The halving is almost here. On or around May 11, Bitcoin’s built-in supply control will kick in once again, and miners’ reward for successfully mining a new block will be cut in half from 12.5 BTC to 6.25. The halving happens every four years and is a key part of Bitcoin’s underlying protocol designed to prevent inflation.

While the halving is crucial to the entire Bitcoin ecosystem, few are more impacted than miners and mining pools. If Bitcoin’s price were to remain constant, miners’ margins would effectively be cut in half, as they’d have to expend the same resources for half the reward. However, many believe that the halving and resulting decreased Bitcoin supply will cause Bitcoin’s price to go up. Others are skeptical, believing that future scarcity is already “baked into” current prices.

It’s against this backdrop that we observe an interesting trend in mining behavior. Blockchain analysis shows that mining pools have been holding more Bitcoin as the halving approaches. This may mean that mining pools believe the post-halving Bitcoin price surge is on its way — or, perhaps, that the surge of the last few weeks will continue through the halving — though we can’t know their motivations with certainty. Below, we’ll examine mining pools’ recent transaction data and what this might mean for the price of Bitcoin.

Analyzing mining pool behavior on the blockchain

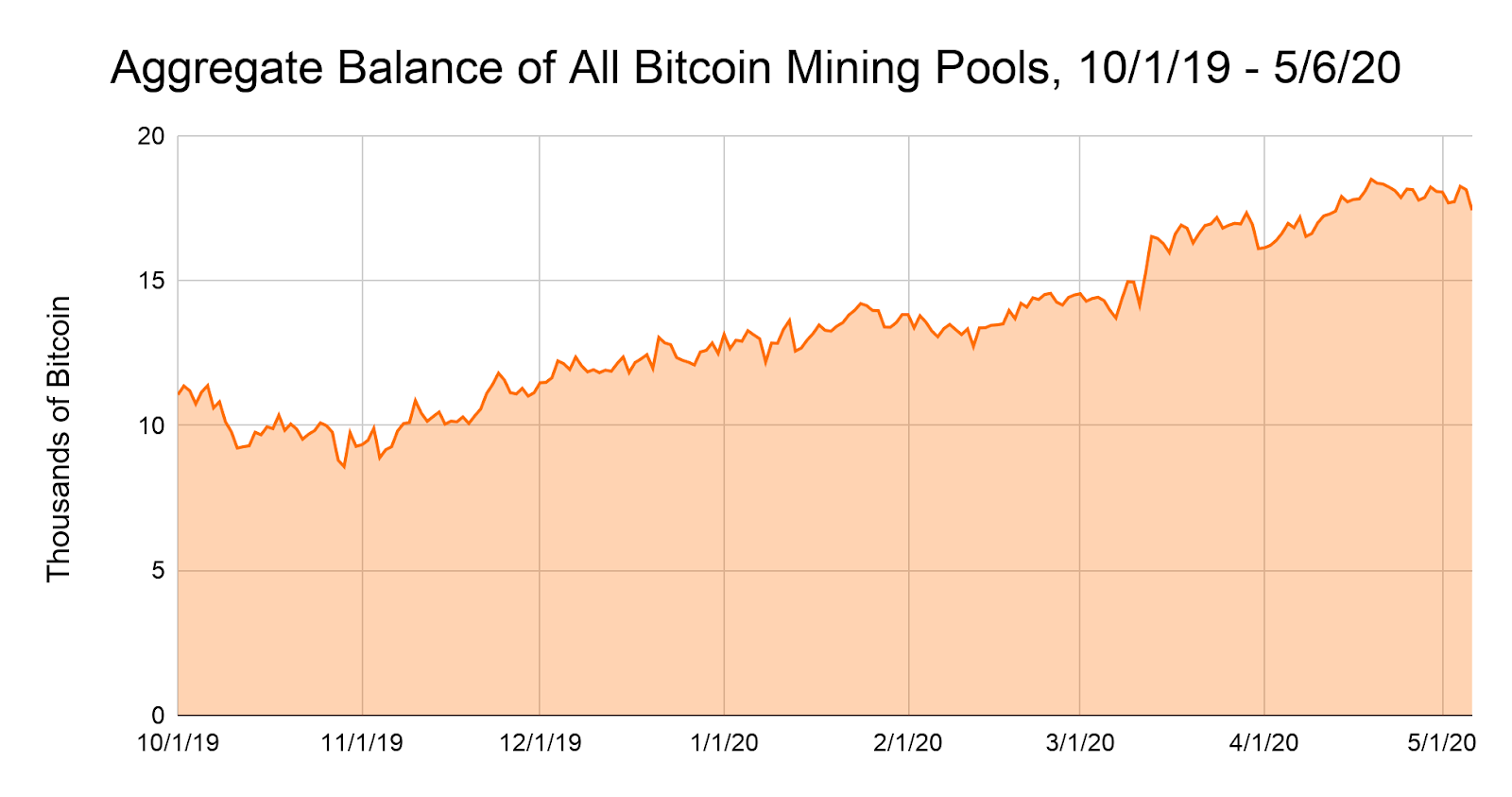

We can use blockchain analysis to examine how mining pools’ selling behavior has changed in the leadup to the halving. We’ll start at a high level, and look at how the aggregate balance of all mining pools has changed over time in the leadup to the halving, starting from October 1, 2019.

We see that throughout October and into mid-November, the total amount of Bitcoin held by mining pools fluctuates, but hovers around 10,000 BTC. However, beginning around November 19, balances climb steadily, indicating that mining pools began holding more of the Bitcoin they generate (after distributing the majority to the miners themselves), rather than selling it off. The trend intensifies around March 12, the same day Bitcoin’s price crashed as a result of the Covid-19 crisis, and mining pools started to hold even more Bitcoin. As of May 6, mining pools’ collective balance sits at 17,422 BTC, compared to a low of 8,579 BTC on October 29, 2019.

