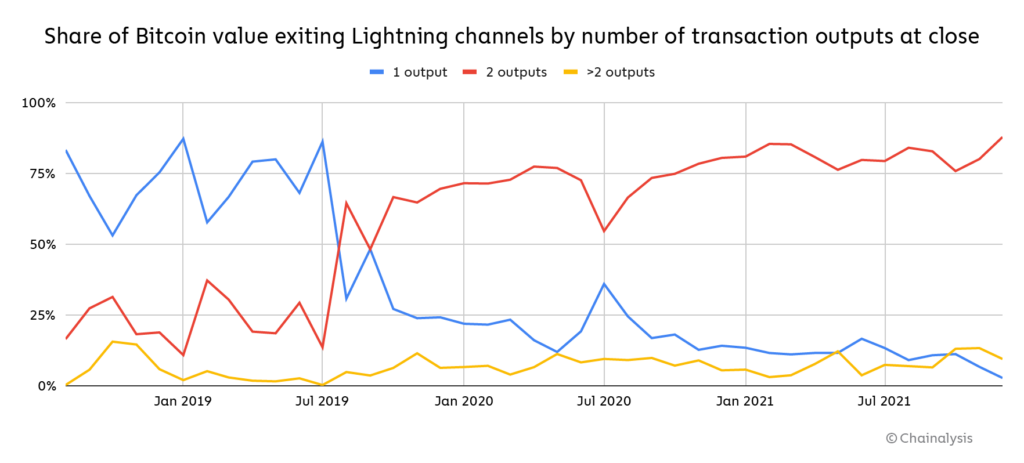

The same pattern roughly holds true if we instead measure the share of total funds exiting Lightning channels at each number of transaction outputs, though in this case, the share of activity occurring on actively used channels becomes the majority a few months earlier in August 2019.

Disputed payment channels also become more prominent on this chart, with the share of funds exiting the Lightning Network through channels with more than two outputs topping 10% in many months. Overall though, the data suggests that the Lightning Network’s popularity is rising steadily, with users opening more channels and conducting more transactions over time.

Monitoring Lightning Network Transactions with Chainlaysis KYT

Cryptocurrency businesses are looking to utilize the Lightning Network to enable fast, low cost Bitcoin transactions. As blockchain technology evolves, we evolve with it. We are dedicated to providing our customers with products and guidance that help them interact with emerging cryptocurrency technology while abiding by global regulatory best practices.

We are excited to announce that Chainalysis will be the first blockchain analysis company to offer customers a transaction monitoring solution for the Lightning Network. In the beginning of next year we will be introducing Lightning Network transaction monitoring to Chainalysis KYT, the world’s leading cryptocurrency transaction monitoring software. Our customers will be able to use KYT to monitor their Lighting Network transactions, screen for risky activity, and gain valuable insights.

The continued growth and evolution of blockchain technology benefits the ecosystem as a whole. We are looking forward to helping our customers take advantage of new technologies in order to drive global cryptocurrency adoption.