Last week, the United States’ Office of the Comptroller of the Currency (OCC) announced that national banks can provide cryptocurrency custody services to customers, meaning that banks are authorized to hold the private keys to a customer’s cryptocurrency wallet just as a hosted wallet service or exchange would. Previously, several states had given state banks permission to do this, but the OCC’s announcement permits it for the largest banks operating across the nation. As part of its announcement, the OCC also reaffirmed its prior decision that national banks can provide banking services to cryptocurrency businesses.

It’s worth noting that this may have been technically legal for national banks previously, as the OCC presented this announcement not as a new policy, but rather as clarification of existing policy. But by formalizing the authorization for national banks to custody digital assets, the OCC is setting the precedent that banks can roll out custodial cryptocurrency tools and platforms. Below, we’ll share a few of our thoughts on what this means for cryptocurrency.

Regulators are preparing for continued crypto adoption

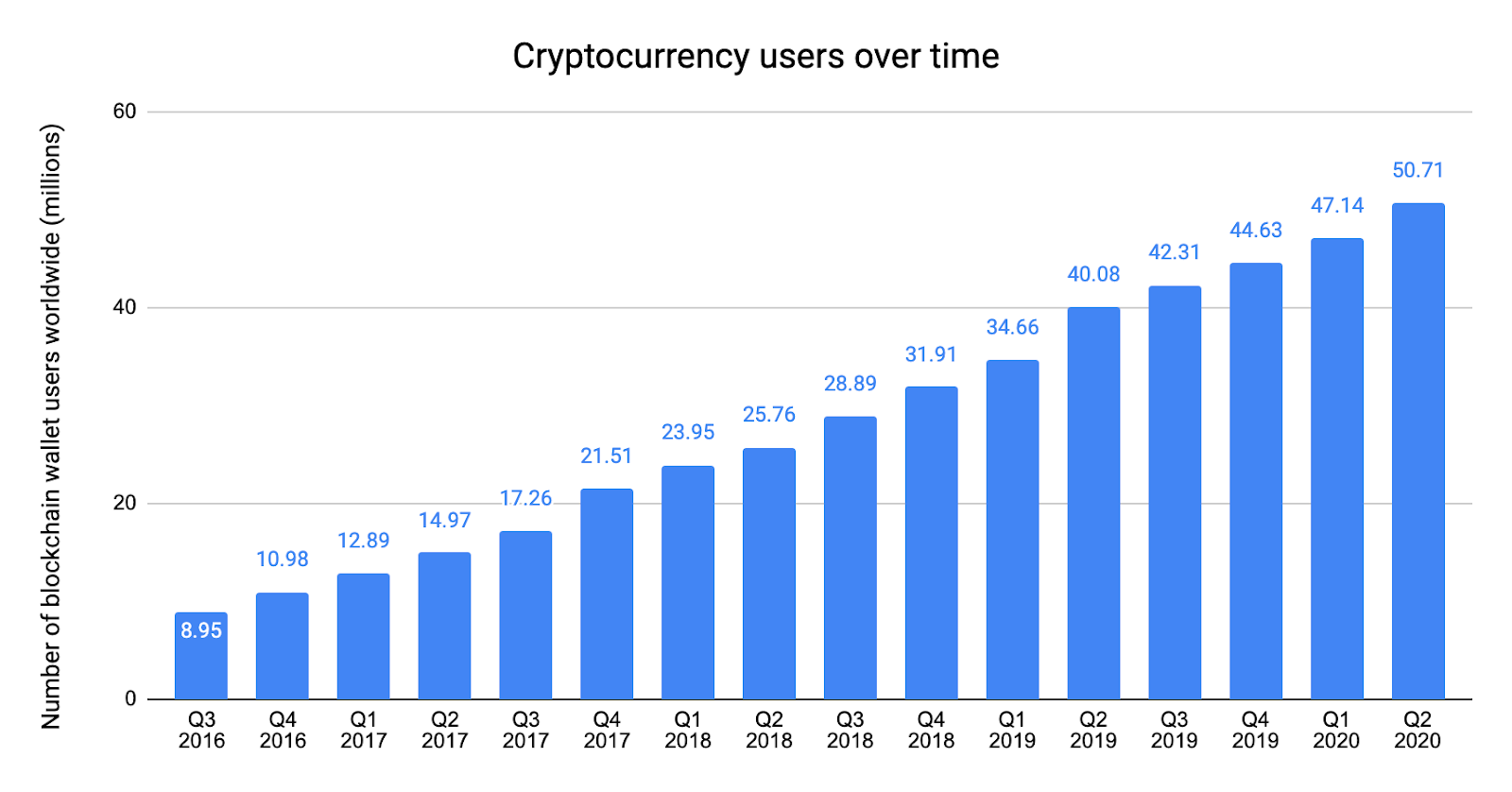

The regulatory clarity provided by the OCC last week comes at a crucial time as cryptocurrency adoption around the world continues to grow.

In just the last year, the number of cryptocurrency users globally has grown by over 25% to reach nearly 51 million. And it’s not just individual, everyday users. Professionals are taking advantage as well. In fact, a June 2020 survey by Fidelity Investments of nearly 800 institutional investors across the U.S. and Europe revealed that 36% were already invested in digital assets, and that 60% believed digital assets have a place in their portfolios. The OCC’s recent announcement suggests that U.S. regulators understand the demand for cryptocurrency is growing, and that they want to empower banks to meet that demand. By giving banks the go-ahead to do that, the OCC is also taking an important step to ensure U.S. businesses stay competitive with their counterparts around the world in terms of fintech and cryptocurrency innovations.

Not only that, but allowing banks to custody cryptocurrency could actually result in greater adoption by providing a potentially safer option for holding digital assets that more people are comfortable with. Though it’s not clear that traditional banks would actually offer more security for cryptocurrency, many likely perceive their bank — with whom they often have a longstanding relationship — as more secure than newer cryptocurrency businesses they’re less familiar with. Given that, it’s possible that the custodial services offered by banks will prompt adoption by users who wouldn’t have bought cryptocurrency previously, growing the user base overall.

Now more than ever, U.S. banks need to assess risks and opportunities in cryptocurrency

Banks now have the go-ahead not just to offer their services to cryptocurrency businesses, as large institutions like JPMorgan have already done, but also to launch their own custodial cryptocurrency platforms. Fintech upstarts like Robinhood and Square (via Cash app) are virtually the only companies combining traditional banking and payments services with access to cryptocurrency today. These are the same companies threatening banks’ wallet share. A recent survey from Capgemini suggests that 68% of consumers globally currently have an account open with a “challenger bank” similar to those described above, or plan to open one in the next three years. This is especially true for millennial banking customers.

With interest in digital assets growing, especially amongst millennials, offering access to cryptocurrency could be a key strategy for traditional banks to stave off the upstarts. But banks can only take advantage of the cryptocurrency opportunity if they take steps to mitigate the risks. That’s where Chainalysis can help. Our products can enable banks involved in cryptocurrency to monitor transactions in real time and screen for risky transactions using the same dataset trusted by government agencies like the FBI and IRS. These compliance capabilities are only possible because, unlike with fiat currency, cryptocurrency transactions are inherently transparent, as all transfers are recorded on a digital public ledger. Banks may be surprised to find that because of this, compliance and safety are in many ways easier to attain with cryptocurrency than with the fiat currencies they’re used to dealing with.

Want to learn more about how Chainalysis enables financial institutions to build effective compliance programs for cryptocurrency? Contact us here to learn more or set up a demo.