This week has been one of the wildest in crypto history. The future of FTX, one of the world’s largest exchanges, is now in doubt as its native FTT token plummeted 84% in the last two days and a tentative agreement to be acquired was terminated yesterday afternoon. As a result, cryptocurrency prices are down across the board: Bitcoin is down 14% since Monday, Ether is down 17%, and Solana is especially hurting, down 43%, though all three have bounced back from three-day lows.

The market is in flux, and it would be pointless to try and make any short to medium-term predictions right now. In the long run, Chainalysis is confident that cryptocurrency can weather any storm. There have been many downturns in the past, and we need only to point to the many users in emerging markets who rely on crypto to preserve their savings and conduct day-to-day business to be reminded of the industry’s value across the world. But for the time being, investors are likely nervous and searching for signs beyond prices of how the market is reacting. Given that, we’ve put together a few charts to outline our view of what’s currently happening in the crypto world, based on on-chain data.

Exchange inflows are stable

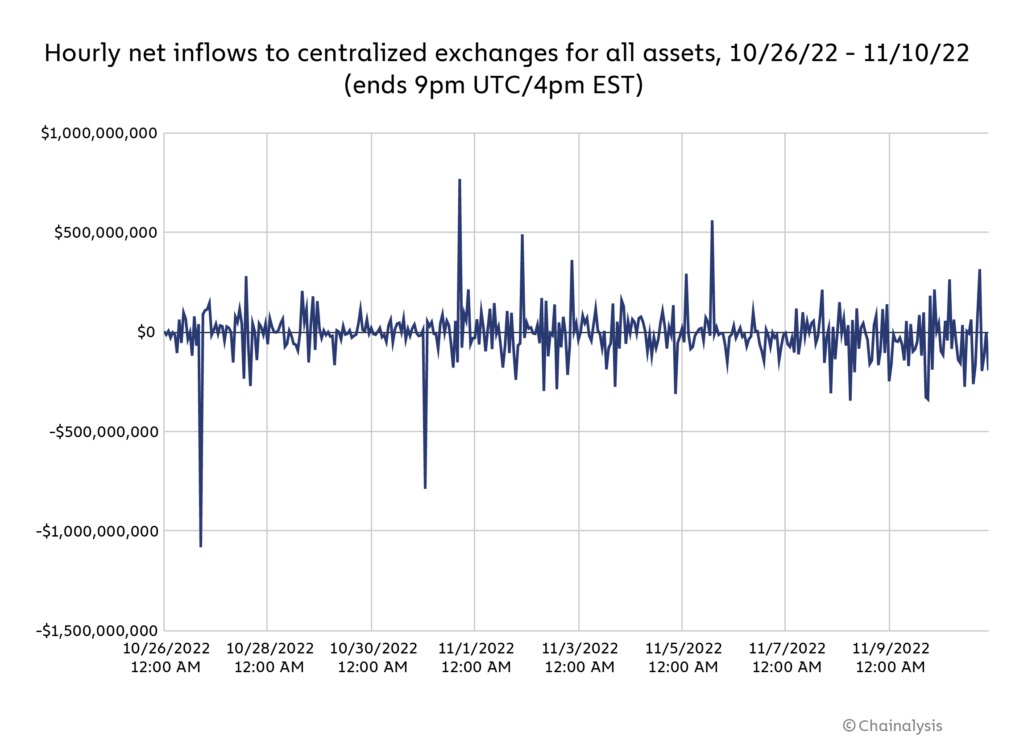

Centralized exchanges are where users go to trade cryptocurrency and convert it into cash, so when the market is extremely volatile, we expect investors to move more funds to exchanges to either take advantage via trading or exit to fiat. But so far, net inflows to exchanges aren’t up significantly, as we can see on the chart below tracking hourly net inflows from October 26 to the present.

Exchange inflows began trending slightly upward on November 7— the day that rumors circulated on Twitter that there would be a large sell off of FTT by other crypto companies, which ramped up the panic around FTX’s health — but there are also many hours with net outflows. Overall, exchange inflows became volatile from November 7 onward compared to the days immediately prior, but not as volatile as they had been in the preceding weeks. We don’t see the heavy inflows we’d expect at a time of increased volatility, let alone the extreme volatility we’re seeing now.

Are investors moving to USD for stability?