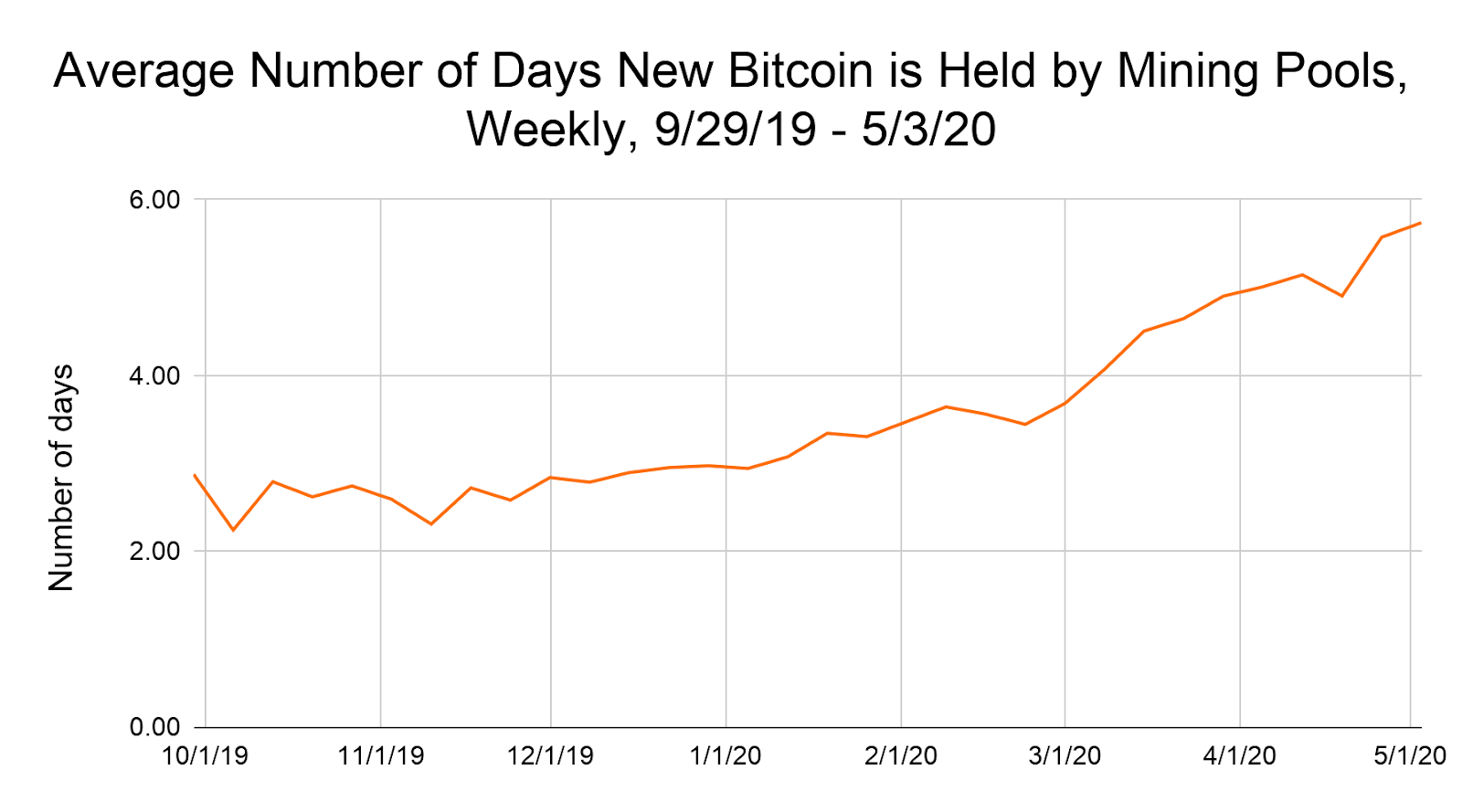

Our data on the average number of days mining pools hold new Bitcoin before selling also reflects this trend.

During the week of October 6, mining pools held each new Bitcoin they acquired for an average of 2.24 days before selling. By the week of March 1, that figure had risen to 3.68 days. The trend intensifies during the week of March 8, with holding time increasing at a faster rate. As of the week of May 3, the average holding time is 5.74 days, more than double what it was in early October.

