Cryptocurrency was created to encourage decentralization. However, there is a high degree of wealth concentration among cryptocurrency holders: over 30% of all Ether and over 20% of all Bitcoin is controlled by a small number of individual agents, called ‘whales.’ These whales are often the scapegoats for any major price fluctuations.

We took a deeper look into the role of Ether whales in the market and found that they account for just 7% of all economic transaction activity. Furthermore, these whales have no meaningful impact on the price of Ether; they do, however, make the market more volatile on a daily basis with their large sell-offs.

Ether whales control a lot of ether but don’t move it often

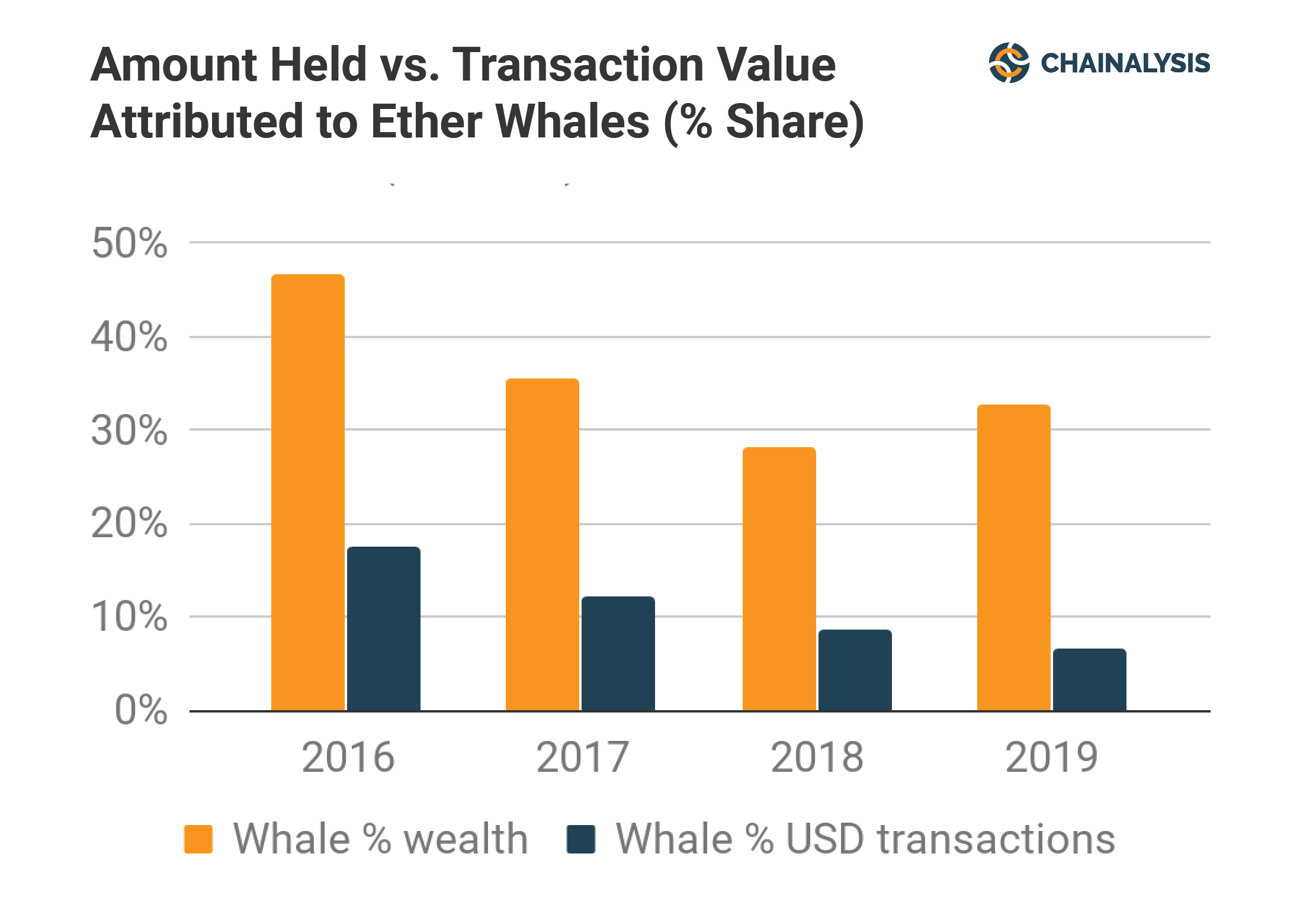

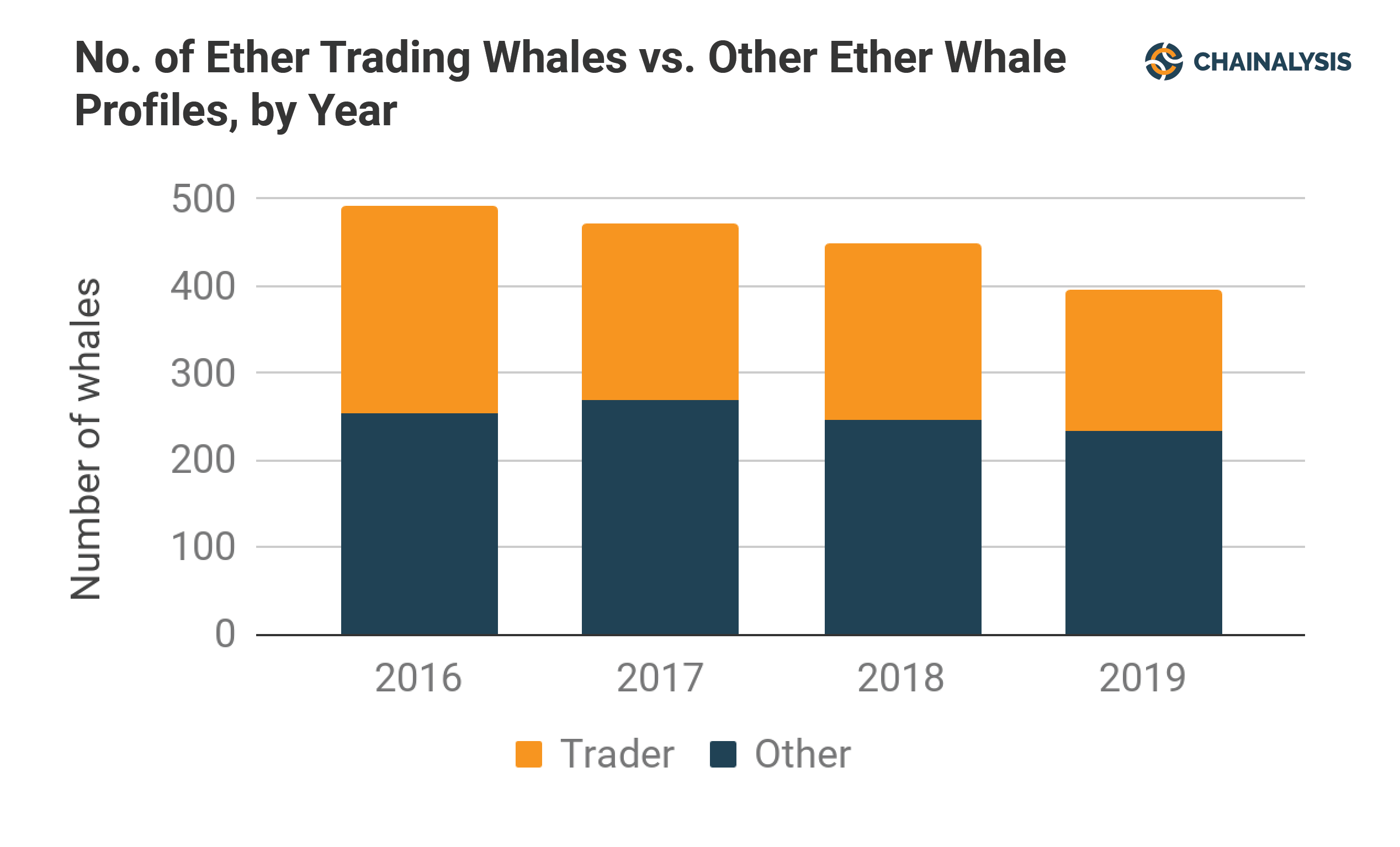

We define whales as the top 500 holders of cryptocurrency, excluding services, who store their holdings off exchanges. Distinguishing the whales from services is the most difficult step in this analysis, and can only be done with years’ worth of blockchain data that has been linked to real-world entities. As of May 1, 2019, of the top 500 largest holders, 124 were services, and the remaining 376 were individual whales. We found that these 376 whales control 33% of the circulating supply in 2019, down from 47% in 2016.

While consistently controlling a large portion of the Ether circulating supply, these whales paradoxically only account for a small percentage of Ether’s economic transaction activity. Whales consistently hold 25-40% of the circulating supply of Ether, but only account for between 5% and 18% of economic transaction volume. This is because most of the whales (~60%) are holding their assets or not regularly trading with exchanges.

Whales don’t impact Ether price but do increase intraday volatility

Could whales influence the price of Ether by placing large orders at exchanges? That is, are these large Ether holders the culprits behind some of the abrupt price swings over the past few years? We investigate this question, focusing on Ether due to its high wealth concentration compared with other major cryptocurrencies.

