As one of the first major stable cryptocurrencies to emerge, Tether saw explosive growth in trading volume over the past year even as the trading volumes of more established cryptocurrencies like Bitcoin or Ethereum declined. What makes Tether so attractive to investors as a store of value is the relatively low cost of moving fiat currency to Tether and vice-versa.

Our research shows that Tether – for which each unit or ‘token’ the company has stated is backed by one US dollar or other asset held by the issuing company, Tether Limited – has been used primarily to facilitate trading. It also reveals that Tether is often traded against lower-volume cryptocurrencies, accounting for approximately 20% of Tether trading volume through the beginning of 2018. This activity often takes shape as ‘pump and dump’ schemes, where prices are inflated in order to be quickly sold for a profit.

Tether’s market capitalization kept growing in 2018 even as the overall cryptocurrency market contracted. The success of Tether provides a glimpse into what the future may look like, although there’s still a long way to go to bringing the traditional financial system and the cryptocurrency one closer together.

Our conclusions about Tether are based on the following key findings:

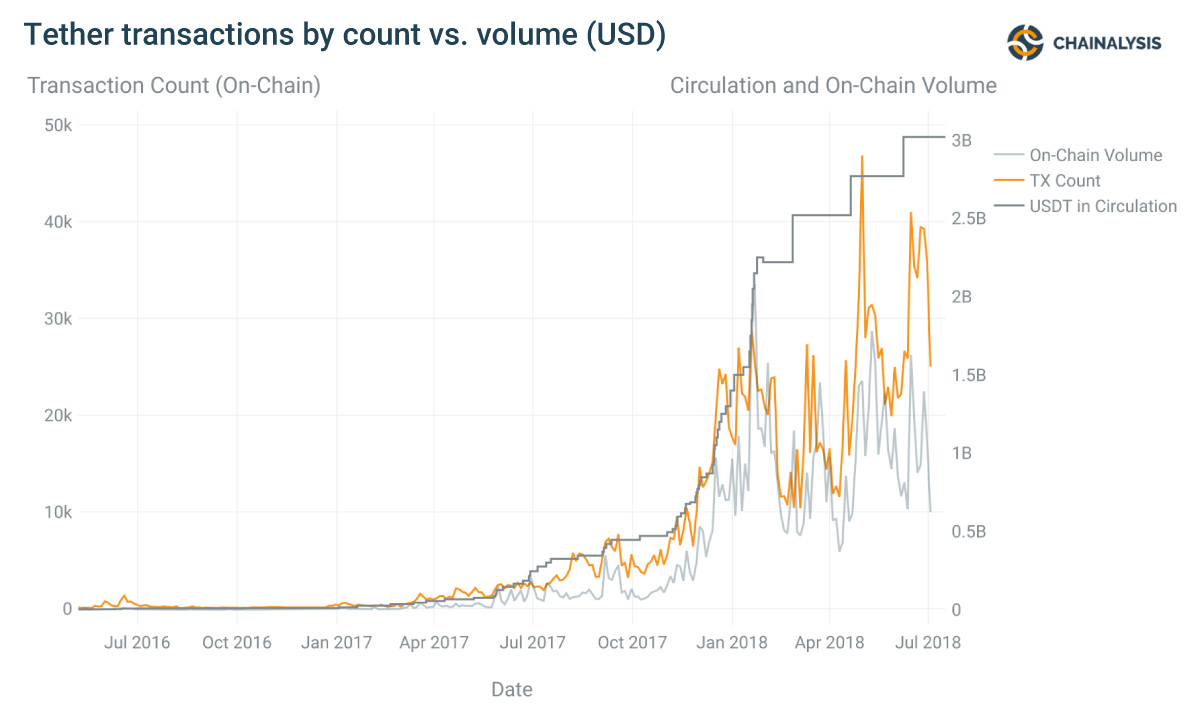

- Tether activity has grown exponentially even as major cryptocurrencies have seen declines. On exchanges that accept Tether, trade volumes for Tether (traded as US Dollars Tether – ‘USDT’) have grown more than 15x between October 2017 and March 2018. Traded volumes for fiat USD on non-Tether exchanges grew just under 3x over this same time period.

- Tether serves as a cryptocurrency bank for traders by allowing individuals to store cryptocurrencies at a stable value. Tether is used almost exclusively for trading. 73% of all Tether on-chain transaction volume is going to exchanges, with only 27% being sent from exchanges, indicating that once Tether is on an exchange, it likely stays there for trading.

- In mid-2017, Tether activity shifted towards being traded increasingly against low-volume cryptocurrencies. Tether also is used as a facilitator for ‘pump and dump’ schemes. The way traders use Tether changed over the 12 months between the middle of 2017 and middle of 2018. Through January 2018, Tether on-chain transaction volume was highly correlated with Bitcoin, Ether, and Litecoin transaction volumes (reaching nearly 75% correlation), implying that the trading volume was focused on these high volume cryptocurrencies.

A view into what the future could look like

The rapid growth of Tether highlights the need for bank-like solutions in the cryptocurrency world even as some unfortunate side-effects emerge, namely the “pump and dump” schemes. This activity gets a lot of attention, often dominating headlines, which hurts confidence in the cryptocurrency ecosystem.

As regulatory oversight matures in this space, it’s likely that the demand for Tether as a store of value for price manipulation subsides as other use cases emerge. Notably, it remains to be seen whether new financial mechanisms evolve to serve the purpose that stablecoins such as Tether are serving today: providing a seamless way to transact between traditional fiat currencies and other cryptocurrencies.