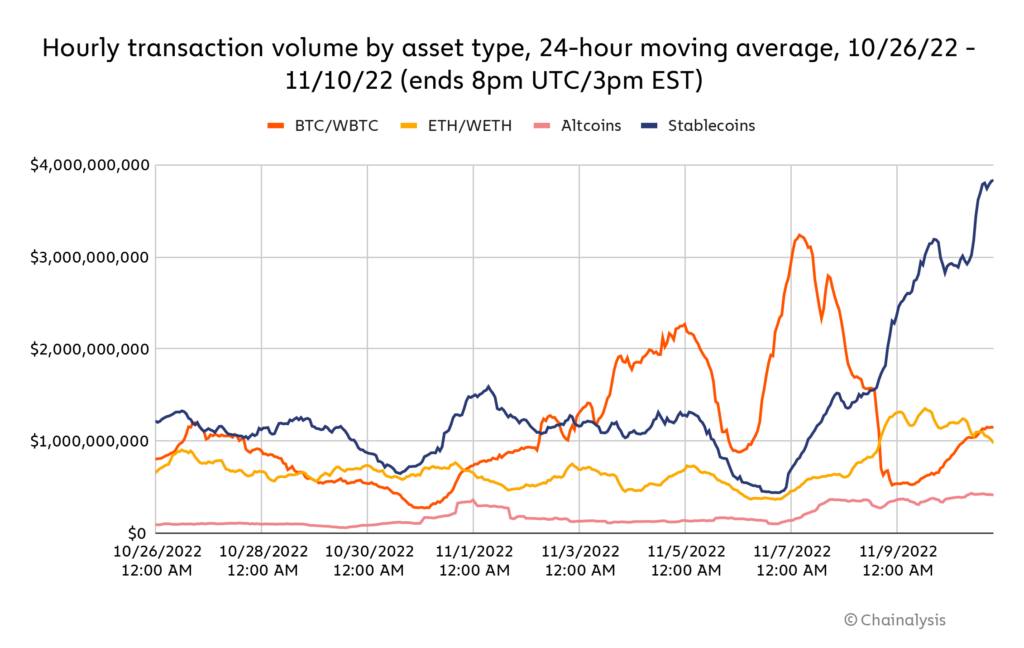

In times of volatility and panic, we’d expect crypto users to seek shelter with the stability of fiat currencies. There are two ways to do this: Trading for stablecoins pegged to fiat currencies like the U.S. dollar, or liquidating entirely and swapping cryptocurrency for fiat. Overall, crypto proponents would likely rather see the former than the latter — if investors swap for stablecoins, they’re more likely looking to stabilize their holdings temporarily, and they can always easily swap back into standard cryptocurrencies when they’re ready to trade again. But if they swap for fiat, it may indicate an intention to step away from cryptocurrency for a longer period of time, or even permanently. Let’s look at both below.

Above, we look at a 24-hour rolling average of transaction volume by asset type from October 26 through the present. Stablecoin transaction volume ebbs and flows in the same basic pattern until November 7. At that point, stablecoin transaction volumes grew steeply through the morning of November 10 as FTX’s situation continued to worsen, blowing past their two-week highs. The data suggests that many investors indeed fled to stablecoins as markets became volatile.

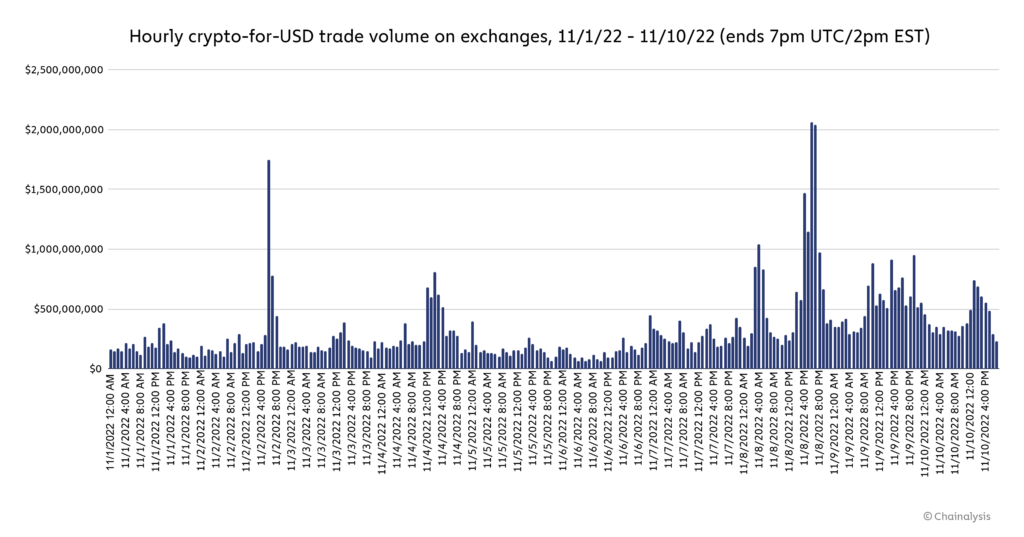

But what about swaps for fiat? For this, we have to step out of the on-chain world, and look at exchange order book data provided by Kaiko.

The situation here is similar to that of stablecoins, though the increase is less pronounced. Again, we see a steady uptick in crypto-for-USD trades beginning on November 7, followed by large spikes on November 8, with trades peaking at 6pm UTC/1pm EST, and remaining at elevated levels through the end of the day on November 10. Since then, they’ve returned closer to normal levels. While the pattern is roughly the same as what we see in stablecoin transaction volumes, the swaps for fiat may be more indicative of users exiting their crypto positions for the long term.

Continuing to monitor

There’s no sugarcoating it: The unexpected potential collapse of an industry stalwart like FTX is a hugely negative development for cryptocurrency, and the resultant chaos in the markets only reinforces that. However, crypto has survived events like this before, emerged stronger, and gone on to reach new highs. We expect asset prices to eventually recover and for cryptocurrency to resume its adoption growth. For now though, we’ll continue to monitor the market for new developments and clues for what the future may hold, and will update as possible.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

All trademarks, logos and brand names are the property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, trademarks and brands does not imply endorsement.