The problem with most analysis to date is that it fails to explicitly identify whether whale activity is impacting price or vice versa. We used a vector autoregression (VAR) model—commonly used in financial time series analysis—because it accounts for these interdependencies between price and flow variables. The statistical VAR model allows us to estimate the impact on Ether price and Ether intraday volatility (changes in price within a day) by:

- Bitcoin price

- Whales sending to exchanges

- Whales receiving from exchanges

We analyzed activity over the period of 2016 to 2019 based on these three variables and found the following:

Ether prices follow Bitcoin prices. On average, a 1% increase in Bitcoin prices yesterday leads to a 1.1% increase in Ether prices today. We find no statistically significant impact of Bitcoin prices on Ether intraday volatility.

Funds sent do impact volatility but not price. Funds that whales send to exchanges do not directly impact Ether price but they do contribute to price volatility. On average, a whale that sends 1 million USD worth of ether two days ago leads to a 0.1 unit increase in intraday volatility today, which is relatively small considering values of intraday volatility range from 0.02 minimum to 417 maximum.

Funds received have no impact. Funds that whales receive from exchanges do not impact Ether prices, nor intraday volatility.

These preliminary findings are consistent with the literature on stock market prices and volatility. Academics have found that large anomalous fluctuations in traded volumes of particular stocks, notably the S&P 500, tend to impact volatility and not price levels. The Chainalysis team is continuing to improve its models, but it is certainly encouraging that the cryptocurrency market is behaving in a way that is consistent with stock market fundamentals.

Although it seems that concerns about the impact of whales on market prices have been overstated, there are still important caveats to our research. We cannot rule out the possibility that whales can impact price changes within single days based on outlier events. Our research analyzed the general impact of flows from Ether whales, and did not exclusively look at the impact of outlier events.