Joined by experts with experience from the Financial Crimes Enforcement Network, Duke University School of Law, and KUNA Exchange & Blockchain Association of Ukraine, Chainalysis co-founder Jonathan Levin testified in the U.S. Senate on “Understanding the Role of Digital Assets in Illicit Finance.” Their testimonies shed light on the ways in which both vulnerable populations use cryptocurrency and illicit actors abuse them, as well as how regulators can benefit from the unprecedented transparency of blockchains.

Blockchain transparency makes it easier, not harder, to detect, disrupt, and deter illicit activity

“By mapping a single cryptocurrency wallet address to an illicit actor,” Levin began, “whether that be a ransomware attacker or sanctions evader, law enforcement can unlock immediate insight into the entire network of services that facilitate the actor.”

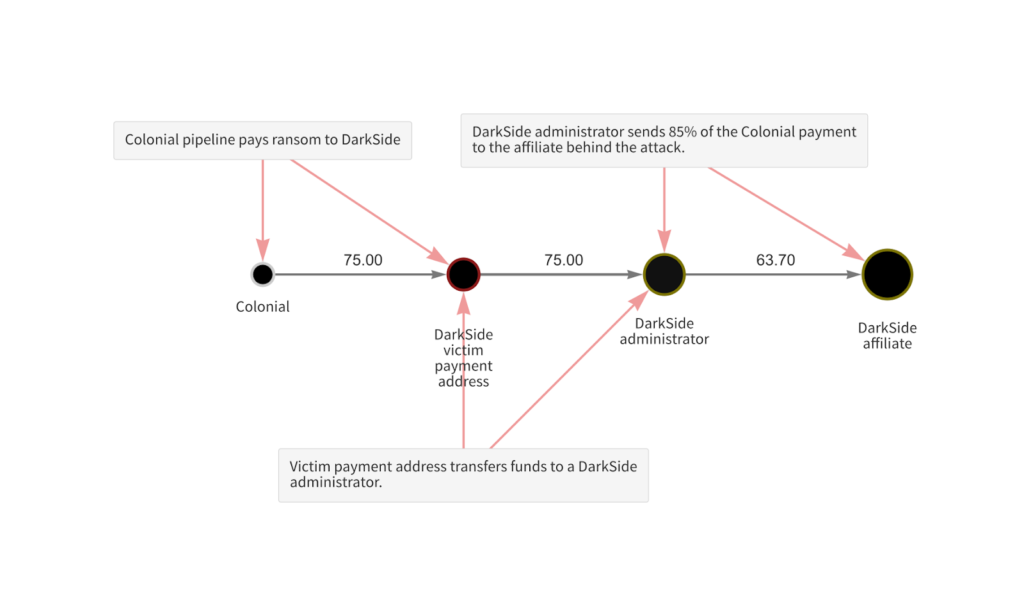

For example, after the Colonial Pipeline Attack, law enforcement could immediately trace the flow of funds from ransom payment to affiliate compensation.

One month later, the Department of Justice announced that it seized $2.3 million worth of Bitcoin from Colonial’s ransom payment following law enforcement investigations.

One month later, the Department of Justice announced that it seized $2.3 million worth of Bitcoin from Colonial’s ransom payment following law enforcement investigations.

“In contrast, in a traditional finance investigation, a similar tip linking an illicit actor to a bank account is just the beginning of a long, expensive process to request and subpoena records that are manually reviewed and reconciled to generate a comparable degree of insight.”

By virtue of this transparency, law enforcement has been able to disrupt terrorist financing campaigns, dismantle websites trafficking in child sexual abuse material, and seize the ill-gotten proceeds of darknet marketplace sales and cryptocurrency exchange hackers.

Sanctions of illicit digital asset service providers are extremely effective

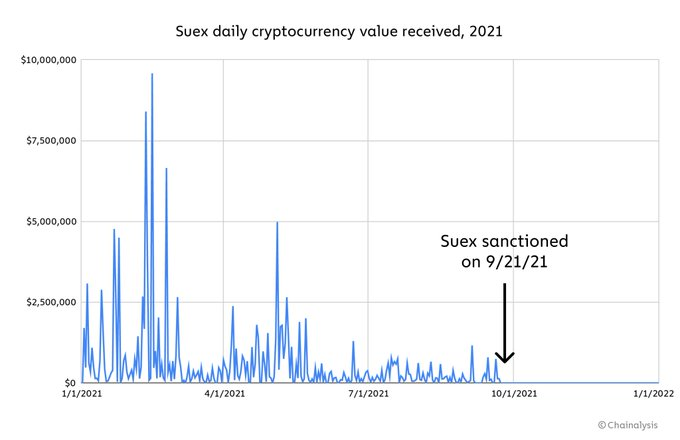

On September 21, 2021, OFAC announced sanctions against Suex, a digital asset exchange that facilitated transactions involving illicit proceeds from scam operators, darknet markets, and at least eight ransomware variants.

After SUEX’s designation, inbound transfers of digital assets into Suex dropped to zero.

Sanctions are particularly effective in disrupting financial intermediaries in digital asset networks because once such an intermediary is designated, funds associated with it can be flagged to compliant participants in the network as very high risk not just to immediate counterparties, but to all counterparties downstream.

By contrast, the source of funds would be more easily obscured in the traditional financial system. For example, if sanctioned Bank A transferred funds to a shell Company B, who then transferred to Company C who then transferred to Bank X, Bank X would be less likely to trace the flow of funds back to Bank A, and would therefore facilitate Bank A’s sanctions evasion unwittingly.

One can therefore imagine that in a financial system built on blockchain technology, sanctions could be a more effective and less leaky foreign policy tool.

Blockchain technology makes digital assets easier to freeze and seize than fiat currencies in certain circumstances

In November 2021, for instance, IRS Criminal Investigation announced that it had seized over $3.5 billion in digital assets in 2021 — all from non-tax investigations — which represents 93% of all funds seized by the division during that time period. We’ve also seen several examples of successful seizures by other agencies, including $56 million seized by the Department of Justice in a digital asset scam investigation, $2.3 million seized from the ransomware group behind the Colonial Pipeline attack, and an undisclosed amount seized by Israel’s National Bureau for Counter Terror Financing in a case related to terrorism financing.

Digital asset donations have been an immediate boon to Ukraine

Michael Chobanian, the founder of Ukrainian cryptocurrency exchange KUNA and president of the Blockchain Association of Ukraine, spoke at length about the role of digital assets in the ongoing Russian invasion.

“From the invasion’s first moment, we at KUNA decided to act swiftly to help our army and the people who suffered most due to these horrific events. In collaboration with the Ministry of Digital Transformation and the Ministry of Defense, our team launched the official Crypto Fund of Ukraine to solicit cryptocurrency donations. … And as of today, the Fund has collected more than $50 million dollars in donations, while shooting for a $100 million dollar goal.”

When Wyoming Senator Cynthia Lummis asked how long it took for Ukraine to set up the infrastructure to accept crypto donations, Chobanian said it took “about 10 minutes.”

Watch the full hearing on the importance of blockchain transparency

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.