Earlier this week, Tornado Cash became the second ever mixer and first ever DeFi protocol to be sanctioned by OFAC. Soon after, Crypto Twitter was ablaze with reports of celebrities, industry notables, and others being sent small transactions from Tornado Cash, each of which could theoretically be an OFAC violation.

Credit: @josephdelong on Twitter

Most observers have written these transactions off as trolling, and while this activity certainly can’t be called harmless given that a sanctioned entity benefits in the form of transaction fees, we think it’s unlikely to set off alarm bells at OFAC. However, it will likely create more work for compliance teams at cryptocurrency businesses, who are grappling with what sanctions on DeFi protocols will mean for them in practice.

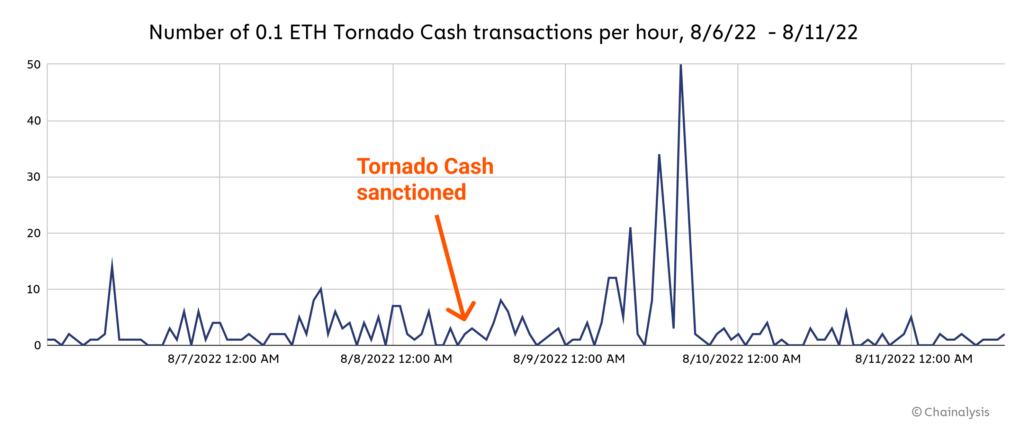

Below, we estimate the scope of Tornado Cash trolling by looking at the number of Tornado Cash transactions involving a deposit of 0.1 ETH — we chose this number as our threshold because it’s the minimum amount that can be mixed using Tornado Cash. Plus, why would someone spend more than that for a simple joke?

The sanctions against Tornado Cash were announced at 10:30am ET on August 8. Between then and 3:00 PM ET on August 11, there were 300 outgoing transactions from Tornado Cash that began with inputs of 0.1 ETH or less, totaling just over $52,000. Many of those transactions went to cryptocurrency industry leaders or venture capitalists, such as Coinbase CEO Brian Armstrong and Andreessen Horowitz venture capitalist Ben Horowitz, as well as celebrities with publicly promoted cryptocurrency addresses, such as Shaquille O’Neal, Jimmy Fallon, and Snoop Dogg.

The graph above begins on August 6, two days before the OFAC designation, and it’s interesting to note a large spike in 0.1 ETH transactions the day after the designation, suggesting that the sanctions influenced Tornado Cash user behavior. Keep in mind though, it’s possible that not all of these transactions were trolling attempts. Tornado Cash allows users to wait as long as they want between when they send funds to the mixer and receive “clean” funds back. It’s entirely possible that some users sent crypto to Tornado Cash before the OFAC designation and decided to get it back afterwards, regardless of the sanctions risk. We should also note that some users made bigger withdrawals from Tornado Cash after the designation, but that overall, its transaction volume has fallen significantly.

Sanctions enforcement is harder in DeFi than in CeFi. What does that mean for compliance teams?

Trolling aside, these transactions underline the differences in enforcing sanctions against a DeFi protocol like Tornado Cash and a centralized service like, say, the darknet market Hydra. In the latter’s case, the service can be rendered virtually unusable by pairing sanctions with a takedown of its website. In the case of a protocol like Tornado Cash, the smart contracts run in perpetuity, meaning users can still transact with it, allowing the activity we’ve covered here.

As the cryptocurrency ecosystem continues to change, we’re continuously delivering improvements to our compliance suite that enable organizations to react to new situations like these, including our free sanctions screening oracle for DeFi protocols, configurable risk profiles, and more. You can contact us here to learn more. In the meantime, we’ll continue to monitor for ongoing Tornado Cash usage — trolling or not.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.