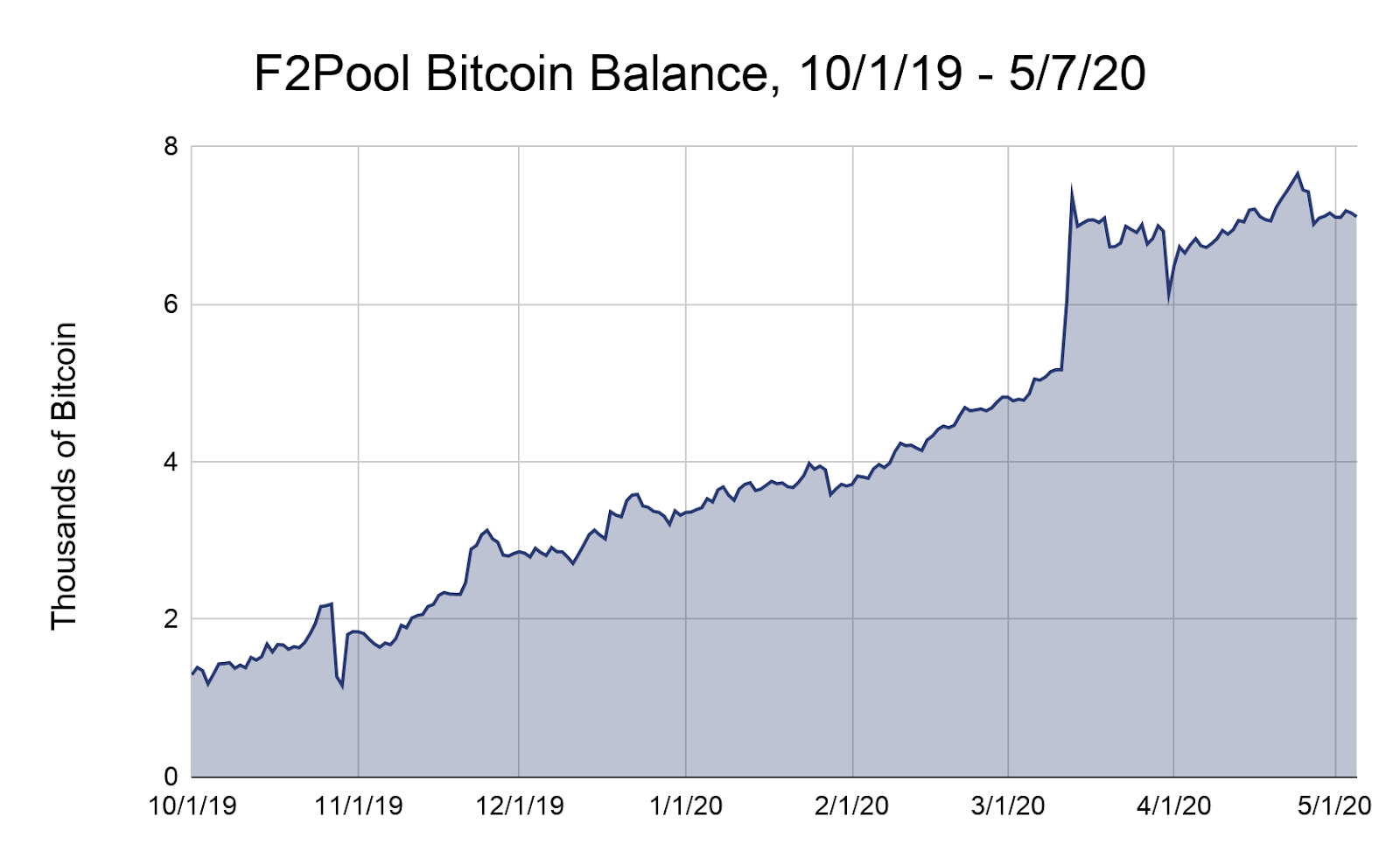

Digging deeper, we can see which individual mining pools are driving the trend. F2Pool is a great example. F2Pool miners have mined more Bitcoin since October 1 than any other mining pool, taking in 17% of all Bitcoin generated since then.

With a current balance of 7,109 BTC, F2Pool accounts for 39% of all Bitcoin currently held by all mining pools. Not only that, but its transaction history almost perfectly mirrors that of mining pools as a whole: F2Pool started holding more in mid-November, steadily increasing its balance, and then doubled down on this strategy on March 12 following the Bitcoin price drop.

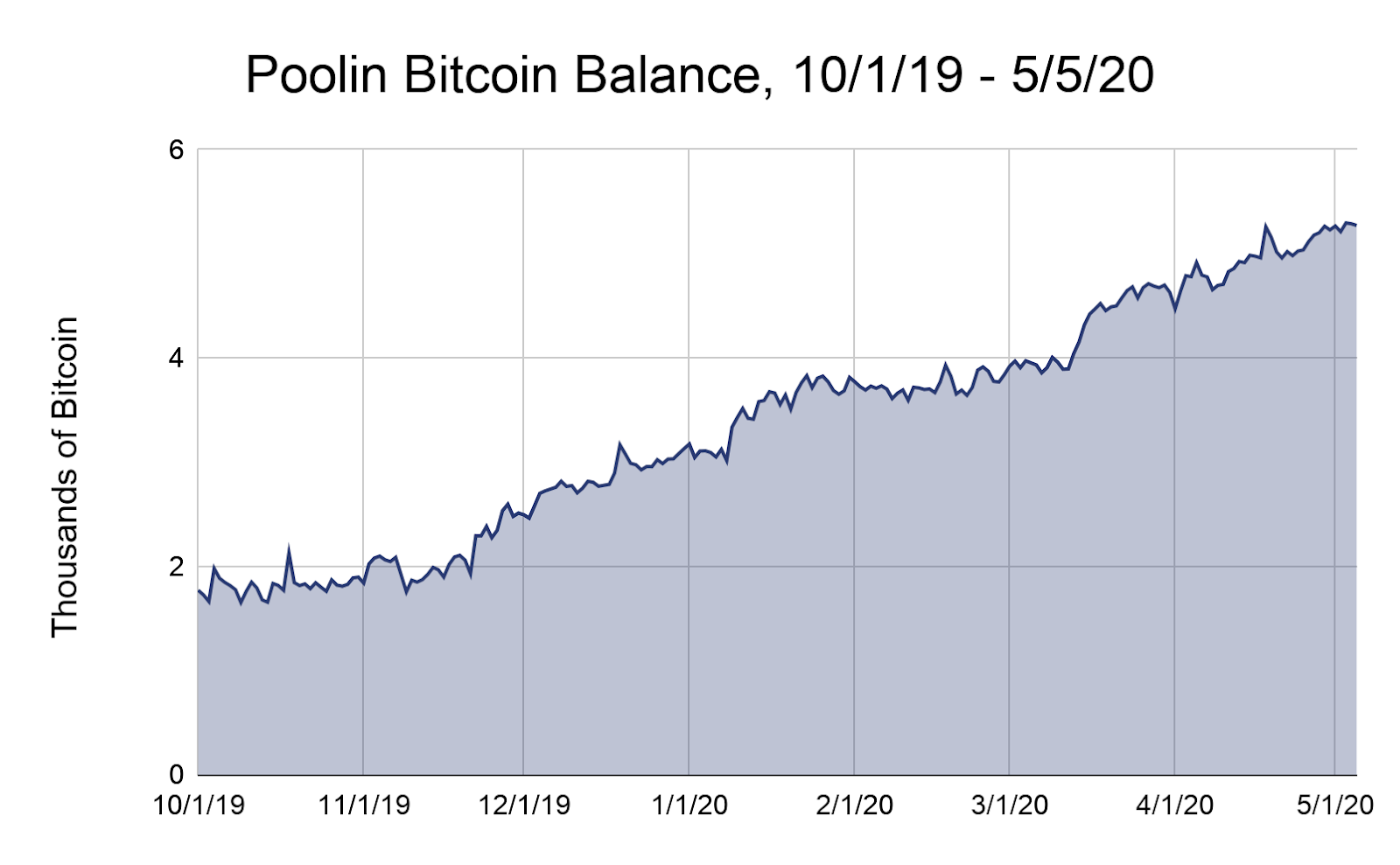

Poolin’s transaction history follows the pattern as well. Poolin is the second-largest mining pool in this time period, barely behind F2Pool, taking in just under 17% of all Bitcoin generated since October 1.

Like F2Pool, Poolin’s balance begins relatively stable, then starts rising steadily in mid-November, and then starts rising even faster around March 12. Poolin’s current balance of 5,272 BTC accounts for another 29% of all Bitcoin currently held by mining pools.

Note: This data in the above section does not extend through the weekend of May 10 and 11, during which time there was a price drop. However, mining pool balances have not changed substantially in that time.

Have we seen this before?

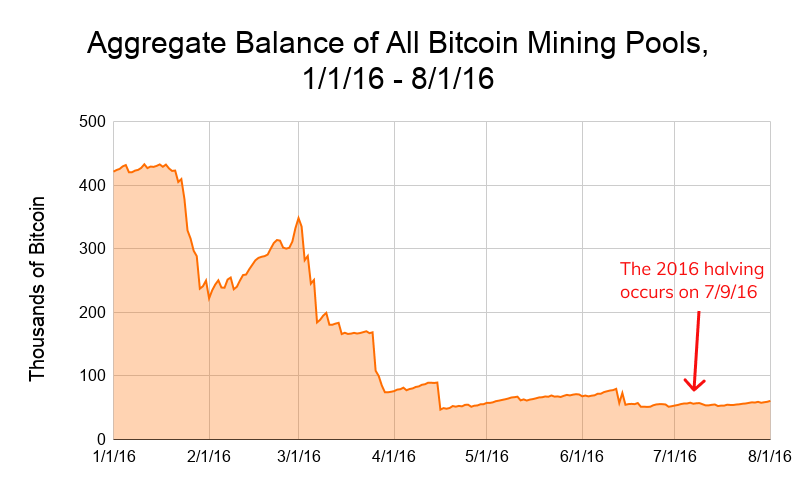

The last Bitcoin halving took place on July 9, 2016. Transaction data from the months leading up to the last halving doesn’t show mining pools as a whole accumulating more Bitcoin in the way they appear to be doing now (though mining pools back then did maintain higher overall Bitcoin balances in general).

In fact, the aggregate balance data shows that mining pools as a whole sold for the first few months of the year, as the aggregate balance fell from 421,132 BTC on January 1 to 46,955 BTC by April 16. Mining pools’ collective balance then grows steadily through May and some of June, but most is sold off by mid-June, weeks before the halving.

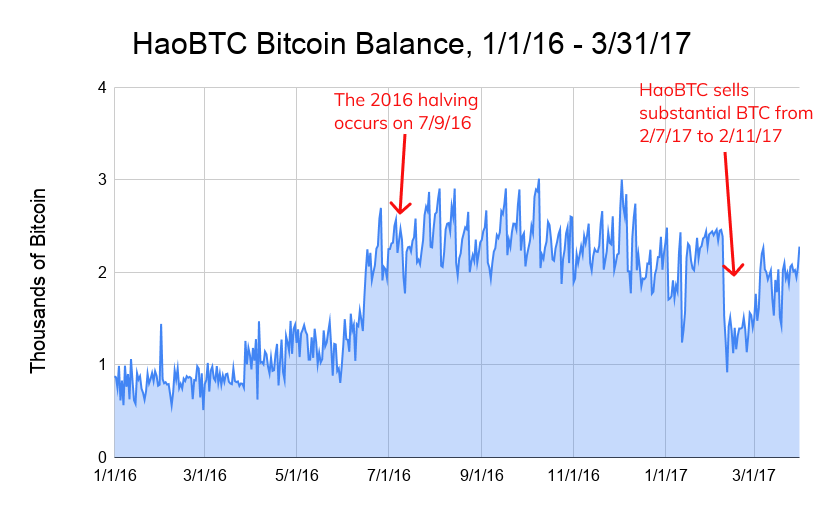

However, we can find at least one example of a mining pool that does appear to have held more Bitcoin in advance of the 2016 halving. The graph below shows how HaoBTC’s balance changed between January 2016 and April 2017. During this time period, HaoBTC was the ninth largest mining pool by Bitcoin received, taking in 2% of the total mined.

HaoBTC’s balance mostly hovered below 1,000 BTC until late March 2016, at which point it began to grow steadily. HaoBTC held even more and its balance began growing faster around June 9, just a month before the halving, hitting 2,337 BTC on July 8. We should also note that HaoBTC launched an exchange around this time in April 2016, so it’s unclear how much of the new Bitcoin moving to HaoBTC’s addresses is from mining vs. customer activity.

Following the 2016 halving, HaoBTC’s balance consistently hovered between 2,000 and 3,000 BTC, before the pool quickly sold off most of its Bitcoin starting on February 7, 2017, reaching a balance of just 920 BTC by February 11.

History would suggest this was the right strategy. During the period between March 28 and July 9, 2016, when HaoBTC held more Bitcoin and built up its balance, Bitcoin’s average closing price was $520.93 USD. But during the five-day window of February 7 to February 11, 2017, when HaoBTC sold off most of its Bitcoin, the average closing price was $1,028.30 (the fact that this sell-off came at the very beginning of the 2017 bull run suggests they should’ve held longer, but that’s another story).

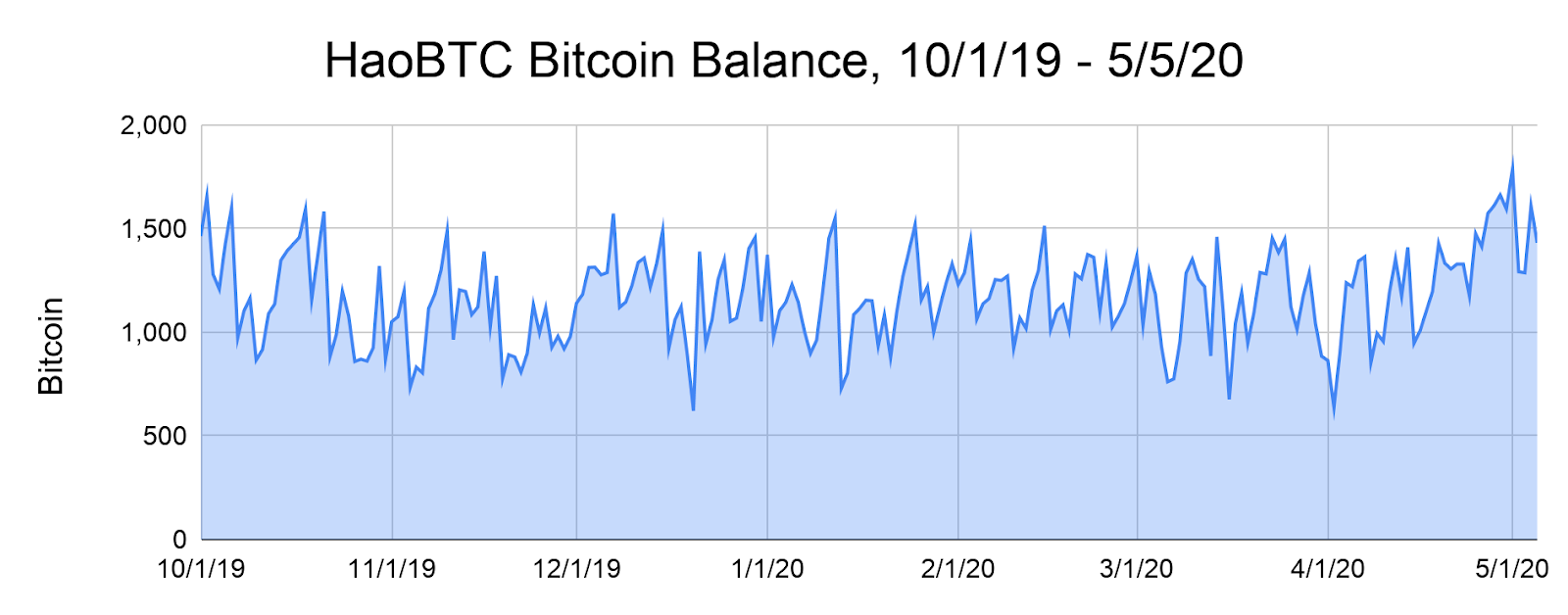

Perhaps it shouldn’t be surprising in that case that HaoBTC appears to once again be holding more Bitcoin as the 2020 halving approaches.

Since October 2019, HaoBTC’s balance has mostly followed a consistent pattern of spikes and declines, typically not going far above 1,500 BTC before the pool sells, at which point it declines to somewhere between 600 and 1,000 BTC. However, that pattern began to change around April 3. Since then, HaoBTC’s average balance has been trending upward, spiking to its highest levels yet — 1,787 BTC on May 1 — and declining less and less with each sell off, hitting 1,287 BTC for example on May 3.

What will the halving bring?

Miners and Bitcoin holders are no doubt hoping that the 2020 halving portends another bull run, similar to the last one. The recent increase in holding by mining pools — especially F2Pool and Poolin — suggests they may be expecting that to be the case. Regardless of whether Bitcoin’s price continues to increase after the halving, this research into mining pool transaction history points to a new use case for blockchain analysis beyond compliance and investigations: the use of on-chain data as a proxy for market sentiment from ecosystem participants. We look forward to seeing what trends unfold following this year’s halving.

Want to learn more about mining pools? Check out our research report on mining pool competition and what it means for the cryptocurrency ecosystem.